Introducing Ditto—Insurance made easy

The first time we read the Finshots newsletter (then called Finception), we immediately reached out to the team, trying to figure out if there was a way to associate and help them reach a wider audience. Making it easier for Indians to learn finance is our top priority, and hence partnered with Finshots through our Rainmatter initiative. As we spent time together, we realised that monetising the content might not be good both for the user and the business; we have always believed that, if possible, education should be for free and with no conditions attached.

One item on our list of things to do for a long time was to build an insurance platform free of conflicts, mis-selling, spam, and, most importantly, advisors to handhold people through the purchase journey. When the team at Finshots decided to solve this problem, we almost instantly said yes to collaborating. This is how Ditto was born. You will now start seeing Ditto within our platforms contextually, for example within the family portfolio view on Console, on the Coin platform, and more. If you want to learn about insurance, the team at ditto has also written an entire module on Insurance on Varsity.

Find below an introduction to Ditto from the founders, the same team behind Finshots.

In 2019, Finshots began its operation with a simple aim — to simplify financial news to millions of Indians. But the ultimate goal was to always do more than just simplify content. It was to offer meaningful insights to people so that they could make better financial decisions. And as we kept building on the content platform, it became evident that many people were woefully unequipped to deal with the complexities inherent in financial decision-making. Most of which came from the insurance domain.

None of our readers seemed to have a good experience with insurance. Some complained of the incessant spam calling. Even others complained of rampant mis-selling. But most people were simply confused. There were too many choices, very little quality advice, and almost no real-time support for people looking to simply understand insurance.

So in January 2021, Finshots took its first step, diversifying from content to advisory, and Ditto was born — to make insurance a little less daunting.

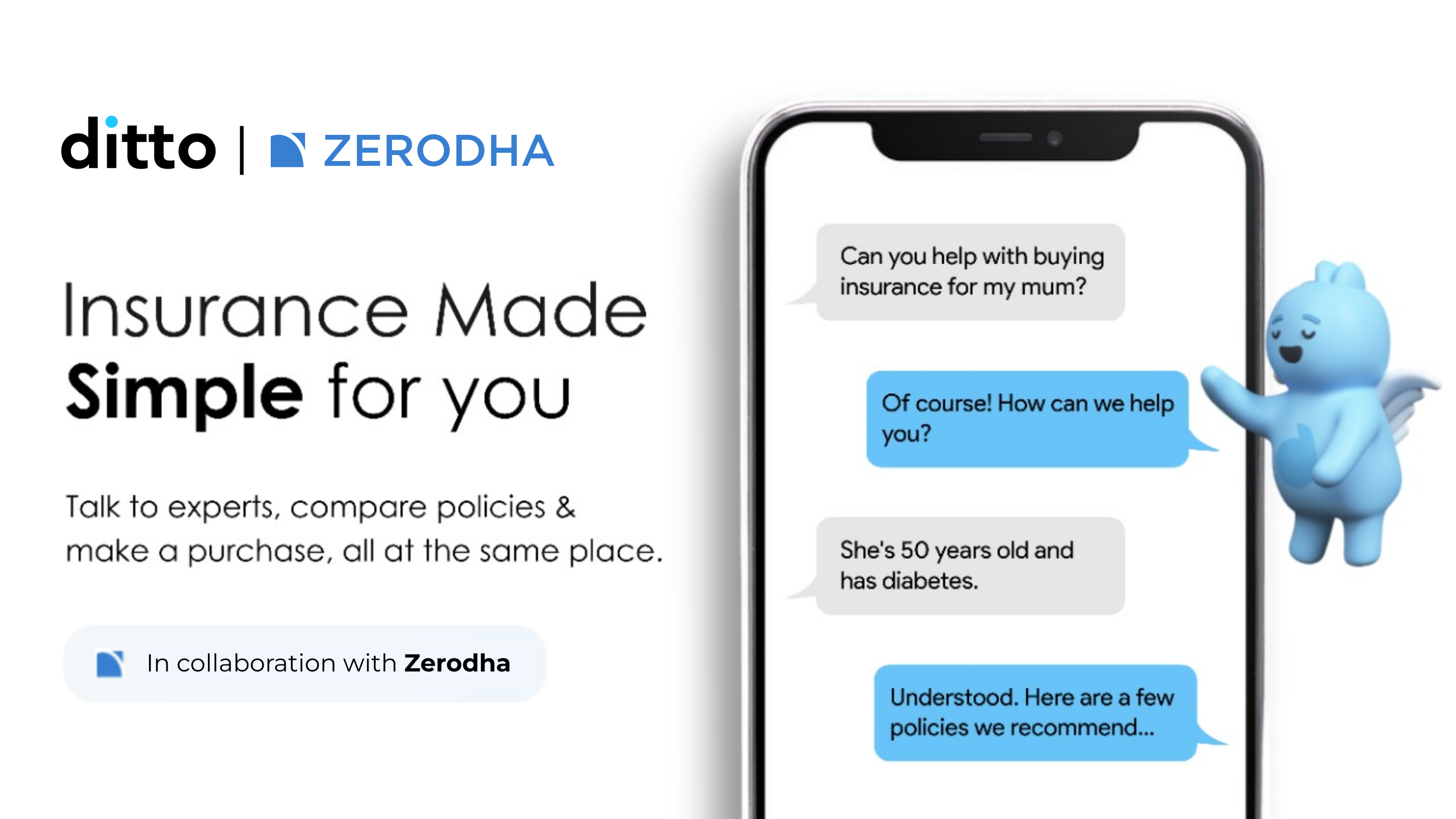

Today, Ditto is the only advisory-first insurance distribution platform. It helps people understand insurance products, compare viable options, and finalize the purchase, all at the same place.

And while several platforms help consumers compare and buy policies, Ditto is different in one key aspect. Instead of employing a large sales force with an explicit focus on selling policies at any cost, Ditto hires and trains qualified advisors who help customers navigate the complex world of insurance. These aren’t sales agents. They truly are advisors.

The platform also offers a 30-minute free call with one of these advisors and also throws in multiple follow-up consultations at no cost. For people with urgent queries, Ditto facilitates WhatsApp conversations with their advisors as well.

We also guarantee a completely spam-free experience. You hear from us when you want to. Meaning, that our advisors at Ditto will not bombard you with spammy messages and will only communicate with you when you insist.

Also, in the past 1 and a half years of operation, Ditto has advised close to 1,00,000 customers successfully and currently offers people the option to buy health and term insurance policies. And yes, we do offer claim support and our advisors will handhold you when you are at your most vulnerable.

So if you are looking to buy insurance or simply have your queries addressed, don’t forget to check out Ditto.

Good initiative

Sir. I am having care helath insurance. Before 5 year I took.now with no claim bonus around 10 lack acccumlated for 5 lac sum assured.

Is this best ? If any other heath insurance which I can get more no claim bonus.

Thanks

Arun nair

I have heard about your company and promoters and am very much impressed about your customer service and recommendation to do good within the limits, prevailing. I am to ask a needy question at this juncture to get recommendation of the best Health Insurance company I have to use after being with Govt run Insurance companies and having fed up with all the tricks behind the sentences / contract and also slow in settling claims, playing with customers faith and getting always a raw deal. Can you suggest one company I can shift, even though as the current Insurance company claim having given me the best discount on premium to be pad for my decades of loyalty? Would appreciate a quick response as I need to make the changes soon. Thanks

Please can you suggest me family insurance

Request to suggest a good home insurance product?

I have bought HDFC ergo health insurance from ditto and made the payment of 3757/- inr . But still I didn’t got any confirmation from HDFC ergo. I called HDFC ergo they say didn’t received any payment still they are searching it’s already 72hrs. To report of situation ditto is giving date of 17 aug’23. Today is 12 aug’23. After 5days they will check my situation. Now I don’t know how to report. So guys buy policy with lot of attention & understanding.

Request to suggest good term insurence, with less premiums for the age 46

Kya hai ye product.. insurance!?

I have no family insurance. I would like to get one. Where do I get started

1s time investment i like him….

I am diabetic since 2017. Age 28, Insulin take twice a day, any health insurance available if yes please connect, if available

Nice initiative.

I have no family insurance. I would like to get one. Where do I get started

I added 2 times fund in my account at used partial amount from my balance and next day rest of the balance is disappeared from my account i want to kno the reason behind this please contact me.

Hey Rizwan, please create a ticket at support.zerodha.com so that our team can check and assist.

I like your initiative to help the people for health and terms insurance.

I sent a whatsapp message yesterday for a helping hand to the bank pensioners who already have a group insurance through IBA Mediclaim policy. The policy has been issued by National insurance company but cover both self and spouse.

Please give us your guidance and suggestions for its renewal though the premium is increased every year.

Thanks please.

KIDAR NATH SINGAL, Bank retired,83 years.

Sir, Now a days Due date for renewal of Health policy in respect of Retired PSU BANK employee, is fast approaching i.e on 30/09/2022,.

In case you can give a suitable policy with reasonable premium,at least > 10000 people may join. The age of proposer may range from 60 to 80. ( Very few>80).0ur Retirees Associations can also take group policy.Last year our claim ratio was approximately 20%I can share all details if Zeroda is will. I am also your customer in Equity segment.

Good initiative…

No idea about ditto

My application is rejected how to re upload my documents

Hey Vishal, please create a ticket at support.zerodha.com so that our team can check and assist.

We want to open a corporate demat account of a pvt limited firm

Hey Gourav, we’ve explained the corporate account opening process here. The account opening process is offline. If you need any assistance, you can create a ticket.

Which life insurance policy can I take? I don’t have policy please help me

👌👍

Hey Guy’s,

Congratulations on this wonderful creation which will definitely help a lot of people of India. As we all know what exactly how this industry currently running their business through their sales people’s..

Few questions..

1. Is this information available only in English language ? If yes it hardly beneficial for 30 to 40% audiance.

2. If someone is already holding a policy in that case how ditto will help them ?

3. How someone can make the decision of policy in just 30 minutes? What after that ?

Thanks.

Hi, I am a co-founder at Ditto. And thank you for your comments.

1. While the information on the website is predominantly in the English language. We do have advisors who can and will engage with you in several other languages.

2. If someone is already holding a policy we review them and let customers know if they should continue holding them, or attach add ons or maybe even port a policy. If the customer does decide to switch we will help then with this process as well.

3. So the initial call spans 30 minutes. But after this the engagement can last a month or even longer. During this time you can text or talk to the advisor at your convenience. And get your queries sorted.

Can the training module for the advisors be made available? Maybe at a certain cost😇😇

Hello Abed

Unfortunately we wont be able to divulge the training material. But the Varsity Module is a pretty comprehensive alternative.

This can prove to be great boon. Excellent initiative and hoping for many more such in hitherto unreliable murky areas. Bravo!

I had a very good experience with ditto. bought term insurance just a day before my 22nd birthday 🙂 Had an amazing talk with one of the advisors. I don’t know if it had a limit of 30 mins, but we talked for more than an hour, spanning 3 calls. I like a spam-free experience. advisors over sales persons anytime.

Thanks Bhagyesh. This means a lot!

@Zerodha has its own style.

Very good initiative, I was waiting for this type of advisory from long time. You guys rock!

Excellent Initiative. Keep it up. Will be in touch. Can send mail regarding Senior citizen Health Insurance. Thanks.

Hi Amit

You can simply visit the website, and text us on whatsapp. Just let us know what information you need and we will offer them to you.

Excellent initiative , but give preference to senior citizens and more matured personalities.

Good iniciative…