Zerodha F&O margin Calculator

Traders,

Zerodha F&O margin Calculator part of our initiative “Zerodha Margins” is the first online tool in India that let’s you calculate comprehensive margin requirements for option writing/shorting, futures and multi-leg F&O strategies when trading equity, F&O, Currency and Commodity on NSE and MCX respectively.

The calculator will ensure that you never have the following queries again

- Margin benefit you get for taking calendar spreads (taking opposite positions on different expiry of the same contract)

- Option writing margins

- Margin benefit for various multi-leg option strategies like iron condors, straddles, strangles and more

The following post explains various ways in which F&O margin calculator can be used,

For Future Margin Requirements

See the example below for Nifty November futures margin requirement.

Total Margin = Span/initial + Exposure

Total Margin is the margin required to hold the position overnight or also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

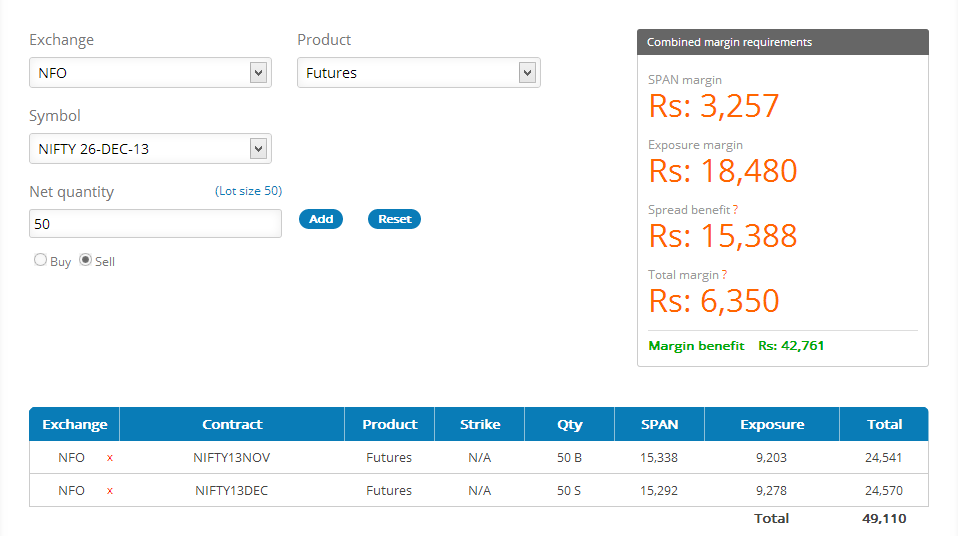

For Calendar Spreads

Calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring a particular date and sale of the same instrument expiring another date or vice versa. Since the position is completely hedged there is a margin benefit for the combined position, as shown in the example below for a calendar spread between Nifty Nov and Nifty Dec futures.

Total Margin = Span/initial + Exposure – Spread Benefit(If any)

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

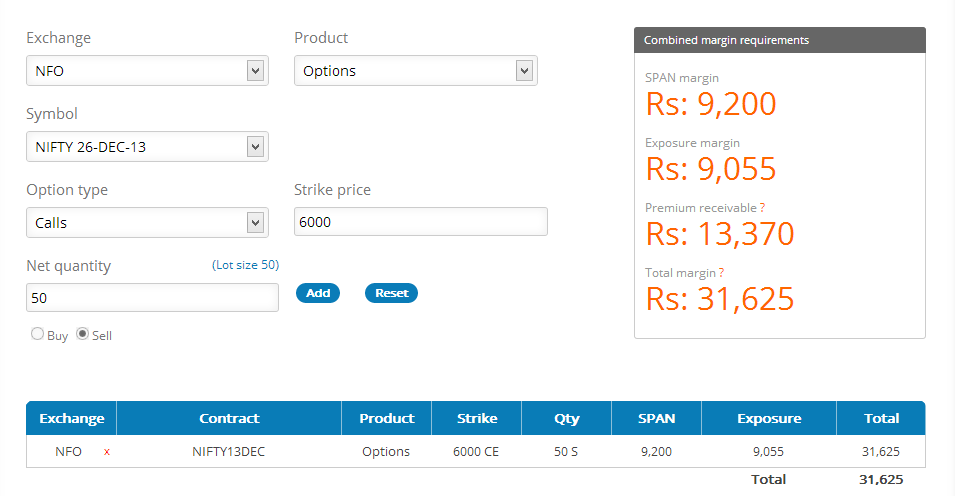

For Option Writing/Shorting Margin Requirement

When you write options the margin required varies based on the underlying, volatility, expiry and more. Until now there was no other online tool that could tell you the margins required before taking a trade, very important for an active option trader.

The example below shows the margin required for shorting 1 lot of Nifty 6000 Dec Calls. Do note that you need to click on Sell after entering the net quantity if you want to see the option writing margin requirement.

Total Margin = Span/initial margin + Exposure margi

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Premium Receivable?

When you write/short options the premium that you receive gets credited to your trading account immediately after taking a trade. Zerodha F&O margin calculator accounts for this premium received based on closing price of premium from the previous day.

So in the example below, the margin required to write/short 1 lot of Nifty 6000 calls is Rs 31,625, but as soon as you take this position Rs 13,370 is credited to your trading account effectively blocking only around Rs 18,300 for this position. It works the same way for both equity and currency options.

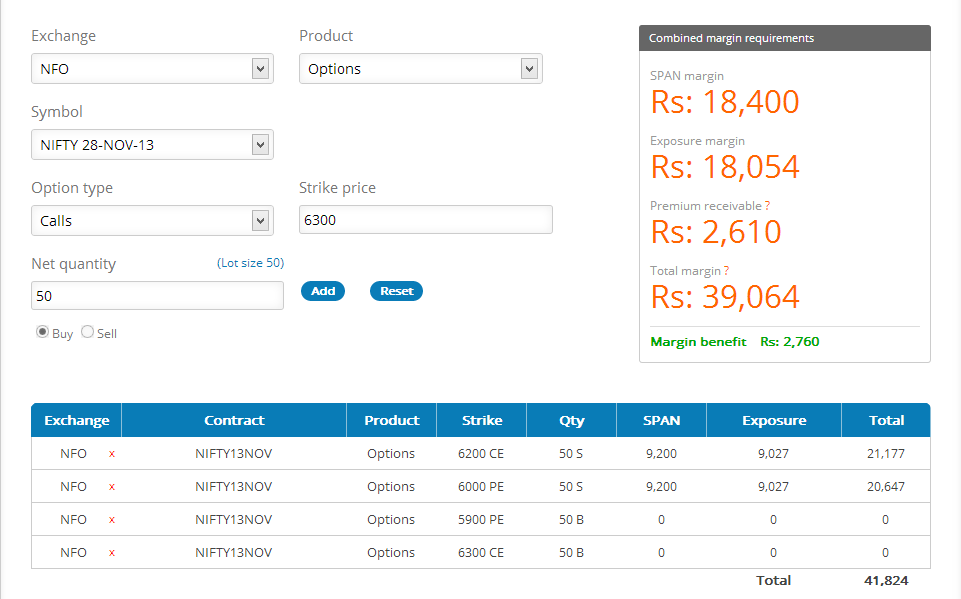

For Multi-Leg F&O Strategies Margin Requirement

There are many popular multi-leg f&o strategies like Straddles, Strangles, Iron Condors, Butterfly, Bull Call Spreads, Covered Calls, and more which would involve taking more than 2 positions at a time. The margin required for such a combined position could be less than sum of individual margin requirements if the positions hedge each other, like in the calendar spread example above.

Knowing the margin requirement upfront for such a position is very important to better plan the trade. See the example below for calculating the margin requirement for an Iron Condor Strategy on Nifty

Iron Condor involves 4 legs and is a limited risk non-directional option strategy designed for high probability of earning a small profit when you perceive low volatility.

Nifty is presently at 6100

- Sell 1 OTM Put – Short 1 lot of 6000 PE in the example

- Buy 1 OTM Put (Lower Strike) – Buy 1 lot of 5900 PE

- Sell 1 OTM Call – Short 1 lot 6200 CE

- Buy 1 OTM Call (Higher Strike) – Buy 1 lot 6300 CE

As you can see below the Zerodha F&O margin calculator will show the margin required and the benefit for entering this strategy in a jiffy.

Total Margin = Span/initial + Exposure – Spread Benefit (If any)

Total Margin is the margin required to hold the position overnight also called NRML margin at Zerodha. If you use the product type as MIS instead of NRML while placing an order you will get additional leverage only for intraday trades. Read our Margin Policy for more.

Disclaimer: Zerodha Margin Policy can change any point of time based on risk and market volatility.

Hoping all of you like this tool,

Happy Trading,

how to know expiry day margin requirement. ?

if today is not expiry day then it just show margin as of today. How can I know what it would be on expiry day?

Today I have created a iron condor stretegy in basket for nifty option using the below details:

buy 26400 ce @ 2.15 (1 lot)

buy 25850 pe @ 1.16 (1 lot)

sold 26200 ce @ 12 (1 lot)

sold 26900 pe @ 4 (1 lot)

But margin requirement is 191000. I don’t know why somuch margin required?

CAN I GET COMPLETE LIST OF F&O STOCKS WITH THEIR LOT SIZE AND MARGIN REQUIREMENT IN ONE EXCEL SHEET. SO I CAN DECIDE WHICH LOT SHOULD I TRADE. ALSO GIVE ME UPDATES REGARDING CHANGES IN THIS LIST.

Hi Dinesh, you can check the complete list along with margin requirements here: https://zerodha.com/margin-calculator/Futures/

The Margin Calculator is failing to function correctly, and Zerodha’s lack of support is unacceptable. If this continues, customers will undoubtedly turn to other brokers. Furthermore, the margin calculator consistently shows inflated margins compared to what is actually available on expiry days. I have faced this issue personally, and it needs to be addressed immediately.

f&q calculator is not working at all

Hi Nikhil, could you please create a ticket at support.zerodha.com with more details and provide a screenshot so we can get this checked?

Are these the current margins , Say @ current lot sizes of Nifty 75 . Calculator shoes a buy of hedges abd strangle of 23000 ce and 22000 pe shows a margin of 83k ? Is it correct

Margin Calculator is not working, No support from Zerodha. If they keep in not supporting. Customers will run to different Brokers.

Calculate is not working

How Zerodha or exchanges calculate the ELM for strategy like iron fly or iron condor .. on expiry or day before expiry?? Please guide

margin clculator not working properly

in options not workin from many time

bu now fo also not working paytm examle

plz rexolve as soon as posible

Zerodha margin calculator is not working for quite some time. Checked in 3 browsers. Is there any problem? Tried to check margins for nifty options n bank nifty options.

After Option buying, for generating SL big margin of money is required. Why is it so ?

Are these calculators updated with the latest margins? I don’t see it working for GOLD futures.

https://zerodha.com/margin-calculator/SPAN/

Margin Calculator is not working. Request Zerodha team to fix it at earliest.

Thank You

Hi Shubham, the margin calculator is working fine. Could you please create a ticket at support.zerodha.com and provide more details along with a screenshot so we can get this checked?

https://zerodha.com/margin-calculator/SPAN/

Above link is for Span Calculator and it’s not working.

Again and again on checking I still get the NAN NAN thing on screen,just fix this margin calculator issue quickly

Margin calculator has stopped working since 5 days ,now it only show NAN

The margin calculator is not working. Please help.

Hi Naveen, the margin calculator is working fine. Could you please create a ticket at support.zerodha.com with more details and provide a screenshot so we can get this checked?

I can not see 2025 nifty contracts in the calculator

Most of the time it is not working, i tried many time but no use. bad service and support team. guys you work to fix the issue

2025 contracts are not available in the calculator. Can you add it?

margin calculator is not working its showing just NaN, im not understanding what it is

Hi Santosh, could you please try again and check?

respected member

you were the only one who was providing accurate margin

but now cumulative lot margin is not correct

single lot is correct

with call put not correct

plz see to it

Hi Jignesh, we’re sorry to hear this. Could you please provide us with more details and screenshots at support.zerodha.com so we can check and get back to you on this?

DEAR TEAM,

I AM UNABLE TO CALCULATE MARGIN WHILE FILLING ALL THE FIELDS IN CALULATOR THEN CLICK ON ADD BUTTON HOWEVER MARGIN NOT CALCULATED PLZ GUIDE US IN THIS MATTER SO THAT I CAN USE THIS TOOL EASILY.

Hi Manohar, could you please refresh and check on an alternate browser?

hi!

up to last month option calculator was working

fantastic

but from current month not working properly

plz update as soon as you can

and try to solve problem

plz reply

Hi Jignesh, the margin calculator is working fine. Could you please create a ticket at support.zerodha.com and provide more details along with a screenshot so we can get this checked?

hi!

this is to ingorm you

option calculation is not working

can bank bought 400950

option sell 680 ce 202500

buy pe 580 pe 202500

margin should be 57722975

but our claculator showing wron

I had bought a Call option of GodrejProp 2300 CE for 1 lot of 475 qties. After a week of holding, i got a warning message to square off for not meeting margin requirements. Why do i need to maintain balance while buying a call option?

Hi Manmath, if you’re holding a long ITM stock options position, there is an increased margin requirement for as the exchange blocks physical delivery margins from expiry minus 4 days. More here.

Team,

In my f&o profit showing till 1Feb for PNB 4000 rs but 2nd Feb I Book loss rs 8800 in same trade but now showing loss -9600 rs yet it should be rs -4800 only

margin not calculated

Hi Jignesh, the margin calculator is working fine now. Could you please check?

how to trade future and option simultaneously

e.g Nifty JUL FUTURE BUY and Nifty 19800 PE BUY

Hi Dayanand, you can try placing basket orders.

IT WAS OBSERBED THAT SOME OPTION ORDERS ARE REJECTED BY ZERODHA DUE TO NOT ACCEPTABLE STRIKE PRICES AS PER SEBI RULE. WHERE TO FIND THESE ACCEPTABLE LIMITES FOR BANKNIFTY & NIFTY INDICES.

Hi, if the option you’re trying to buy is outside the allowed range, we show a Nudge with information about the allowed range. You can also check the allowed strikes here.

icannot calculate margin calculation

result shows “NAN

PLEASE RESOLVE AS SOON AS POSSIBLE

¶

Reply

Hi Jignesh, the margin calculator is working fine. Could you please do a hard refresh (Ctrl+Shift+R) and check?

While selling ur not giving full settlement as per the rate and more over ur charging 15.93 on sales. Pls clarify

Hi Sandhya, as per SEBI’s peak margin norms, 80% of credit from selling your holdings will be available for new trades. The remaining 20% credit will be blocked under the delivery margin field on Kite until the next trading day. Explained here.

@zerodhateam margin calcutor is not working when i put my strike price and press add button then calculator showing NAN NAN NAN why is not working please check this

Hi Ragnaar, apologies for the delayed response. This should be fine now. Could you please check?

i m not getting margin calculation

result shows “NAN

PLEASE RESOLVE AS SOON AS POSSIBLE

¶

Reply

We’re working on it, Jignesh, and are sorry for the inconvenience. For now, please use the Basket orders feature on Kite for checking the margin requirements. You can learn more on basket orders here.

i m not getting margin calculation

result shows ”NAH

Hi Jignesh, we’re having this checked. For now, please use the Basket orders feature on Kite for checking the margin requirements. You can learn more on basket orders here.

The margin calculator has stopped working? Please do check.

Hi Pankaj, we’re sorry for the inconvenience. The margin calculator is working fine now. Could you please retry and check?

I have encountered the problem countless number of times. The calculator simply keeps on showing NaN no matter what you do.

I tried

1. Press reset button

2. Restart browser

3. Clear cookies

4. Use different browser

Nothing works. When I try it again next time (at least a day after) I found it working.

I have found it highly unreliable …. it won’t work when you need it…. even in live market hours.

I have seen the same question many times on this forum and Tradding QnA. over a period of 3-4 years. Everytime there is one answer: ”Now it is working. Please try again.”

I can’t believe Zerodha could not fix it once for all in last 3-4 years even when it was reported multiple times.

HI

MY QUERY IS REGARDING WEEKLY OPTION MARGIN CALCULATOR.

IS IT POSSIBLE TO USE WEEKLY OPTION OF NFO AND CDS.

PLEASE HELP

WAITING FOR YOUR RESPONSE.

THANKING YOU

Hi Darshana, weekly strikes aren’t currently available on Margin Calculator. We’ll take this as feedback and look into the possibility of making weekly strikes available. For now, you can also use Basket Order to calculate the margin requirements:

https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/holdings/articles/kite-basket-orders

Hi, I am using the margin calculator for options on crudeoil (MCX). I have observed few issues

1 – The Symbol it shows are of underlying futures and not options

2 – Sometimes when I add multiple sell position it shows unreasonable margin benefit. I am not sure if that’s a bug or not. For example

Span Rs. 4,27,846

Exposure margin Rs. 17,039

Premium receivable ? Rs. 26,070

Total margin ? Rs. 4,44,885

Margin benefit Rs. 31,70,831

I have a position in canara bank future .A margin is also deposited.Now if I want to sqare off the position they are asking the margin again.It means I have to pay margin for buying and selling separately.It means double margin?

Hi Vishnu, you don’t need any margins to square-off the existing position. Please check whether you’ve any pending orders. If you have a pending order, new order placed will be considered a new position and you’ll need margin. You can modify the pending order or cancel and place a new one.

The span calculator for 20 oct 2022 is not showing the premium receivable correctly. The premium amount is showing almost double if we sell options.

For example

1 lot (250) of 2400 call for deepak nitrite for oct series is trading at 7.5.

The premium receivable should be in range of 1700 to 1800. Zerodha is showing as 3075.

Hey Gaurang, the margin calculator will show premium values based on the previous day’s closing price.

Why are weekly option premiums not showing up? Only monthly expires are shown for indicies.

What is Peak Margin,

What is the Peak Margin Rate

Hey Sudarshan, you can learn more about margins and penalties here.

how much margin we required if we sell both call and put of the same expiry at same time? e.g. today is 22/09/2022 and @3:15 market is running at 17625 and I want to sell one lot of each 18000 ce and 17250 pe of the expiry 29/09/2022…

Hey Abhijit, you can easily check the margin requirements using our Margin Calculator or Basket Order feature on Kite.

How it is getting margin benefit with selling call option

and Buying put option

eg: maruti 9400 call sell 400 , and buy 9200 put 500= getting margin benefit 4500.

How it is getting benefit while it is not a hedge position

Why i can’t buy and sell future of same expiry at the same time??

Why is this calculator not working for ”LEAPS” (Long-Term Equity Anticipation Securities)?

It’s almost as if these are very guarded secrets of the Indian stocks ecosystem and if someone wants to explore it, it will be a long, lonely journey!!!

They are instruments we can trade in – right? Why no support for their calculations?

Hey Raj, thanks for the feedback, we’ll look into the possibilities of adding LEAPS to the margin calculator. Btw, you can check margin requirements using the Basket Orders feature on Kite.

Hi there , I need Zerodha’s policy on Margin rules for Long stock option contracts. NSE re-introduced D-N-E facility for Long stock option contracts w.e.f. 11apr22. So its now NOT compulsory for stock option buyers to take/give physical delivery of shares on contract expiry. Does Zerodha presently charge ”Delivery risk” margins on Long stock option contracts during the last week of expiry ? My broker does so. Please clarify. thanks and regards, Ravi

how to calculate margin for weekly expiry options

Hey Poobathi, you can easily calculate the margin requirements using the Basket Orders feature on Kite, here’s how.

Hi

Weekly Expires of NFO is not included in calculator, please include that too, i know there are many queries regarding this . also today i was checking MCX margin i think latest files are not updated and in case of crudeoil option and future expiry are different but it is showing same any difference in this. For example Option 15-06-2022 and future 17-06-2022

Hey Satinder, thanks for the feedback. We’ll look into the possibilities of making weekly strikes available. For now, you can also use Basket Order to calculate the margin requirements, here’s how. For the second query, could you please create a ticket at support.zerodha.com with more details, so that our team can check and assist?

Why doesn’t the Margin calculator show weekly expiries of NF & BNF? It only shows Monthly expiries.

Hey Devashish, weekly strikes aren’t currently available on Margin Calculator. We’ll take this as feedback and look into the possibilities of making weekly strikes available. For now, you can also use Basket Order to calculate the margin requirements:

https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/holdings/articles/kite-basket-orders

bandhanbank feb future contract price scan range is 81 points hence max loss in 16 scanning range risk array comes out to be 91000 ruppees for selling 1 lot of bandhanbank feb future contract so how its span margin is showing 1,17,000.

please help me out in this

hiii for straddles can we place target & stop loss for entire basket

eg 18100 ce at 100

18100 pe at 110

so total 210 paid

target is 250

sl 150

can we place in such a way in basket order

I’m trying to compute margin for a combined positions (2 positions). Here, the exposure margin for each single position is around 30k INR, but for the combined portfolio it is showing the total exposure margin as ~11k. Could you please clarify on how exactly is this calculation done?

The positions I’m calculating on:

1. AARTIIND22JAN 850 Sell

2. AARTIIND24FEB 850 Buy

These positions are for futures

Hey Ishan, in F&O the margin is calculated on portfolio level. If you have two positions like Long Futures and Short Futures, here your risk is limited compared to having only a long or short position. So you get margin benefit, reducing your overall margin requirements. You can learn more about this here.

If you have any general trading related queries, you can post them on TradingQnA.

weekly options are not available in margin calculator. i will request you to guide me about this…

Hey Shrikanth, weekly strikes aren’t currently available on Margin Calculator, we’ll explore the possibilities of making them available 🙂 You can also use Basket Order feature to calculate the margin requirements. More on basket orders here.

Calculator does not show Nifty weekly options in the dropdown. Only monthly Nifty options are shown. Please add Nifty weekly options as well for calculation.

Hey Ajit, we’ll look into the possibilities. Thanks for the feedback. Also, do check out the Basket Order feature on Kite, you can easily calculate the margin requirement using this. More on basket orders here.

I am trying to calculate margin for PUT Sell and BUy, it says contract already added

1. first add 17200 PUT Buy

2. then try to add same strike Sell

it says contract already added, seems something wrong.

The uptime of the margin calculator page needs to be same as Kite platform, atleast during trading hours. Currently this is down much more often than Kite (like now) and taking a trade becomes a bit of guess work wrt margins. Ideally, this calculator should be in the Kite platform itself in some form but even if not, pls monitor uptime of this tool and get it close to 100%.

Why doesn’t it calculate margins for Nifty and Bank Nifty’s weekly options.

Hey Namit, we’ll look into the possibilities of adding Weekly Options to the calculator. However, you can easily calculate the margin requirement using the basket order feature. More on this here.

SIR, I WANY WEEKLY BANK NIFTY CALCULATOR.

If i buy stock option between last friday before monthly expiry and squared off the same before the monthly expiry (last thrusday), will there be any extra delivery margin that will be levied or i just have to pay option premium as usual.

What is formula to calculate Option strategy margin…I understand Exposure Margin is fixed but how do you derive Span Margin for 3 leg strategy i.e. 1 option buy and 2 option sell of the same underlying and same expiry

not showing option margin

Can I get a list of stocks where the margin required for FnO buying is less than Rs 50K

Please provide margin calculator for weekly options also.

Also, Zerodha displays OI limit error even if I am buying hedge positions against existing short option positions. Please resolve this problem

I cant find the weekly expiry date in the margin calculator.

sir,

your zerodha margin calculator does not display the margin requirement many times. today I wanted to know the margin requirement of JSW Steel sep 800 CE for sell. there was no display. It does show sometimes for other option trades.wonder what went wrong. pl advise.

Hi Nitin,

Today I tried the following set up to execute through basket (market price) order.

1 Lot BUY Nifty 16350 Aug CE at 126.60

1 Lot Sell Nifty Fut Aug at 16315.15

1 Lot Sell Nifty 16400 Aug PE at 195.10

In the basket order window the margin required shown as 51000/- and Final Margin as 42000/- ( Approx) and my available margin was approx 92000/-. But my 1st two legs got executed and the 3rd leg rejected due to margin shortfall. Zerodha brokerage calculator also shows almost same margin requirement as the basket order window. Please help to overcome this problem.

Hi,

I am doing options trading on zerodha. I sold 4 lots of bajajfinserve16000 strike call option (expiry 26 aug 2021) and zerodha is showing margin used as 884306.29 lac and now total available margin in my account is 2,60,630.81. Now suppose I don’t carry out any further trade till expiry then this margin of 8,84,306.29 will be enough to hold the position? Or the margin will reduce when the trade will go against me? This is because I am seeing my margin going negative on zerodha (on > funds page) as the option trade go against me (when price of bajajfinserve goes higher). Is there still chance of getting margin penalty even if I don’t carry out any other trade before expiry? I am not sure why zerodha is showing negative maring sometimes when the price of bajajfinserve goes higher. I have already paid margin then why zerodha showing negative margin sometimes though I never carried out any other further trade. Plz clarifiy this.

How will I get the margen money blocked by system in option selling , margin calculator is not showing benefits of hedging .

if nifty future at 15850,i sell 1 lot at limit 15900 & buy 1 lot at limit 15800 ,ordered at same time for intraday position (MIS) ,,how much margin require ?

I was buy options of Bank Nifty Jul 35200 CE 35 quantity on Rs. 59 Premium and when i was selling such options that time my order not exected due to insufficient margin. Actually I was selling such options on Rs. 65, and you are asking Rs. 1,14,000 approx maintain margin.

I did not understand this margin calculation.

ON 19 JULY21,I ORDERED JULY 2215700CE LIMIT PRICE 60 . RS 4500 MARGIN WAS DEDUCTED . HOWEVER, WHEN I CANCELLED THAT ORDER MY MARGIN MONEY IS NOT CREDITED BACK TO MY ACCOUNT.

I need a position wise margin report. I currently manually feed in each position in the calculator. Why can’t you create a simple report that we can access in the Console?

Hi,

This does not seem to work for NSE_CDS options, and also could not find symbols for weekly options and futures

As per Zerodha Margin calculator In a multileg position eg Sell NIFTY JUL 16200 CE, SELL NIFTY JULY 16200PE, BUY NIFTY AUG 16200 PE Following margins are indicated.

1Span Margin 68681

2EXPOSURE 31637

3 Total Margin 100318

MARGIN BENEFIT 95621

In Zerodha we have first to place these orders one by one ,requiring full margin. . Does it mean margin benefit available, is post placing the orders. Or is there any sequence or method through which all these orders can be placed simultaneously having funds equal to or slightly more than the margin requirement worked out by Zerodha calculator . Further more there are some limitation on trading in some strikes in next monthNRML , if one takes position on that strike ,is the margin benefit disallowed in that case

for a particular trade your calculator show somewhere around 50,000/- but when the trade was executed its asking for 2,80,000/- margin.

huge difference. company like zerodha should be transparent.

Hey Gopi, can you please share more details? This could be because you have other positions that increase the margin requirement, since margins are calculated for the entire portfolio and not a single order.

Margin Calculator not working for Nifty/Bank Nifty Options. It shows NaN.

Margin Calculator not working

The margin calculator for writing CDS options are not working. Getting Nan. Am I missing something ?

Dear Sir,

Zerodha margin calculator provides only monthly options in the list. What if I want to hedge any futures contract with weekly options and know beforehand margin requirement. The margin benefit is available for such a scenario as I use this strategy , but how to know beforehand??

Hi Team,

While trying to calculate margins for NIFTY, Bank NIFTY expiry is only available on the basis of monthly and not weekly.

Please suggest a way out/solution for the same.

Hi, seems the calculator is not working… it is just showing NaaN for all cases and not updating

if i sell bank nifty option CE and PE , of same strike say 37000 CE AND PE than why margin required is above 350000 risk is only one side so margin must be for one leg around 175000

this calculator need to show the margin for the intraday future trades

it will only shows the cash and carry values

Do we have cross margin facility at Zerodha at different segments? Lets say I have 300 shares of HUL in my demat and I want to sell 1 lot of Call. Can I provide shares for margin?

why there is difference in margin for options trading calculated here and while doing trade ? for example :

Sell 4 OTM CALL– Short 4 lot of 31300 BANK NIFTY

Buy 4 OTM CALL (Lower Strike) – Buy 4 lot of 31200 BANK NIFTY

As per your calculator the margin required is

Span Rs. 0

Exposure margin Rs. 62,397

Total margin ? Rs. 62,397

Margin benefit Rs. 5,30,711

But in actual margin required for above both trade is more than 90,000/- instead of 62397/- . Why there is such difference ? does total premium amount for buying 4 OTM CALL (Lower Strike) 31200 BANK NIFTY is not included in the above margin of 62397?

Why am I not able to calculate the weekly expiry margin. The dropdown box shows only Nifty Monthly expiry but not the weekly expiry. E.g., it shows 28th Jan but not 7th Jan, 14th Jan & 21st Jan Expiry.

You can see the margin on the order window itself, Pradip. In you want to use the margin calculator, you can use te monthly contract margin for the weekly contracts. They are similar.

Why am I not able to calculate the weekly expiry margin. The dropdown box shows only Nifty Monthly expiry but not the weekly expiry. E.g., it shows 28th Jan but not 7th Jan, 14th Jan & 21st Jan Expiry.

Why am I not able to calculate the weekly expiry margin. The dropdown box shows only Nifty Monthly expiry but not the weekly expiry. E.g., it shows 28th Jan but not 8th Jan and 15th Jan Expiry.

Where can I find margin required for selling quarterly or semiannual nifty options?

Is the SPAN margin calculator working ? I think it is showing wrong margins. When I try to place orders, the margin is different.

Hi

i am not able to add weekly expiry strikes for Nifty and Banknifty to calculate the margin. Pl help

Hey Ashish, the margins for the weekly and monthly contracts are similar. You can use the monthly contracts for now.

Hi sir,

I want to know what is maximum margin requìrment for nifty fut 1 lot at sep 2021 for co cover order if nifty is @13200 and stop loss is 30 points.. please answer in exact figure thanku sir

Hey Avinash, no way to predict the exact value since it depends on the value of Nifty at the time and the volatility, etc. What I can tell you is you’ll need full SPAN+exposure margin.

In Margin Calculator for F&O, Total Margin calculating is for Intraday or its for carrying overnights till Expiry?

Also if i want to use simple spread strategy – one buy & one sell, first i have to buy or sell?

Will the Total Margin reflecting in Calculator is accurate at the time of trading hours?

Because selling needs higher margin funds which i may not have at the time of trade. so what i do for spread ? First Buy and then sell ? or First Sell and then Buy ?

Kindly help please

Suppose if take one buy option and one sell option and allow it to expire on settlement day do I require to provide margin before expiry?

Sir,

Is spread margin benefit is available only zerodha, UPSTOX? Is is availble in all brokers? In otherwords, is margin benefit facility broker specific or is it given by Exchange?

The future & option lot size of Reliance is not correct in the the calculator, it should be 505, therefore is not able to calculate.

Sir, I want to sell bank nifty call and put options . how much margin I must required to 5 lots (25*5=125)?

i opened new account in zerodha & first time start in F&O.

Pl let me know if i trade in Nifty, not squareoff trade till expiry and the remaining premium amount whatever left,

Will it comes in my account ?

Is any penalty need to pay for this ?

What will be impact of STT charge, if i don’t Squareoff Nifty option at ITM on expiry ?

Waiting for reply from Zerodha

No impact. Read here.

No, if you have shorted, the premium is yours to keep.

The margin calculator just keeps on spinning for Options at least. Any issues going on with it ?

Hi….

can anyone explain what the below statement in option margin calculator mean.

Next month option one can trade on 11000 and 19500 strikes only ?

Nifty contracts allowed for trading

Current Week- All strikes are allowed

Next Week- TO 11600 CE & PE

Next Month- 11000 TO 10950 CE & PE

The margin calculator displays the range available to trade long buy options due to OI restrictions for different expiries.

Hi Nithin:

Since the past week, your span margin (initial margin) data has started diverging from the span margin as calculated by span risk manager – the tool prescribed by NSE. I understand you rely on Thomson Reuteurs (Refinitiv) for your span margin feed… can you please check the divergence? This is very important as you have now included the margin calculations as part of your api, and I am building an algorithm that relies heavily on the margin calculations and your api.

Best,

Akshay

Hi Akshay,

We haven’t noticed any difference in the margins from the calculator and with the ones required by NSE. Can you email me on [email protected] and I can have this checked?

Hi Faisal,

Can we have separation of cash part of margin and pledge part of margin acceptable for a given position

say latest rules cash is 20% of the total margin and Pledge securities value can be rest 80% ? these rules keeps changing hence it will be better if you can show that as part of the calculator

NFOx

BANKNIFTY21SEP Options 36000 CE 25 S 1,51,696 18,359 1,70,054

NFOx

BANKNIFTY21SEP Options 36000 PE 25 S 1,09,963 18,359 1,28,322

Total 2,98,376 Total margin ? Rs. 1,88,413

so out of this 188413 some 40 K needs to be cash and rest 160K can be pledge shares ? can you show this in calculator

Hi,

When I do a strategy in Zerodha margin calculator, the total margin is seen as 17000, but when I create a basket in kite, it shows the margin required as 54000. Why is this mismatch ? This happens everytime with me.

Can I pledge IDBI Gold ETF for option trade ?

Hey Thomas, all elidible stocks and ETFs are listed here. The ETF you’re looking for ins’t available for pledging, I’m afraid.

F&O MAARGIN KA LYA PHLYA FUTURES LEE YA OPTION PLZ JIS MA MARGIN KAM LAGE…….HADING KA LIYA PLZ

What will be the margin requirement for SBIN Future lot for one month and call short for one month??

Hi Team, If I want to enter an iron condor trade which has four legs and upon unwinding, will I be charged a total of Rs. 160 ( 80 Rs on Entry for the four legs and 80 Rs on Exit). can someone please clarify and regarding the profit projections in sensibull, does it take into account all the charges involved?

If I want to avail 100% of marin benifits by investing in ETF and Liquid bees

In ETF only 50% margins can be usable

How can i reduce 50% remaining margin without cash?

Shall i go through Both ETF and liquid bees?

Please revert

I have multiple holdings in my portfolio in zerodha. all are options. i am running short of margin and getting reminders. is there any way i can know how much margin will get freed up if i sell x holding or y holding?

I think the margin calculator needs an update. There should be an option to select the expiry. By default we can only select monthly contracts.

Hi,

This week in July 2020 I bought options of Infosys 940CE 1 lot. In last week of expiry means on Monday. In zerodha fund balance it is showing margin delivery margin applied of rupee = 22,571.28. Because of this my fund balance of zerodha is in negative.

My question is –

1) Do I need to add this Delivery margin amount into account or not to clear this option position.

2) Does it because of options in last week of expiry?

3) What is physical delivery?

Hi Nithin,

Wanted to know when will the Weekly Nifty & Bank Nifty be available in the margin calculator.

Thnx…

I want to know what is Span Margin, Exposure Margin and Premium receivable?

Date :- 21.07.2020

bought 10800PE in last week , today iam not able to buy because it is showing out of range, can you help me out. I want to average my position.

Please advice

Hi Team,

Could you please let me know what is the Margin provided by ZERODHA for Equity Segment for Intraday- Bracket and Cover Order.

Regards,

Sadananda KK

did any extra charges taken by zeroda after using this hedging positions…. because i booked loss 1k last trading day but i have to pay near 1.6k …

why are we not getting current week option (nifty 16 july expiry)ticker in margin calculater. Only last Thursday of the month position we could see.Please clarify

why are we not getting current week option (nifty 16 july expiry)ticker in margin calculater. Only last Thursday of the month position we could see.Please clarify

Since yesterday, the Margin Calculator is showing the result as NaN. Is there anything wrong with the system?

Yess I also saw this any one please explain

Hi Sushil, the margin calculator is working fine. Could you please refresh and recheck?

Why am i not able to see the weekly series in Banknifty options (tried Banknifty Jul16th)?

Anyone facing same issue??

Margin for hedged position was working on 1st june. Now it is now working as per the margin calculator. I tried for SBIN Butterfly strategy. Buy one 190 call sell 2 200 calls and buy one 210 call. Margin calculator shows 37000 but the trading terminal requires 1.36 lacs. Pleas explain

Similarly Bear call spread Selling 200 call and buying 210 call shows 46000 in Margin calculator and the terminal requires 1.4 lacs. Please explain and rectify as soon as possible.

Did you have any other open positions at that time? Margins are a function of all your open positions together.

No.

I want to do covered CALL short/writing for Nifty 50 stocks. Will i get margin benefit while writing the call as i will be already holding the stocks in holdings? Please explain me clearly…

No, margin benefits are only for F&O positions that hedge each other right now.

Is there any problem, if we leave the OTM options, whose value became meager, without squaring off, on the expiry date?

No, these will expire worthless.

i use d margin calculator to find margin required to buy axisfut jul 20 ..but the span margin is 1,82,448(1.8L) and exposure margin is 18,757 ,total 2,01,205(2L) ,so i have to pay 2L to buy that future stock?

in varsity they said only % ,i thought it come between 50k to 1L . i dont understand the math.reply

When we are going for a short strangle, in Nifty or BN, (i.e., Sell one call and one put), is there any provision, we can set a stop loss for both the positions put together or do we have to set individual SLs?

Hi Sir,

I am Zerodha member. I bought Reliance 1780 Call options and sell Reliance 1860 Call options. It required around 32,000 rupees to trade both. I am planning to hold both the trades till 17th july.

My questions are,

1) Can i hold these two options till 17th July with the same margin or do i need to have more funds in my account?

2) If I get any message from Zerodha about insufficient funds, then do i need to square off SELL option or both BUY and SELL options?

3) Can I hold ITM call option till expiry (i will square off before 3pm on expiry day) without having full amount. for ex: Reliance is 1900 on 30th july. So, do i need to have 9Lakh rupees in my account till I square off ?

Thanks in Advance.

Regards

Krishna

bro me b itne din se isika soluation dund rha hu.. koi dang se btata hi nai uper support team ko kabi phone hi nai lagta kabi galti se phone lag b jaye to unke pas information hi nai he kuch.. pareshan ho gye he ek month se jyada ho gya sebi k new rules ko per ab hume benefits nai de rhe zerodha vale. me soch rha hu upstox me switch kr lu

1. Margin requirements may go up or down over time based on movement of Reliance.

2. You will need to exit the short position in case of margin shortfall since you’ll have paid full premium for the buy, you can hold that.

3. Closer to the expiry, margin requirements will go up.

Thanks Matti 🙂

Why bank nifty weekly and nifty weekly option contracts are not being shown in margin calculator..???

Will add this soon. In the meanwhile, you can refer to the monthly contracts. The margin requirements are similar.

its not working , I tried many times after putting value its not giving any result . just hanging . Give some other tool or link

What are the contracts and transaction types you are adding? Buy options only require premium. These won’t show up on the margin calculator.

nifty cmp 10550.. suppose want to plan option multileg stategy cover call… buy 10600 call sell 10700 call.. good margin benefit are there, but how to check it in weekly.. in your margin calculator only monthly expiry showing.. so how to calculate for weekly?

The margin requirements for monthly and weekly contracts are similar. Weekly contracts coming soon on the Margin Calculator.

why similar margin required for weekly and monthly.. monthly almost tripple value than weekly.. and when i am buying atm call after that otm call selling the order getting rejected.. i have margin for buying so why need extra margin for cover call ?

Today mis margin were veryhigh.will it be same tomorrow too??

Hey can you please add weekly options to your margin calculator.

A)Do i need to maintain margin required for both contracts while placing order? and once both the order are placed, system will check if it is hedge position or not and only then the system will release the margin if its a hedging position?

B)Or its will be directly done? ie if i have 50k in my acc i will be able to buy ce option and sell future.

which one is true? A or B

You will need full margins for the first position and only the reduced margin for the second position. If your strategy has buy and sell option legs, place the buy order first (since that requires only premium) and the place the sell order which will require the lower margin as per the new framework.

Here is it necessary to execute the first buy order or placing the order is sufficient. The hedging margin calculator is not working properly in the kite browser version. Please check and advise.

The buy order needs to be executed for you to get margin benefit. If it’s just an open order, it can be cancelled after the short position is open. 🙂

Margin for hedged position was working on 1st June. Now it is now working as per the margin calculator. I tried for SBIN Butterfly strategy. Buy one 190 call sell 2 200 calls and buy one 210 call. Margin calculator shows 37000 but the trading terminal requires 1.36 lacs. Pleas explain

Similarly Bear call spread Selling 200 call and buying 210 call shows 46000 in Margin calculator and the terminal requires 1.4 lacs. Please explain and rectify as soon as possible.

In options margin, whatever the strike price I have entered, it shows zero(0) rupees as margin to buy a call option…Is it real??

Can we buy a call option with zero rupees??

If it possible, then what is the premium collected by call option seller??

what is limit against equity for future after haircut.

nifty 31 dec 2020 margin is not showing .kindly consider it

Sir,

In this calculator, there is no way i can calculate the margin required for weekly expiry options. if you add this facility it will be very helpful.

Thank you.

I want to buy bajajfin 2100 call and sell bajajfin 2500 call in calculater is showing margin 18000 is it right ?!

What to do for getting margin benefit on spread like strategy ? I mean 1st sell or 1st buy to get margin benefit …

Obviously you have to buy first with just premium and then while you sell, the margin requirement should be lesser than the naked sell.

hello….i am your customer..my id is JS2405….can i sell monthly nifty call option and buy weekly option to hedge ??will i get margin benefit as per new sebi rules from 1 june 2020???

1. Please enable bank nifty weekly option margin calculator.

2. Please enable basket order in kite app.

3. If i buy Nifty 9500 CE and sell Nifty 9600 CE of same expiry then margin benefit is not showing in margin calculator.

Kindly update margin calculator ASAP.

As you don’t allow to trade beyond range in Banknifty and Nifty as well. So if I have to create position based on far away strike(beyong range) with hedging, how can I do that?

How much margin is required for trading in nifty/banknifty future at intraday basis?

Check out intraday margin requirements here. The link to this page is also available on the blue banner at the top of the margin calculator page.

Team Zerodha, We know that in Nifty and Bank Nifty, weekly options are more traded than the monthly contracts. In the margin calculator, there is no option to check for margin requirements of weekly contracts, without which it is difficult to analyse p/l before the trade. Sometimes I even forgo the trade if profit to loss percentage is not appealing.

I am sure that there are many people who are already eyeing you for this.

I request you to add this simple functionality in calculator. Is this in your To do list?

It is on our to-do list Mayank. However, even until we do this, you can simply look at the margin requirements for the monthly options. They’re the same as the weekly options.

Is the margin requirement for calendar spreads using the WEEKLY options, same as calendar spread using the monthly option ? Please clarfify. I do not see the margin benefit showing up when I do the transaction.

Yes, it is.

HERE FOR INDICES, IN OPTIONS, ONLY MONTHLY CONTRACTS ARE AVAILABLE FOR CALCULATION. WE NEED THIS FOR WEEKLY CONTRACTS AS WELL.

The margin requirements for monthly and weekly contracts are the same.

Margin Calculator NOT WORKING?!?!?

Whatever happened….

I needed to calculate the margin requirement for Nifty option selling and couldn’t do it…..

Hey, the margin calculator is working fine.

Hi why is is not showing me margin to sell SBI May 200 CE

Exchange Contract Product Strike Qty Initial margin Exposure Total

NFOx

SBIN20MAY Options 200 CE 3000 S N/A N/A N/A

I am trying to calculate the margin required for buying Hero motor Call option for strike 2050 but Zerodha calculator is not showing any money required.

I am confused can you explain.

Regards

Praween Kumar Verma

ID-QV6620

as now we cant do BO and CO for MIS Future , in that case where is the margin calculator for NFO Future. The one currently showing in calculator doesnt match the amount while buyinng in MIS future . For example CIPLA MAY FUT shows different exposure margin (Buying price per lot) to that showing in Zerodha while buying which is way more ..Please help . Thanks

Check this: https://zerodha.com/marketintel/bulletin/249809/latest-intraday-leverages-mis-bo-co

Can you the MIS charges per transaction, if transaction charges are deducting more than 20 rupees.

In my portifolio MIS transcation charges deducting 70 rupees/ 1 transaction.

Check all taxes and charges along with brokerage on our brokerage calculator.

Can you please Weekly options into the list? Margin is always showing for Monthly.

The margins for weekly and monthly contracts are the same.

For getting option margin benefit do we need to sell both positions in one order or both can be sold separately during the same trading day in different orders ??

You get the margin benefit only when both positions are open.

## F&O

i purchase nifty 7 th may 10000 CE ……..a lot (75)@ Rs. 36 =2700 and sale 75*65=4875 on 30.04.2020

gross profit =2175

it is correct calculation???

Yes.

Why Margin calculator not showing span and exposure margin for F&O segment.

It does show the margins, Hemant, I just checked.

hi..not able to add 30th APRIL BANKNIFTY OPTIONS. N MARKETWATCH..ALL THE OTHER EXPIRIES R SEEN

how much margin required to BUY NRML Order banknifty option?premium*lotsize sufficient? or v need to have the banknifty futures margin in addition to it?

To buy an option, you only need to pay the premium.

I have seen the MIS on Bulletin and it is mentioned as Index F&O – 2.5X(40% of NRML margins) for Indices futures . But don’t understand it . how to calculate the amount needed ? It means that 60% amount I need to have to trade 1 lot of Bank nifty futures ?

You need 40%, not 60%. You can check the NRML margin requirements here: https://zerodha.com/margin-calculator/SPAN. The ”Total Margin” is the NRML margin. You need 40% of that for MIS positions.

I wanted to Sell One Lot Bank Nifty Option of 23 April Expiry… but the date by default on the system was of 30 April. How does one activate the weekly expiry. Thanks

Hey Allen, explained here.

How many days higher margin will be charged. Now market behaviour is normal.

Hello sir,

Option calculator not showing weekly margin,

plz provide solution!

thank you!

Refer to the margin for the monthly contract, it’s the same.

Hi,

Sir i want to ask you something about margin calculator. Sir , is there about to come new version calculator, because

i did’t find BO & CO Equity calculater. pls do something for me.

Thanks

Yes, we are currently redesigning the margin calculator.

Why don’t you keep current version F&O margin calculator untill new update ready to deploy

Was not able to find, options with different expiries in this. i.e. NIFTY 16Apr20 Expiry options? Only monthend options are visible? Is there any other way to get them?

The margins for the monthly and weekly contracts are the same. You can refer to the monthly contract margins.

Hi,

I want to write nifty strangle only on expiry day intraday basis. What will b the margin requirement for 1 pair.

Margin calculator provided data for positional call

Satya, add teh contracts to the margin calculator on the day of expiry to figure out the margin requirements. Margins change daily, so this cannot be answered in advance.

Hi! Drop down menu for type of option doesn’t show all the date options for NIFTY. It is showing only month ending options. How can I calculate margin for let’s say NIFTY 50 16 Apr or 23 Apr

Margin requirements for weekly and monthly options are the same. You can refer to the monthly contract margins.

As I am seeing margin again increase in nifty and banknifty is it temporary or permanent

Sir,

Indiabulls Housing Finance Ltd Put Option for April Expiry series with strike price of Rs. 20/- sold on 2.4.2020. Lot size is 1200 shares.

Maximum risk involved is 1200 x 20 = Rs. 24000/-. But margin required shown is Rs. 32203/-.

Why ?

Does the calculator show margins after considering premiums received or without it?

Lets say, the calcualtor shows me the margin required for an option spread to be 1 lakh.

BUt I am receeving a premium of Rs.10k by writing the spread.

So, my actual money blocked form my trading account will be 1 lakh OR 90k only (1 lakh-10k of premium)?

Can you please clarify @siva @faisal

You will need 1lk.

Hello,

Just a query, in your calculator i cannot see the margin requirements for writing options (CE/PE) for Nifty Weekly Expiry. Am i doing something wrong or the system just doesn’t compute for weekly expiry as of yet ?

Hi ,

When i looked at the calculator , i find that it is not showing correctly the premium received.

for example, For shorting 1 lot of nifty call option, the premium receivable is not matching with current LTP listed in NSE Options chain website or from the Ticker add to the Kite.

So , how this premium calculation is done ?

Also, is this calculation is fixed like Span and Margin or is it going to change based on the price of the call option .

Please clarity the doubts.

Thank you,

Hi. Can you please let me know how much the margin required for selling 1 lot (75) nearest nifty weekly options (1st April 2020 expiry at the moment) is? Thanks in advance

i think for option selling u need to have the margin amount of nifty futures..for option buying u jus have to pay the premium price *75

That’s right.

Thank you for the reply. I do know that for option selling you need to have the margin amount of nifty futures. But I thought that margin requirements are different for weekly options are monthly options. I was under the impression that, for selling monthly options, the margin requirement is same as that for futures, but that, for weekly options, the margin is lesser. Am I correct in this assumption?

Why am I getting NA in all the 3 last columns? Am thinking of buying a April 1 expiry BANKNIFTY Call, am not able to. Can someone help me out?

profit is there in long position. Is the margin more than 100% of the contract?

It isn’t 100% of the contract value, check the margin requirements here.

I have long position in yesbank may futures, purchased at 15.7, now the price is 26. It means I am having positive balance. Why do I receive messages repeatedly that unless you pay xxx amount, your trade will be squared off? As per my calculation my trade value is 18.7 x 15.7 = 1,38,160. Even if entire thing is gone my total loss will not be more than 1,38,160. Why do I get messages for balance even if by balance is more than 2,28,800/-. By this action, I am not able to take more long positions in futures.

This would be because the margin requirements to hold the position will have gone up.

Does this mean a person having long contract in futures has to keep adding on margin money when the contract value is increasing in value? I purchased at 15 and now it is 25. Do I need to add money as if I am purchasing at 25 ?

Not necessarily. Futures are settled M2M, meaning any gains you make during the day are credited to your account. However, in the current case, the margin requirement could have gone up from say 50% of the contract value to higher, hence the additional margin requirement.

Hi,

Whenever I try to use the Margin calculator in the night, it does not calculate margin requirements for shorting any instrument in FnO segment. Why is it so?

I am newbie, Today i tried to buy a 1Lot of Option call that is Nifty12200CE and its price is 2023.80 and it’s rejected ,can you please advice how much balance should have in my account for this types of tread?

Hey Ashok. The 12200 call option closed at 87.3 today. At 87.3, you need 6,547.5 (87.3 x 75, Nifty’s lot size) to buy the option.

thx

I am a newbie here , so please can anyone explain me how it is calculated ?

Eg. For JPYINR

LOT SIZE: 1000

Price = 65.86

NRML Margin = 1778.

Now , in the calculate , I give cash available as 6586 , so it shows that I can buy 3 lot , how it is calculated ?

Margin required for 1 lot = 1778. Margin available = 6586. 6586/1778=3.69. Since you can’t but a partial lot, you’ll be able to buy 3 lots.

@Matti In one Lotthere are 1000 units , that means total cost of 1 lot is 65860 , out of which I only need to pay 1778 i.e only 2.69 % . Is it so ??

Yes, that’s right.

NIFTy weekly options contract are not available in the options calculator.

Hey Saravana, the margin requirements for the weekly and monthly contracts are identical. You can refer to the margin requirement for the monthly contract.

newly entered in option

When will the new margin requirements be applied to CO/BO?

In the margin calculator, it still shows the earstwhile margins.

Hey Sid, we’ll send an email when margins are to change. Until then, whatever has always been available will continue.

I have tried for getting Margin calculation requirement for Bank nifty Jan’20 futures contract today. It is not showing up any results for the same. Pls look into the issue.

Hi Poojan. The margin requirements for the monthly contract and the weekly contract are the same. You can refer to the margin required for the monthly contract on the calculator.

Hi Matti, I was referring to futures contract margin, which was not working on 11/01/20. It is working now. Thanks.

Wanted to know what is the margin requirement for nifty option selling MIS for weekly expiry, as the online calculator shows only the monthly expiry.

The margin requirements for the weekly and monthly contracts are the same.

Suppose Banknifty is at 27000 (future price). I want to place two MIS orders for Futures Trade. That means I would square off the position before 3.20 PM on the day itself. My first order is a Bracket Order for buying Banknifty at 27100 with stop loss of 75 and target of 100. My second order is also a Bracket Order for selling Banknifty at 26900 with stop loss of 75 and target of 100.

1. How to calculate Margin requirements when I place this orders ? As only order could be executed at one time, so margin requirements should reflect that. I couldn’t find it in Calculator.

2. Supporse Buy Order is executed and I now want to change the Stop Loss and Target. Will it be possible in view of the order being a Bracket Order in the first place.

1. You’ll need margins for both orders individually.

2. Yes, you can.

Hi Zerodha team!

I am only BUYING an option. I am not selling/writing of option. I am trading in Daily time frame. Suppose say i am buying an option of USD/INR and would like to carry forward till expiry. Do i need to maintain margin for carrying it overnight ??

note:- i am not selling any options or buying a spread. its a plain option buying

Option buying only requires you to pay the premium.

So Unlike Equity share buying intraday via MIS option, Buying MIS or Normal call option is one and the same? .. we do not get extra margin via MIS for buying call option right?.. so in which scenario will a call option buyer use MIS option??

If we buy a futures lot worth Rs. 90000 and sell futures of next month worth Rs. 95000 in two separate orders (pushing them at same time via kite connect) rather than in single order (via spread) how much margin do we need to have in our account until both the orders are executed?? Do we need to have Rs. 90000 Or Rs. 90000+Rs.95000

Also tell me is it possible to place calendar spread order via kite connect??

Thank You

I’ve answered your question about margins in another comment. As for the spread orders, this isn’t available on Kite Connect. You’ll have to handle this on your end to achieve this behaviour.

On the Options page, I could see weekly options expiry (every thursday) but the zerodhas calculator only provides monthly expiry margins. Do we have a facility to check margin requirements to enter weekly options expiry?

The margin requirements for weekly and monthly contracts are more or less the same, hence we show only monthly contracts.

How can they be same. Option expiring on first week thursday will have different thetha than same option on month end thursday. Can we not update the calculator to include weekly nifty expiry options?

My A/C id is NV2998. I have purchased one ICICIPRU SEP440 CE & I also had paid premium against it but yesterday night I receive a mail & SMS from your side for margin. I am unable to understand that how much money I have to transfer in my trading account so as I can square off my position myself on Monday or Tuesday or Wednesday or on expiry date. Kindly help me by telling the required margin that has to be deposited by me on Monday.Also tell me phone number where ican talk directly regarding my above problem. thanks sir ji.

f&0 margin calculator does not working please check updates sir

equity any one working

Hey Abdul, what’s the issue you’re facing?

Sir,

What is the margin required to trade at the money options of 200 qty bank nifty the next 4 days in August month ?

The Margin requirement for Shorting Options of FnO Stocks in MIS product is not available. Kindly provide a tool for the same as BO and CO. BO CO is not available for shorting options, so it is not beneficial in calculating Margin requirement in MIS.

Margin calculator is not working properly. I am trying to find out margin benefit by adding futures and options. And it is not showing margin benefit.

Best create a ticket on our Support Portal.

The margin calculator is not updated for weekly NIFTY options. Its still showing only monthly dates. Need to update it to pull weekly contract ending dates.

Hi Zerodha team,

I have a doubt in selling options. Please tell me how much free cash required for buying an option worth 1000 Rs.

Span Margin ,Exposure margin & total margin terms finds difficult for me to under stand.

And previous writing/sell trades all were rejected even if i am writing to an amount of below 100 Rs ( with an available cash balance of 3000 Rs in my account.

Also please tell me how much money in cash required for selling one lot worth 100 rs.

Awaiting reply,

Thanks

Midhun

When you’re writing an option, the premium has nothing to do with the margin requirement. The margin required is calculated using SPAN and Exposure. You need to have SPAN + Exposure to short. I suggest you go through this module on Varsity for more.

Suppose I sold Put option of RELCAPITAL JUN 80 PE at price of Rs. 10 on 10/06/2019 and than if I’ll buy it at price of Rs. 8 on 20/06/2019.

Q1- How much profit should be credited to my account ?

Q2- Margin required for aforesaid transaction.

Q3- Is this trade possible, I mean can I sell Put options today and buy it later anytime before expiry of traded contract ?

I am interested in straddle for intraday. How much exposure I will get?

I am unable to add multi leg options in the margin calculator.

Also I cant see current week BankNifty.

Please check.

It’s possible to add multi-leg strategies. Works fine, I just checked. What’s the error you’re seeing? The margin requirements for weekly and monthly contracts are more or less the same, so you can use the monthly contracts instead.

I also have the same issue… cannot see current weekly expiry of Nifty & Bank nifty details….

The margin requirements for weekly contracts are the same as the monthly contracts and you can refer to the same values.

Please check enginersin mlt lot size in your calculator.

it is 4100 but your calculator shows 4600.

Having this checked. Should be updated shortly.

Sir, i’m new to trading. Just one query, if incase i buy 4000 shares of POWERGRID on 30th April 2019 (assume spot rate is Rs 190) and simultaneously, i sell 4000 (one lot) of same stock in futures and on the expiry 30th May 2019 i square off both the positions. My question is:-

1) In the above example, i should have Rs 7.6 lacs (4000*190) in my trading a/c for buying the stock. How much i need for selling the stock futures.

2) If incase during the middle of the month, stock price goes up by 20%, do i need any additional capital or not?

Regards,

How to buy and sell nifty strike option your margin calculator what is the brokerage prices other service try to make under stand me easy way through calculator provide detail below.

hello sir,

I just want to know if I buy a stock (quantity equals to ot size ) in cash and sells its future for current expiry , do I need to pay any extra margin ,and also if the stock is liable for physical delivery , do I need to place any request in zerodha to keep my position open till expiry ,being zerodha system use to close any such positions prior to expiry

Yes, you are required to maintain additional margins for the future contract if the contract is liable for physical delivery. One way you can keep up to the increased margins, pledge your holdings to get collateral margins.

As long as you hold the margins required, we will not close your positions.

I want to know how Exposure Margin of a Written option is different from Exposure margin for Future. There are slight differences in calculations and I want to know why that is.

This is a work related query I work as a Business Analyst.

Hey Shashank,

The basis for computation of exposure margins for index futures, stock futures and short options is explained in this Support article. Apart from this, you can refer to this circular from NSE for exposure margin computation of long dated options.

By when will the margin calculator support weekly nifty options?

Please provide sell & buy videos in apps, & add margin calculator in application.

Bcoz some people are new in trading market then they not know many more for sell & buy

Intraday, future, option, derivative etc. So please provide demo video & margin calculator in kite add

I appreciate for the Margin Calculator, to be more useful can you provide Intraday Margin option. Regards.

Hi, when opening account i was told that i will be provided with 2.5 times leverage for intraday option trading. But when i bought banknifty i dont see any leverage given. im just able to buy only with my own amount. Please clarify. 40 is in my account. i tried buying banknifty 27600 CE at 153 (20 lots) got rejected. finally i was able to buy only 10lots and available margin is 9k. that is just zerodha allowing me to just buy with my own money and no leverage or what so ever.

hi,

Not able to calculate margins on weekly bank nifty options.

can you pls provide the same

thanks

Amar

Hey Amar, the margins required for the monthly and weekly options are the same. Hence no separate item in the margin calculator.

Please can you publish updated Margin calculator which will be effective from 21 Jan 2019. Also request you to inform about availability of margin benefits will be available on covered trading under new revised margins?

margin calculator:

sunpharma futures (feb19) trading at 386

sunpharma options 380 PE (feb19): strike 380

enter the respective and THERE IS NO MARGIN BENEFIT SHOWN in margin calculator??

please explain why so for this hedged position….

and the margin calculator ALMOST-ALWAYS fails when more than 1 leg is entered by way of options/futures for the ’SAME UNDERLYING’.

I suggest zerodha to test your margin calculator for margin benefit more and then only deploy the correct working version.

And i request you to please test these facts before giving a generic ’do-this-do-that’ reply.

thanks

Kumar,

I presume you meant Sun Pharma Feb Future Long and 380 Put Buy.

I tested it out and found no issues(here’s a screenshot).

Could you share a screenshot of what you are seeing? It could be an account specific issue and I can have someone from our Support team access your computer and resolve it?

The calculator is used extensively on all days and we haven’t received any such complaints.

Hello,

Are the calculations always current market scenario? as in, updated as and when new regulations come in effect?

Thanks.

Yes

If i have stock in delivery, and want to sell an option, will i get the same exposure benefit?

Kalyan, cross-margining between stocks and derivatives is currently not possible with us.

However, you can pledge the stocks you hold and use the collateral margins to take the covered call position.

Check this post for more

Today i faced a problem , brokerage calculator said i can make a spread out of 2 90 000 , when i put in orders were not being placed , so i put all mis orders and started converting them , could convert 2 legs and the 3rd leg refused to get converted saying partial conversion possible , Mr.Swamy at the call centre also could’nt help saying margin requirements are more now , i had to dilute 23% of my position in loss and not to mention additional brokerage costs , please mention a way on how to put in spreads. Call centre suggested that full margin will be charged when placing orders and after that the rest will be released , ?? then what is the point of having discounts in spread margin , cause il have to cough up the entire margin first ??

My Zerodha id is XD5871.

1) My question is regarding Option selling. How much amount required in our account for option selling.

For example: If i would sell strike price 10500 Nifty Put option at Bid price 27.40 INR so what amount required? Like wise for Call option 11000 strike price?

Guide me

You can check out the margin requirements on the Zerodha margin calculator.

Please include Bank Nifty Weekly Expiry Margin Calculator

Margin requirement for GodrejInd Future trade is exponetially increased….over last two days.. please check

For the same future samco shoing 136000 as margin and ZERODHA is asking for 388000 margin thats rediculous.. anything more than 160000, 170000 dows not work… Please checkout

Hey Manish, GodrejInd is a compulsory delivery contract. As such, margin requirements are high during the expiry week. Explained here.

I have equity holdings equal to FNO lot size. does it require same margin for riding a call option of that scrip.

Hey Raghavendra, your holdings wouldn’t have any effect on the margins required to take F&O trades.

whether cross margin benefit is available in this scenario Equity vs options

Hey Ragavendra, cross-margin benefit is only available across different derivative contracts. Not across cash and derivatives though.

Guys, I am looking margin required for weekly Bank Nifty Option Contract, Pls share the list or let me know where i can find it

Hey Som,

Banknifty weekly margin requirements are similar to the monthly ones.

hi

why there is no Banknifty weekly option available in option margin calculator?

Hey Sreejith,

Adding Banknifty weekly options margins clutters the margin calculator.

However, as a thumb rule you can note the margins are similar to the monthly option contracts as there is no considerable difference between the two.

For calendar spread margin can’t be calculated?

Yes, calendar spread margins can be calculated on the SPAN Margin calculator page.

But present week expiry banknifty options are note available in the list

Want to know this asm on equity derivatives is temporary or permanent

Hi Sarvesh,

The new additional margins are applicable from Nov 30th, 2018 onward. Check out this support article – https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/additional-surveillance-margins

Tell nse to remove asm on equity derivatives. No return left for option writing after taking risk in stock market.

Hello, this is not working…….I have tried for Yes Bank Call Option for SP -160……System is not giving any response

zerodha calculator does not show the margin required for intraday trading. For example if I want to sell one lot of nifty 10500 december call option on intraday basis -it does not show me the margin required for intraday. For this I have to go on a trial basis and sell one lot intraday without knowing the margin required. Can you please rectify this defect

Hey Prakash, the margin required for intraday positions is 40% on the NRML margin requirement for indices and 50% for everything else.

Will it be possible to have margin calculator for weekly expiration of BankNifty contracts?

The margin requirements for the weekly contracts are the same as the monthly Bank Nifty contracts, Jay.

Sir, Could you pls clarify this instance?

If a client Has Rs.4 Lakh cash available in his account and takes 4 Short positions (Index Options) worth Rs. 5,50,000/- and his Margin short fall at 1,50,000/-.

Now,(1) How long he can keep this Shortage without paying as this shortfall is getting reduced day by day..?

(2) In case of non-payment, What will be the Penalty for this Shortage?

(3) How this Margin is calculated for different strikes, any specified Ratio is there?

Kindly clarify.

I want to trade in optins,

I want to know how much amout i require in my trading account for

buying options in yes bank. and what is the risk of loss in option trading.

Hey Shantanu, best check out the Varsity module on options trading.

will i get any type of intraday limit to trade in future or option. and what amount should i have to trade in justdial future on intraday basis.

You can check out the margin calculator to know the margin requirements. The MIS column indicates what you need to trade a contract intraday.

Why can’t we have margin for Buy MIS order in FNO?

Diptesh, option contracts are heavily leveraged inherently. For a contract with a premium of Re. 1 and lot size of 1000, if the underlying is trading at even Rs. 100, a contract worth Rs. 1,00,000 can be bought for Rs. 1,000. That’s a quite a lot of leverage!

Diptesh, option contracts are heavily leveraged inherently. For a contract with a premium of Re. 1 and lot size of 1000, if the underlying is trading at even Rs. 100, a contract worth Rs. 1,00,000 can be bought for Rs. 1,000. That’s quite a lot of leverage!

Hi,

I purchased 1 call of 11400 strike price and Same strike price 11400 Put buy but when put is hick i tried to sale it out system asking asked me for margin money as i do not have sufficant fund in my account. so can i wont be able to sale PUT and CALL without margin money.?, suggest me what should i do so i would be not loosing money.

What is the intra day margin for bank nifty is 40,000 enough to play intra day.

Regards

SIR,

KYA MAIN FUTURE STOCK KO MIS MAIN KHARID SAKTA HU?

sir

is there any problem in currency span calculator is not working properly plz check it once

Hi,

I have gone through this forum twice. Contacted Zerodha Cust. care once. But I am still carrying a confusion. I hope someone clarifies it. This is regarding the cash balance and margins.

My initial cash balance before I take a future contract – 80000.

I buy a MSUMI Oct Fut contract with margin requirement SPAN 35000 + Exp – 24000 = Total 59000.

So after buying the contract – Margins blocked – 59000. Cash available – 21000.

Now that the free cash balance is 21000 (which is less than SPAN) will I get a margin call.

Or this free cash balance can be utilized for taking another position (like an option / equity stock).

My interpretation and the customer care exec. tells me that the free cash balance should also be above SPAN.

So for buying a future contract – the total amount I need to have = SPAN (already blocked) + Exposure margin (already blocked) + Free cash (atleast = SPAN).

Please clarify.

I wish to regretfully say that few of the questions and one/two answers have created this confusion.

Is there any obligation on part of client to maintain free cash in account greater than SPAN (over and above the already blocked initial SPAN + Exp margins, considering the position is either making profit or amount is adequate to take care of M2M losses).

Pranav, you just need to maintain SPAN + Exposure. You can use the free cash to take other positions. However, if you have some free cash left in your account, in an event when the position goes against you, the free cash will be utilised and a margin call won’t be triggered.

I see 1.3 lacs margin blocked for a Nifty option contract….is this how much u block?

ICICI Direct blocks 80 k for Nifty and 1.2 lac for BankNifty

Dear Sir,

I would like to know how much margin I require to short nifty and banknifty atm options for intraday only

Margins will be around 25k for intraday using MIS order type. You can use BO/CO for lower margins(this requires you to have a mandatory stop-loss which reduces the risk of the trade). Check our Margin calculator for more details.

Dear sir,

Please share me blocked options stock list… So that it is easy to choose option stock.

your option plateform does not shows different statergies in option trading plateform why dont you check american site where different statergies are shown.

Dear Sir,

request you to provide margin requirement for weekly options also of banknifty.

I am not finding the Bank Nifty Weekly expiry options included as part of the Margin Calculator. Am I missing something. Please let me know where I can find this in Zerodha.

SIR, I cannot find how to calculate margin requirement for weekly expiry options of bank nifty, how can I find that?

Hi sir,

i have zerodha account and i have invested in equity.

i wanted to know how to pledge the equity shares and trade in options with that margin

Can anyone tell me how percentage of exposure margin is defined?

THERE IS NO OPTION FOR MCX MARGIN CALCULATOR IN OPTION SEGMENT. SO PLEASE UPDATE YOUR SOFTWARE AS SOON AS POSSIBLE…………

Does margin benefit for specific strategies which is shown in margin calculator automatically reduces total amount required for that position. I mean for example suppose I am having 15000 puts of 250 strike on sbi and if I want to sell 240 strike therefore I should get margin benefit for the amount shown in calculator. So will the total amount required to short 240 put automatically reduces and the total amount required to short that put be approximately equal to as shown in margin calculator.

Hey Prakhar, while placing the second order, you’ll be required to have the full margin required for the order. Once the positions are parallely open, the margin benefit is released.

I observed that margin requirements for banknifty is shown only for monthly expiry and not for weekly expiry. Whether the requirement is same or less…

It’s the same, Rajesh.

If this is the same, why are the weekly expiry dates not included in the drop-down. At least there should be some remarks indicating the same in the page when the margin amounts are shown for the Bank Nifty. Should cause a lot less confusion.

span calculator not showing weekly expiry dates of bank nifty

what is the tcs 1 lot margin for overnight position

Hey Ketan, you can calculate your margin requirements here https://zerodha.com/margin-calculator/.

Hi,