November 21, 2023

Do you know how much you need for your retirement?

Satya Sontanam | Personal Finance

Remember back in the day when landing a government job was like hitting the jackpot? Needless to say, it was held in high esteem by Indian parents for a marriage alliance. It’s a coveted career option mainly due to the perks of ‘job security’ and ‘retirement benefits.’

Let’s focus on that retirement part. While the retirement benefits that we can get from a job or a government have been emphasized for years, retirement planning that we ought to do for ourselves has not received the same level of attention. Growing up, most of us did not hear about the importance of retirement planning, did we?

“Retirement planning that we ought to do for ourselves has not received the desired level of attention.”

I often wondered why retirement planning isn’t as common a topic of discussion as it should be.

One possible explanation could be rooted in our cultural history. In India, the joint family system has been a form of living for generations. There has been a shared responsibility towards one another in the family. There was always that unspoken understanding that children would take care of their elderly parents.

Also, with low-income levels for many in India, long-term planning for retirement often took a back seat.

But things are changing. Income levels are rising, and so is our intention to be financially independent as we age. Of course, retirement planning goes beyond financial readiness; it’s also about preparing emotionally for a fresh chapter in life and discovering a new sense of purpose. But being financially prepared at least ensures we don’t have money problems.

Starting off

But retirement planning can be overwhelming for many. It involves numerous assumptions and dauntingly large numbers that might seem unachievable. For this, the answer is not to completely avoid it but to start slowly.

“The two important steps in retirement planning are: 1. Knowing how much you need for your retirement; and 2. Start investing small.”

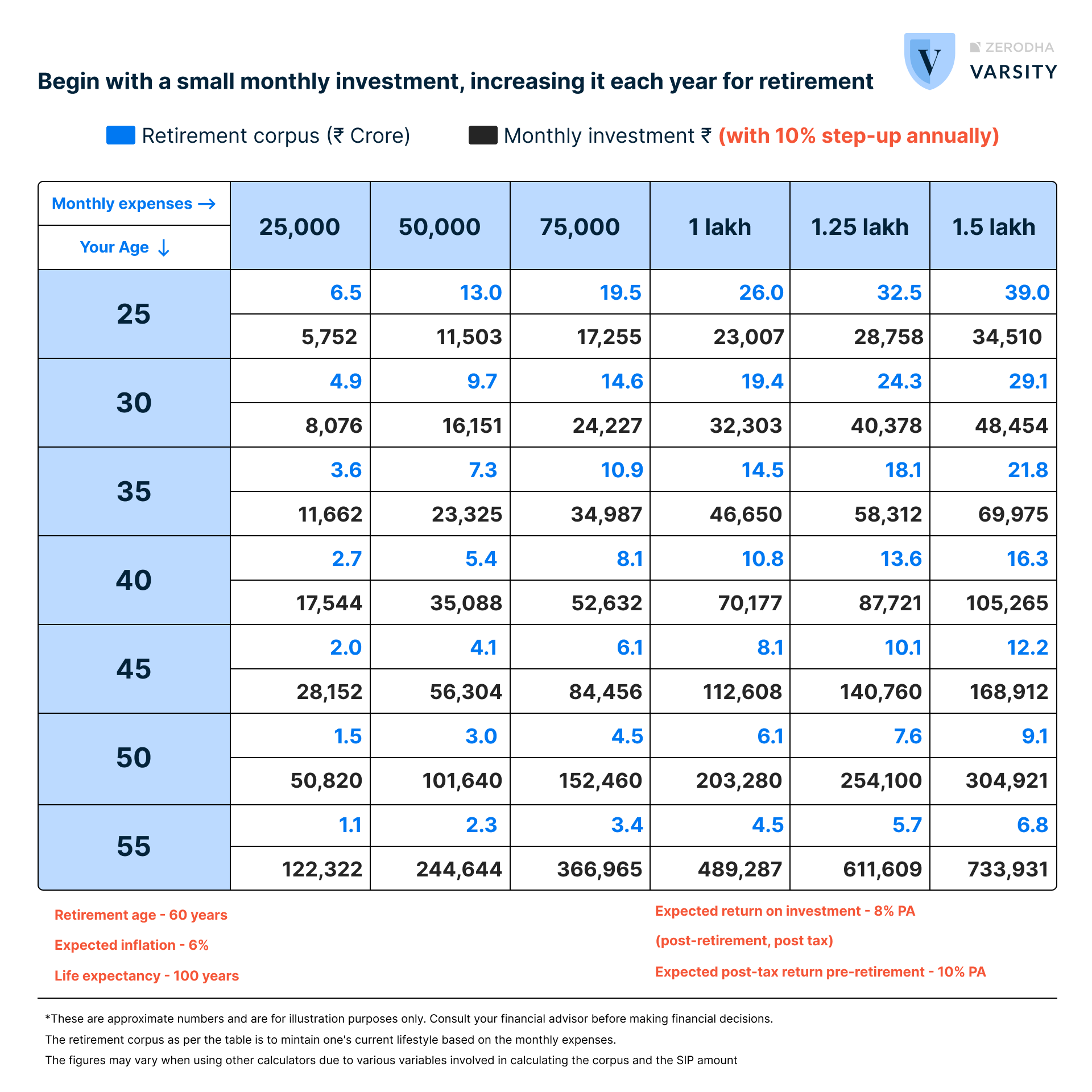

To handle the first point, we have put together a handy table (table 1, as shown below) that provides a quick estimate of your required retirement corpus.

Let me break it down with an example on how to read it:

Imagine Arya, a 30-year-old with monthly expenses of Rs 50,000. If Arya wants to maintain the current lifestyle during the silver years, the retirement corpus to aim for is Rs 9.7 crore by the age of 60. Now, to build that nest egg, Arya should consider investing around Rs 47,000 per month.

Do these numbers seem a bit daunting to you? For many 30-year-old young folks, setting aside Rs 47,000 every month exclusively for retirement could be a big financial commitment. Our income might not be that hefty, and we’ve got other financial goals to juggle—like saving for a home, foreign trip or our kids’ education.

This is when most people give up retirement planning. Our brains are wired to avoid tasks that seem too difficult or impossible. But what we can do is to break down the task into smaller and more manageable steps.

So, we compiled the second table (table 2) that tells you how much monthly investment you can start with in the first year and then keep bumping it up by 10% annually. As our income is likely to climb, increasing our investment every year should be manageable.

Now, as per the second table, Arya can start with just Rs 16,000 monthly investment in the first year (Rs 47,000 as per table 1), which can be increased by 10% to Rs 17,600 in the second year, Rs 19,360 in the third, and so on, all the way up to age 60. The last year, Arya should be able to shell out Rs 2.8 lakh per month. But that is 30 years from now. This approach could make the whole retirement planning exercise a lot less overwhelming.

Ultimately, the choice is yours – whether to save the same amount uniformly every year or keep increasing annually. But the key is to start saving.

Anyways, the above two tables come with some set of assumptions, which you can see in the footnote. If you want to customize it as per your requirements, you can do so by clicking on this Excel link here.

Do your math

If you’re a DIY (do-it-yourself) investor and want to play around with the numbers to figure out your retirement corpus, check the link above. You must fill in some blanks (blue shade in the Excel) to arrive at your magic number. I came up with something called ‘L.I.F.E’ that you need to know before using retirement corpus tools out there.

- ‘L’ for life expectancy: This talks about the number of years we are expected to live. This figure determines how much money we need to save to support ourselves financially after retirement. Since the life expectancy of humans is increasing over the years with medical advancements, financial planners usually suggest taking 100 years.

- ‘I’ for inflation: You would have heard that inflation would eat into your savings. When the prices of our everyday expenses go up, the purchasing power of our savings comes down. So, we need to consider inflation after retirement. In India, inflation could come down as our economy keeps growing. But we generally consider it to be around 5%-6%.

- ‘F’ for return after retirement: It is the average annual rate of return that you expect your retirement corpus to generate during your retirement years. Many would become risk-averse regarding the retirement amount and reduce their exposure to volatile assets such as equity as they age. This also reduces the return expectation. For the above tables, we assumed the post-retirement expected return (post-tax) to be 8% per annum.

- ‘E’ for expenses: This talks about the monthly expenses that we are likely to incur during our retirement age. It’s difficult to forecast what our expenses would be many years ahead. So, there’s a way around it. You can give your current monthly expenses (in the blank). The tools will inflate your expenses (adjusting for inflation) until retirement age. Since you used the current expenses as input, the retirement corpus output you get allows you to maintain the present lifestyle during the retirement years as well.

Once you get the retirement corpus number, you may want to know the monthly investment you need to save towards it. For that, you must input the expected rate of return that your investments would generate before retirement. On a conservative basis, we considered this return (post-tax) to be 10% for the above tables. You can also specify by what percentage you want to increase your savings towards retirement annually, if required. As you can see above, we considered a 10% step-up.

Conclusion: At the cost of repetition, the two most important factors to get started with retirement planning are – 1. Know how much you need for your retirement; and 2. Start investing towards it, even if it’s a small amount.

We also interviewed a financial planner on how to go about retirement planning. Check the video on YouTube – https://www.youtube.com/watch?v=bKKMtCieJ-c&t=331s

Thank you so much the blog is great insights for me to look forward to my retirement but Can I have the updated document mentioned in above blog many people edited the attached retirement document.

https://docs.google.com/spreadsheets/d/1ENQh9cHTPJoAw4Gbgd6kuh98stdh2giPBu0mtRRf3zw/edit#gid=1435701872

Hi Pratik,

Thanks for bringing it up to our notice. The google sheet has been restricted for the \’edit\’ access. The link mentioned in the story has also been updated. Request you to download the sheet into your device for editing and customizing.

Hi Dinesh,

That\’s a good question. When you say, my investment of Rs 100 earns 10% per annum, it implies that you are earning Rs 10 per annum in the first year. Hope you agreed till now.

In the calculator, we talk about monthly investments (SIPs) that you need to start. So, Rs 100 will be invested across 12 months – Rs 8.33 per month. The moment you invest, your investment will start giving you returns.

To earn Rs 10 per annum (as stated above), your monthly investment of Rs 8.33 can generate return at just 9.57% per annum rate (not 10%), since the return is assumed to compound every month.

To arrive at that 9.57% rate, I used Nominal function in the excel.

It could be a bit technical but more accurate way of calculating the monthly SIP amount to build a target corpus.

Coming to step-up SIP – this amount is the monthly SIP amount you need to start with in the first year and keep increasing it every year by a given percent. If you want to know how it is arrived at, you can check the excel formulae.

Thanks for reading!

What is Nominal APR and how the stepup SIP is calculated.