10.1 – Market structure

The topic of clearing and settlement is super important to understand as it gives you a sense of the movement of money and funds between your account and, let’s just say, the stock market. For instance, when you buy a stock, say 100 shares of Marico, you need to clearly understand how long it takes for the broker to remit these 100 Marico shares to your Demat account. We can extend this to stock selling as well.

The lack of understanding of the clearing and settlement process could leave a void and leave you with many unanswered questions related to the market structure. Hence, for this reason, we will explore what happens behind the scenes from when you buy a stock to when it hits your DEMAT account.

We will keep this discussion practical with a clear emphasis on what you need to know about clearing and settlement.

We will keep this discussion practical with a clear emphasis on what you need to know about clearing and settlement.

10.2 – What happens when you buy a stock?

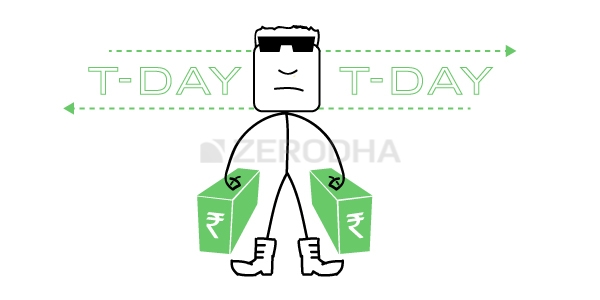

Day 1 – The trade (T Day), Monday

Assume on a Monday, you buy 100 shares of Reliance Industries at Rs.1,000/- per share. The total buy value is Rs.1,00,000/- (100 * 1000). The day you make the transaction is the trade date; brokers refer to this as the ‘T Day.’ The assumption is that you intend to hold Reliance Industries in your Demat account for a few days or maybe years, and it is not an intraday trade.

When you place an order to buy, the broker quickly validates if you have the necessary funds. In this example, the order will go through only if you have Rs.1,00,000/- in your trading account; it will be rejected otherwise. Assuming the trade is executed through Zerodha, the applicable charges are –

| Sl No | Chargeable Item | Applicable Charges | Amount |

|---|---|---|---|

| 01 | Brokerage | Zero for Equity Delivery. For intraday, charges are 0.03% or Rs.20/- whichever is lower, per executed order | Zero |

| 02 | Security Transaction Charges(STT) | 0.1% of the turnover | 100/- |

| 03 | Exchange transaction Charges | 0.00345% of the turnover | 3.45/- |

| 04 | GST | 18% of Brokerage + Transaction charges + SEBI charges | 0.62/- |

| 07 | SEBI Charges | Rs.10 per crore of transaction | 0.12/- |

| Total | 104.19/- | ||

Additionally, Rs.15/- towards stamp duty is applicable. Stamp duty is charged at 0.015% on the buy side. Hence the total applicable charges are Rs.119.19. Note that these rates are subject to change; you can visit Zerodha’s Brokerage calculator to figure out the exact applicable rate when you wish to carry out a transaction.

So an amount of Rs.1,00,000 plus 119.19 totaling Rs.1,00,119.19/- is required to carry out this particular transaction. Remember, the money is blocked in your account when you place a trade, but the stock is yet to hit your DEMAT account.

Also, on the T day, the broker generates a ‘contract note’ and emails you the copy to your registered email id. A contract note is like a bill detailing all your daily transactions. You can save the contract note for future reference. A contract note gives you a break up of all daily transactions and the trade reference number. It also shows the breakup of charges charged by the broker.

Day 2 – Trade Day + 1 (T+1 day, Tuesday)

Starting January 2023, India became the first country to implement a T+1 settlement for all the scrips listed on the stock exchanges. Earlier when you used to buy the shares, these would be delivered to your demat account on T+2 day. For example, if you bought shares on Monday, these will be credited to your demat account only on Wednesday. With T+1 settlement, if you buy shares on Monday, they will be credited to your demat account on Tuesday, the next day itself.

So on Day 2, also called T+1, the settlement is due to the exchange. Assuming the purchaser and seller are trading via two different brokers, the funds are debited from the buyer’s broker’s pool account by the clearing corporation and credited to the selling broker’s pool account. Also, on T+1 day, the shares will reflect in the purchaser’s DEMAT account, indicating that you own 100 shares of Reliance.

10.3 – What happens when you sell a stock?

The day you sell the stocks is again referred to as the ‘T Day’. The stock gets blocked when you sell the stock from your DEMAT account, and by the end of the day, the stocks are ‘earmarked’ for settlement. Please refer to the next section to learn more about earmarking.

Before the T+1 day, the earmarked shares are delivered to the depository. On settlement day, the blocked shares are debited from your demat account and moved to the clearing corporation for payin. Against the debit of such shares, you’d have received a credit for the sale after deducting all charges. You may be interested to note that you will receive 80% of the funds on T-Day and the remaining 20% on T+1. In other words, the seller will be settled fully on a T+1 basis, just like how the buyer is settled.

What transpires between T day and T+1 is a complex settlement process involving the stockbroker, clearing corporation, depository, and the stock exchange. Each entity uploads and receives multiple files to ensure the transaction goes smoothly. As far as you are concerned, you need to remember that equity transactions are settled on a T+1 basis, meaning, if you are a buyer, you will get the shares on T+1, and if you are a seller, the funds are credited on a T+1 basis.

10.4 – What is earmarking?

Earlier, for the settlement of a sell trade, the broker would be required to debit shares from a selling client, hold the securities in the broker’s pool account, and transfer the securities to the clearing corporation (CC) on T+2. Upon transfer, the client would receive a credit of funds against the sale, and the transaction would have been said to be settled. It was usual practice for brokers to debit shares on T day or T+1 day and transfer it to CC on T+2 (since the settlement was on T+2).

From the time the shares were debited until they were settled, the client shares lie in the broker’s pool account, possibly allowing a broker to misuse these securities. SEBI identified this as a potential risk and introduced “earmarking” for settlement. In this new earmarking system, shares are no longer debited from the client’s account; they are only earmarked for settlement. Think of earmarking as a temporary hold on the securities towards an upcoming settlement for the sale transaction initiated by the client.

On settlement day, the shares are debited from the investor’s account and credited to the clearing corporation. This new process eliminates the need for brokers to hold client shares in their pool account, thereby eliminating the risk that comes along. The new earmarking process has been made mandatory from November 2022.

Key takeaways from this chapter

- The day you make a transaction, the trade date is referred to as the ‘T Day.’

- The broker must issue you a contract note for all transactions by the end of T day.

- When you buy a share, the same will be reflected in your DEMAT account by the end of T+1 day.

- All equity/stock settlements in India happen on a T+1 basis.

- When you sell shares, the shares are blocked immediately, and the sale proceeds are credited again on T+1 day.

- Earmarking of shares was introduced to ensure the securities don’t move out of the client’s demat account to the broker’s pool account.

Hi, I sold full quantity of a particular the holding stock and the order is showing completed under executed tab. where as it is still showing under position tab and when I select the same , I could see ADD and EXIT options. What is the significance of same. Do I again need to exit from here. What happens if I don\’t exit from here.

The add and exit option is to give the traders an option to quickly add and exit positions. For example, if you have 100 shares of Biocon, you can add another 50 quickly or exit 25 from the 100 you hold.

Think of it as a quick way to manage your position. If you have exited fully, you dont have to worry about it.

Hi,

I bought SBI Share and sold it the same day but I did not receive the amount in my funds.

You should get it the same day. Else, please contact the customer support.

I am quite confused. Lets say I sold stocks today on Tuesday so in trading account I will get 80% on same day and then on T+1 I will get remaining 20%. From trading account I can withdraw it immediately or this also takes sometime ? For eg on same day where I receive 80% amount so I can transfer it to bank account and if yes than how much time it will take ?

Actually there has been a change to this. You can now use 100% of the proceeds, check this – https://support.zerodha.com/category/funds/fund-withdrawal/withdrawal-timeline/articles/withdrawal-timeframe

Hi, I want to know if I buy 200 shares of x company at 1000 price on CNC but I see profit same day and sell them at 1050 price. So while buying on CNC, I pay STT as per CNC but this is intraday transaction so at the end of day is my STT revised in contract not?

This will be considered as an intrday trade and settled and billed accordingly.

I invest 52.60 Lakh in IPO of Vikram Solar Pvt Ltd through Premji Invest Ex. Said IPO sell and gain total 1,66,03,978. I want to withdrawal invested amount only but they said that without service fees 20% paid can not withdrawal. When Handling charge 1.40 Lakh already paid. Please suggest further process

Ah, Rajendra I dont know the entire context. Also, I\’m surprised Premji Invest accepts outside client, its a private entity dealing only with the family money of Azim Premji. Please check double check and confirm.

Is he being scammed and scammers asking for more money?

Sorry, can you share more context on this?

Hi I have held 20 shares of x company at price of 1215.

Sold those 20 shares for 1250. On the same day I bought another 20 shares of same x company at 1289. So according to FIFO the executed order should be for 1215 priced shares but instead here Zerodha credited back my 20 shares of price 1215 and sold shares bought on same day with 1289. Due to this it shows me a loss. why did it happen ?

Date Order Units Price

19/08/25 Buy 20 1215.45

21/08/25 Sell 20 1250

21/08/25 Buy 20 1289.50

21/08/25 Buy 20 1238

Based on the above transcript and FIFO

logic my shares of 1215.45 should be sold at 1250 and I should have made some profit.

But according to Zerodha My shares of 1289.50 were sold with buy of 1289.50 and sell value of 1250 and I am in loss. Also instead the shares with 1215 were credited back to my account with the other 20 shares priced at 1238 rwith now at total of 40 shares at 1226.72. Why did it not follow FIFO since my oldest shares were supposed to be sold no matter I buy the shares with same quantity or price @zerodha

You first need to match intraday trades, remove them as they\’re speculative in nature and then do FIFO for capital gains.

Why didn\’t the FIFO rule apply here ?

Sorry, dint get the full context. Can you please elaborate on your query?

I had same scenario with JK PAPER, like in your case you bought again, for me to buy i have to sell my holdings by entering tpin, after getting funds i bought again, question is how is the contract being wave off, how can intraday pairing considered without selling the holdings for funds to avail?

I think its flaw in the system

I am definitely going to raise this issue with sebi

Appreciate if you also raise from your end.

In fact this is how it should take place based on FIFO by pairing

19/08/25 Buy 20 1215.45

21/08/25 Sell 20 1250 — this pair will result to contract

As there is no sell remaining will be delivery

21/08/25 Buy 20 1289.50

21/08/25 Buy 20 1238

With the present logic while trading human intervention is required and we have to keep note of the BUY & SELL

Hi, if I have bought 5 stocks of XYZ at 100 rs a year and a half ago, and then I buy 2 more shares of the same company today at let\’s say at 85 rs. Now, after a month, I decide to sell 2 shares. Question 1: which shares out of these 7 shares will be sold first? Question 2: How will we determine whether the profits that I booked will come under long term gain or short term gain?

Answer 1 – As far as I know India follows the FIFO method(i.e. First In First Out)

So, when you decided to sell 2 shares after buying 7 (5 old @100 and 2 recent @85), the 2 share you sell will be sold from those 5 old share.

Answer 2 – So based on your sold shares this will come under long term gain cause you hold them for more than 12 months.

//Long term capital gain – Holding period is more than 12 months.

//Short term capital gain – Holding period is less than equal to 12 months.

Thats right 🙂

1) Its based on FIFO logic. Fist in, first out

2) Again based on FIFO.

Sir if i buy and sell share in a day and in terminal i say i am going to go for long will it classify as intraday?

It is an intrday trade as long as you initiate and square off the position the same day.

Some brokers like HDFC Sky are giving same day settlement, i.e funds are usable immediately after sale of the shares. Is there a plan to roll out same day settlement on Kite as well? Would make sense since some opportunities come on the same day, but may not be available the next day. Besides, it\’s about time retail traders get a level playing field like the bigger traders/funds.

Do check this Aditya – https://support.zerodha.com/category/trading-and-markets/margins/margin-leverage-and-product-and-order-types/articles/profits-from-fno

Understood, but then I\’m able to initiate a fresh trade for full value when I\’m selling on the same day itself. I can\’t do that in Kite.

Aditya, can you please check once with the support team?

Ok, will do!

Happy learning 🙂

Reached out to them, they have reverted that MTF sell value will not be credited same day. This is exactly my issue, it should be allowed when other brokerages are having this facility.

Aditya, I\’ll share this as a feedback to the team.

Ok, thank you so much for the promptness! Hope something can be done for this.

Also, is there a timeline for Zerodha offering International investing opportunities? US, APAC, Europe etc? Have been reading for quite sometime that it is being planned.

Thanks Aditya. Unfortunately I dont have a timeline for this.

Can I do tax harvesting by selling my shares EoD (just before market closes ca.3:25pm) on Monday. And then place an AMO to rebuy them as soon as market opens on Tuesday? I have spare funds to do this.

Will my tax harvesting strategy work? or will I have to wait till Wednesday to rebuy the shares?

Also, when do I know the sold stocks have left my demat account? becuse I have just sold my shares and they are still showing up on my holdings tab as 0 qty. they are also showing up on my positions tab as -x qty, but its clearly saying \”SOLD HOLDING\” against each stock.

Nel, I\’d suggest you speak to a CA and seek their advice on this. I cannot really comment on this 🙂

Hi, as per the video of this segment, it takes t+2 days for the shares to be credited in our demat account.

But in this chapter, Point no 10.2, it says \”Also, on T+1 day, the shares will reflect in the purchaser’s DEMAT account\”

Could you please clarify on which day the shares are credited in buyers account.

Harshit, that is because the regulations keep evolving. However, what you need to understand is the underlying mechanics of how things work. Eventually it is 2 days, 1 day, or instant, does not matter.

Sure thing.

Happy learning!

Stock sold under CNC order, will not funds release on the trading day or on the next day.

Settlement cycles have changed, you will now get the funds the same day.

I have sold 9 quantities of CDSL which I bought yesterday but the money is not showing in my funds section please tell what to do

Vinayak, for this I\’d suggest you speak to the support team. I wont be able to help you with it.

I am facing the same issue, how u got it resolved?

If I Purchase Any Share On 15th Jan & If It\’s Ex Dividend Date Will Be 16th Jan

Will I Get The Dividend ?

You will get it if the shares are fully settled in your demat.

if we buy a stock for eg 100 rupee on next day when its price fluctuates to a high 110 does it take 110 for the stock to deliver

No, your purchase price is 100, so you get it delivered at 100.

How to check if the stock is eligible to be sold on T+1

Here – https://support.zerodha.com/category/trading-and-markets/corporate-actions/general/articles/how-to-do-btst or I\’d suggest you call the support desk.

hi, thanks so much for this, can I sell the shares I bought on T+1 or should I wait for T+2 so that they get credited in my account and only then sell them? I ask this as there is clear indication on the shares that we already have and that are in T+1 category on KITE app.

YOu can sell on T+1, not an issue. But do make sure the stock is eligible for selling under T+1.

i sell my shares worth 100000/-. the amount was credited my zerodha accout next day. how many days can i kept my money with zerodha account with out buying/trading shares?

You can keep it for as long as you want. But if you have no use, why not withdraw and keep it your bank account?

When intraday sell shares are converted the profit of purchased price and sell price is not added to profit. With this jungling loosing good amount so it is better not convert intraday sell shares with available equity when you the share price is higher than purchase price.

Hmm, not sure if I get your query fully. Please do talk to the support desk once for this.

IF I HAVE 1 LAKH CREDITED IN MY DEMAT ACCOUNT AND IF I UTILIZE THIS FUND FOR INTRADAY TRADE AND AFTER MARKET CLOSE THEN SHALL I ABLE TO WITHDRAW MY FUND THAT ARE ALREADY CREDITED??

Yes, you can withdraw funds that are fully settled and credited to your account. But ensure its free balance.

Do I need to transfer fund before buying shares or I can transfer money after buying shares? Please help.

Always before 🙂

I have icici 1 qty stock of 500 in my demat account.I sell it for 550 in morning and buyback for 580 same day before market close. So should i get 80 profit in one qty????

If you sell at 550 and buy back at 580, you make a loss of 30 right?

If i buy a stock today morning and i want to sell the same stock today at 3:20 like that is that possible in equity delivery?

Yes, its an intraday trade.

I have been holding 100 shares of XYZ and on certain T day I buy 20 shares more at lower price. On T+1 day, the avg buy price has been adjusted. Now if I sell 20 shares on T+1 day, which stocks get sold? The ones I have been holding since long or the 20 shares I bought the previous day?

It works on a first in first out basis (FIFO). So the one you\’ve been holding for long will get sold first.

If we sell an equity on T+1 day, since buy orders are already sent to the exchange on T day-end, it is out of broker’s control and cannot be treated as intraday. Also, equities don’t hit demat on T+1 day and we sell equity that we don’t yet own resulting in shorting.

I found one of these points while going through the comments of this particular post.

Is this point still relevant, because the equities will hit put demat account on at the end of T+1 day and thus there would be no shorting?

A follow up, like the but orders are sent to the exchange at the end of the T day, similarly the sell orders are also sent to the exchange at the end of the T day?

Yes, the point is that these trades still carry the BTST risk. Yes, all orders are sent to the exchange.

I have some doubts to clarify about the delivery margin after sale.

1) To my understanding, when a sale is executed, zerodha holds 20 OR 25% as delivery margin(DM)?

2) If zerodha holds Rs 2500 (25%) as DM of a Rs 10000 sale, WHY does my available cash(AC) and available margin(AM) show the full Rs 10000, should it not display Rs 7500?

3)Also, What exactly is Used Margin(UM)? And why is it negative after a sale?

My account statement looks like this:

AM: 10000

UM: -10000

AC: 10000

4) Since it shows Rs 10000 as my AC and AM, does it mean that I can use the FULL amount to buy another stock or I can only buy upto Rs 7500 on that same day? Or do I have to wait for the UM to be zero and WHY?

Your feedback and clarification would be greatly appreciated.

I think this is easier to explain over a quick call. I\’d suggest you call the customer support desk for this. Thanks.

I sold some equity shares on T1 but the money is not reflecting on zerodha fund. When will it reflect or available for withdraw?

It should, please do check once with the support team for this.

WHEN WILL MY FRIDAY (OPTION – BANK NIFTY) INTRADAY PROFIT WILL SHOW IN MY ACCOUNT ?

It will be shown immediately.

I bought the share yesterday but due to huge loss I sell it today when will be my amount will credited in the demate account

It should be in your account by now.

Hi,

Yesterday I had stock worth of X amount in zerodh. And I had sold all the stocks yesterday. (Profit +/- 500 only)

Today I have seen my wallet and it showing lesser amount from My X amount (10k + amount not showing)

What is the reason?

I had traded some new listed stock. Is might impact? If yes what is the settlement process for new listed stocks

You get 80% of funds on day 1 and balance the next day.

Sir,i execute sell side of my shares,which I bought in pay later,and i forgot to unpledge.

Shares are already blocked what i do?

Pls contact the support center for this, the share will be auctioned mostly.

What happens if we sell a holding share that we own through one broker and purchase the same share on the same day through another broker account?

Well, you are just swapping your holdings from broker A to broker B. Thats it.

Hi, kindly advise if I sell some shares( securities )and my brocker is not crediting that amount in t+1 days what can I do, can I Sue him?

Thanks

Yeah, but do check with the broker for reasons for not settling your funds.

Sir, yesterday purchased 70 shares and today also purchased 30shares then today I sold 70shares of yesterday shares, but in portfolio showing -40 shares

Today I am not received any amount in my demat account. Can you please answer this question

Hey Rakesh, I\’d suggest you speak to the support desk for this. I wont be able to help with this query.

Why my amount is not showing in funds after selling ?

I have received a mail in form of tax invoices but it’s not available in my funds on Zerodha.

Please do check with the support team for this, Ashok. Thanks.

Can I pledge T1 holding stocks for collateral margin

No Sagar, the collateral that you pledge should be fully settled in your account.

Hi,

i sell my stocks on friday can i withdraw money on saturday ?

please help

Yes, you can once the funds are fully settled.

Let’s say I have 2 unsettled lots of futures in my account

Assumed lot size : 15 at buy price of 100/- per share… so a total of 30 futures @ 30*100 = 3000/-

Now on a new trading day I buy 2 more lots at 80/- per share (30*80 = 2400/-)

My unsettled lots on this day now show 4 lots at an average price of 90/- now

In this case, if on the same trading day (day 2) I sell 2 lots @85/- , which of the lots will be considered sold ? The same day ones or the older ones – that is, Will my P&L show a profit or a loss ? Or will the average price of 4 lots be considered ?

Average will be considered.

I have PURCHASED THROUGH ANGEL ONE ISIN BPCL SHARES ON

21/06/2024.AS PER THE ECONOMIC TIMES NEWS 21/06/2024 LAST DATE FOR ELIGIBLE BONUS SHARES. BUT AS PER T1 SETTLEMENT DATE. ANGEL ONE NOT SHOWS SHARES IN MY D MAT ACCOUNT. WHAT I DO FOR BONOUS SHARES

You need to speak to your broker for this. We wont be able to help 🙂

If I sell shares on T+1 can I able to buy futures with that amount

Yeah, you can.

How does the withdrawal process work if your portfolio is in crores, can you withdraw it all in your bank after selling your shares or is there another process for bigger volumes? Please suggest

Hi can I sell a few of my shares today and use the funds from the proceeds of the same to buy new shares on the same day ? Thank you!

Yes, you do get 80% of the funds immediately and the rest the next day.

If I buy shares and it goes up after my buy order is executed will i be in profit by the time shares are credited into my demat account? As my order got executed at a lesser price before going up

Today i. e july, 3rd 2024, i purchased 250 equity shares of dcxindia for intraday. I sold them. Again i bought another 250 shares, and added another 250 shares and then i Sold them. Again i bought 260 shares. This time the price went down. And i ended with Rs. 600/-loss totally. And my position is showing loss on all the shares. Why. Please explain.

I\’d suggest you call the support desk for this, they will explain Venkata.

I have a query, Let\’s say I already hold one futures lot of nifty and I want to sell two lots (basically convert my long position to a short position) then what\’s the margin I need? Is it the margin for one lot or two lots because the other lot gets canceled out so Ideally I assume the margin required would only be for one lot

Ah, you can actually use the margin calculator for this. But I think its for 1 lot as the long gets offset with 1 short.

I am a bit confused in my friend\’s case of physical settlement of option. Please guide how will the monetory settlement work

My friend bought Dabur 555 CE of June Expiry and it went ITM on monthly expiry and as the contract was not tradeable, my friend had to take delivery of shares on June 29. Now the broker account showed a shortfall of around 7 lakhs, so my friend deposited cash and took delivery of shares and sold the shares at 600 per share after receiving the delivery, what is the cost of receiving Dabur in physical settlement for my friend? is it the strike price meaning 555 or the closing price of the monthly expiry day? and how will monetary transaction take place in this case?

Physical delivery in options is basis the strike price, Nivedita. So in this case its 555.

If shares are bought on T day and sold on T+1 day, will money immediately reflect in Funds section?

Yes, upto 80% on same day.

I bought 15 titagarh shares yesterday and have sold today through GTT, the order has been executed. But the fund has not been credited, which we know 80 ℅ fund is credited on the T day and rest 20℅ on the T1 day. Please clarify this.

Kausik, please do call the support desk for this. Not sure if i can help you with this query.

How are the trading charges levied if I (a) sell CNC on the same day and (b) sell CNC on the next day?

You can check this Paul – https://zerodha.com/charges/#tab-equities

Is it possible to buy and sell equity (CNC) on the same day? Or do I always have to go with MIS only for that?

Yes, you can do an intraday trade.

where does the proceeds of sold GS Govt of India units sold are credited? into fund balance or credited directly into the bank acct linked to the demat acct?

You get it to the bank account.

i purchase 10 stock of exide on thursday & sell on friday today on dated26/04/2024 but my amount is not showing in avabile margin

Manish, I\’d suggest you speak to the customer support for this, nothing much I can do 🙂

Sir if I buy some stocks on 12pm to 2;30pm when will they deliver to me and can I sell them next morning is it possible

Yes, you can buy during any point while the market is open.

Hi, I am holding Kotak neo account, I do fno on regular basis. My question is in kotak when I sell any segment the money hits account in few seconds, means it gets credited in account immediately which I can use to buy other index. Is this facility available in zerodha

Yeah, you can.

Hi.. I sold Share X on T day, can I repurchase the same share on T+1 day.

Yes, you can.

I want to sell my shares. after authenticating my shares appears in open column in orders bar at the end of the day it shows me authentication was cancelled. what can i do for sell my stocks?

I\’d suggest you call the support line for this, they will help you with it.

If I sell a share under T+1 can I buy another share against it today ?

You get 80% funds against the sale, which you can us for other transactions.

My quarterly settlement amount has been not credited to my primary bank account , but funds are withdrawn from kite equity account please explain about this

Please do check with the support team for this, I wont be able to help on this.

can i buy shares on nse and sell the same shares on bse on the same day just to capture the price diiference?

That will create two separate positions, Nabhi.

Hello Sir,

There was a GTT for a stock, but as I dont want to keep that stock which was bought so i sold on T1 day (Yesterday brought and sale on today). but the fund is not updated.

Please advise, is that will take time to settle as it was in T1 day stock. Hope the fund will be update soon.

However, your comments will be helpful for mane of new like me.

Thank you

Arnab, I wont be able to help with this, request you to please contant Zerodha customer desk for this query.

Sir kindly advice at the earliest please as the settlement date is near.

As I mentioned, not sure if I understand your query fully.

My son opened a block trading account,once, the company has invested more than his portfolio, without his consent, my son made the payment. Second time the company again make investment of an exorbitant amount for that that, he is not in his financial capacity.What will happen if my son don\’t settle the account. Can my son can get his portfolio amount?

Sorry, I dont really understand your query. Not sure what a block trading account is. Need more details.

Isold stock today which was purchased yesterday when amt credited to dmat

You will get it by Monday.

i have sold t+1 equity now received the two times for total sell value. Now I am concerned abt settlement procedure in zerodha.

Unlikely, but will anyway get this checked. Thanks.

Hello sir I m little confused yesterday I have sold my 42 shares adanigreen at the rate of 1860 and after that I have repuchased same share again at little high rate so now my original fund shows 73000 and rest of the amount shows in settlement equity so what will be the amount in fund

I\’d suggest you please call the support desk for this, Rutha. They will guide you on this.

Hi , if the sell my shares on Friday,when I\’ll be able to transfer full amount to my bank

On T+1 basis.

Sir,

The intraday square off is roughly at 3:20pm for most of the brokers. So if I buy a stock from (the nifty sectors eg shares listed in nifty infra, nifty private banks etc ) at 3:29pm and sell it next day at 9:15am. Are there any chances that the shares that are sold to me are not short selled, as I am purchasing it after intraday square off time ? and Most of the shares are settled in t+1.

This is on the assumption that you\’d be transacting on F&O and equity swing positions.

On 2-2-24, some order booke iwith market rate it’s booked but after some time same position was open in account what’s the issue. Also same time customer care not responded

Have you created a ticket for this? If not, I\’d suggest you do. Thanks.

When will settle the profit of Friday closed market in my funds

Monday it will be settled.

My profit is 17k but my account credited only 11.5k, I have traded f&o instrument.

Please call the support desk, they will explain all the deductions.

I sell my share after t1 day and if I buy the same share , I get the share on the same amount as I bought at first time even if the share has more value at the time of second buy and next day my 20% is not credited as my understanding . Why does this happen ,can you elaborate or am I getting it wrong?

Thats the settlement cycles, Marsook. How much more you will get really depends the share price.

I sold my shares at a profit. However I see the total P&l showing negative. Does this mean I have incurred loss and not profit.

Yes, considering other charges you may have incurred a loss.

Hi,

I have transferred few of my stocks from another demat account( account closed already) to my zerodha account. All stocks have been transferred but not yet settled for trading.My query is how long does it take time to settle the transferred stocks so that I can trade all those?

You will have to touch base with the support team handling these queries. Unfortunately, we wont be able to help you with this. Good luck.

What is Net settlement for Equity with settlement number. please explain in detail with example

These are operation parameters for a depository participant. Think of it as an invoice number 🙂

Yesterday I bought 13 quantity of ESSARSHIPPING Shares, I sold all 13 today, but the money has not credited into my demat account. not even a single penny from my investment, how to deal with this issue?

Please do check once with the support team for this, Joseph. I wont be able to help you with this.

One of the trader by name @purab_darba on insta , he is a binary trader nd also have telegram channel as sigma binary so when I msgd him about trading he told me to open quotex account by his link and to deposit 20dollars nd share my trader I\’d than he would add me to a vip group where I can copy his trades.Is it good to share my trader I\’d or what?? Can anyone help me please 🥺

Dont even think about it. This is a scam, please stay away from such things.

I have a simple query. I am having a zerodha account. Under portfolio page, invested value is shown. This invested value must have a relation with the money transferred by me to zerodha.

My question :

What is the formula relating invested value, fund available and money transferred to zerodha by the investor.

Request please give specific reply depicting the clear relationship in between above i.e.

Invested value

Money transferred and

Fund available.

Regards.

Invested value is the value of funds invested in market. For example, you can transfer 1L to your trading account, of which you buy 45K worth of stcoks. Then invested value is 45K, and 65K is the balance available. You can use the balance available for any further trading or investing activity in the market.

If I sell shares on Friday when will my account get credited the amount ?

Full amount on T+1.

Assume i bought a shares on Friday in CNC, can i sell them on monday

Yes, you can. But you need to be aware of the risk of BTST trades. Check this – https://support.zerodha.com/category/trading-and-markets/corporate-actions/general/articles/btst-risk

Hello,

I have withdraw my SIP on 22november, today it\’s 28th november but ammount not credited into my account.

Mahesh, please do check once with the support desk, I wont be able to help you with this query.

I buy 25 stocks of JMD Ventures 24nov

& Sell after 2 days 26 nov but it is showing under process, how many days it will taken or what can happen ?

Can you please reach out to the support desk for this? Thanks.

i purchased reliance penny stocks in 15 sept 2023 and sell it on 30 sept but I can\’t withdraw my amount in current account..Why And how much time to get settled in penny stocks

Ankit, why dont you check with the support team for this?

I had buy share yesterday in CNC and sold the same share on next day morning, how long it will take to settle the order in the Dmat, second after selling also the no amount is not showing in the Dmat account. can u please clearify the same.

All settlement is T+1 basis.

Mainne apana share sold kra profit book karne ke liye, lekin sold amount wale column me sold ka amount feed nhi kra, sold karne par instead of profit there was huge loss.

Why…

I TRIED MANY TIMES TO CONTACT KITE ZERODHA, CALL CENTRE BUT ITS NOT DONE, HOW TO CONTACT WITH KITE ZERODHA CUSTOMER SUPPORT CALL CENTRE. 9638268887

Please try calling this number – 080 47181888

Hello team,

What potential risk can be posed when shares are lying in broker\’s pool? i.e. What misuse a broker can do with these shares?

Thanks,

Nandkishor C

Thoes days of misuse is gone. Brokers cant move shares without the clients approval now.

I have sell my shares today, In order, it shows complete, but It will be in positions (sold holding ),Not all amount credited to my available margin, when it will sold and when I get full amount.

You should get the amount on T+1, Venkatesh.

For newbies, it will be easier to follow 10.2 and 10.3 if they are presented as an ordered list.

Can you explain what you mean by an ordered list? Thanks.

If i purchase 100 Shares today – T day

If i get 10% appreciation next day T+1, can i sell the shares even if it is not credited to my account?

If yes, is there any penalty to this?

Yes, you can, but you cant do this across all stocks. I\’d suggest you call the support desk to check if the stock you intent to buy today, sell t\’row qualifies for such a trade.

As per this chapter the shares sold will reflect in the account on settlement day only from November 2022.however 25 shares of Tata Power sold today were immediately debited and shown less in the account.can you please state the reason.

I\’d suggest you speak to the support desk for this, Ratna.

If I sell a share on Thursday, T+1 will be Friday, then will I get the money to be transferred to my bank account on Friday or will it be reflected on Monday?

Friday, if Friday is a working day.

Suppose, I purchased 50 share share of RIL as CNC for a positional trade. But the trade moves against my analysis. And hits my stoploss. Will I be able to sell them of on T+1 day? Or I will be penalised to sell on T+1 day?

You can sell on T+1.

Incase I have sold my shares on Friday , when can I receive the payment earliest?

You should get it by Monday.

Suppose i bought 2 stocks of one share , but at the time of selling I sold it one by one , so how much money will get debited 15 or 30 ?

Not sure what the query is, Vani. Can you share more context?

Can you explain with an example how the broker would misuse the shares in the earlier process where on sell, wherein shares were debited until they were settled, the client shares would lie in the broker’s pool account?

You can see this – https://timesofindia.indiatimes.com/city/hyderabad/karvy-scam-heres-how-it-unfolded/articleshow/85471866.cms

Please can someone explain the calculation of GST and SEBI charges in the table?

Check this – https://zerodha.com/brokerage-calculator#tab-equities

If I place order of Index fund but couldn\’t pay that money to zerodha, what will happen.

Isell some share on 11/9/2023from my demat account which is belongs in 5paisa but full settled till date not reflected in my ledger account which is difference more than 2300/what\’s the problem for said money kindly seen the matter sympathically in your system

Sudarsan, I\’d suggest you speak to the support agent for this, I\’d not be able to help you with this as I wont have access to you account.

I bought a long term stock for rupees 716 and sold them with a loss of 2% that is 704 something but when i sold them the remaining amount didnt come in my equity funds or its not showing anywhere! Why is this happening and what is this?

PLease do contact the support desk for this.

Withrawble balance is free from all charges or after all the settlement time period???? It can use for new buy ??

Eg. I sell 100 shares today on date 10, next day 11 till 12:00 o clock m not able to withdraw money to bank, but after 12 or sometime the balance show for withdraw is showing , all the fund show for withdrwable now i can use it for another buy whithout any charges??? Or it take one more day to ignore margin penality chareges in zerodha

Please do check with support team for this.

If witdrawble balnce show in funds, can i use all fund without any charges??

Yes, you can withdraw the funds to your bank account.

This needs to be updated. Now, the settlement cycle is T+1

We will do that.

If we purchased shares yesterday and sold today in cnc then when will be our funds show in our account

I’m a fresher in trading so i want to ask can i sell my stocks in 1week or 3-4days from the date of buying and if yes then how?

I sale my share supposed Rs 80,000 but I have received only Rs 50 is it correct

Please get in touch with the support desk for this, Farhan.

Sir, i have 70 shares and yesterday i brought T1:10 shares and complete 80 shares i sell today, But that T1:10 shares\’ money not credited in my Demate account?

Pankaj, can you please call support desk for this?

how many times i can buy and sell a one company share in a day

As many times as you wish.

Currently all trades are settled on T+1 settlement cycle, need to update

Yes, will do.

How much time it takes for transferring my existing holding to Zerodha. The existing is Ventura and they are claiming that it may taken 10 Days.

If possible, please check with their team to figure out their process.

Suppose i sold some shares with 15k profit and 15k investment..how much charges will b cut? How much i wil get in hand? Plz give example n share …i hv gone through the charges document but not sure why 18percent gst cut

Nitul, you can simulate all the charges here – https://support.zerodha.com/category/console/reports/contract-note/articles/virtual-contract-note

As i sell shares on friday when does my money will be credited which is on hold

can i sell shares in zerodha as per my choice when i purchased date

below i my holding in zerodha

Date Qty. Price Age (days) P&L

2023-07-10 9,500 17.70 11 18,050.00

2023-06-01 10,000 11.20 50 84,000.00

2023-01-04 10,000 10.40 198 92,000.00

can i sell CNC of purchase date-2023-01-04 THE LAST ONE FIRST

IF yes then how . please let me the process

thank you

Yes, you can sell these from CNC.

I have sold some shares on 18.07.2023.When is the credit going to reflect to my account since the shares are already debited?

It will be on T+1 basis.

I have a clear understanding that there is an approximate charge of 120 rupees when purchasing a share worth 1 lakh. Now, I\’m curious to know if there will be any charges applicable when selling the share?

There will be a few charges, Vinoth. You can check the virtual contract note for this.

Hi, if I purchase shares on 18th, my understanding is that they will get credited in my demat account on 20th as per the T+2 settlement rule. If the ex date for dividend or bonus is 20th for the share, would I get the dividend or bonus or the seller? As in who is considered the shareholder as on ex date?

Yes, you will assuming shares are in your demat by 20th.

I sell the shares on Monday 1000rs single share if same day stocks goes down means it\’s affect my selling price.

After you sell, it does not matter if the price goes up or down since you are out of the market anyway.

Hi Karthik, I bought some share on Friday and sold on Monday, but all the invested and profit money is not reflecting in my fund balance, what can be the problem and how it can be resolved?

Gaurav, do check with support on this.

If I sell my holding stocks today at morning, suppose 9000₹ stocks I sell today. How much money will I recieve on same day for trade ?

As of today, you will get 80% credited to your account against the sale of stocks from your demat account.

CDSL: Debit in a/c *78906 for 20-SUZLON ENERG-EQ RS 2 on 12JUN

What is the EQ RS 2,

CDSL: Debit in a/c *78902336 for 20-SUZLON ENERG-EQ RS 2 on 12JUN

What is the EQ RS 2,

EQ = Equity shares.

If Thursday We carry Option and Friday Sold that , then can we take payout on Saturday ( First Saturday) ???????

FO settlement is T+1, so Monday given Sat is a holiday.

If i sell a share is there a guarantee that could be sold at the last traded price at which i initiated the sell ??

No guarantee in markets 🙂

I am fresher just for learning i bought 3 shares of federal bank after some days i sell all shares. 15 rs deducted additional i don\’t know why can you please tell why ?

Belal, please check the contract note to understand all charges.

Today i bought 100 shares and sell the same day for the long-term stock that is CNC, it have not choose the intraday option while buying but profit or lose money is not reflecting in the fund balance. Can anyone explain

Please check the contract note, Suyash.

What happens if the share price changes between the settlement period?

It wont affect you as your transaction is already done and recorded, right?

Sir, On 06/03/2023 I sold all my shares of one company and again purchased similar quantities on 06/03/2023. Today on 08/03/ 2023 I am finding all my repurchase stocks are being reflected in my D – Mat account which is correct but what I am finding that the description of purchase is being shown the same as of old purchase stock dates which should be the new date. Please let me know what is the correct thing?

Thats right, because the sale and repurchase of shares on 6th March will be considered as an intraday trade and wont have an impact on the buy average in your holdings.

A conceptual question.

Why is there a need for T+1 or T+2 cycle? If the brokers merely need to change the name of holder from person X to person Y and deliver money to person X in lieu of the same, why can\’t this be done instantaneously.

Okay maybe at the bank\’s end, the clearing might take time, but if its essentially changing the holder name from one person to another in an already held pool of equity by the stock broker / depository, why does that not happen instantenously?

(I\’m thinking of something like UPI, where the payment is made instantenously, since all banks have to do is change the ownership of already held funds from one person to another)

There is a backend process, Abhinav. Money has to be debited from buyer, credited to seller, and shares have to be debited from seller, credited to buyer. Ensure no auction here and all that stuff. By the way, T+1 is a big step forward!

Lets suppose there is only one person selling 10 shares at Rs 100 and I put a limit order for just 2 shares at Rs 100 so will I get my shares or will the order not get executed until someone is willing to sell just 2 shares at Rs 100?

YOu will get your 2 shares as long as the price matches.

Hey Karthik, I am new to Zerodha and have two questions-

1. I bought 2 shares of idea and sold 1 on the same day that is today but I noticed despite the market price matching my limit price and the bulk of transactions of idea shares happening my buy and sell is taking quite a lot of time. Is it because no one is selling just 2 shares and buying just 1 share?

2. Do I need to pay DP charge for the above transaction?

1) Yeah, it depends on how the market is moving and the liquidity at that point

2) Nope, since this is an intraday trade

Hi, as T+1 is introduced in the market from January 26 2023 could you please explain the benefits of the same?

Hi Karthik,

Great job on the Varsity content!

Notifying you that this chapter needs an update with a move to the \’T +1\’ settlement cycle.

Cheers,

Shekhar

Thats right, will do that 🙂

hai i selled my shares today with sum of 3000 rupees and the amount credited in d mate acount is 2400,so when will the rest amount credit to my acount,kindly explain iam new to zerodha

It will be settled on T+2 basis, basically 2 days after you do the sell transaction.

Why should wait for \”Funds from the sale proceeds get settled to your trading account after two trading days\” and than \”the funds are typically credited to the bank account within 24 hours from the cut-off time\” while comparing to e-commerce, they crediting back with in first 24 hr after raising issue or calling for refund ??

This is not e-commerce, Rohit. Please see the chain of events in the clearing and settlement process.

I bought shares on 5.01.2023 (thursday), will these be reflected in my Demat account on 9.01.2023, because on 7.01.2023 was saturday and on 8.01.2023 was Sunday

Yeah, its T+2 working days. Weekends are not counted.

Hi, if i buy x company share in CNC and sell after a week or more.

What is the charge going to be?

No brokerage charge, but other statutory charges are applicable – https://zerodha.com/charges/#tab-equities

After selling a stock , how fast I can recieve the money in my bank account? Where to check the default settlement period for my trasing account?

Equities are fully settled on T+2 basis.

Sir I am buy shares on 6 December and 8 December shares are automatically sold and not show in holding but shares sold Price not coming in demat

For this, I\’d suggest you speak to the customer support desk. They will help you with it.

Hello, I want to buy shares in a highly illiquid stock for long term, when I checked the data, I found that there were some buy orders but no sell orders for the stock. Nobody wants to sell the stock and nobody has sold that stock since Aug 2020. The volume is zero. If I place a buy order for that stock and nobody is willing to sell the stock then what will happen? In how many days will my funds be transferred to my demat account?

You won\’t get the stocks so that money won\’t move out of your account. So no question of transfer.

I buy 550 bcg stocks on Monday it\’s T+2 day stock but by mistake i try to sell on Wednesday … On Thursday morning that stocks shown in ( SHORT) on next day Friday in my demat account that stock not visible and even i checked my balance but there also amount not credited…. Any one explain please

I\’d suggest you please talk to the support desk for this, they will help you with it.

Why there is a difference in my fund balance and realised P&L and how can i see my pending fund settlement

Satish, can you call the support desk for this?

I had applied for an ipo. I got a message that shares are allotted. However it is not reflecting in my portfolio.

Kinjal, can you please call the support desk for this?

I have a question – so I sold one share at rs 300. But that amount is debited from my funds along with 15.95 of charges.

I believe this 300 rupees should have been credited to my account. Can anyone help me with this?

The debit is towards applicable charges. Can you please call the support desk, they will explain the charges to you.

Hi, adding to the above question, can I buy another stock the next day with the amount I sold for today?

Yes, you can.

Hi,

Can we buy and sell on the same day without using margin? Unlike BTST, I don\’t want to wait for a day, the same day we purchase (without using margin), can we sell ? Kindly help answer

Thanks

Yes, you can.

I have confusion .

I had earned proffit of ₹ 748 in intraday with laverage. I had ₹ 4154 in my available margin.In the evening ₹ 343 was deducted as a charges and taxes of the total trade now i am worried weather i will get full ₹748 of my proffit.or some money will be deducted o

From that amount also because its showing only ₹405 in unsettled credits WHICH is exactly 343 less than the proffits expected (748-343=405).so will get₹ 343 back or not .

Taru, I\’d suggest you call our customer service desk for this. They will explain the charges to you.

how much margin required if i have 30k portfolio and wants to do BTST for inr 2k ? is it 20% of 30k or 2K?

You will need the entire amount. Basically number of shares * price per share.

Suppose I bought shares on Friday. Shares will be credited on Tuesday considering T+2 settlement process. In terms of payment, when I need to pay full settlement amount if shares bought on margin?

You need the full amount at the time of placing the buy order for these shares.

I have sold.my shares on October 14, 2022 but funds are still not credited to my bank account

Please check with the support team once for this.

Hi, I sold the shares recieved from an ipo, but the profits plus an amount was not shown in my fund balance. Where did it all go

It will be credited on T+2 basis.

what Will be the charge on BTST

No brokerage charges, but there is a DP charge which is applicable.

I have been sold my nifty futures in 5 paisa broker through CDSL verifying OTP on 13.09.2022 but said funds or sale proceeds are not reflected in to my trade account.funds value nearly 75 lakhs.please any one advice or suggest me to got my money / funds back…..wher i consult is NSE Mumbai or 5paisa Broker office at Thane Mumbai.

Call me 9052888891.

Ravi, you need to call your broker for this. We cant help you with this.

I\’m received the trade price in massage\’s in every end of the day. But it\’s not debited in my account.

Please do check with the support once.

Zerodha.

Shares of Reliance sold today worth ₹10000.

Can the money be used to buy shares of Infosys on the very same day.

Yes, you can.

I have sold 1 share on Monday for Rs. 65 and Tuesday in my available cash showing only Rs 55. Why its showing less than actual amount. could you please let me know

The balance will be settled on T+2 basis.

Hi karthik,

i bought ioc shares 250 qty on Wednesday and sold out on next day from T1 holding ioc shares. But still i didnot get my sold ioc shares money credited into demat account. is there also any risk involved??

Can you please recheck? Else, you can speak to customer desk for this.

I sold shares on monday morning. The Amount shown in account .but the amount could not transfer into bank account till thursday night. No holiday between monday to thursday.

Ajoy, I\’d suggest you speak to the support desk for this. But before that, do try to transfer today. It should work.

If I trade in equities CNC am I charged 20 rs for buying and 20 for selling ??

No brokerage for CNC trades.

1. You have mentioned that heavy penalty will be imposed on intraday trades. Pls explain why this and what will the amount of penalty ? .2. You have stated that there are NO Charges on purchase of shares for Delivery,Still you charge some amount on every purchase !!!

Please share the context in which this was stated.

Thank you.. If I purchase different quantity say 50 shares, what will be the nature of trading?

Hi, I have a query:

I purchased 100 shares of a particular company one week before and I sold entire stock today. If I purchase the shares of the same company today, will it be treated as intraday trading?

Yes, the sell and buy (assuming same quantity) will be treated intraday.

I had buyed x company shares yesterday on delivery on nse.. Today I sold it on bse.. Funds are not reflected in available margin to trade.. Pls help me

I sold my shares on Friday and half money came to my demat account but the rest money doesn\’t came till now and today is wednesday

The settlement will happen on T+2 basis for equities.

If I bought shares on 11 august and sell on 22 august and again buy on 22 august then when will the shares come in my demat account ?

The trade you do on 22nd i.e. buy and sell will be considered as a intraday and the shares that you bought on 11th will remain intact in your demat.

I sold 437 LIC shares from my holdings yesterday morning and bought back 400 before closing but today only 100shares credited to my account. 300 shares not credited. Will you please give me the reasons for the same.

I\’d suggest you speak to the customer desk about this as they will have more account-specific information.

My profit of Rs.3000 not seen in today 20th august 2022 which I sold on 18th august 2022 in f&o.

Please do check with the support desk for this, they will help you with it.

I am have started investing recently. I bought an equity on 12th of August, 13th, 14th & 15th was holidays 16th and 17th market was open but still on 18th August my portfolio is showing 0 qty. T1:2 for that particular share. What should I do ?

16th was a settlement holiday, although trading was open. Check this – https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/what-is-a-settlement-holiday-and-its-impact

Hi Sir, I m Trading in Nifty and Banknifty Only So Can I skip these Modules 8, 10, 11, 12, 13 and 14? and Kindly Suggest Which modules are Purely for Trading

Yes, you can head to the trading module. But its good to know stuff 🙂

I sold my shares for rs 2585

Hi, I think i got into a problem. I purchased 50 Shares of a company on wednesday 3rd aug 2022 for 2582 Rs and I sold them today thursday 4th aug 2022. Now im left with 255. rs in my trading account.

net settlement for equity with settlement number ,with this narration why amount getting deducted from my zerodha ac whenever i sell share.

Its a settlement for you right? Anyway, please do call the support desk for a better understanding of this.

In BTST I purchased share on Thursday and sold on Friday with profit of 6k, but profit yet not added to my fund till Monday night, when will it be added

Yes, please check this article for an explanation – https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/btst-meaning

On sale holding of equity securities buy in different breck outs can I chang settings LIFO and FIFO

Before sell effect p&l accordingly.

Ah no, that cant be done.

I am holding a NRI Demat account. I have sold some shares on 12th July.. till I have not received the amount to my demat account. It’s already T+2 day..I suppose to receive ok July 14th.

I\’d suggest you touch base with the support desk, Vivek. I\’d not have any information on this.

How can I transfer the sale proceeds of the stock from dmat account to my bank account ?

Yes, you can. You can place a fund withdrawal request from the broker\’s back office. If you are trading with Zerodha, login here – https://console.zerodha.com/

Can I sell my holding shares after market closed?

No Sandy, you cant as markets have to be open for you to sell shares.

What are the benificiary demat charges for settlement that are deducted from my account daily?

Anil, all charges explained here – https://zerodha.com/charges/#tab-equities

I have question relate to fee/charges structure.

If I bought ABC company share @10 rs at 10:00 am and again bought 10 shares at 11:00 am for same and again bought 100 shares at 3:00 pm for ABC only. Will all the transactions have single charges or multiple charges for multiple transactions ?

Depends on what you do later. If it is an intraday trade then all three are considered as a different trade plus when you sell charges will be applied. No brokerage charges if you take delivery.

Hello Karthik Rangappa, I have a doubt regarding buying of shares.

1. On the T-day money gets deducted from the trading account of trader. where does that deducted goes?

2. When did exchange gets the money?

3. What actually happens during clearance day?

1) Goes to the seller via a bunch of market intermediaries.

2) Same day

3) The buyer gives money, the seller receives money, and gives delivery of shares.

Thanks Karthik, Much appreciated

Happy learning!

I sold shares on zerodha on 17th May, my account is not showing any credit.

How long it will take ?

Does running account statement and Bill to bill statement affect credit process?

I\’d suggest you speak to the support desk for this.

When i was trading last time, it was showing that margin available is 12K, but cash available it is showing -3K, is there any penalty for that or only delayed charges have to be paid. does zerodha keeps this penalty and delayed payment charges or it goes to exchange

I\’d suggest you check with the support team once for this.

Hi, I added funds on thursday, did some option trades, and exited all the positions. When can I withdraw my capital and profits

On Friday evening.

How many days I can keep shares in demat account without selling them?is there any charges applied for keeping shares for long time??

You can keep it for as long as you wish. There is no restriction on that, no charges as well.

I seles holding shares in cnc today, I was purchased Rs1574, now I sales that share today at Rs 1600 , but in my balance not settled fully

Hi

If I sell my holdings today and by that amount the same day if I trade intraday in CNC.

Fot it, Do I get charged any penalty?

No, there wont be any.

If I sell a 100 share on T-2 day what are the charges?

YOu will have to pay the DP charges plus statutory charges.

Yesterday my closing balance was 7000 in account. But today opening balance is 5300. Why they cut too much amount.

Please do check with the support desk once. I\’d not know the reason.

Hi, I had some funds in my account. Today I found out that the fund has been removed from the account. Upon checking the statement, I saw something like \”Net settlement for Equity\”. Any idea why this happened and where did my money go? The transaction dates back to 02/05/2022 and it was a national holiday on 03/05/2022 so I take it that I am supposed to wait for the funds to be credited into my bank account till T+2 which is till 05/05/2022.

Is my understanding correct?

okay karthik. can u pls provide me the support contact number..?

Harshit, you can start from here – https://support.zerodha.com/

If i sell all shares on Thursday. Then when i can withdraw 100% amount after all deduction?

Please help

You can on Monday.

Hello sir/ma\’am

i have one query…I have been getting charged additional 20-30rs daily on intraday trading with the statement written as NET SETTLEMENT FOR EQUITY WITH SETTLEMENT NUMBER…I want to know that what kind of charge it is?? Is it a mandatory charge like other charges…?? If not then how to get rid of this additional charge which is not included in the brokerage charges list shown by zerodha on the website…please answer the query ASAP…

Harshit, I\’d suggest you call support for this and figure.

Hi.

In case I buy 100 shares of xyz at 100 rs cnc and if before closing time it goes to 120 rs. Can I sell it .and if yes what will be the charges.

2.

What if I sell on T1 day

What if I sell on T2 day

What if I sell on T3 day. I mean charges for all

Yes, you can sell it off on the same day. If you do, then it will be considered as an intraday trade and charged accordingly. If you sell on T1/2/3 then there is no brokerage charge, but other charges like DP charges and statutory taxes will be applicable. Check this – https://zerodha.com/charges/#tab-equities

If I but 2 share in CNC today @2000

1 same share tomorrow @2005

2 same share day after tomorrow@2008

And sell all share T3

What will be charge and brokrage

Is it 3 trade or 1 trade

Ajit, we have explained the charges here – https://zerodha.com/charges/#tab-equities

Basically, if you have delivery of shares and sell from DEMAT, there is no brokerage.

Hi, If i sell a share on monday when the delivery margin will credit to my zerodha account.

You can withdraw funds on T+2 basis.

I did not got my 17 rupees from the zerodha account.

Hello,

Assume i have Bought 10 shares at rs 50 and after t+2 day(after they came in my demat account) i sold them for 48.Now here is my question

1.Can i buy those shares back if they are availabe at Rs.40 the same day and will there be any penalty or charges other than normal charges for every trade.

2.And will DP Charges be charged for teh sale i made of 10 share and then bought them back or no dp charge will be charged.

3.Will Dp charges will be charged for second time again(if carried for t+2) or if i sold t+1 day. when i sell the 10 share i bought back after selling them first?

1) Yes, you can buy back. No penalty as such. The sell and buy will be considered as an intraday trade

2) No since its a intraday trade

3) Yes, provided you don\’t transact again.

I do understand this but after selling the stock it shows in position as sold holding

So I want to know if I can use this sold holding to make a profit by buying the shares on a lesser amount again .

No, that thing is position will get cleared by end of the day. It is not an actual position.

Hi Kartik sir,

Could you please shed some light on how brokers fix up permissible leverages for intraday trading? Do they use VAR? Also, if the stock moves against the client at a rate that is greater than the original leverage so much so that it hits the circuit, will the RMS of the broker proactively square off the trade the moment margin money becomes NIL or will they allow this trade to move into T+3 settlement a.k.a the auction ? (Assuming the retail client has moved enough funds to cover the margin requirement alone)

And if so, how will the broker collect the balance amount (if any) from the client? Are there practically any client accounts that are classified as bad debts at the brokers end? Is that even possible?

Regards!

Akhil, Leverage for Equity trading is capped at 5X today. This is because SEBI has mandated an upfront margin collection of 20%. So the max you can get on any scrip is 5 times. If the risk is higher, leverage provided will be lower.

When a client takes an intraday equity trade, the client assumes all risks that come with such positions. While the broker can attempt to square off positions, the onus lies on the client. If in the event that the trade has to be settled in the auction market, the client is liable to bring in the debit balance failing which an interest at the rate of 0.05% on such debit balance is charged.

The broker\’s actions for recovering such debit include, but are not limited to: filing an arbitration with the Stock Exchange, serving a notice to the client for recovery etc.

Hey there, I added 3156 rupees in my groww balance and purchased stocks for 3119 and my closing balance was 37 rupees and in the evening. Stock margin was -1157 something and now my groww balance is -1119. I am really scared of my negative groww balance can you please help me understand what is this.

Bharat, I\’m really not sure. You will have to check with Groww team for details.

I buy 8 stocks 6 April and sell it on 7 April with some profit and i again buy same 10 stocks with lower price , 7 April , but the price of 8 share is same as 6 April and 10 share average is showing 8 share 6 April and 2 share of 7 April ..

TArun, I\’d suggest you check with the support team once.

What if I sell a t2 stock on the same day of buying

You cant.

i have sold my holdings for Reliance today and want to re-invest tomorrow. My settlement is yet to occur. However, I have separate margins available (i.e. additional cash)

Am i liable for any penalty?

No, you wont.

Sells done on 31/3/22, DP charges debited on the same day, but sells amount not credited till 06/04/22.What is the reason?

Stocks are debited same day (hence DP charges), and equity settlement is on T+2, hence the funds hit your account 2 days later.

I am a little confused on the following issue.

I am trading in NRML thru margin money.

I book profit of say Rs 5000.00 on sale of RIL share on say 01.04.2022.

Simultaneously I have a debit balance in my utilization account so obviously the booked profit will not be reflected in my withdrawable amount.

Then when will this amount of Rs 5000 be available for withdrawl or will these be utilized to reduce my utilized limits.

Please clarify.

Sarbjit, settlement happens on T+1 basis, so assuming you closed the position on Friday, the settlement will happen on Monday.

Hello sir,

Plz revert to my query..

If I buy a stock for long term purpose. let\’s say today but unfortunately I need money on T+1 day i.e next day ,so, in this case Can I sell that stock on T+1 day.

Will there be any issues with my account in future.

TIA..

No problem as such. But not all stocks can be sold on T+1, so make sure the stocks that you want to sell is permitted.

When I sell shares on Monday exactly when I can get money in my bank account?

80% on T+1 and the balance of 20% on T+2.

I bought a stock for an amount \”x\” and after a few months sold it for amount \”y\”.

y>x.

When I sold the share now for the amount y, the profit of (y-x)Rs didn\’t get reflected in my trading account I received some lump sum with the same amount x that I invested, where is that y-x amount of profit

Divya, you need to wait for full settlement i.e. T+2 days.

Thank you sir!

I analysed the trades in juxtaposition with the settlement mechanism and hence, the question.

Ain\’t the MIS trades net settled? If I am not getting a hit on my demat, did I ever buy anything? Because, the buy deal would crystallize if and only if the ownership of the security passes onto me against which I transfer the requisite money. But In MIS trades, the shares would be directly passed on to the final buyers demat and he is the one who pays for the shares. isn\’t it? My trading account will be credited or debited as the case may be with the differential! So, how are the two trades independent when they are settled net?

P.S. I beg your pardon for I had executed MIS trades years before and I am not so sure about the settlement mechanism these days! But I for some reason believe that they would still be net settled! Please correct me if I am wrong.

Thats correct, Akhil. All MIS trades are intraday and net settled. No shares are credited or debited to your account. But beware, if the stock that you trade hits a circuit, then you could be in trouble.

Hello Karthik sir,

It\’s been a while that I have been thinking of this aspect and would like to know your thoughts on the same! It\’s about the MIS a.k.a the intraday trades under equity segment.

Isn\’t it equivalent to being an intermediary who guarantees :-

1. the buyer of the security; the delivery of x number of shares and

2. the seller of the security; the delivery of x amount of rupees.

To illustrate it better with an example, say I execute a MIS trade by buying 100 shares of BEPL at 132 Rs. a piece and on the same day sell 100 shares of BEPL at 135 Rs. a piece. Thus, I take hold of 100 BEPL shares of the seller guaranteeing him Rs 132 per piece in return and sell those at 135 and return 132 to him and keep 3 Rs per scrip as my commission for acting as an intermediary. Not everything would be this fun had I been able to find a buyer for BEPL at 130 Rs. a piece. Thus, I\’ll put 2 Rs per piece from my pocket and return the guaranteed 132 Rs. to the seller of BEPL. This 2 Rs. per scrip would in turn represent the guarantee cost. Obviously instead of me doing this, my broker would do it and credit my account with commission or debit it with guarantee cost ( plus charge me for transaction costs).

I can construct a similar example for a sell first buy later trade ( Yes! On an intraday basis).

Sir, So here is the question! Do you find Sense in these? Is my logic consistent with the settlement process?

P.S. I\’ve been an avid reader of your content through Varsity and I admire your efforts and thoughts!

Akhil, so the way it works is that each of these trades is an independent trade and one is not connected to another.

Trade 1 – You buy 100 @ 132, so someone sells this to you at 132. Deal done.

Trade 2 – You sell 100 @ 135, so someone buys this from you at 135. Deal done.

Trade 1 is not related to Trade 2.

i sold one share of wipro today at 604 but at the same time my account was credited with 485 only so what about remaining money?

Full settlement is on T+2 basis for equity transactions.

Today\’s back it was showing authorisation for sell shares if typed TPIN. But today itwas not showing the authorisation option. I send Power of Attorney to broker during last week.

Hariharan, did you transfer shares using E-DIS? I\’d suggest you contact the support desk for this.

So a broker gets money 1 day in advance from its customers on Day T before they part with the same to NSE/BSE on T+1. So doe NSE/BSE get it one day in advance it seems before its transfered to the person owning the shares…

A large broker could have a core amount sitting in his bank a/c every day that r could technically be invested in Liquid funds that generate 4% per annum ??? This is free money in addition to brokerage etc already charged

Its not necessary for a customer to transfer money 1 day in advance. If you decide to buy 100 shares today, then just before buying the shares you can transfer the funds from your bank to your trading account. The main point to note is that you should have funds in your transaction before you buy, without funds, the transaction wont go through.

If I have shares with T+1 showing on Holding , and on same day is Ex-date for Corp-Action like Bonus or Split for the stock , will it be applicable for my holding.

Yes, because you would have bought it the previous day.

When will I get the credit blocked in my delivery margin upon selling my share

You get the credit right after the sale.

Dividend tds Applocable on amount 780

Hello Karthik garu 🙂,now the markets follow T+1. It is not updated here.

Its yet to live, Sameer, I\’ll update when do 🙂

hello , i am new in Option trading , i want to know when i buy 38000 CE at.5.13 of 13 lot, and i sell it at.5.55 , i use the brokerage calculator to know my total loss . its saying around 260 but it debit Rs-420 . why ??????

Sankar, please do check the contract note for exact details. You may have other positions as well. In contract note you will get all these details.

I sold 5 TCS yesterday and its still showing in my Holdings. Somewhere I read there will be a negative sign before the number of shares sold. I still see the 5 TCS shares. How do i make sure that the shares that I intended to sell are actually sold. It doesnt shows up in the orders tab as when we but it shows up there

Thanks

You sold from CNC right? Anyway, please check the holdings today again.

Hi, I have purchased some share on Monday (21/02/2022). So on T+2 day which is Wednesday (23/02/2022) I got mails from CDSL that my shares have been credited to my demat account. But in Zerodha kite app under holdings it is still showing as T1.

Can you please help.

Can you please check again, Pronoy?

Hi. I have a very peculiar problem. I wanted to participate in the current TCS buyback (2022). By mistake I bought 53 shares on 21st Feb. Now following the

T+2 cycle, the shares will get credited to my demat on 23rd Feb which is the record date. However i have overshot the limit to participate in buyback retail category(4500 rs × 53 shares= more than 2,00,000 rs). My query is

1. Is there any solution for the above situation?

2. Can i do BTST of 9 shares to be eligible for buyback?

Yesterday I have short selled 100 ambuja cement (ambujacem) shares at 343.50 price . At the end of the day I have exited this trade at 338.00 price. My profit was 550 rupees. Yesterday I received only the amount which I have invested. Today I was supposed to receive my profit but instead of getting profit 81.00 rupees were deducted from my demat account.

Please let me know what is the issue

The settlement is post deduction of applicable charges.

I sold 40 shares of Hindalco on 11.2.22 at the rate of 541.85 and received a credit of 12912.39 on 16.2.22. Can you clarify this accounting.

80% credit on T day and the balance on T+2 (upon settlement).

Sir,if i sell my shares today then my profits will be credited on T+2 days. But when will my starting capital be credited in my account so that I can use it to buy other shares or F&O? Can i buy shares from my starting capital tomorrow or will i have to wait till T+2 day to buy???

You will get an 80% credit of sorts for the amount you\’ve sold, Suman. YOu can use that funds to transact.

I\’m holding stock more than year and if I sold it today can I do trading on the same on that day.

Yes, you can.

What happens to my share price, when when I buy back a same stock that I had sold a day before? Suppose I had purchased a share at Rs100 sold at 150, then again I buy back at Rs 140. I mean buying before it get settled in my damat account. Will it be Rs 140 or Rs100?

It will be 140.

Suppose I bought nifty indexed PE as Normal . Can I sell the same day ? What are the consequences involved ?

Yes, you can Dhirendra.

Hii !! I wanted to ask about the amount of brokerage that will be charged on a transaction of rs3400 equity … actually rs13 was charged for the same so wanted to enquire.

Its 0.03% or Rs.20, whichever is lower. Check this – https://zerodha.com/charges/#tab-equities

I have a specific question which I couldn\’t find in all your support. Here it is with example:

21st Monday I purchased A share 200qty cnc mode

23rd Tuesday again in cnc purchased same share 100qty.

Selling sames share qty 100 on 25th Thursday in cnc