Everything about advance taxes

Why should investors and traders pay advance tax?

Paying taxes is often seen as an annual ritual done while filing an Income Tax Return (ITR). In reality, it’s a continuous process, and one aspect of this process that often goes unnoticed is advance taxes.

Since the deadline for 3rd instalment of advance tax is approaching soon, traders and investors should check if they have an advance tax liability and pay the same before 15th December 2024.

In this blog post, we’ll delve into the world of advance taxes, covering everything from its definition to the myths surrounding it, how to calculate the liability, penalties for late payment, and the process of paying advance taxes online. You can also watch video on this topic below.

What is advance tax?

Advance tax is essentially a proactive approach to paying taxes. Instead of paying the entire tax liability at the end of the financial year, individuals and businesses estimate their tax and pay it over four instalments within the same financial year.

It’s also known as “pay as you earn” tax, ensuring a smooth and constant flow of income for the government throughout the year.

When is advance tax applicable?

Advance tax is applicable to individuals and businesses whose estimated tax liability for the financial year exceeds a certain threshold.

According to Section 208 of the Income Tax Act, individuals with an estimated tax liability of Rs 10,000 or higher are obligated to pay advance tax. However, senior citizens aged 60 years or above, without income from business or profession, are exempt from advance tax.

Below are the four instalments of advance tax:

Myths about advance tax

- Salaried individuals: Some believe salaried individuals don’t have to pay advance taxes because TDS is deducted by employers. However, if additional income sources exist, such as rental income or dividends, advance tax obligations may apply.

- Traders & investors: There’s a misconception that traders and investors can pay advance tax at the end of the financial year. In reality, it’s a quarterly obligation. Profits from trading or capital gains must be estimated and advance tax must be paid in instalments accordingly.

- Businesses and professionals: There’s a notion that businesses can pay the entire advance tax by 15th March. However, this is true only for businesses who’ve opted for the presumptive taxation scheme, and others must adhere to quarterly timelines to avoid interest penalties.

Advance tax for traders & investors

Most traders and investors don’t know how to calculate their advance tax liability accurately. While others wait for the financial year to end to see if they make a net profit or loss, and then pay taxes accordingly.

But advance taxes have to be paid on a quarterly basis, and not doing this will result in interest penalties.

Now there’s a bit of a nuance depending on whether you are an investor or trader.

Since profits from F&O and intraday are considered business income, traders will have to estimate their profits for the entire financial year and pay the applicable advance taxes as per the four instalments.

Now if at the end of the financial year, you have calculated and paid additional taxes or you make net losses from all your trades, you can always claim a refund while filing the ITR.

The same process can be followed by investors who have earned capital gains from their investments.

However, because it is not possible to accurately predict your stock market profits, the government allows you to pay advance tax as and when you actually realise gains. But this is only allowed in case of capital gains and not F&O/intraday profits.

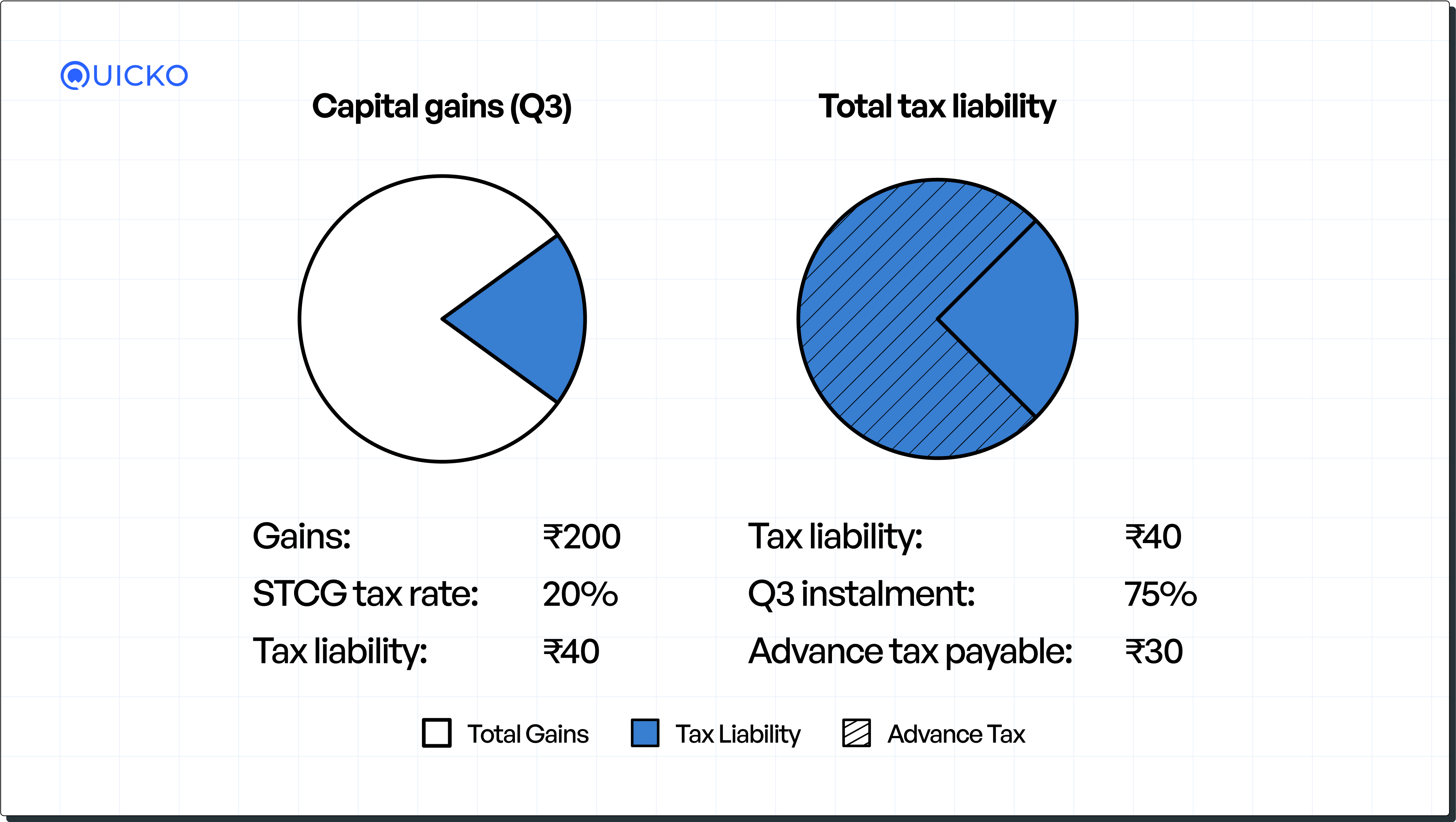

This means that instead of assuming and estimating your capital gains for the entire year, you can calculate them on a quarterly basis. For example, if you don’t make any profits in the first two quarters but earn ₹200 in Q3, you can directly pay 75% of tax liability as advance tax.

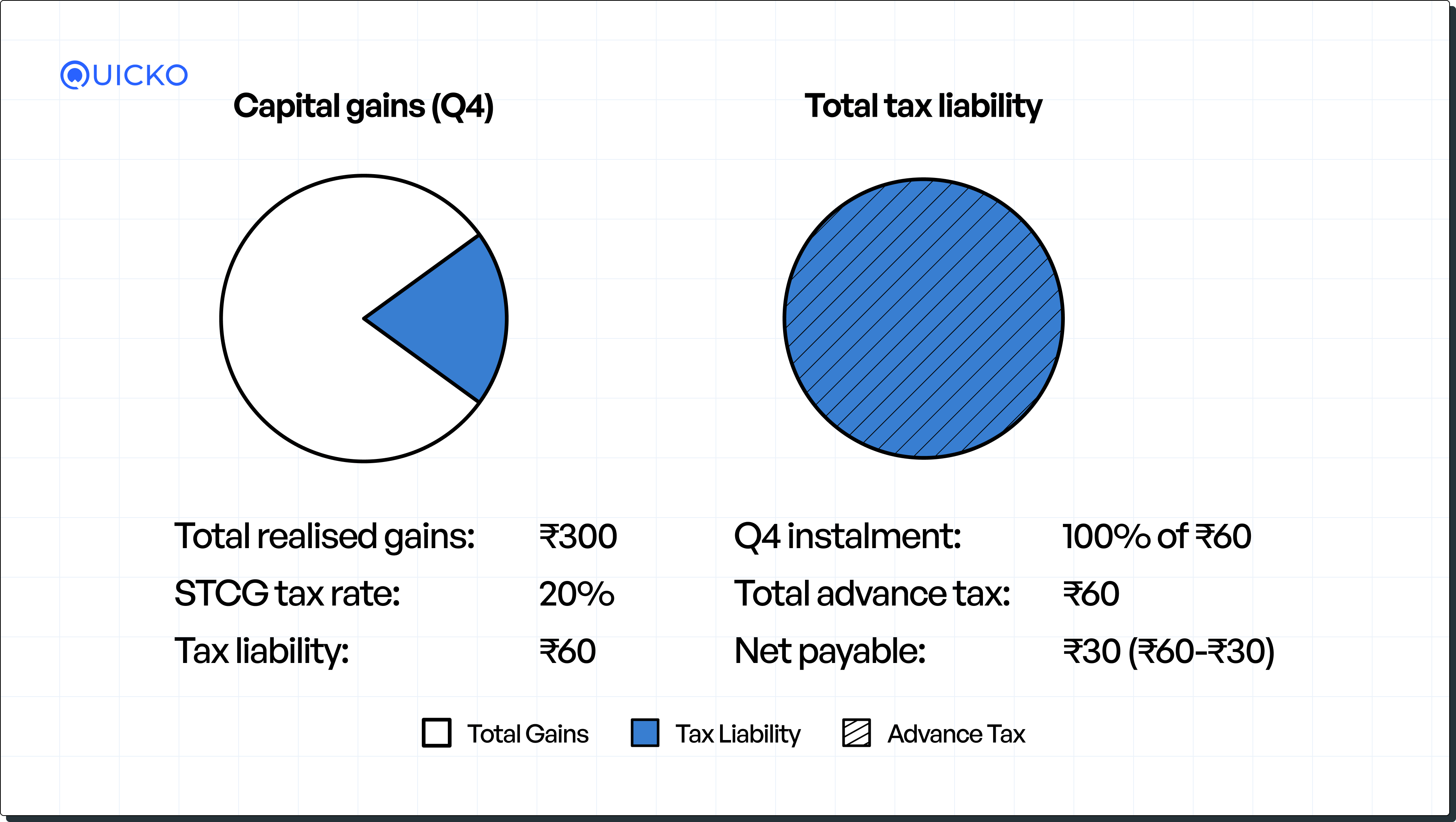

And then in the fourth quarter, if you earn another 100 rupees in capital gains, your advance tax will be calculated on the total realised gains of 300 rupees. However, your net pay would be adjusted against the advance tax paid in third quarter.

Note: The tax rates for STCG and LTCG were revised in Union Budget 2024. For domestic listed shares and equity MFs, LTCG realised before 23rd July 2024 will be taxed at 10% while those realised after this date will be taxed at 12.5%. Similarly, STCG will be taxed at 15% if realised before 23rd July 2024 and 20% thereafter.

How to calculate advance tax liability?

Here’s how you can calculate your advance taxes.

1) Estimate your total income

Start by estimating all your earnings for the financial year, including salary, business income, capital gains, or any other sources.

2) Account for eligible deductions

Subtract deductions you’re eligible for, such as those under Section 80C, 80D, or any other applicable sections.

3) Compute tax liability

Calculate your tax liability based on the applicable income tax slab rates. Remember to apply special rates for income like capital gains and consider the regime (old or new) you’ve opted for.

4) Check eligibility for advance tax

If your total tax liability exceeds ₹10,000 in a financial year, you are required to pay advance tax.

5) Adjust for TDS/TCS

Subtract any TDS/TCS already paid from your total tax liability and pay advance tax for the remaining amount.

Interest on late payment of advance tax

If advance tax isn’t paid on time, a simple interest of 1% per month on the outstanding amount is applicable under Sections 234B and 234C.

How to pay advance tax online?

While both offline and online options exist, paying advance tax online is efficient. Here’s the step-by-step procedure:

- Visit the e-filing portal of the Income Tax Department

- Click on ‘e-Pay Tax’ under ‘Quick Links’

- Enter PAN, mobile number, and OTP

- Select ‘Income Tax’

- Enter the relevant assessment year and select type of payment as ‘Advance Tax (100)’

- Enter tax details and choose a payment method

- Preview details and click ‘Pay Now’

Save the tax receipt for future reference during ITR filing.

Conclusion

Understanding and complying with advance tax regulations is essential to avoid penalties and last-minute burdens at the end of financial year.

If you found this information valuable, please feel free to ask any questions or share your thoughts in the comments. You can also visit Quicko, India’s leading tax filing platform, if you want any further assistance with understanding your advance tax liability and paying the same.

Until next time, this is your guide to understanding advance taxes!

What if i have not paid first instalment of Advance tax and i pay less than required before 15th September. If i realise the extra payable before 15th September can i pay one more instalment or i need to wait till 15th Dec window?