Electricity futures are now available for trading in India

Starting today, electricity futures are live for trading on Indian exchanges. MCX has started trading in these contracts from today, and NSE will start from Monday, July 14, 2025.

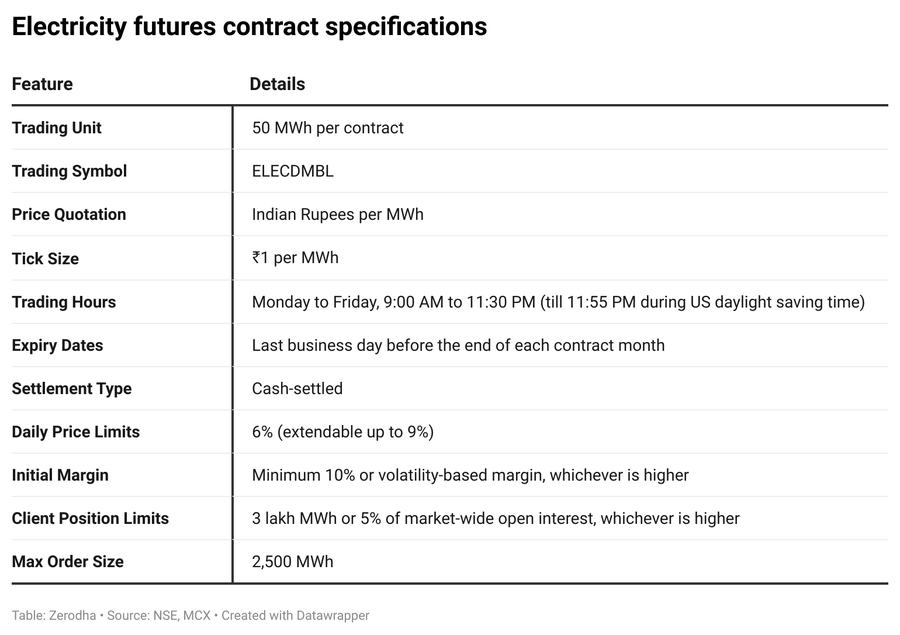

These contracts will trade from Monday to Friday, from 9:00 AM to 11:30 PM (11:55 PM during the U.S. daylight saving period, November to March).

Here’s a quick explainer on electric futures trading from today’s Daily Brief by

@zerodhamarkets👇

A futures contract lets you lock in a price today for electricity you plan to buy or sell later.

This gives power producers, distribution companies, and even speculators a new tool: the ability to secure a future power price, on a regulated exchange, without having to create or take delivery of that power.

Until now, most electricity in India was sold via long-term Power Purchase Agreements (PPAs) between generators and discoms, covering the base demand through 5, 10, or 25-year contracts.

But demand and supply aren’t constant. Heatwaves, monsoon failures, or outages cause sudden spikes or drops. That’s where short-term markets like IEX’s day-ahead and real-time trading came in, allowing utilities to buy/sell electricity for immediate delivery.

However, those are physical markets. You’re actually buying electricity. The new electricity futures offered by MCX and NSE are purely financial contracts. No physical power changes hands. It’s a cash-settled bet on what power prices will be in a future month.

So, why aren’t electricity futures being offered on IEX, India’s biggest power exchange?

It comes down to regulation and who governs what. In India, physical power markets are regulated by CERC, the Central Electricity Regulatory Commission. But derivatives are financial instruments. So they come under SEBI’s jurisdiction.

Since IEX is a CERC-regulated entity. It can’t offer SEBI-regulated financial products like futures. That space is reserved for SEBI-approved exchanges like NSE and MCX.

So, what’s the point of these contracts? At a basic level, it’s about hedging. Power generators can lock in future selling prices. Discoms can protect themselves against price spikes. Speculators can bet on market trends.

20

20