Order placement simplified

Over the past few months, we have been working hard to introduce new features to simplify your order placing experience on Kite. Here are some useful additions we have made to the Kite order window:

- Order slicing – You can now easily place large orders without having to worry about exchange freeze limits.

- Available margin – Instantly know your available funds on the Kite order window.

- Market depth – Now easily access market depth on the order window itself.

- Remember F&O quantity – Kite remembers the quantity you entered for a contract and automatically fill it in when you open the order window next time.

- Market Protection – Makes your market orders safer, preventing them from executing at unexpected prices during volatile market conditions.

- The new Basket icon lets you quickly build and execute multi-instrument orders from anywhere in the Kite platform with just a few clicks.

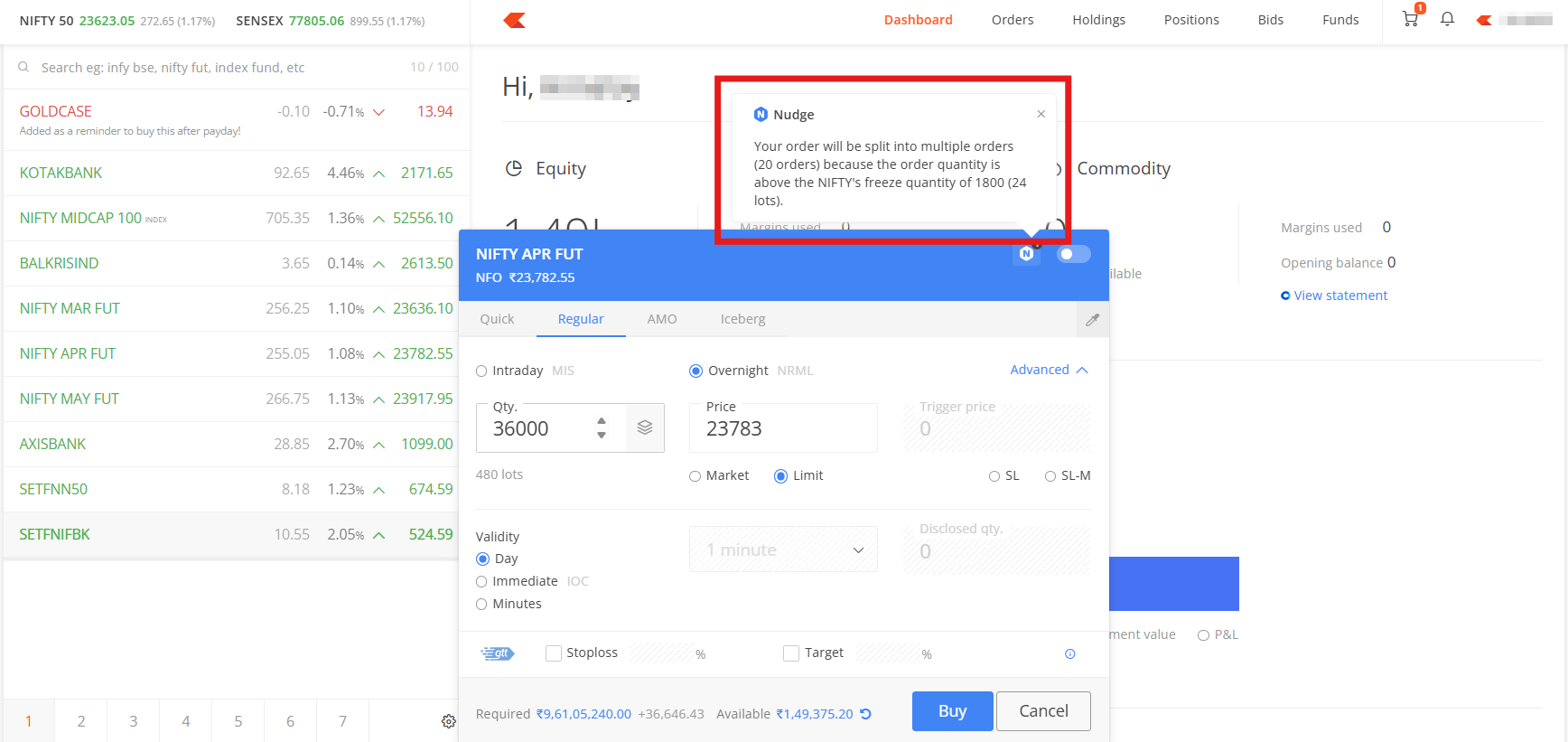

Order slicing: Handling large orders with ease

When you need to place a large order, exchange freeze quantity limits can be an issue. Our new order slicing feature solves this problem automatically.

When you place an order that exceeds exchange limits, Kite automatically splits it into smaller parts. For example, with large Nifty orders, the system can divide your order into up to 50 slices, with each slice containing 1,800 quantities. This allows you to handle up to 36,000 quantities without manual intervention.

The brokerage will be applicable for each sliced executed orders separately. For instance, if the order is sliced into 5 order, then the brokerage will be applicable for 5 executed orders individually.

A simple nudge appears when you enter a quantity beyond the freeze limits to indicate that your order will be sliced. For easy tracking, sliced orders are marked with a blue layer icon in your order book.

This feature works across Kite web platform—in the normal order window, Option Chain, Quick Baskets, Trade from Charts, and positions. It even simplifies closing large positions. If you hold multiple large positions that exceed freeze limits, you can select all the positions in the Positions section and click on Exit all to automatically slice the order for you.

Currently, order slicing is available only on Kite Web but will be available on the Kite app soon. Note that it will also be added to the ATO in the upcoming update.

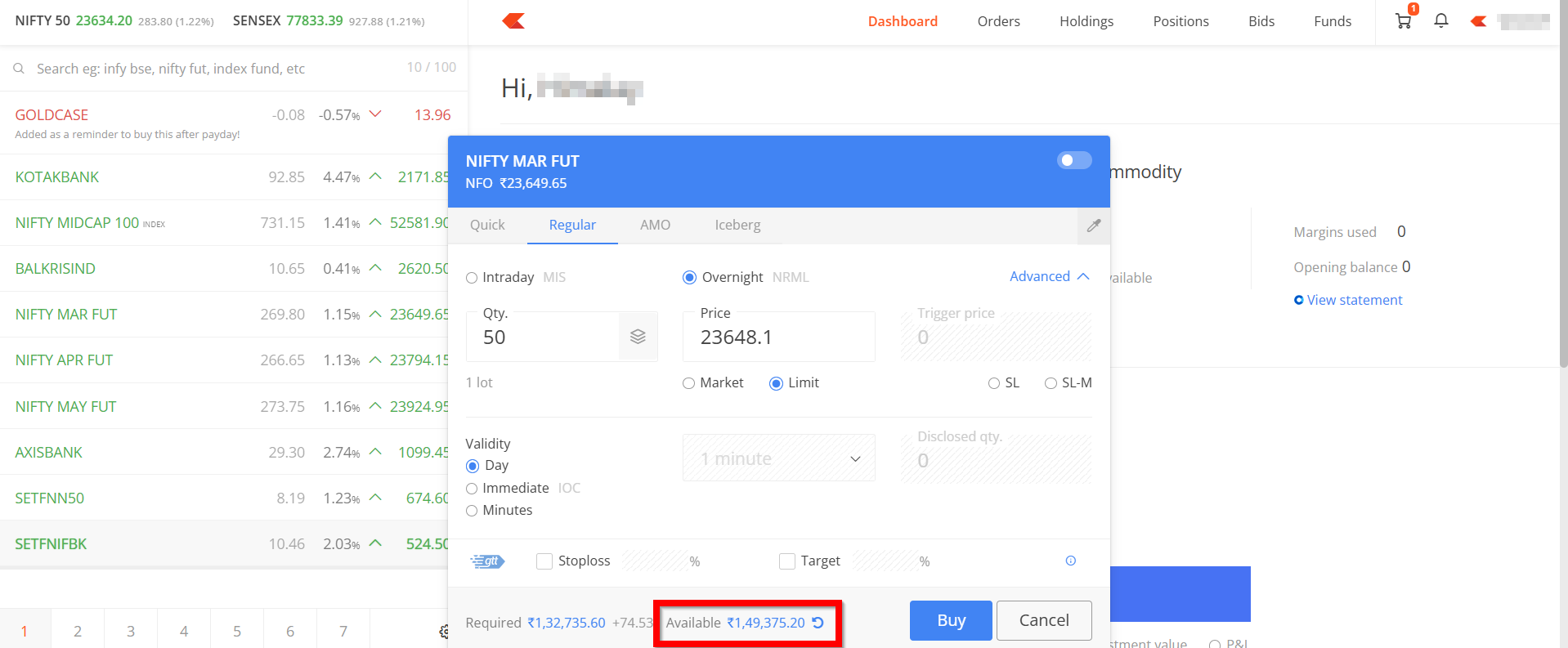

Available margin: Know your available funds on Kite order window

Before this update, you had to check your available margin separately from the order window on the funds page, which added an unnecessary step to your trading process.

Now, Kite Web displays your available funds directly in the order window. You can now instantly see if you have enough margin before placing a trade, without having to switch between tabs.

Market depth on Kite order window

Understanding market depth is crucial for making good trading decisions, especially with large orders. Previously, you had to hover over a stock in your marketwatch and then click for market depth.

With our latest update, market depth information is just one click away in the order window. Simply click the dropper icon to instantly see the top five bid and ask prices along with their quantities. Need more detail? Click the arrow to view the full 20-depth market for NSE stocks.

You can also click on any bid or ask price to automatically fill your order window.

Remember F&O quantity: Save preferences

If you frequently trade with the same quantity of F&O contracts, the Remember F&O order quantity feature is useful. Once enabled in your profile settings, Kite will remember the quantity you entered for a contract and automatically fill it in when you open the order window next time.

This feature works across all contracts with the same underlying. Set a quantity for Nifty Futures, and it will be applied to Nifty options as well. The Remember F&O order quantity is available for all index, stock, commodity, and currency F&O contracts.

Market protection

Market volatility can sometimes lead to orders executing at unexpected prices. Our new Market protection feature on Kite web gives you more control when placing market orders.

Regular market orders execute at the best available price, but in fast-moving markets, prices can shift quickly between when you place an order and when it executes. Market Protection solves this by setting a predefined range around the current market price.

The market protection percentage is calculated as per the below table:

| Security type | Price range (in ₹) | Percentage of the Last Traded Price (LTP) |

| EQ and FUT | Less than 100 | 2% |

| EQ and FUT | Between 100 and 500 | 1% |

| EQ and FUT | More than 500 | 0.5% |

| OPT | Less than 10 | 5% |

| OPT | Between 10 and 100 | 3% |

| OPT | Between 100 and 500 | 2% |

| OPT | More than 500 | 1% |

When you place a market order with this protection enabled, the system actually places a limit order with boundaries set at the above mentioned percentage above the last traded price (for buy orders) or below it (for sell orders). If the price stays within this range, your order executes just like a regular market order. But if the price moves beyond the protection range, your order remains pending as a limit order at the maximum allowed price for buys or the minimum allowed price for sells.

Enabling this feature is simple: just click on Advanced and check the Market protection box when placing your order.

Market Price Protection is currently available only on Kite Web but will be added to the Kite app soon.

New basket icon

We have simplified how you add instruments to a basket, making trading simpler. The Basket icon is now easily accessible from all pages on Kite web, allowing you to open a basket with a single click and Search & add instruments directly.

You can also add instruments from your marketwatch, holdings, positions, and more by clicking on More and selecting Add to basket. Once you have added all your instruments, review and edit your basket or place your orders with a single click on Place all.

For options traders, we have added a basket toggle icon to the option chain. When enabled, you can add multiple option strikes to your basket at once, eliminating the need to search for each strike individually.

Please share your feedback on these new additions to the Kite order window below.

Note: These features are currently only available on the Kite web, but will soon be available on the Kite app.

Once slicing order is placed – cant we modify all orders at once? Please suggest. I understand Exit all positions in positions page is one option – but what if i dont really want to exit at market rate.

in market protection order, i have a query..

lets say a freak trade happened and in rare case , that freak trade got captured in the ltp.

say the freak trade is 1000 points, now even if i place market protection and trade can get executed at around 1000 price right because the lilmit order becomes 1% of 1000 ?

Hi Ajan. Yes, in case of a freak trade, the market protection order takes that freak price as LTP and calculates the limit price 1% away from it.

So if the freak trade happened at ₹1000, the limit price would be ₹1010 or ₹990, depending on the order direction, and your order could execute near ₹1000 — the freak trade price.

Everything is good except for Order slicing.

The whole idea of freeze quantity is that you don’t end up taking huge order by mistake etc

Request yuo to please revert it or provide a setting in profile so that it is active for those who what it.

yeah true

Hi Saurab, You will receive prompts to confirm order slicing before placement, so there’s an opportunity to review and avoid any mistakes. That said, we’ve noted your feedback and will share it with the team for consideration on making it a user-controlled setting.

Previously you have not regular otm order above 200 points in case of nifty , angel one provides it that is one improvement done by zerodha and it is good.

BUY FIRST SELL NEXT IF I PLACE AN IRON BUTTERFLY ORDER. It is beneficial for margins.

Is market protection order type coming to KiteConnect API as well ?

I know it was there earlier but was deprecated around 2018.

It will be good to have it added back to the APIs.

Hi Himavanth, your feedback has been noted. We will check into the possibilities.

I loved the order slicing and showing of margins on order window. There is one issue I observed with slicing. Once I click on BUY/SELL, there is another popup to display –

”Your order will be split into multiple orders (2 orders) because the order quantity is above the NIFTY’s freeze quantity of 1800 (24 lots).”

On this popup, Enter key DOES NOT work and I have to use mouse click.

My suggestion is, please do NOT show this popup at all or give me an option like ”Do not show this message again”.

Hi Mangesh, currently the Nudge cannot be disabled. This confirmation helps prevent accidental order placement, especially if Enter is pressed again unintentionally. With the ’Remember Quantity’ feature, this avoids placing a larger order than intended. However, we have noted your feedback and will look into it. Thanks.

please add auto square off once a particular amount of SL or Target is achieved on all the open position held. If that defined amt is achieved it should trigger market order for closing all my positions.

Hi Varun, will bounce this off our team. Thanks for the feedback.

Can’t place stop loss and Trigger order at a time worst application

Hello team, please add live profit and loss on IQ Chart Screen.

Also please add CLOSE TRADE button on IQ Chart screen to book profit or loss instantly.

Hi, your feedback has been noted. We will check into the possibilities. In the meantime, we’ve included this in the TradingView – Trade From Chart (TFC), which is currently in beta. You can try it out here: https://tradingqna.com/t/tradingview-trade-from-chart-tfc-beta-now-live/180530

Pls introduce trailing Stop loss option in our kite app

Is it possible to keep a Trailing SL automatically ? Like if 10 Rs moved then TSL will be 8 and so on?

Hi Suryanarayana, we’ve noted your feedback and will explore the possibilities.

Pl add TSL and placing/closing orders on the chart itself.

Hi, thanks for the feedback. We’ll check on this.

Kindly add algo trading facility directly alerts from streak

Can you please allow stop loss trailing bar in trading view chart same as in q chart

Hi Sami, thank you for your feedback. We’ll look into the possibilities.

Good

Kindly allow to raise trailing stop loss automatically.

This feature will help day trader very much.

Hi Gurjeet, thank you for your feedback. We’ll look into the possibilities.

0.25% for Placing GTT order should be removed and any price should be allowed.

Bring back bracket order

Hi Sreeram, the Bracket Order feature has been discontinued for some time now. Here’s an article that explains why: https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/why-bo-stopped

Hi Kanyakumari,

1. We’re working on it; we’ll keep you posted.

2. The exchanges already send this message every trading day with the total traded value for all trades you have done on the exchange on that particular day. However, your feedback has been noted. We will check into the possibilities.

Can you add two indicators i.e.ATC-LHAL [ATC] & Simple Volume with Pocket Pivots of tradingview in zerodha chart

Some times we may intend to place a order on Nifty index if Nifty reaches a particular level. For that case pleas allow the user to access or create an ATO order from the option chain itself similar to the basket orders that we can create now. This will help users to create orders for options contract when Nifty reaches a pre defined level such as a major support or resistance or a Fibonacci level etc.

Please consider adding this feature for index and stock option chain so that we can place automatic orders based on a level on spot chart.

Ek aur aisa feature jo pahale se lgbhag sal bhar se dusre broker me available hai … Well done yehi umeed hai zerodha se ki wo har badhiya features sabse akhiri me lounch karega ….kabhi toh koi features tum pahle lao …..kuch din aur aisa hi rha toh dheere dheere top 10 broker me bhi ni rahoge.

I have a feature request w.r.t placing orders. Basically for building any position, user should be able to place an order for quantity X with preferred price range of A to B with every Y% drop Z% of X is placed. say for an order of 1000shares at 220Rs, user will say execute the order between 210 and 225 such that for every 2% drop in price order for 100 shares is placed.

This can integrate well with GTT.

Please add candle closing timer as in Trading view, it would be great.

Hi Vijay, the countdown to bar close feature is currently available in Trading View charts on Kite.

If you are referring to ChartIQ charts, we have noted your feedback.

Hi,I had request for a sort and filter option sector wise.Sort etf’s together.Can you consider it to on Kite web holdings,not in the console.Thank you

Hi Anju, your feedback has been noted. We will check into the possibilities.

Good to see new features. But still need few additional stuffs

For scalpers, the current position and status line in the chart itself, second one is to position exit/ partial exit button in respective chart itself, third one is to display position status in existing chart page instead of keeping a separate menu.

May be you can compare other good platforms and implement in a better way. So that high frequency traders will get more chances of profit

Loved the newly added features.

Trailing SL is extremely important feature. Could you please bring this in ASAP.

True

Hi Sudhir, we’ve noted your feedback and will explore the possibilities.

Bas note bas karo kabhi action bhi lo nhi toh sare client hath se chale jaenge.

hi, for the basket option would be great if there is an uploadable format in xls or csv.Makes it very easy when trying to place multiple orders. Adding them 1 by 1 can be quite tedious

regards

I loved the newly added features.

Trailing SL is extremely important in today’s volatile market. Could you please add on this feature as well.

Hi Sudhir, we’ve noted your feedback and will explore the possibilities.

Appreciate your concern for the customers. Many years now, no problem encountered. Easy to trade . Maintain the same level of service.

Thanks for the improvements. Please introduce the feature that enables users to place stop loss and target along with order in one go.

Very Good Guys. Pls also add trade from chart feature as well!!!

Hi Akash, we’re working on adding the trade from chart feature to TradingView charts, and it’s on our list of things to do. Thank you for your feedback, and we’ll keep you posted.

I hope 2030 tk jarur a ajega ye features zerodha me kyuki in logo ne than liya har badhiya kam last me Krna hai.

Hi Its Good Work

Kindly start Delivery trade with use of collateral margin

currently we can use collateral margin only for intraday

other broker are providing MTF trade with using Collateral margin and we can use this feature in Delivery so one can buy delivery trade in MTF with using of collateral margin

very good

Great job guys. Keep up the good work

Basket me option chain ka bhi feature aana chaiye jaise sensibul me add hota hai, Basket me option chain select kr ke add krne se kafi smooth rahega,

Live profit loss add in same screen,

Correct, this feature is most important feature.

They also should add CLOSE TRADE feature which closes ongoing trade instantly.

I always think that zerodha should provide us freeze fund facility

(When trader freeze his limited fund he can not use the frozen fund for 12 hour)

To minimize losses and to controll psychology on losing day

Market protection is not available for me. Please check.

Hi Tridib, to enable this feature, click on Advanced and check the Market Protection box when placing your order on Kite web. If this isn’t available for you, please create a ticket at support.zerodha.com and provide a screenshot so we can get this checked.

Market Protection sets a predefined range around the current market price. But what if there is wrong hit by someone else and now the range woud get set around the latest but wrong level. The range should not be influenced by just one last price but an anchor, like say 10 ema of last ten trades

Hi Zerodha Technical Team,

In Console – > Reports – > P&L section – Segments drop down box, Currently we have seperate segements listed like Commodity, Currency, F&O etc, Can we have addtional option like ALL Segments in the drop down please. This if made available, we can select this ALL segments and select date range, will give us a complete view of our performance across all segmens. It would be a good feature to have. Kindly consider.

Thank you

Hi Ramesh, this on our list of things to do, and we’ll keep you updated.

New changes are really nice especially market depth on order screen. I used to open market depth at back and order popup on front and dragging order popup to side to see market depth. But because of this new change of market depth along with order I don’t need to do what I was doing earlier and help me.

I have one suggestion, now all stocks under holding having one list, can you provide functionality to do grouping of stocks under holding with group total so that it would be easy for investors to group stocks under different categories like Auto, IT, EV, Solar/Wind, Gold, miscellaneous stocks and easily find out how much we have invested in specific category. Currently we have to export the stocks and keep track this in excel.

Hi Dinesh, your feedback has been noted. We will check into the possibilities.

First i would like to congratulate Zerodha for brining in these features also would like to add a few points here if you can actually introduce them it would be wonderful

1) with Market protection i think it would be better if you allowed the user to set the percentage we have this facility in fyers and shoonya as well depending on the instrument type i usually set the percentage on market protection, i think you can also introduce that here .

2) it would be of great advantage if you can bring in trailing stoploss feature.

3) ice berg orders don’t usually go at market price in zerodha if you are introducing market protection then you should allow iceberg orders to be exited at market price which in some cases is very helpful due to the volatility in the market.

Hi Asim, thanks for the feedback. Your concern has been communicated to the relevant department. We’ll look into the possibilities.

Thanks a lot, market depth on order window was much required feature.

If I have a holding in any stock, then whenever I open the chart of that stock, my holding should also be visible to me in the side panel .

Hi Sawan, your feedback has been noted. We will check into the possibilities.

1. Brokerage per equity is not defined in this system! Can you improve this system regarding this? And include it in the contract note.

2. Total trade value (I) Buy and (ii) Sale does not reflect in the Trading platform! Can you include it in the platform?

Hi Kanyakumari,

1. We’re working on it; we’ll keep you posted.

2. The exchanges already send this message every trading day with the total traded value for all trades you have done on the exchange on that particular day. However, your feedback has been noted. We will check into the possibilities.

there should be an option to make the unexecuted order remaining valid for post closing trades at the closing rate since these trades are on first come first served basis. the condition can be the rate at which the order is placed is higher than the official closing rate.

How can I exit all my position at once at ”LIMIT” price (the last traded price)?

Currently it exits at Market price, at the next available buyer/seller, which is a huge loss.

Nice Work.. Market depth and Basket feature are really good.

Please add EXIT option according to P&l ..

Example : Exit all positions when toal positions Profit is+5000 ,

Exit all positions when loss is -5000

This is exactly what a option trader needs.

A large portion of investors who are Senior citizens dont join Zerodha as they find the format confucing , make the format easy to buy and sell equity preferably Kite for dummies

Zerodha should also bring trailing stoploss (auto trails with feed gap from ltp) like we have in upstox

Pravin Agarwal not opening ac

I appreciate the new measures to simplify and for ease . The holding quantity exceeding 365 days too should remain displayed at the time of order along with the column of holding quantity. This will help while placing order to know whether this sell order will cause which capital gain STCG or LTCG , sometimes you never know if the quantity placed for order is just one day short of 365 days. In that case one will like to delay sell order by one day. At present in Zerodha to know the holdings more than 365 days , one has to go to portfolio and use tag, this is very cumbersome and unfriendly unlike other platforms. Zerodha we expect to be the leader in all such so important functions to help its customers in saving huge capital gains tax.

Very useful improvements……. Always appreciate your continual improvement efforts

No use of whatever you simplified. Your app will not function at the crucial time. You people will create

” glitches’. Your SILOS will not see order placed, executed or cancelled or rejected. Then you will go to X and post ’ regret ’ statement and falsely claim

” resolved ”. Then your team members will speak at the levels of fraudsters.

How to see remaining funds.because i already inactive my account

Need scrollable WL of charts over multiple layouts like TV , Fyers

Awesome features, thanks.

Very good sir

Plz give brokge facility which has been closed by u .. starts it again zerodha..

please enable bracket orders of index options and intraday for stocks

This is going to help a tonnes, Thanks alot Kamath brothers.

just add sell and buy through chart directly, have asked for it many time.. you all are really lacking behind in comparison to other trading apps. i will be shifting soon if this feature doesnt get added.

if you activate Chart IQ instead of trading view charts, you can use this feature. its there from 6 years.

But we not trade beyond freeze quantity.

Really bro? You are comparing Tradingview charts with IQ charts?

All updates that have already been given have been consolidated with a few new ones. Right now, the protection mode in the advanced tab is not working. It needs to be set right. I have yet to verify certain new updates.

Very useful

Are you guys looking at adding functionality of placing buy/sell order and stop loss through chart?

There is an issue about chart. Simply I said if I make a support line or do something else in chart in my watchlist section and save it , but changes not applied to charts in my portfolio Section.

Whenever we short sell or sell the scrip you may show the entire scrip in red colour rather than showing numbers in red to quickly identify short positions. Just a feedback

Good

It’s been very long since you deprecated the tag without any information. I’ve lost all my tagged data planned for long term. Losing trust in you guys.

Nice feature

Crpto exchanges are very improved

we wish our indian exchanges more than that

Pl observe and adopt tq kamath sir

And it is necessary of bracket order facility

Few suggestions –

1. Kindly increase max stock limit in watchlist to 250 so that we can create a watchlist for all FNO stocks for analysis.

2. In full chart view (chartIQ) there should be a collapsible watchlist tab so that we need not to type stock name everytime while doing the analysis part.

3. In chartIQ, kindly add a custom timeframe remember option so that we need not to add it everytime.

With the above features order placement is simplified. which was the need of a retail trader.

thank you zerodha

Many a time a request is made to display in holdings – DAY GAIN/ Loss AMOUNT by giving a sort option.

While this useful feature is available across all the trading platforms, it is absent in Zerodha.

Do try to include this useful option.

Much awaited slices. Thanks zerodha

Please enable market order for GTT also

Zerodha please trading on chart ka option do …Bahut problem hota trailing me ….Drag and drop feature is best for trailing….

Nice this app

In my kite app view chart is not showing.what happening so. I updated kite app still not showing view chart.A white blank display is showing.pls help

Can we have market protection % by default for all orders.

Why it has to be done per order.

Lets say i want protection from 5% of LTP than i will just add that once and it will apply to all orders.

Many a time a request is made to display in holdings – DAY GAIN AMOUNT by giving a sort option.

While this useful feature is available across all the trading platforms, it is absent in Zerodha.

Do try to include this useful option.

Awesome improvements done by team Zerodha. Kudos.

Hi

Actually my account is not working

And no operate

Ple active my account

For options strike chart instant buy and sell features like trading view and able to put target and stoploss at the same time in the chart after taking an entry would be more helpful.

You should On chart trading options as like trading view app is much needed.

Thanks for order slicing feature and the ability to see available funds at order placing window.

Keep up the awesome work.

Pls Add running P&L on Chart & option to close it on chart. went between chart and position is very irritating .some times we lost profit on that….Total order placement from chart. Much awaited feature in zerodha

Can you add feature for below scenario:

1. I have CE position and current price is 100INR

2. I need to switch position with other PE position have price 100 or less

3. With selling CE position, PE position at market rate bought.

What is the use after retail traders participant gone 80 out of 100. When it was needed that time people shifted another broker now they also trying best but nothing special until margin not increase like before 2019.no matter how beautiful the Taj Mahal is, what is the use if don’t comes to see it ?

It’s a good post farm i like to use

When did the entry and exit on chart using a line is updated on the kite

You guys should come up with feature where you can just drag the sl in the live chart. Thats it

Hi Team Zerodha!

Every time there is a pop-up about the newly added feature/s, I hope to see the feature enabling on-chart placement of orders. But all in vain. Why is it taking so long? The idea is to allow the trader to place the order and the target and the SL on the chart itself (at the time of taking the trade all at once).

Awaiting…..

what about auto stop loss trail. abhi manual stoploss manage karna padta hai .

Awesome Updates – Thanks

”Could you please add a feature to exit trades for partial lot sizes? For instance, if I’ve bought 6 lots of Nifty F&O, I’d like to be able to exit 3 lots at market price. Currently, this is quite challenging to do on the mobile app.”

Please add count down clock with LTP

Hello,

In the ICEBERG orders, it does not make sense to change market order option to limit option every single time. If it cannot be placed, why provide the option ? Please freeze the market order option in the ICEBERG orders section and make limit option as default.

In the ICEBERG orders, when we enter the quantity we want to buy or sell, it would be beneficial if the number of legs can be automatically calculated instead of we trying to calcualte and then enter the value. For example: If I am placing an order for 5000 qty in Nifty option, the number of legs should be automatically calculated to 3 ( 1800+1800+1400)

waiting for sort by %(percentage) in GTT on mobile.

These are all very important and necessary features..

very useful improvement ,for quick order placement as well as protection.

testing

when we are placing sl order keypad popup and it

hide price box

kindly do somthing

Any possibility of placing orders over voice. It gives additional speed to put orders.

Please add all type of order placement in trending view chart

Thank you zerodha

chart is not so good we dont get the chart of a pertular company in simple watch list like trading view. Please work on that. thanks….

Dear Sir/Madam,

In the market protection SL and Target is based on % can you add it based on points also from the market price.

Please set the particulars limit in loss’s so people loss less money and enjoy future options and trading

very nice very good, thanks

SL pending orders should be able to be closed at market price whenever needed, at present only cancel is available.

Hi Elaine, your feedback has been noted. We will check into the possibilities.

Absolutely wonderful. The improvements stated above clearly indicate that Zerodha is always studying & improving ease of operational matters & security for customers.

Thank you all from my heart.

If I have to exit half quantity. The order slicing opens another popup and it is annoying.

thank you for what you are doing for us..

mtf order if hit stoplos after that we have no purchage again its very big problem pl that solve it thanks to you yours yash veer singh pph no 9212511227

is it possible to set the market protection feature as default?

Hi Deepak, currently, it cannot be set as default, but once selected, it will apply to all orders until manually unselected, logging in with another ID, or switching browsers.

Please give option to place both SLM buy order and SLM stop loss sell order in a single order

Hi Alok, your feedback has been noted. We will check into the possibilities.

These features were long awaited for last 5 years and finally you have done it. Suffered a lot in the past in absence of these features when quantities were much larger under old margin rules. I had also written to Nithin & team for these. Many thanks

Will you pl. allow to modify the size of kite windows ? they are so big, with lots of blank space, thus panning the window is impossible.

Further empty spaces between each line be reduced.

Hi Gopinath, your feedback has been noted. We will check into the possibilities.

Hi Gopinath, thanks for the feedback. Your concern has been communicated to the relevant department. We’ll look into the possibilities.

Very good legcture

Waiting for ”trailing stop loss” option

Hi Sadique, will bounce this off our team. Thanks for the feedback.

Very nice

please add trailing sl on chart

Hi Vishal, will bounce this off our team. Thanks for the feedback.

Very nice

Coin and Console shows long term status ONLY for Equity. It does NOT show long term status for Mutual funds. This should also be added.

Using Kite APIs should be free. Other brokers like HDFC Sec, ICICI Sec etc provide free use of Trading APIs.

Hi Bharat,

We have now added a free personal Kite Connect tier. Read more

Make possible to add basket in the market watch and buy and sell through keyboard shortcuts

Hi Navpreet, you can add the scrip to the basket from Market Watch using the ”More Options” menu. Keyboard shortcuts are available here: https://support.zerodha.com/category/trading-and-markets/general-kite/others-kite/articles/keyboard-shortcuts.

In the order placement window where in there is depth shown, Please add day open high low and close.

Hi Laxminarayanan, will bounce this off our team. Thanks for the feedback.

nice updates .. mazing UI available in market for now ..

EVERY THING IS GOOD!!!

HAND OF APPLAUSE !!!

But One thing is there you must think upon

most users (retails) enter the trade using single screen

in the background there is chart open on the right there is the market watch and an order window is open there at the bottom of the chart

so the order window overlaps the chart

while entering the order there come the message in ”N” which is above the order window

which additionally obstructs the vision of the chart

if possible make that view only on the order window as the space that would take is of otherwise not so important on the order window

furthermore, if possible give us the option to make the order window transparent to some extent.

please do consider.

once again, Zerodha and its vibrant team do deserves the kudos for their incessant endeavor to make trading easy in traders hand and adding features for that.

Thank you.

Please try to bring margin feature to kite mobile also asap

Hi Deepak, if you are referring to available funds on the Kite order window, it will be added to the Kite app soon.

your doing manythings, still why your not doing trailing stoploss..there are many other brokers having that feature..

Hi Sreenivas, we’ve noted your feedback and will explore the possibilities.

Zerodha can add ” clock” showing current exchange time, which can greatly benefit ”pre-open” order placement.

Hi Smit, will bounce this off our team. Thanks for the feedback.

Hi Kite,

In dark mode to increase quantity of contract, increasing arrows missing. At lite mode its available but not in dark mode.

Hi Sushil, will bounce this off our team. Thanks for the feedback.

when we are going to get target stoploss and price setting on chart itself.every other broker is giving that.

HI Sanjay, will bounce this off our team. Thanks for the feedback.

Finally, thank you so much Zerodha. Now waiting for trading from charts and trailing stop loss.

Hi Pawan, we’ve noted your feedback and will explore the possibilities.

Is order slicing feature available in kite api as well?

First stabilize your system. 25th Mar morning hour it went down for a couple of minutes. This creates hell lot of inconvenience. Focus on stability rather than adding new features.

Hi Jeet, we’ve been working fine. Could you please create a ticket at support.zerodha.com and provide more details along with a screenshot/video recording so we can get this checked?

Still waiting for sort by GTT on mobile.

Hi, we’ve noted your feedback and will discuss it with our team. Thanks

Hi,

Lot of helpful features and appreciate the same.

What about the charges that you were displaying earlier. They are no where to be found.

Thanks.

Hi Nirav, the applicable charges are displayed between the required and available margins on the order window.

Hi Shruthi,

Got it now 🙂 Thanks for highlighting.

Regards,

Nirav

Very nice

Good