December 1, 2023

What could ruin the party for an all-time high Nifty?

Vineet Rajani | Opinion

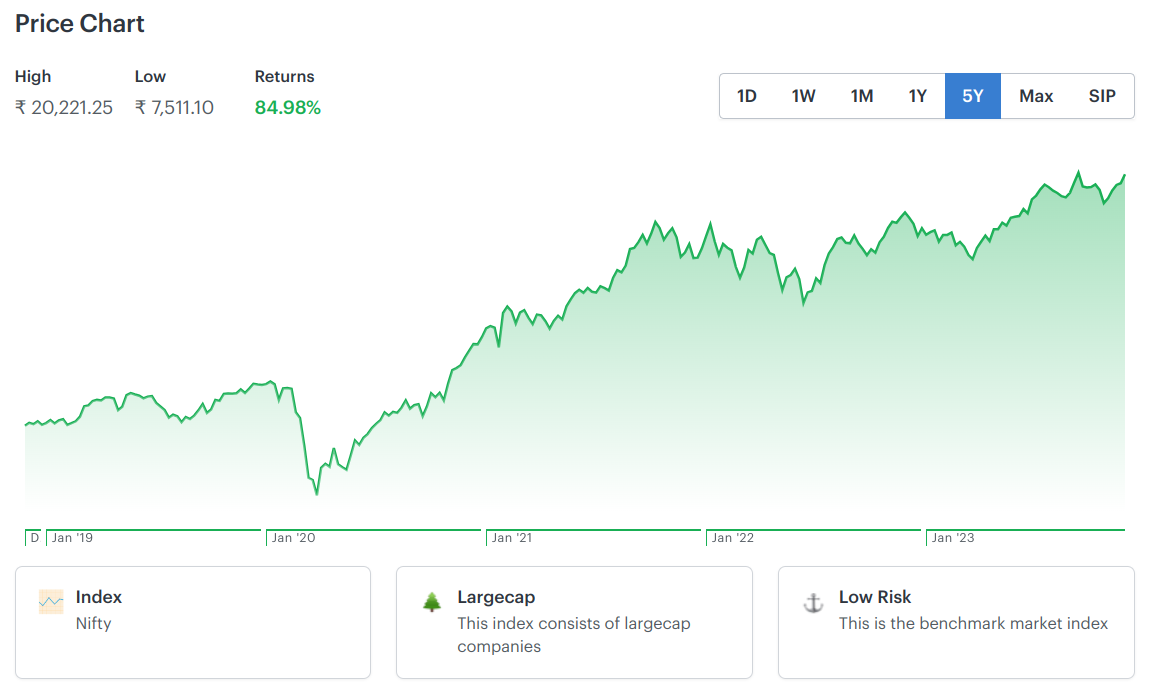

In the blink of an eye, the year 2023 is wrapping up. After gaining about 5.5% in November 2023, the Nifty 50 index is hovering near its all-time high, which was achieved too long ago in September 2023.

There will be many bull case scenarios suggesting a rally higher up. But let’s look at the bear case and figure out the factors that can potentially drag the markets down.

-

- General elections are due in the first half of 2024. A hung parliament with no national party having a majority could depress the sentiment. Markets are usually not happy with a coalition government. Coalition governments often find it difficult to introduce or pass new bills. This impedes economic progress and development.

- The Russia-Ukraine war has been going on for almost two years. Israel has been at war with Hamas for two months now. The fear of China annexing Taiwan always lurks. Any of these conflicts escalating to a regional or global level could have a devastating impact. Supply chains will be adversely impacted. Commodity prices could soar. Gold will become expensive.

- India primarily depends on imports for all its crude oil needs. A war, pandemic, natural calamity, or manmade disaster sends oil prices skyrocketing. Higher oil prices culminate in higher input costs and consumer inflation. Other fuel prices also shoot up. Businesses suffer.

- Continued high interest rates in the West could lead to a recession. An economic slowdown is likely, if not a recession. Slower consumption in foreign countries could hurt the demand for India’s exports. The Indian IT has been feeling the heat for some time now. This became evident when TCS and Infosys significantly scaled down their hiring plans.

- India’s GDP grew at 7.7% in the first half of FY2024. It is poised to be the fastest-growing economy, with an expected growth of 6.5% this year. A sudden, unexpected shock to growth could derail the prospects. Such a shock could be from within or outside India.

These are known risks that can be factored in. But risk can originate from anywhere, at any time, and in any form. The degree of impact of such risks on the economy and markets cannot be forecasted. Your best bet is to allocate across asset classes mindfully. When you spread risks across asset classes, each asset class becomes a hedge for the other.

Do note that these bear-case scenarios are possibilities, not forecasts. Forecasts must be backed with data, statistical probabilities, and adequate reasoning. There is a good chance that India’s GDP will be at least as much as is forecasted.

I hope this note acts as a reminder of sanity, at least to myself, in times when euphoria has taken over.

Leave a Reply