SGB issued in 2016 matures: Comparing returns of SGB vs. other forms of gold

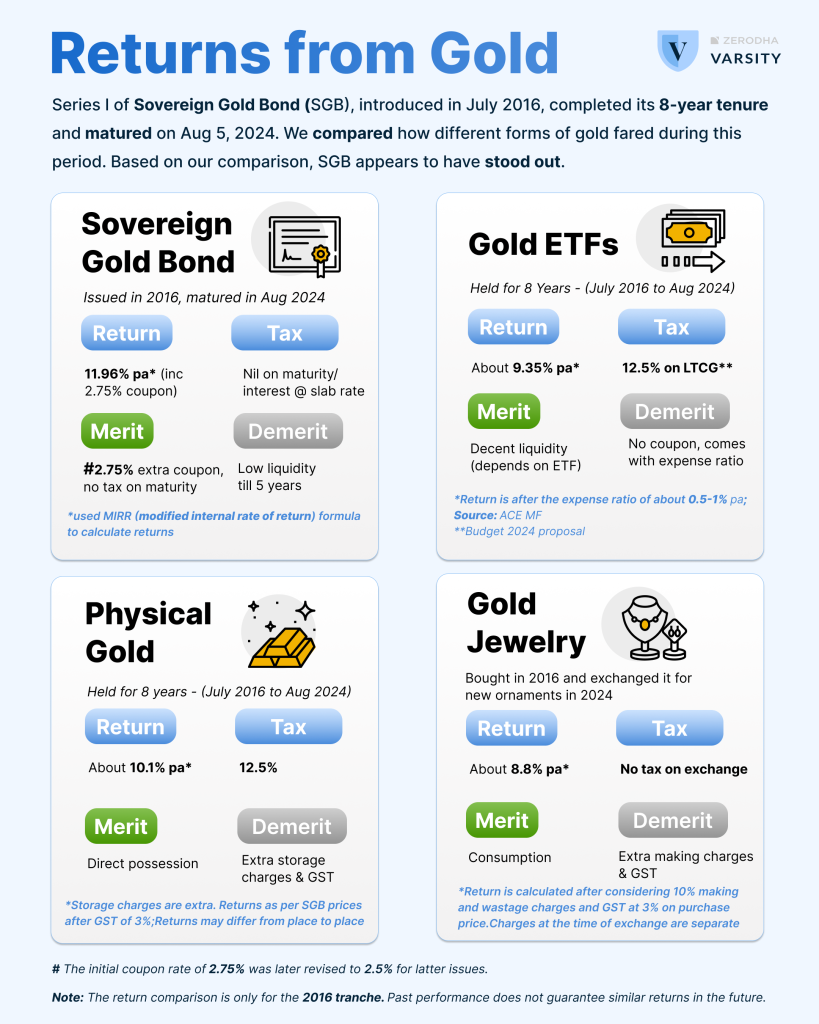

Series I of the Sovereign Gold Bond, issued in July 2016, was due for redemption on August 5, 2024. We compared how different forms of gold—such as SGBs, gold funds/ETFs, physical gold, and gold in jewelry form—fared during this period. Remember that every form of gold ownership has its own merits and demerits. Based on our comparison, SGB appears to have stood out from a returns perspective.

Sovereign Gold Bonds (SGBs): The major advantage of buying gold in the form of SGBs is the extra coupon of 2.5% of the initial investment that a subscriber is entitled to receive. But the drawback, if you say so, is the lock-in period of 5 years. While SGBs mature after 8 years, they are available for pre-mature redemption after five years. These bonds are also traded on the stock exchange, but the liquidity is quite poor.

Coming to the SGB in focus here – the first series of SGBs issued in 2016 – matured on August 5, 2024, with a redemption price of Rs 6,938 per gram. The subscription price of the same was Rs 3,119 when issued in 2016. With a coupon of 2.75% (changed to 2.5% for latter issues), this SGB issue has delivered about 11.96% per annum return in eight years. If you wonder how we calculated that 11.96% return, we used the MIRR (modified internal rate of return) formula in Excel with initial outflow as negative and subsequent payouts as positive. Since the interest payout gets credited to the individual’s bank account, we used a 3% savings bank account interest rate as the re-investment rate.

By the way, capital gains on SGBs are exempt from tax if held until maturity. This, too, is a big differentiator for SGBs compared to other forms. The interest earned, however, is taxed at one’s slab rate.

Gold Funds/ETFs: Gold fund or ETFs (exchange-traded funds) is another form of investing in gold. These funds have gold as the underlying asset, and thus, the prices of these funds represent the market value of gold. Since asset management companies manage these funds, there will be a small component of expense that we need to pay. This ranges between 0.1% to 1% of the value of the investment every year. The liquidity with gold funds is high as an investor can sell his/her units in the fund anytime and withdraw the money. Liquidity of gold ETFs, which are traded on the exchange, depends on ETF to ETF. The approximate return from gold ETFs during the above SGB’s tenure is about 9.35% pa. Of course, this return is after the expense paid to the AMC. This is one of the best ways of holding gold after SGBs, in our view. For ETFs bought in 2016, the tax on capital gains is 12.5% as per the new Budget 2024 proposal.

Physical gold: Let’s look at how holding physical gold would fare compared to above. Direct possession of gold can be considered as both a merit and a demerit. Some like possessing physical gold because it is tangible—it can be seen and touched. While others look at it as a burden because of fear of theft and an extra requirement to store it in lockers. Anyways, to each their own. One thing to note is that when buying physical gold in the form of coins or bars, one needs to pay GST at the rate of 3% of the value. Without considering the storage charges, which could vary depending on the service provider, the return on physical gold would be in the range of about 10.1% after GST. We considered SGB prices only as the proxy for physical gold prices. Note that physical gold prices differ from place to place, and this return slightly differs from the actual return. In terms of tax, there is no tax if you exchange gold for gold; else, it is 12.5% for long-term capital gains as per the Budget 2024 proposal.

Gold in the form of jewelry:

One major use case of gold in India is buying it as jewelry. Many of us hear from friends and family that investing in gold jewelry is wise because gold prices tend to rise, making it a good investment. However, if you’re buying gold jewelry for consumption, this analysis doesn’t apply. Buying gold jewelry is one of the least preferred options from an investment perspective. This is mainly due to the making and wastage charges, also known as value addition (VA) charges, which can range from 5% to 12%, plus an additional 3% GST. When considering these charges (with VA at 10% and GST at 3%), the rate of return over eight years would be significantly reduced to 8.8%.

If you exchange old gold for new jewelry, there is no taxation. However, remember that you will still incur VA charges and GST on the full value of the new jewelry purchased by exchanging the old gold.

Conclusion: Each form has its pros and cons. Series I of the Sovereign Gold Bond (SGB) issued in July 2016 matured on August 5, 2024, yielding an 11.96% per annum return, including a 2.75% annual coupon. Compared to other forms of gold investment during this period—such as gold funds/ETFs (approx. 9.35% pa return), physical gold (approx. 10.1% pa return without considering storage charges), and gold jewelry (approx. 8.8% pa return)—SGBs appears to have stood out during that period.

A very important reminder is here: It’s important to remember that past performance does not guarantee similar returns in the future. Similarly, current tax benefits may not continue indefinitely. Needless to say, these things matter; it’s always good to have a reminder.