SEBI’s new rules for index derivatives: Here’s what’s changing

On October 1, 2024, SEBI released a circular that changes a few things for index derivatives. Here’s a breakdown of all the changes and their impact.

Increase in contract size

Currently, the contract size for index F&O contracts is between Rs. 5 lakhs to 10 lakhs. Starting November 21, 2024, the contract value will be increased to between Rs. 15 lakhs to Rs. 20 lakhs.

To meet this criteria, NSE and BSE will revise the lot sizes for all new index F&O contracts introduced from November 21, 2024, onwards.

- Existing weekly and monthly contracts will continue with the current lot sizes until they expire.

- Newly introduced contracts will have the revised lot sizes as follows:

| Sr. No. | Index | Symbol | Present Market Lot | Revised Market lot |

| 1 | NIFTY 50 | NIFTY | 25 | 75 |

| 2 | Nifty Bank | BANKNIFTY | 15 | 30 |

| 3 | Nifty Financial Services | FINNIFTY | 25 | 65 |

| 4 | Nifty Midcap Select | MIDCPNIFTY | 50 | 120 |

| 5 | Nifty Next 50 | NIFTYNXT50 | 10 | 25 |

| 6 | BSE Sensex | SENSEX | 10 | 20 |

| 7 | BSE Bankex | BANKEX | 15 | 30 |

| 8 | BSE Sensex 50 | SENSEX50 | 25 | 60 |

For quarterly and half-yearly contracts:

- The lot size will change on December 26, 2024, end of the day for Nifty.

- The lot size will change on December 24, 2024, end of the day for Bank Nifty.

- The Lot size will change on December 27, 2024, end of the day for Sensex.

These changes will come into effect from the following expires:

| Index | Expiry | Expiry Date | Effective change |

| Nifty 50 | Weekly | December 19, 2024 | Last weekly expiry with existing lot size |

| Weekly | January 02, 2025 | First weekly expiry with revised lot size | |

| Monthly | January 30, 2025 | Last monthly expiry with existing lot size | |

| Monthly | February 27, 2025 | First monthly expiry with revised lot size | |

| Quarterly & half yearly | March 27, 2025 | Will be revised from December 26, 2024, end of the day | |

| Nifty Bank | Monthly | January 29, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 26, 2025 | First monthly expiry with revised lot size | |

| Quarterly | March 26, 2025 | Will be revised from December 24, 2024, end of the day | |

| Nifty Financial Services | Monthly | January 28, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 25, 2025 | First monthly expiry with revised lot size | |

| Nifty Midcap Select | Monthly | January 27, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 24, 2025 | First monthly expiry with revised lot size | |

| Nifty Next 50 | Monthly | January 31, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 28, 2025 | First monthly expiry with revised lot size | |

| Sensex | Weekly | January 03, 2025 | Last weekly expiry with existing lot size |

| Weekly | January 10, 2025 | First weekly expiry with revised lot size | |

| Monthly | January 31, 2025 | Last monthly expiry with existing lot size | |

| Monthly | February 28, 2025 | First monthly expiry with revised lot size | |

| Quarterly & half yearly | March 28, 2025 | Will be revised from December 27, 2024, end of the day | |

| BSE Bankex | Monthly | January 27, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 24, 2025 | First monthly expiry with revised lot size | |

| BSE Sensex 50 | Monthly | January 30, 2025 | Last monthly expiry with existing lot size |

| Monthly | February 27, 2025 | First monthly expiry with revised lot size |

Note: If you hold quarterly and half-yearly contracts in Nifty after 26th December, Bank Nifty after 24th December, and Sensex after 27th December, that are not in multiples of the revised lot size, you won’t be able to square-off the position and will have to hold it until expiry.

In such case, you can either buy or sell an additional quantity to match the revised lot size or square off the position beforehand.

No calendar spread benefits on expiry day

Traders typically hold positions across different expiries (known as calendar spreads), this provides margin benefits and reduces the margin requirements.

On the expiry day of the F&O contracts, there’s a higher risk that the price of the contract expiring will behave very differently from contracts expiring at a later date. This is because of larger trading volumes on that particular day, which can lead to unpredictable price movements.

To manage this risk, SEBI has decided that traders will not get any margin benefits for calendar spreads on the day of expiry for contracts expiring on that day from February 10, 2025.

Example: Let’s say you have a short option expiring on 31st January with a margin of Rs. 1 lakh and a long option expiring on 28th February. Since your short position is hedged by the long one, you get a margin benefit and need only Rs. 50,000 instead of Rs. 1 lakh.

However, on 31st January (expiry day), this margin benefit will no longer be available, and you will have to maintain the full Rs. 1 lakh margin.

Limiting weekly expiry contracts

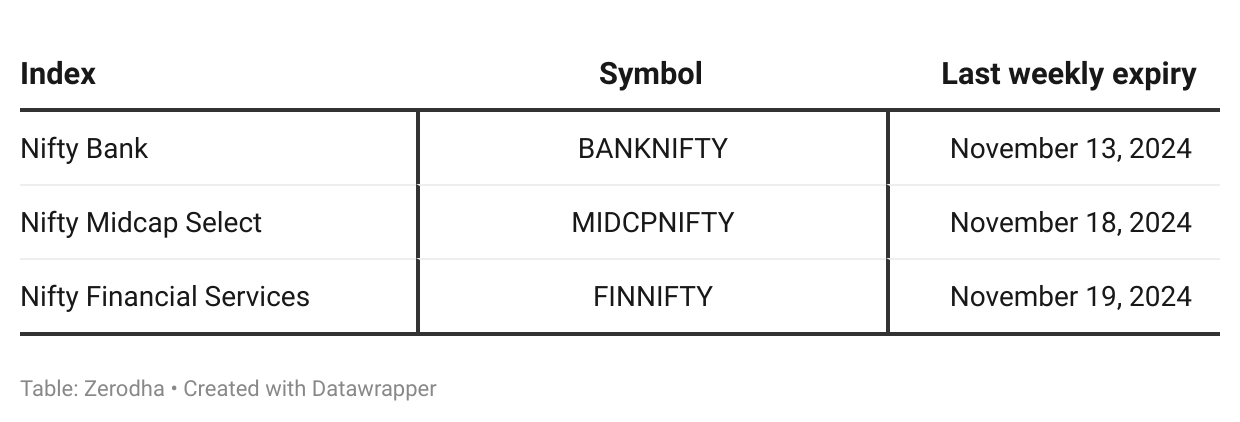

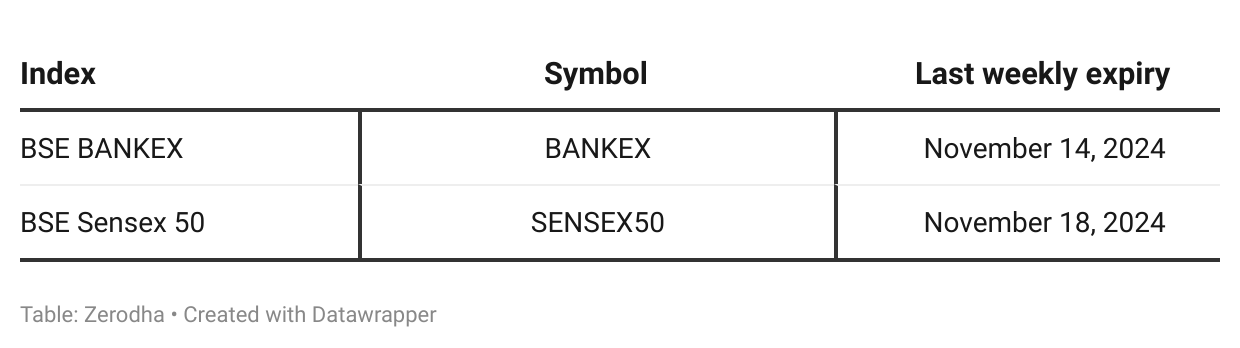

Currently, there are weekly expiries for 4 indices on NSE and 2 on BSE. Under the new rules, stock exchanges will only be allowed to offer weekly expiry contracts on one benchmark index. This comes into effect from November 20, 2024.

NSE has discontinued weekly expires for Bank Nifty, Nifty Financial Services, Nifty Midcap Select, and Nifty Next 50 indices will no longer have weekly expires.

BSE has discontinued it for BANKEX and Sensex 50 indices.

Here’s how the expiry schedule will look like once the changes come into effect.

Additional margins on expiry day

Starting November 20, 2024, an Extreme Loss Margin (ELM) of 2% will be applied to short positions (selling options) on the expiry day to cover potential risks due to increased volatility.

Example:

- You’re shorting Nifty 26500 CE, which is expiring today

- Since it’s the expiry day, a 2% ELM is charged for this short position

- Additional margin (per lot) = 2% × Underlying price × Lot size

- Assuming Nifty is at 26,200, the calculation will be:

= (2 ÷ 100) × 26,200 × 75

= ₹39,300

Upfront collection of premium while buying options

To ensure there is no additional leverage provided, SEBI has mandated that an option buyer now needs to pay the entire option premium upfront.

Nothing changes for you at Zerodha, as we have always collected option premium upfront for buying options.

Intraday monitoring of position limits

SEBI and exchanges have limits on the maximum positions a single client or a broker can hold for a particular contract. For clients, this limit is set at 5% of the total number of all derivative contracts of the same underlying and 15% for brokers.

Currently, these limits are monitored at the end of each day by the exchanges. Starting April 1, 2025, these will be monitored multiple times throughout the trading day.

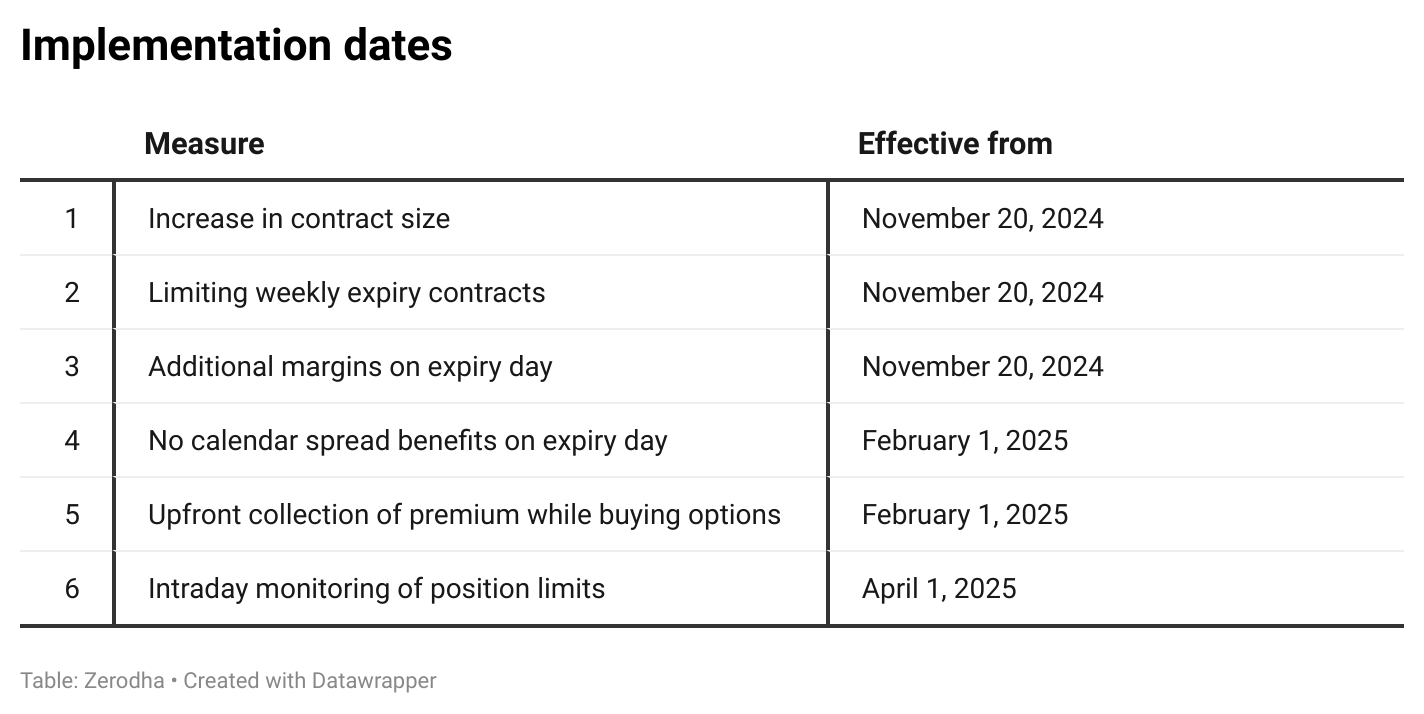

Here’s when all the changes come into effect:

If you have any queries, post them on this thread on TradingQnA.

Hi, I am holding 26300 pe ending with 30-12-2025, with pledge, how much I need to maintain cash margin on the day of expiry i.e., 30-12-2025.

What if sufficient liquid bees are already there in the trading account in pledged state. I mean I am still receiving emails to maintain sufficient balance to avoid any auto square off of spread. Can you please explain this case? As I was told that this cash collateral also acts as cash equivalent. Then why I have recived email before expiry day.

Hi,

Could you please let me know if this falls under Calendar Spread margin rule for 10th July Expiry?

1 Lot SELL – 25500 CE – 10th July,2025 Expiry

1 Lot BUY – 26000 CE – 10th July,2025 Expiry

1 Lot BUY – 26000 CE – 17th July,2025 Expiry

Here, I have an ATM CE Sell and Far OTM CE Buy positions of this week’s expiry.

I also have an ATM CE Buy of next week’s expiry.

None of your articles clearly talking about this scenario and hence requesting for your kind feedback, as soon as possible.

Many Thanks,

Krishna

Sir please explain I have a long position on 13 th February (expiry date)and short in 27 march then what will be the margin position?

Your article doesn’t explain this issue.

In my zerodha Account After selling Nify of tomorrow expiry, stop-loss triggered and Purchased again the same stock,how come this possible..now for 8100 worth 33000 margin blocked..what to do now..?Pls suggest..

Hi Rag, could you please create a ticket at http://support.zerodha.com so our team can check and clarify this for you?

ELM is such a disappointing move from SEBI. This is not going to save retail traders from incurring losses in any way.

Yos

Can we have a simple calculator through which we can understand the required margin on expiry day

After years of trading options, it’s only now that I am able to generate some profits. 2% plm on expiry day has compelled me to reduce my position size. Now it will take a longer time to recover my losses.

True sir. Sebi has made impossible for a retailer to make profit

Dear Zerodha Support Team,

I am reaching out regarding the additional margin requirement of 2% on expiry day, as mandated by SEBI. While I understand the regulation, I would like to confirm how this applies to my current hedged positions in NIFTY options.

Details of my positions:

• Position 1: Sell NIFTY 24800 CE 5th Dec, 16 lot

• Position 1: Buy NIFTY 24900 CE 5th Dec, 16 lot

• Position 1: Sell NIFTY 24000 PE 5th Dec, 16 lot

• Position 1: Buy NIFTY 23900 CE 5th Dec, 16 lot

Given that these are hedged positions, I was under the impression that margin benefits would offset some of the additional exposure margin. However, my account shows. (Used Margin ₹ 4,32,999.98)

Could you kindly verify if the margin calculation is accurate and clarify if the 2% additional margin applies fully to hedged positions?

I would appreciate a detailed explanation of how the additional margin is computed and whether any adjustments are possible based on my hedge.

Thank you for your assistance. I look forward to your response.

Hi Suryanarayana, could you please create a ticket at http://support.zerodha.com so our team can check and clarify this for you?

Sebi discontinued the weekly expiry. It effected from 2nd December. It’s a bad experience for me. After many years i studied and do well the option trading on expiry day. Just started to profit from loss. The rule is very disappointed me. Please revive the weekly expiry on all indices. Zerodha can request to exchange and sebi to revive that.

This rule of banning weekly expiry is destroying my trading life as after loss of lacks we have gain knowlege of how to make profit. And by removing weekly expiry SEBI have made me choose other carrier which is not easy for person like me who is trading for 10 years. It completely destroyed my carrier.

Suggestion for Zerodha – for positional option selling position, pls also display margin required during expiry day along with the margin requirement that you already show.

That way, user may not need to calculate the additional margin required on expiry day.

Time to change government, also I am removing portfolio for all stocks of Adani. Everytime in fraud news.

Yesterday I took a short position in Nifty 21 Nov CE (tomorrow exipry). Today, there is a huge jump in margin requirement. Has the additional 2% ELM has been added today itself, i.e. on a holiday ? Zerodha margin calculator shows this figure (after the jump) but Angel One margin calculator shows the older figure (before the jump). Zerodha needs to clarify, if the day(s) prior to expiry are holidays, whether the additional 2% ELM will be applied on the holiday itself, or on the day of expiry at 8 am as per the normal margin update cycle.

Dear zerodha team

I took position yesterday utilized certain margin and having extra margin also . But today huge margin shortfall is showing in my account .

As today is trading holiday so I cannot square off position.

What can I do to avoid penalty except adding fund.

Yes we must move to court against such rules.

After studying a lot, people become profitable in FnO and now see what these people do. Will you ban restaurants as many of them are not profitable?

Only consistency from govt and regulator is screwing of retailers. Sad but truth is living in this country has become so difficult with each passing day. Hope some day things change for better.

is there any changes on option premium price hike??

Hi,

I want to know about ELM 2% which charge on expiry day in index option. Pls clear I am also buy option against my selling position that why my maximum profit loss will already fix. That only 5% of my total fund including all types of margin. Why am I pay extra 2% margin. That is near 12500/- per index option sell.

If sebi& Nirmala ji aim is to save losing money of people.They must reduce GST.They must also ban Intraday equity trading.Why only ban f&o index derivatives trading.If the government not have capacity to create new jobs for youngsters,then why spoiling f&o derivatives traders job.What this traders will do from Monday to Wednesday.

What about stocks future contract

what was ELM on Options Weekly expiry before?

Go Bangladesh or srilanka open a debate account and short Indian rupees 😊

Plz then reduce all the extra charges

Starting November 20, 2024, an Extreme Loss Margin (ELM) of 2% will be applied to short positions (selling options) on the expiry day to cover potential risks due to increased volatility.

When you will give this extra collected money back? Immediately after the expiry day?

Since inception of FnO trading the win lose ratio was always 10/90. 90% or more have always lost money. If SEBI thinks this ratio will change in favor of those who lose, they are living in fool’s paradise.

Why at the first place NSE kept reducing the lot size? Nifty started with 75 and reached to 25. Banknifty started with 50 and reached to 15. Why SEBI allowed NSE and BSE to introduce so many indexes?

Whoever starts any business without knowing nitty-gritties will always lose, same is true here too. Rather, my suggestion to SEBI is, stop huge gap-up and gap-down opening, that is the place where maximum retailers are slaughtered. Control operators who maneuvers market to suit their profit.

By these rules, you have just changed the losers’ crowd, winners will still be same.

Dear Sir,

While entering a position how can I calculate the final margin required on expiry day? If I know the margin requirement of expiry day I can control the position sizing accordingly while entering into the position.

Pls advice.

Needs updates

It seems Buch madam and her team do not have any other issues in hand. That is why she and her team has taken up this task of messing up the Index options trading processes. They think they are going to save people from making losses. I wonder how these steps are going to do that. People will still trade and many will still make losses. Only this time the losses will be bigger as the lot sizes are being increased. People do make losses in trading in equity and commodities also. If Buch madam is so intent on preventing people from making losses, then ban all types of Options trading altogether, even you should stop all types of intraday trading.

Steps of Buch madam are only going to increase trouble of serious traders. Those who have spent years learning the process of option trading are going get hardest hit. Those who are new comes will continue to make losses whatever step you take.

Happy with recent changes. Option trading must be banned for small investors whose portfolio is less than 10 lakhs. I think small investors must use options only for hedging and not for trading .

Exactly sebi is just harming retail traders and not taking any action against big players…this gov is just for rich and not for middle class…they just want tax from us..Hate this modi gov

very well explained

Excellent. Presently, there are too many players in the field (in crores) who are spoiling the direction of the trade and price for their immediate gain/loss.

On revision, there will be options and futures, just like stock options. Generally, retailers are fed up with these undercurrents.

Increase lot size is not good for middle man

Lot size increasing is a burden on low capital budget traders, it should be:

Nifty 50 —- lot size 50

Nifty Midcap Select —- lot size 100

Nifty Financial Services —- lot size 50

How a new trader can learn and grow with low capital

These rules benefit only sellers , but not buyers who are with small capital and skill power.

Everyone is option trader now a days. but big loss of brokers………

how many amount required for 1 lot in nifty

Hi Sachin, with lot size of 25, if you bought 1 lot for 100, the premium requirement was Rs. 2,500 (25 * 100), as the lot size is increasing to 75, with price of 100, the premium required to buy 1 lot will be Rs. 7,500 (75 * 100).

If nifty contact we take a premium of Rs 100, how much will it cost?

Example on additional margin requirements on expiry day seems to indicate that farther OTM strike (say 26000 CE) would require more ELM than a relatively near ATM strike (say 25000 CE). That is illogical as shorting 25000 CE has more inherent risk than shorting 26000 CE.

True that.

Broker 20 per order or change?????

No changes, Mohan.

Its a very good initiative to protect the gambling in trading business. Apart from above, it is also need to enforce about min retention time frame of equity/F&O after initiation of any trade so as big gamblers may face restriction to spoil the market.

Also remove current finance minister Nirmala sitharaman who is working only for rich.

this new rule by SEBI for increased lot size of Index options will also apply to equity options ? or they will continue as per the present lot size?

Hi Rajendra, these new rules apply only for index F&O, for stock F&O there are no changes.

Can I sell an old monthly nifty expiry contract after November 20th and before the monthly expiry, please explain.

You can, Pallab. Lot size for all the contracts that are trading currently will have old lot size. It will be revised for new contracts that will be introducted for trading from November 21. We have added a table explaining from which expiry new lot size will be applicable in the above post.

Bad decision by sebi by removing weekly expiry of midcap,finifty,bank nifty

Excellent

Lot size remains the same for Nov monthly derivatives contract, right? These lot changes are applicable for December monthly contracts and weekly contracts expiring after 20th November. Please clarify.

Hi Krishnaveni, lot size for all the contracts that are trading currently will have old lot size. It will be revised for new contracts that will be introducted for trading from November 21. We have added a table explaining from which expiry new lot size will be applicable in the above post.

What about Freeze qty limits per order?

Hi vatsal, the exchange hasn’t yet provided information on this. We’ll keep you updated on it.

What will be the max quantity in one order? Will it change to 5400 for nifty given the new lot size?

Hi Ganesh, the exchange hasn’t yet provided information on this. We’ll keep you updated on it.

Wts the new lot sizes of all INDEXES

As of now,

option premium melts (decreases) till expiry.

As per the new SEBI circular, the premium will decrease as the same till now or increase.

Please update on this.

What about stock options?

Are there any changes on margin requirement, expiry dates,lot size etc both for buying and selling

Finally Everything is now Cleared Reading this. Thank you.

Plz explain what is upfront premium and will this effect stock f&o, plz explain briefly

Hi Mandar, nothing changes for you at Zerodha. We’ve already been collecting upfront premium while buying options.

what will be new margin to sell one naked nifty option

There is a confusion. Suppose I have a position of 1 lot of 25 in NIFTY futre December 24. What will happen after 20 November, Do i need to add money or position?

Hi

Is there any changes to stock derivative and option trading?

I am newbie, tell me will the stock options lot size increase if the index derivatives contract size increases?

Hi Mandar, these changes are applicable only for index F&O. Things remain the same for stock F&O.

Many traders should file case in supreme Court against this order.

Hi Zerodha team, Can you tell me if the Commodity F&O is also affected by the new rules

Hi Samm, these rules do no apply for commodity or stock F&O, only applicable to index F&O.

No calender spreads benefits

Increase the lots size of lots

If you do calender spreads strategy margin money needs 50 thousand approximately but with this rule margin money needs for same strategy will be 4 lakhs approx

This is end of options trading in India. Indian traders will find out way to trade in foreign markets. This will effect Indian stock market as well . Bez trader will go for foreign market. With small margin money trader can do trades in foreign markets. India will loose traders and investors both for long term.

The existing positions will be forced square off or it will be adjusted in porportion to new lot sizes. e.g. Nifty position of quantity 75 for Dec 2024 will be auto converted to 1.25 new lot of 60. In case it has to be squared off then all the time premium will go for toss as loss. I hope it can be that hardship, when is circular/confirmation expected from Exchange on this.

such a popular largest broker if you are really concerned about retailers pl answer these:

1. who is termed retailer in Sebi parlance in option trading? is it capital employed, or quantum of trade? obviously retailer must be the guys who can only buy call or put options with involvement of max 1 to 2 lakhs per trade mostly intraday. what will be the total turnover of all of them together in nifty or bank nifty per day along with details of how many are gaining or losing by how much in a month? i trust it will be miniscule percentage o total daily turnover of the index.

2. most small guys make a loss because they don’t exit loss making trade, or averaging in falling prices expecting rebound, not using stop loss etc.

3. here to aid such small guys zerodha should provide higher version of Trading view platform most importantly (a) auto saving of all drawings without limit permanently in all charts and more watch lists. (b) most important the order form provided in trading view .com with buy/sell button, price, buy or sell for closing with price and stop loss value, (where any one is triggered the other is cancelled). educating these guys the benefit of stop loss would go a long way.

for a big guy like zerodha the cost of providing these should not matter. finally sebi will only restrict retailers in trading lesser lots than previously done to suit their capital. the standard cigarette type warning and disclaimers are waste of net space and govt will make money on higher charges. these retailers turnover will not effect any profits for big brokers as claimed, so they can put additional charges on retailers even on delivery.

Very informative and useful.

Dear Zerodha,

As you are one of the leaders of Broking Industry, our kind request (from all traders) may be forwarded to Hon’ Nirmala Aunty (MoF – GoI)

REQUEST : WHY IS SEBI NOT TAKING ACTION FOR UNWARRANTED SPIKES/SWINGS IN PREMIUMS FOR FnO? (IN FOREIGN MARKETS THERE ARE RULES TO CURTAIL THIS)

Q1. WHO IS MAKING THESE SPIKES TO HAPPEN?

Q2. WHO IS MAKING PROFIT FROM THIS?

Q3. WHY ISINT THE RETAIL TRADER GIVEN AN EQUAL TRADING OPPORTUNITY IN OUR OWN STOCK MARKETS?(OR IS THE RETAIL ONLY INVOLVED FOR BEING JUICED OUT – BY WAY OF LOSSES AND TAXES)

THE MoF-GoI/SEBI MUST ANSWER THESE QUESTIONS OPENLY

Sebi knows how to curb retail trader participation but don’t know how curb big guys injection trades

how much percentage of price is increased for buy a stock future

SEBI should not do this, coz the reason behind losses of small traders are telegram channels who provide tips without certification and without any knowledge of market, SEBI has to ban them to operate this type of ponzi channels who claim to give 10-20% profit on single trade,

Current rules of options trading and expiry are good and are in running in correct manner, this rules should be continue

Stop tips provider, make them to take SEBI registration before start any tips providing services and algon with they have to pay monthly fees to operate channels also. So false channels will no longer do this volatility in market

Please send sebi circulars

How will change of lot size work for nifty from 25 to 60. What if I have bought one lot (25) of 25000 pe of December expiry. How will I be able to close the position since new buyers will be able to buy only one lot of 60. Can anyone explain.

Hi Sagar, we will have to wait until exchange cirular to know what exact process they will follow. We’ll keep you posted on it.

Finally , a good decision by regulator…much appreciated.

If SEBI is so concerned about retailers making losses on expiry day, why do they allow retailers to trade on expiry.

Instead of implementing all this measures ,SEBI should directly simply retailers from trading on expiry.Its a one time solution .

IS CONTRACT SIZE MAKE BIG IN STOCK OPTIONS ALSO?

No, Manjunatha. These rules are applicable only for inde F&O, not for stock.

I think traders are making money out of small lot size cause there are multiple ways to learn the basic to advance and ”they” fear that it might get out of hand so they started making it more congested limiting the accessing of the contract so that big trading firms can only be eligible to participate. They know that with technical analysis and fundamental basic breakdown there is this possibility of creating profit in option trading. Government of India really trying there level to minimize the indulgence of low capital retailers but as we are desperate to break through this wall of poverty we will emerge from this darkness and hold our flags held high continuing in the path to find peace with this i rest my comment …

Jai Bharat

Bharat Mata ki jai

.

.

Akay

Hi .

How the lot size is adjusted for the current positions .

for eg if have 3 lots of nifty how it’s adjusted? What will happen to the 15 lot ( 3lot = new 1 lot + 15 )

Dear Ms Buch/SEBI,

Here are my two cents on the recent Future and Options trading curbs imposed by your esteemed organization.

Now there are addictive and certified dangerous means out there which are indulged into by the common public on a daily basis – my case in point for instance being the cigarettes and tobacco products. Isn’t it true that these products are research proven by scientists and doctors to cause cancer and kill people. But, sadly I am yet to see a cigarette being priced at a 1000 rupees or a regular cheap IMFL bottle priced at 10000 Rs…or best these products being phased out completely altogether. All we see are warning labels on the packs and in tiny fonts in TV shows/movies – telling us that this stuff can actually kill you. And, people use it anyways on a daily basis in copious amounts. What is your reasoning – ’Its their choice’..isn’t it (Revenue being the other..but let’s not go there). My point exactly. Its the choice of the individual to know the risk and yet take it.

So, please tell us why has Trading in Futures and Options become such a roiling issue all of a sudden that you need to go all guns out to deter people and make changes almost every couple of quarters. Its not a drug ma’am, its a cycle..it has always been there. It was there with stocks when the booms happened in the 90s. Why don’t you extract data on how many F & O traders became profitable finally after two years of losses. Why only focus on the loss makers. You might get a different perspective on the so called F & O froth/surge that you and the h’nble finance minister are so worried about.

There are those who dream of a stellar future in trading and have toiled night and day with burning passion for the same, please don’t crush them.

Please let better sense prevail and not haste to appease the higher ups who know nothing of a trader’s journey (it is a tough but exceptionally rewarding one).

Faithfully yours

A (erstwhile loss making) Profitable Options Trader

Brokers & referral walo ka 60-70% profit margin kam ho jaega…

This change has pros and cons. As we know, nowadays, our young generation is madly involved in these FNO segments without knowing such key points and having their own risk appetite. Limiting weekly exp contracts for other indices(excluded NIfty & BN) will help to get involved less people which is required as since these has been started overall market behaviour has been changed what we witness due to that many traders & their setups getting failed nowadays.

Hoping for better index management & more reliable operation from them to avoid such glitches during market hours.

Happy Trading, Learn-Earn

Whos are ”they”?

Sebi, market makers and government seen options has potential to make poor guy very rich. And may be data also wrong or retail traders are becoming profitable(just turned around) obviously we all cried for years we learned. So they just don’t want you to become rich. Bcoz if it happens you know whos going to become poor.

And see one more thing., that data was coming from years 9outof10 are losing. Most of loss they make on expiry day. So for their benefit they increased expiries. Initially it was successive( I mean when daily expiry started there was literally atm ce,pe, both goes to 0 it was happening)..

But now things got changed and now aggression can seen only in expiry index…

Look things are clear. You given them power. Power to control your life. And now They are using it.

This empire is made of blood. Many peoples are died many are dying. Nobody did anything for retailers. Nobody gonna do, it’s truth. Whatever they are doing it’s for their benefits only.

You are just asset or equipment of their business. They Uses and then Throws.

Explained very clearly.

When NSE is going to finalise weekly contract information and I assume Sensex continue the same weekly contracts and BANKEX is not available for it

Why SEBI only think for FNO trading?

Why lot size is increasing? What will do for poor trader and lose making trader? How they will comeback ?

How new trader will learn from big lot size?

Everycase loss may definiately increase.

Why everyday expiry removed?

Last one year learning from mistakes and again change.

Non sense.

Why STT charge increases?

SEBI should think to reduce technical glith and traders profitability.

There is no need to chage at all. Everything is fine.

Again changes means everything is new to start.

SEBI should continue for unchanges in FNO trading.

Very Bad decision of SEBI…All small traders Growing The Indian Stock Market And Attract new Foreign Investors and traders Investment but SEBI only listens to the govt. they increased lot size to increase turnover per lot so that Govt get more STT. bullshit rules. They are not saving retail traders but killing them.

Hi,

Reg calendar spread limitation, does it apply to diagonal spread also, like different expiry&different strike price?

Why SEBI and NSE have taken this decision investors may gain and loose money common in the market.but sometimes they may get huge profits in options .

Now no chance to the poor to become rich.

This is why the rich becoming richer and the poor becoming poorer.

Very sad , misery, 😭😭😭😭😭

SEBI only listens to the govt. they increased lot size to increase turnover per lot so that Govt get more STT. bullshit rules. They are not saving retail traders but killing them.

Thank you posting in well arranged and understandable way

Why sebi. Your decision is only favour for riches. It makes door closed for poor to become richer.Why this partiality. Why stoping weekly expiry. Monthly expiry margins are costlier than weekly than how a low volume trader or poor trader will trade monthly expiry. Same time this cause earning loss for nse& bse too.

SEBI failed to provide full date. It give the loser data of retail fno investors only. They do not provide the gainers data. Moreover they also failed or purposely did not provide the gainer and loser data of HNIs, FIIs, and domestic institutional investors data. I saw many retail investors with windfall gains who become HNIs. Is it hurts SEBI? Who is behind SEBI. IF NOT SEBI should provide full dataset for transparency.

Sebi are you also there for the richer community? To stop losses instead of increasing lot size u could have arranged for training and allow to trade only after certification.

Worthless idea of increasing lot size

Sevi is clearly mentioned that lot size changes are made for equity index derivatives as per their circulation, but some youtubers are saying that it is applicable to the single stock derivatives as well. Is there any truth in it. I think as a leading brocker in country, you will have much clear answer. Please do share your thoughts.

What about commodity futures and options. Any changes

Non-sense , stop increasing the lot size …..and weekly expiry shldnt be removed ……dumb rules

It’s a joke!

After all the international speculation on the leadership board, they are trying to create PR ripples.

Weren’t they away about the weekly expiries? Didn’t they reduce the lot size of the index options in April?

God bless this country 🙏

The calendar spread is a very legitimate hedging strategy when you are trading options. I might buy a nifty option of a specific strike price expiring a month from today. And then sell an option of a higher strike expiring this week. It goes to reduce my cost of holding the long option. Why would SEBI do away with that flexibility.

Is there any impact on the futures?

Yes, Pradeep. Same rules apply for index futures as well.

Is there any changes with equity option as well or this for index only

Hi Narendra, this is only for indiex F&O, does not apply for stock F&O.

I have 10 lots (250nos) Dec 2025 25000 PE. What will happen to this when the contract size changes.

Which instrument continue for weekly expiry after 20 november, nifty or banknifty? Whats the more chances we all want to know

Hi Jai, NSE is yet to announce which index will be allowed for weekly expiry.

Wow, beautiful and simple explanation . I read the same news on some other sites and it didn’t make any sense to me.. cheers Zerodha