Instantly sell pledged cash equivalent securities

Pledged cash-equivalent securities such as Liquid ETFs, Sovereign Gold Bonds, and Government Bonds can now be sold instantly without waiting to unpledge them.

Previously, if you wanted to sell pledged cash-equivalent securities, you had to place an unpledge request on Console before 3:30 PM. These securities would only become available for selling the next day. This one-day delay not only caused inconvenience but also affected F&O traders who use these securities for managing margins and meeting mark-to-market (MTM) requirements.

What are cash equivalent securities?

Instead of holding cash in their accounts, many traders prefer to invest in low-volatility securities such as Liquid ETFs, G-Secs, and similar instruments and pledge them for margin to trade in the F&O segment. Since these securities are less volatile compared to stocks, the collateral margin from pledging these securities is treated as equivalent to cash.

This approach allows traders to manage their funds efficiently and also allows them to meet the minimum cash margin requirements set by exchanges for F&O positions. Exchanges mandate that 50% of the margin for F&O positions must be in cash or cash-equivalent collateral, while the remaining 50% can be in non-cash collateral.

For instance, if you hold an F&O position with a margin requirement of ₹1 lakh, you need to maintain ₹50,000 (50%) in cash or cash-equivalent collateral, with the other ₹50,000 in non-cash collateral.

How to instantly sell pledged securities?

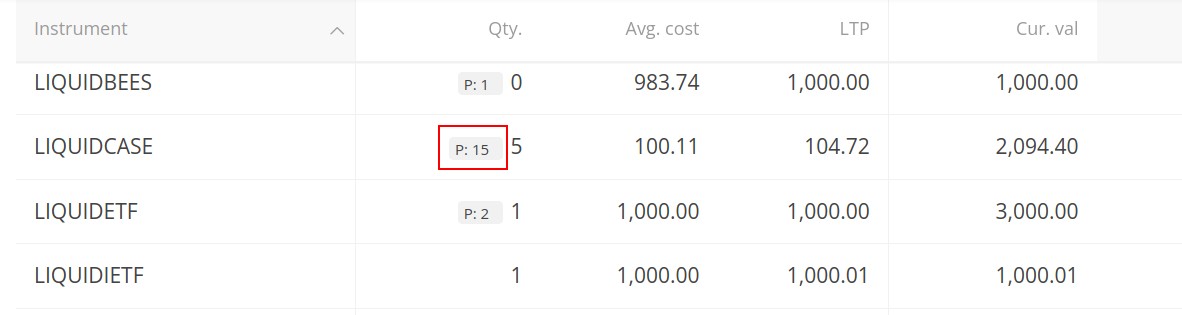

You can sell pledged securities instantly by placing a sell order as you normally would. The pledged quantity is displayed separately with a “P” symbol in Kite holdings, alongside any quantity that is not pledged.

When you sell pledged securities, the collateral margin provided against those will be reduced from your account. Once the order is executed, you will receive 100% of the sale proceeds, just like any sale of free holdings. These funds can then be used for purchasing other securities, trading F&O, or any other purpose.

Did you know?

- When a sale trade is executed on a holding that has both pledged and free quantity, the pledged quantity is reduced first, followed by the free quantity. However, at the end of the day, any sale obligation will be fulfilled first with the free quantity. To learn more, see Why is the collateral margin reduced when the holdings are sold?

- If you buy back the pledged quantities that you sold on the same day, the pledged quantity will be reinstated, and the collateral margin will be immediately added back to your account.

For Pledged share any monthly charges? Or others charges.

Fund Fast Account me nhi aata

Fand add ma dikat ha

y dont you implimnet same in liquid mutual funds to redeem instantly upto 50k. if it so veryyyyyyyyyyyyyyyyyyyy helpfull when market red time. i requested many time.

but the answer is same we will update.

every AMC allowing instant redeem from liquid funds. then we can capture market red by redeeming some units and can buy fallen good stocks. even you are maintaing just flotform like COIN. please do solution instant redeem. at least allow me redeem 50% instant and remaing you have a chance to adjest price.

or at least provide cash against liquid fund instant. whatever do we want instant redeem

Hi, at Zerodha, investments in liquid mutual funds are held in a demat mode, whereas instant redemption facilities are available only for funds in a non-demat mode. As a result, instant redemption of mutual funds is not available on Coin.

Good

Can we get the cash by pledging SGB or shares ? Can the pledged cash be used for buying stock in intraday or CNC ?

Hi Banni, SGB’s can be pledged, however, the collateral margin cannot be used for buying stocks for delivery. It can only be used for intraday equity, trading futures and shorting options.

I understand that we need to bring 50% cash and cash equivalent for F&O positions. But is it also applicable on intraday trades or only overnight trades?

Hi Arvind, this is applicable only for overnight positions.

Can we do the same for Liquid Mutual Funds purchased on coin in future?

Hi Arun, mutual funds cannot be sold without unpledging, as the proceeds are directly credited to your primary bank account. For mutual funds, you can place an unpledge request from Console.

Good for knowledge

Hi Team,

I am a long term equity holder/swing trader.

How will the pledge option be useful for me ? Can i use the collateral amount from pledging to buy new stocks.

Is Zerodha planning to enable Margin buying (MTF) on equity ?

Hi Saroj, collateral margin cannot be used for buying other stocks or ETFs for delivery. It can only be used for equity intraday, trading futures and shorting options. MTF is currently under beta testing and will be available for all our users soon.

considerable

Ok sir

Plz send hindi video

Good

My SGB is not linked to my demat account. How can I sell it instantly?

Shot sell kyu bandh Kar rakha hai .

Very good

Very nice 👌

Good

If i pledge my Liquid or LTGILT Bonds ETF’s holding, can I use those funds to buy Low volatile ETF for long term?

Anyone please answer me. Thanks

Hi Avijit, collateral margin cannot be used for buying other stocks or ETFs for delivery. It can only be used for equity intraday, trading futures and shorting options.

Good

Good 👍

Very good 👍👍

Useful

Good

Nice

Awesome

Hi Zerodha Team,

Is this F&O 50% cash component applicable to CNC positions in 0 DTE now?

Will there be any change after the new regulations?

Or Intraday orders should be created rather than CNC even for 0DTE?

This is not applicable for intraday. Even if you use Overnight (NRML) order type, as the positions are expiring on same day, it will be considered as intraday trade.

Nice

Good

OK sir

👍

Good

Aacha

NICE…