Explainer on new price band rules for stocks trading in the F&O segment

Last week, SEBI introduced key changes to the dynamic price bands for stocks in the F&O segments. These changes aim to enhance volatility management during significant stock price movements and reduce information asymmetry.

First, let me explain what dynamic price bands are. All stocks and derivative contracts traded on the exchanges have defined price bands within which they can trade for the day. These bands typically range from ±2% to ±20% of the previous close price, depending on the stock’s volatility and other factors. If the price hits either limit of the band, trading beyond that point is not allowed.

However, for stocks in the F&O segment, there isn’t a daily limit on price bands, meaning prices can theoretically move without restriction. Initially, the price bands are set at ±10% from the previous close for stocks and futures contracts (For options, the price band is correlated to the theoretical pricing of the option when the underlying equity is at ±10%). If this band is hit, it can be incrementally revised throughout the day. The 10% limit is primarily in place to prevent abnormal trades caused by fat finger errors.

Below are some of the optimisations to the existing framework for smoother revisions in price bands.

Enhanced conditions for flexing price bands

Currently, an underlying stock requires a minimum of 25 trades from 5 different accounts executed at or above ±9.90%(or ±14.90% or ±19.90% and so on) for the price bands to be flexed. This has been enhanced to 50 trades across 10 trading accounts and 3 trading members to ensure flexing is done only on genuine market movements and not fat finger errors.

Alignment of equity stock and current month future contract

Currently, the price bands of futures contracts are flexed only if the underlying equity stock has its price bands. This has been modified, under new rules, the price bands will be flexed if either current month futures or underlying hits their price bands. We have in the past noticed instances where the current month futures contracts had hit the price bands but the equity stock price took time to reach the price bands leading to a longer halt in the trading of F&O contracts.

Cooling off periods and stepped flexing of price bands

Currently, the first price band is set at 10%, beyond which there is a 5% flexing after a 15-minute cooling period once the price band is hit. This has been revised to the following:

|

Instance |

Price Bands |

Flexing (%) |

Cooling-Off Period |

|

Beginning of the day price bands |

±10% |

– |

– |

|

First Two Instances |

1st: ±10% to ±15% 2nd: ±15% to ±20% |

±5% |

15 minutes / 5 minutes (if hit in the last 30 mins of trading) |

|

Next Two Instances |

3rd: ±20% to ±23% 4th: ±23% to ±26% |

±3% |

30 minutes |

|

Further Instances |

5th: ±26% to ±28% 4th: ±28% to ±30% |

±2% |

60 minutes |

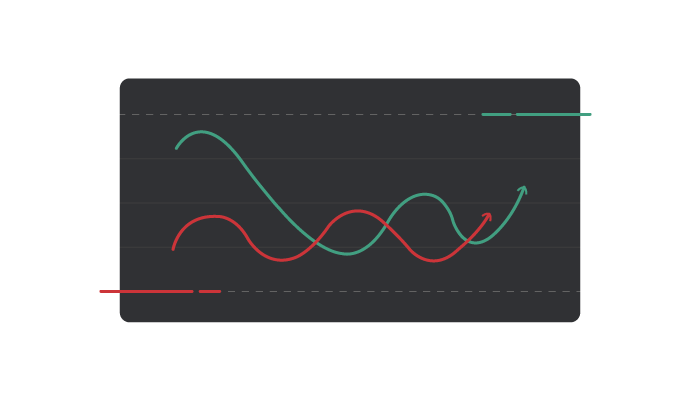

Sliding price bands

SEBI has now introduced sliding price bands. If the price bands are flexed in one direction, the band on the other side is concurrently flexed by an equivalent amount, which was not the case earlier. The exchange will cancel orders that would be active in the old price band.

|

Scenario |

Lower Band |

Upper Band |

Action |

|

Beginning of the day price bands |

90 |

100 |

– |

|

Upmove of 5% |

95 |

115 |

Orders ₹90-₹95 canceled |

|

Down move of ~14% |

90 |

110 |

Flex to original price bands |

Trading in options during cooling off period

Currently, options continue to trade at their existing price bands until the stock’s cooling off is lifted and the new price band is applicable. However, the circular has created a provision for a temporary floor or ceiling price that can be created based on the LTP (if liquid) or theoretical price (if illiquid) in the sentimental direction of the contract to allow for traders to hedge/derisk their positions in times of market volatility. We’ll update this section once the exchanges come up with the operational SOP for this.

Implementation timeline

|

Phase |

Implementation date |

|

Enhanced conditions for flexing price bands |

June 3, 2024 |

|

Alignment of stock and current month futures price bands |

August 19, 2024 |

|

Cooling off periods and stepped flexing of price bands |

August 19, 2024 |

|

Sliding price bands |

October 21, 2024 |

|

Trading in options during cooling off period |

October 21, 2024 |

If first 2 instance flexing is on upper side, and then there is downward flexing, so whether 5% would be flexed for this downward flex or 3% would be flex

Thanks for the detailed information! 🙂

Please explain with examples to visualise better.

Please explain everything in hindi then I will take benefit of your beneficial material.

With Thanks

Plz describe in hindi

Pls elaborate as their are major gap for the options trader.The volatility is much higher and price fluctuations is more than any other segment and our stoploss will be rejected by this type of rules.

very quickly got my accounts blown out and the trading systems did not protect my capital and incurred a heavy loss.

What care should be taken in terms of GTT orders in this case when we have stop loss set for erratic moves in F&O. Wouldn’t the order fail if the limit price isn’t in the band and later when the band opens up have repercussions where the SL actually doesn’t get triggered?

This is not correct But old rules is the better my opinions

The main problem comes in options and it is very difficult to manage the option prices. The risk of blowing up capital in options is higher than Futures and stocks. So option price band rules should be made clearer.

I have not understood much. What is F&O securities? If they touch the higher price band, and even crosses +20% price band, what is the action from the stock exchange?

Didnt understand much.. Need to explain with examples to get better clarity

In the past there have been instances wherein relatively higher strike calls (50 multiples) have a ”higher” value for ”lower circuit value” implying as if higher strike call has more inherent value than a lower strike call. Due to this anomaly, the trading volume for the whole day is very low in such option. This forces trader either to wait for expiry to exit position or by paying an unfairly higher price than that of a lower strike call option.

I had raised this issue and provided snapshots, but zerodha attributed it to dynamic price range and did not do anything. Will these anomalies be addressed now?