How to plan your finances with Hindu Undivided Family (HUF)

Succession planning is a crucial aspect for any family. There is a plethora of examples around us where proper succession planning wasn’t in place and it complicated and messed up matters.

But what if there was a structured framework that not only aids in succession planning but also brings along significant tax benefits?

This is possible by forming a HUF i.e. the Hindu Undivided Family.

In this article, we will delve into the details of Hindu Undivided Family, understand its definition, structure, tax implications, and how it can be a strategic tool for financial planning.

What is an HUF?

Forming an HUF is straightforward – all you need is a family.

For instance, Mr. Sharma, his wife, and their two kids together form an HUF. And then individuals who lineally descend in that family will automatically become a part of Mr. Sharma’s HUF.

Every HUF has three types of members:

a) Karta

The Karta is generally the eldest male member in the family, in our case Mr. Sharma. Keep in mind that the assets of the HUF are owned by the entire family, and the Karta is just a manager and decision-maker.

b) Coparcener

Coparceners are members who get a share in the properties or assets owned by the HUF by birth. They can demand their share in the HUF and even ask for partition. Quite obviously, the Karta is also one of the coparceners.

c) Member

Members also have a right in the properties or assets of the HUF. They are entitled to all the benefits from the HUF and its income. However, unlike coparceners, they cannot demand partition of the HUF and exercise their rights to the assets.

An HUF persists until dissolution and can add coparceners up to four generations. After that, only membership is possible. Assets are collectively owned, with each member’s share determined by the familial hierarchy.

Tax implications on HUF

For tax purposes, HUF is treated as a separate entity and requires a distinct Income Tax Return (ITR).

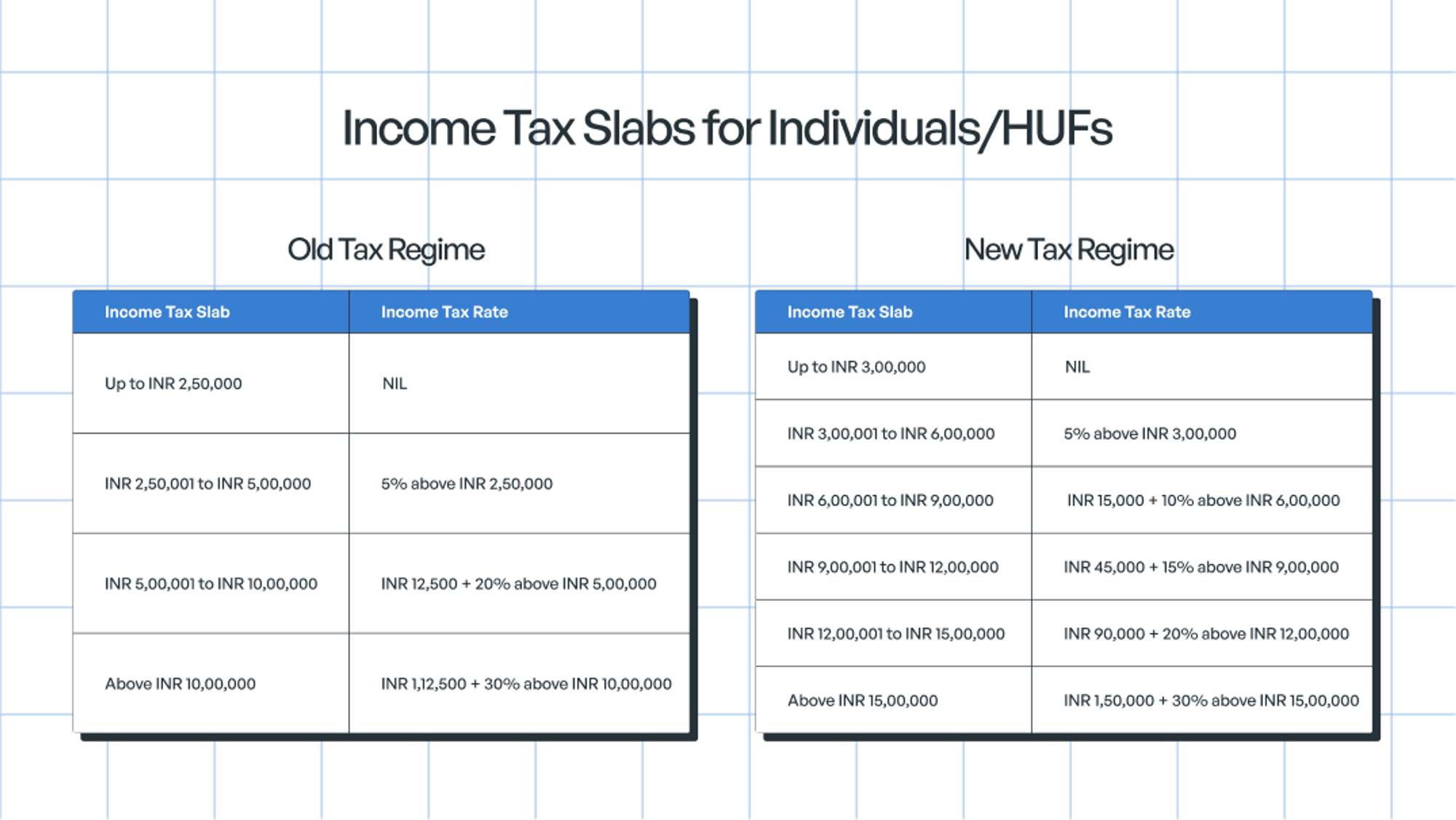

It follows the same income tax slabs as individual taxpayers, with available deductions similar to those for individuals.

Various deductions, including those under sections 80C, 80D, and 80G, are available. Refer to the image below.

However, standard deductions and tax rebates applicable to salaried individuals are not extended to HUFs.

Further, while an HUF cannot have a PPF account in its name, it can claim deductions for amounts deposited by the HUF in the PPF accounts of its members.

Planning your finances using HUF

The real power of an HUF lies in its ability to facilitate tax planning and financial strategizing.

Some of the most common examples of how you can use HUF to save taxes are as follows:

Transferring ancestral property on HUF’s name

Suppose you have an ancestral property in your name that generates rental income. If you fall in the 30% slab, you will have to pay a 30% tax on this rental income. But you can transfer the property to the HUF’s name, and if the rental income is less than the basic exemption limit of ₹2.5 lakhs, you would be paying ZERO taxes on this income. And even if it is above 2.5 lakhs, the tax rate would be much lower than it would have been in your case.

Opening a demat account on HUF’s PAN

Many people open a demat account using their HUF’s PAN and use it to apply for IPOs to increase their chances of getting an allotment.

Further, people also use it to invest and trade in securities, thereby distributing their capital gains or profits between multiple demat accounts, thereby reducing their tax liability.

Transferring money to HUF’s bank account

If a husband and wife are both salaried employees, they can pool their capital and transfer it to the HUF’s bank account. This can result in a tax-free interest income of up to ₹2.5 lakhs because of the basic exemption limit.

Accepting gifts

An HUF can also accept gifts. While gifts received from members are non-taxable, gifts from non-members are taxed as Income From Other Sources (IFOS) if the cumulative value of gifts received is greater than ₹50,000 in a particular financial year.

If the HUF doesn’t have any income source, then it can receive a gift of 4 lakh rupees without paying taxes — by availing the ₹2.5 lakh basic exemption and claiming the remaining ₹1.5 lakhs as a deduction under Section 80C by investing in tax-saving instruments like ELSS.

Deduction on home loan repayments

By adding the HUF as co-borrower in a home loan, the HUF can claim the following deductions:

i) Home loan interest of up to ₹2 lakh under Section 24(b), and

ii) Principal repayment of up to ₹1.5 lakh under Section 80C.

Watch the video on our channel to learn more about these in detail.

Conclusion

Despite its potential benefits, forming an HUF and transferring assets may involve complexities and costs. Additionally, joint assets cannot be sold without the consent of all members, which can pose challenges as families expand.

However, when planned meticulously with a long-term perspective, HUF can emerge as a powerful tool for tax planning. Whether you possess ancestral property, multiple income streams, or seek an extra demat account for IPO investments, forming an HUF can be a worthwhile consideration.

If you found this information valuable, please feel free to ask any questions or share your thoughts in the comments. You can also visit Quicko, India’s leading tax filing platform, if you want any assistance with saving, planning, or filing your taxes.

That’s it for today, see you in the next one!

Hi, can an NRI form an HUF and enjoy the benefits as mentioned. Although his family is resident.

Hi,

Thanks for all detail however i have 2 questions.

1. If I am the Karta of HUF and HUF does not have any income source, I am salaried person and transfer monthly amount to HUF, HUF then invest to funds and shares via demat. Now capital gain by HUF will be taxed to HUF or Kartha as individual? I am asking this because how Karta contributed to HUF, is this gift or loan? If gift then section 64(2) and clubbing all come to picture. This is where I am fully confused.

2. Now if I am Karta of HUF, I contribute to HUF, HUF invest it in funds or shares and generate capital gain, if that is taxed to me as individual is fine, but later HUF reinvest that to funds and share, not next time the capital gain is taxed to HUF, right?

Can i become the karta of huf account which my father already have? Can i transfer the PAN of my father HUF to my name?

An individual with 30% I. T. slab has purchased a flat in his own name from a financer and is repaying the loan through EMI. He has his spouse and a minor son. How can he get tax benefits by forming an HUF: 1) Can he transfer the property in the name of HUF immediately after its formation to claim the interest on HBL Loan from the HUF account? 2) Will he have to wait till 3 years until 3 consecutive ITRs of the HUF are filed to do so? 3) Can he gift the property to his minor son appointing his spouse as a manager? What are the tax compliances and process of gifting in that case? 4) Can he transfer his own Fixed Deposits including rental income from the property in the name of HUF immediately after its formation?

What are the tax implications for kart who wants to transfer shares from his individual account to HUF demat account . What is the basic rule to dissolve HUF and how much shares will each member get?

PLEASE HELP !!! My CA is saying that HUF can only receive Rs 50000 a year gift and that to from a non member. HUF member cannot transfer even a single penny to the account even via interest free loan. I like Zerodha idea of opening a Demat under HUF but if I cannot transfer a single penny, with Rs 50000 I wont be able to do much. Please let me know what ”initial” amount I as a karta or a HUF member can deposit in starting and How much a Karta or HUF member can transfer to HUF account every year without being taxed.

yes you can only receive 50k as tax free… you can take a 400000 gift and pay tax on it. the 4 lacs gift is all taxable income. tax of 4 lac income is 0 as per the slabs. therefore in a 4 way 4 lacs gift becomes tax free …. you have to ensure that HUF has no other taxable income

I want to open a demat account for my HUF and transfer a certain amount of money each month for investment in stocks and mutual funds in order to decrease my tax obligation on capital gains. Does it sound right, or am i missing something?

Should I transfer my ancestral gram land to HUF.?

How can I transfer my ancestral property ie farm land in the name of HUF. And if yes, which is minimum expenses way of transfer.?

How can I benefited by such transfer.

Can somebody from Quicko respond to my query?

Have another question.

Can I keep on transferring money to my HUF like 5L, 10L in a year, make an FD and earn interest in the HUF and will there not be any clubbing of income applied?

Hi,

Say we already have an HUF for myself, wife and daughter.

Both myself and wife are working and in 30% tax bracket.

Both of us have chosen new tax regime. But we also have a separate health insurance policy for ourself and have bought another health insurance for our parents. Since we have opted for new tax regime we don’t get any tax deductions on Health insurance under new tax regime. Could we apply for deduction under 80D in the HUF by opting for old tax regime for our HUF?

Hello,

I want to create an HUF for myself, wife and a daughter. At the time of creation of the HUF, I’ll put an initial capital of 25 lakh rupees. The 25L in the HUF will be put in an FD and earn interest from it. In that case will there be no clubbing of income applied?

Me & wife are both salaried employees, comes in 30% slab for ex. Let us say 10 lakh each, if we transfer 2 lakh each to Our HUF account. Will it be our income reduce to 8 lakhs.

Is that you saying? & we don’t have any rental income.

Hi,

If you transfer funds to the HUF, your taxable salary would not reduce. However, any income such as interest generated on that money would likely be taxable at a lower rate as the HUF would not fall under the 30% tax bracket.

Recently I was planning to transfer certain some of money from Karta or Coarcenor to HUF account and invest from it.But my CA told that it will attract clubbing clause and later on in future if I earn anything from the money which is transferred from Karta or comparcenor to HUF account will be clubbed with either and be taxed accordingly whenever departments finds out same.

Pls clarify on this aspect.

The following conclusions can be drawn from the provisions of clubbing and gifts according to the Income Tax Act.

An HUF can build a corpus at the time of incorporation. Any capital raised and contributed at the time of incorporation is treated as HUF’s capital and clubbing provisions shall not apply.

After the HUF is formed, the members can pool capital in the HUF and transfer capital as a gift. Gifts from members are exempt in the hands of the HUF and the HUF can use this capital to generate income, clubbing will not be applicable here.

However, if the members transfer any personal movable/immovable property to the HUF, any income generated from the property will be clubbed.

You can always take a second opinion from a CA or lawyer for the same.

What would a person with no ancestral property transfer funds to HUF?

if I form a HUF for a new demat account and trading purposes, then how would I be transferring the initial capital, if I have no scope of ancestral property or any inherited gifts

I understood the concept of HUG but how do I transfer the initial Capital in HUF’s bank account? Is that a gift money that I am transferring from my personal Bank A/C to my HUF’ bank A/C? And do I write the same while preparing the HUF documents? Or can I keep adding the capital whenever I feel like? Please guide.

Thanks

Much appreciated

Hi,

The members of an HUF including the Karta can pool capital at the time of incorporation of HUF. Once incorporated, you can also transfer money to the HUF as gift and gifts from members are exempted in the hands of HUF.

The info is indeed valuable. Can I transfer holdings from demat account to my HUF’s demat account?

Hey,

You can transfer the shares as gift. Gifts from members are not taxable in the hands of HUF.

Sir

I have HUF with me,wifeand daughter as members. Can my HUF receive gift of 3 lac from my brother ?

WHAT are the options of increasing amount in HUF if huf dont have income source?

In article you have mentioned that husband and wife pool the capital and transfer to huf…what does that mean? And what are its tax implications?

Hey,

As your brother is not a member of the HUF, gifts received of more then ₹50,000 from non-members are taxable in the hands of the HUF.

With regards to building capital in the HUF, the members can transfer money as gift and gifts from members are exempted for HUF.

Are there any guidelines for the initial seed money to start an HUF Bank Account. Can the Karta put in the seed money to start the HUF.

Hey,

While forming the HUF, the members including the Karta can pool in assets/money and the same will be treated as HUF’s capital.

Thanks team for detailing out on HUF.

1 query:

Can we add or create a company under HUF?

Hi,

As per the Income Tax Act there are different types of persons and HUF is treated as one of them. For creation of company(other then OPC) you need at least 2 individual directors.

Can a hindu husband & wife alone(no kids) form an HUF and claim tax benefits ?

Hi,

Yes, a husband and wife can form an HUF.

First off, great video…

I am trying to understand how you say clubbing provisions do not apply. I have an HUF and I am the only member of the HUF who is earning so if I were to transfer my income or property to HUF, won’t I hit into the provisions of clubbing (section 64 (2))

This is what the section states… Section 64(2) Hindu Undivided Family – In case, a member of HUF transfers his individual property to HUF for inadequate consideration or converts such property into HUF property Income from such converted property shall be clubbed in the hands of individual..

Can you please help clarify?

Hi,

The following conclusions can be drawn from the provisions of clubbing and gifts according to the Income Tax Act.

An HUF can build a corpus at the time of incorporation. Any capital raised and contributed at the time of incorporation is treated as HUF’s capital and clubbing provisions shall not apply.

After the HUF is formed, the members can pool capital in the HUF and transfer capital as a gift. Gifts from members are exempt in the hands of the HUF and the HUF can use this capital to generate income, clubbing will not be applicable here.

However, if the members transfer any personal movable/immovable property to the HUF, any income generated from the property will be clubbed.

You can always take a second opinion from a CA or lawyer for the same.

So in theory it’s another virtual member of family with its own tax compliance and benifits. Investment done under it will not be accounted with investment done using personal account. Hence getting additional capital gain benifits?

Hi Atul,

Yes, the HUF is considered a distinct identity which is separate from its members. Hence, the income for the HUF is assessed separately and you can claim deductions on the same.

understood investment (putting money into ) HUF. How can we take money out of HUF . please explain

Hey,

The HUF can also transfer money to its members as gift. Moreover, the HUF can purchase assets in its own name as well.

Can you plz guide us where we can use HUF money?

How much money we can use it?

Like can I use this money for my daughter marriage and child education

Can Karta transfer his own income to HUF? and invest to get Income tax benefit.

Any limit?

Will the income from this Investment attract clubbing of income on Karta’s account?

AMAZING CONTENT YA & EXPLAINED SO EASILY. LOVED IT. THANKS TO ZERODHA AND ITS INCREDIBLE TEAM. LOOKING FORWARD TO MANY MORE BLOGS AHEAD.

Thank you for your kind words!