Trading India VIX – Simplified

Traders,

NSE will be launching the most anticipated contract in the recent past for trading “Futures on India VIX” on February 26, 2014. We at Zerodha as usual, will be offering you trading on this new product for free until June 1, 2014. Following is our attempt to simplify trading on India VIX for you. I have taken the help of the NSE module on VIX, and from Akhil Bansal. who specializes in volatility based products, a B.Tech from IIT Delhi, an MBA from Richard Ivey, and Founder-CEO at Indianvolatility.com.

Introduction

“VIX” is a trademark of Chicago Board Options Exchange (CBOE). CBOE was the first exchange in the world to compute a volatility index back in 1993. The derivative (F&O) trading on VIX started in 2004 on CBOE and its popularity has grown immensely over the years. With the increasing popularity of option trading in India, and since India VIX is designed similar to the CBOE VIX, we should be seeing a similar trend in trading activity on the India VIX contracts in the coming years. .

Popularity of CBOE VIX Contracts

What is India VIX

India VIX is a volatility index based on the index option prices of Nifty. It is computed by using the best bid and ask quotes of the out of the money, present and near month Nifty option contracts. VIX is designed to indicate investors’ perception of the annual market volatility over the next 30 calendar days, higher the India VIX, higher the expected volatility and vice-versa.

We will not get into the complex mathematical formula used to calculate the India VIX, but here is how you interpret VIX.

For example, if India VIX is 16.8025, this represents an expected annual change of 16.8025% in the Nifty over the next 30 days. That is, you expect the value of Nifty to be in a range between +16% and -16% from the present price of Nifty for the next 1 year for the next 30 days. So if Nifty is presently at 6000 the expected range of Nifty for 1 year is between 5000 and 7000.

If you want to calculate expected volatility for the near term using the VIX, say a month then formula to use is (VIX/Sqrt (T)) %

- If you want to know what is the expected monthly volatility of Nifty based on VIX of 16.8025, you should divide 16.8025 by square root of 12 (T = 12, 12 30 day terms in 1 year). So the expected volatility of Nifty using VIX for the next 1 month = 16.8025/3.464 = 4.85%

- This information of expected monthly range of Nifty can be used by people who trade Nifty options as well, especially the option writers. For example, shorting options above or below the expected monthly range of the Nifty.

Movement of India VIX

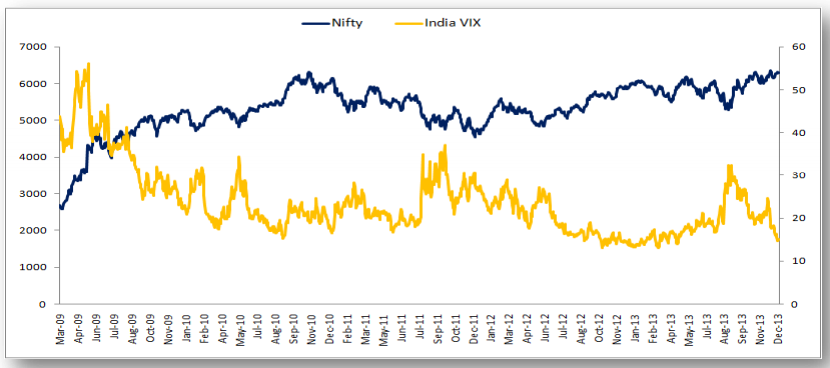

Historical data for India VIX is available from Mar 02, 2009 even though the futures trading starts only on Feb 26, 2014. Find below India VIX plotted against the NIFTY for the last 4 years.

NIFTY vs India VIX

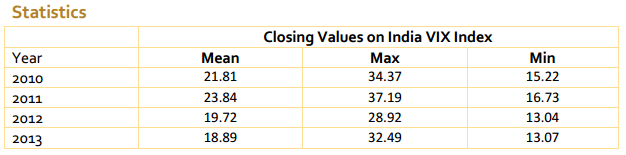

Yearly Range of VIX for last 4 years

We can now infer:

- A negative correlation between India VIX and Nifty, VIX tends to drop when Nifty goes up, and vice versa.

- India VIX at high levels implies a market expectation of large movement in Nifty and vice versa.

- Range of India VIX for the last 4 years has been in between 13 to 35 as shown in the table above. Yes, VIX had spiked to 50+ levels in 2009 when we had 2 upward circuits moves on the day election results were announced, but otherwise the range has been between 13 and 35. Looking at the past 4-year data, we can say that VIX is considered high if it is above 25 and low if it is below 15, so the normal range is considered between 15 and 25.

Trading India VIX

India VIX is an index, and very similar to Nifty, you cannot really trade an index unless you have derivative (F&O) contracts on them. With the introduction of India VIX futures, we can use the India VIX to hedge the volatility risk to our portfolio and/or use it to speculate.

The future contract on India VIX

- Lot size: 750 (Reducing to 550 effective 2nd July 2014)

- Symbol: INDIAVIX

- Tick size: India VIX will be calculated up to 4 decimals with a tick size of Rs 0.0025 (for example, India VIX today is 17.0025)

- Quotation price: India VIX * 100 (multiples of 100). If a trader wants to buy or sell contracts of India VIX futures at 14.1475, then the price that shall be be quoted would be Rs.1414.75.

- Trading hours: 9.15 AM to 3.30 PM

- Expiry Day: Tuesday (Every Week)

- Contract Cycle: 3 weekly contracts

- Final Settlement price: Closing Price of the underlying India VIX index

- Final Settlement procedure: Cash

- Margin: Initial Margin of 9% + Exposure Margin of 5% = 14% of the contract value

Here are some of the ways of using the India VIX futures

- You have a stock portfolio and are worried about markets going down, or volatility increasing : buy India VIX futures.

- You see that India VIX is at the top end of the 4 year range (around 35), and you speculate that it is going to go lower : you can short India VIX futures.

- Elections are around the corner, and you find the India VIX at around 20 and expect the volatility in the market to pick up : you can buy India VIX futures.

Using India VIX instead of Options

From the Black-Scholes model we know that options price increases with increase in volatility and decreases with a fall in volatility if everything else remains same. Currently, the only way to trade volatility is by buying or selling options (calls or puts as may be the directional bias of the market). Downside of this approach is that in the real world all other things like time decay (theta factor), stock price (delta factor) do not remain constant while volatility is moving. So it becomes hard for a trader to purely trade the volatility with options. Using the India VIX such a volatility trader will be a able to trade much more efficiently.

Technical Analysis and India VIX

If you look at the India VIX historical data, it is an easy observation that it is not a trending data series but rather an oscillating data series (range has stayed between 13 and 35). Since the India VIX doesn’t trend after a certain point, but rather oscillates in a range, we shouldn’t use trending indicators like moving averages, but rather use oscillators. One such good oscillator to use would be Bollinger Bands. See the chart below for India VIX, and how India VIX has reversed most of the times it has touched either the upper or lower end of the 20 – day Bollinger Band.

If you are a technical analyst, you can use other similar oscillators for predicting the move of the India VIX

India VIX and Bollinger Bands

Wishing luck trading India VIX.

how to buy it

If shorts enter into the market then vix raises and markets fall.

If there is just profit booking then vix will not raise but markets may fall.

Is above statement true ???

If u believe yes, plz elaborate the reason behind that.

Thanks

hii sir

sir please tell me which option stratagy is best for new traders

breakout strategy

Retest strategy

reversal strategy

all with candle confirmations

hiii sir …

good afternoon

am new to fno trading sir

want to start trading in nifty and banknifty options

sir ’ my doubt is if india vix is -3% or -4% should i buy call or put option or should i sell

and if india vix is +2 % to +4% should i buy or sell call or put option

please help me

I trade a directional intraday strategy in Nifty using options. At what VIX level should I be a option writer and at what VIX level should I switch to option buying?

Hi ,

I am confused why u have divided vix by sqrt of 12 instead of sqrt of 30 wen u r calculating valatility for next 30 dayz.. and also if I want to know expected volatility of nifty for next week or say next 5 dayz what shud I do?

Because they wanted to calculate the volatility for a month if yearly volatility is 16, and u want to calculate monthly volatility so 16/sq root of 12.

It will be time to search for the other option than equity & commodity… its vix because more volatility index will be came down by time. It will be usable in this type of situations (when markets zigzag). Most of the traders don’t know that vix can be traded in fut. That too in common days it’s not much profitable I think. So that it’s volume are less. Hope vix will be tradable in near future….

hi, why am i not able to see future contracts of india vix in zerodha kite?i can only see indices and not contract

This is because the India Vix futures don’t trade anymore. The contract doesn’t exist.

It’s hard to find knowledgeable individuals on this matter, but you sound like you know what you’re talking about! Thanks

ALOHA!!!!!!!

From what I have perceived from day trading for 1 year, it is generally advised to refrain from day trading during high volatility days, because higher volatility implies deeper retracements….. So in terms of VIX , what percent in your opinion is risky for intraday trade ? Thanks

Hello

I’m unable to add India vix future on kite. How to trade the same, please help?

That would be because the Vix futures have stopped trading.

May i know what might be the reason for that?

There was hardly any interest in the product, with just two contracts exchanging hands in Feb 2016, when it was last traded.

Hello, have any idea why in INDIA VIX no trading happening?

What could be the reason behind it? I’m trying to trade since 9 levels now it’s 15.

Right from when it was launched, no liquidity came through for this contract. People not interested generally I guess.

Oh ! It’s wonderful opportunity !

Sad there are no traders..

In US VIX is multi million dollar interest for traders!

Thank you for giving responses to each such queries.. no other broker does that! Keep it up!

getting ’internal server error’ while adding INDIAVIX Aug Fut to my market watch for last 3 days. Thought it would get sorted during the weekend. Any suggestions?

Can you email [email protected] with client ID?

Is trading in indiavix possible?

Is there a empirical relation between India vix and IV of various option contracts.

You can post this question on Varsity here: http://zerodha.com/varsity/chapter/volatility-applications/

sir

why there is no trading happening currently in indiavix ,if you know any reason ,or when will be the trading resume in indiavix ?

Seems like no public interest to trade Indiavix. Can’t say when it will become active.

thanks for your reply

How to ask a question in trading q&a?

Login and click on new topic https://tradingqna.com/

Hi Just to inform you that there are some unauthorized trades are happning in my account knowledge plz solve urgently

Namit, Can you send an email to [email protected] and [email protected] with your client ID.

Great work. Now very clear with INDIA VIX. Thanks Nithin. Keep going

I tried to add India VIX futures on Nest trader but it wasn’t showing prices. Has India futures stopped trading?

I couldn’t find options for the same. Are there no options for VIX?

Dear Nitin & Team,

While trying to adding India VIX fut in MarketWatch list it showing ”Scrip not found”. Please let me know the process..

Currently you can’t trade on India vix on kite. You can use Pi our desktop for this. Btw, there is no trading that happens on Indiavix currently.

Thank you for you quick response.

Is there a way to know the strike wise historical IV of Calls/Puts of Nifty of historical contracts?

This link gives IV only for today:

https://www.nseindia.com/live_market/dynaContent/live_watch/option_chain/optionKeys.jsp?symbolCode=-10006&symbol=NIFTY&symbol=NIFTY&instrument=-&date=-&segmentLink=17&symbolCount=2&segmentLink=17

I guess no. You’ll have to save the data on a daily basis.

hi sir

My id is RS 7456 have been trying to reset my password for past three days and not fixed till now please do the needful Recent ticket number is 961206

Your ticket has been closed, passwords have been emailed. We see your request received at 8.43 pm yday and the reply was sent at 9.08 pm

Hi, vix has to be created in realtime for Nifty future and traded in intraday. otherwise, it may not be a right choice. I read a book where it explains all http://www.amazon.com/gp/product/B01A14BUIU

Hi Venu,

I have a Demat account with India Infoline and have few holding over there, I just want to map that Demat A/C with Zerodha’s Demat A/C. Could you please guide me how to do this. Thanks in Advance.

You can’t map two different demats to one trading account. You will need to transfer all the shares from your indiainfoline demat to Zerodha demat.

Dear Sir,

I find this is the best article on the internet. Zerodha is the best Broker according to every view. It is a humble request please provide explained article on ”Using India VIX instead of Options”.

Thanks

Volatility has been explained on Zerodha Varsity module here: http://zerodha.com/varsity/chapter/understanding-volatility-part-1/

Hi,

My trading account id is DP1142

Till recently I only had trading account with zerodha but in the month of december i got zerodha demat account but the problem with the demat account is that i am not able to do BTST and the stock comes in my account after 4 to 5 days due to which i am losing. When i emailed at [email protected] , they told me that i have two demat accounts linked to my account, I don’t know how you guys linked two demat accounts to one trading account but still as they asked me to submitt a demat account closure form, I have submitted the form through DTDC courier on 29/12/2015 but still i am not able to see most of my holdings in my account and due to which i am so fed up with zerodha demat account that i am planning to shift to some other online discount broker, Even though i have to pay brokerage on delivery trades, i am fine with it, atleast i will get good service. Zerodha this wasn’t expected from you. And your hyderabad office guys they have no clue that i have two demat accounts linked to my account and they say that everything is fine with my account. please let me know when can i get all the holdings in my account so that i can transfer my account to some other broker.

Hi Prem,

Sorry for the inconvenience.

You’ve held your demat account previously with ILFS where you had some holdings. You’ve purchased the same shares again after mapping your Zerodha demat account to your trading account and shares have gone to this account. If you’re holding the same shares in both your demat accounts, holdings of only one demat will show, that’s a system limitation.

In light of this, we’ll get your demat account closed and have all your shares transferred to Zerodha’s demat account which is when all your holdings will show.

We’ve received your closure letter and have forwarded it to ILFS. As a Business policy, ILFS processes all account closures after 10th. We’ll push this for priority closure and have shares transferred to your Zerodha demat asap.

Nithin Sir,

If I want to buy an option, I would want to buy it when the volatility is low. So how do I decide if it is justified to enter into the trade, ignoring other things as of now (time, direction etc.). For eg Implied Volatility for 7900CE is 8.78, CMP 7946. Is 8.78 low enough to enter a trade?

Will it be possible by your technical team to add the margin calculation of every segment to kite’s buy or sell window? Because in the buy or sell window a good deal of space is available to add this margin calculations. As the available funds for each segment for each user is accessible from with in the individual user account. If you put the margin calculation or calculator to each user account then the user can easily calculate how much they can trade for each segment with out moving out of kite and can make quick decisions on what to trade and how much to trade. You can customize the buy & sell window more like I showed in the picture I have uploaded. Hope you under stand my suggestions.

Vismadev, your suggestion in our list of things to do. Actually something cooler than what you are asking for.

I am Looking forward to it.

Dear, Nithin, though I don’t know the present customer base of Zerodha in kolkata and it’s immediate surroundings. But one thing I am sure of a that a good number of people do trade in the stock market in these areas both in intraday and delivery trades. And after opening account with Zerodha my self last year, I talked with many of them, and I found that they are not at all aware of Zerodha’s amazing offers and technologies. They are also kind of suspicious about Zerodha’s dependability. Intrday traders of this region have a habit of either go to broker’s place and trade or by phone call the broker and trade through the brokers operators. As most of them are not accustomed with online trading advantages. So, I do have some suggestion to hack into this huge trading community, hope you would consider some of it for the spreed of Zerodha’s business in Kolkata, it’s surrounding as well as in Eastern India.

1] Need to advertise using leaflets in big towns and it’s surrounding suburbs through the news paper delivery system chain.

2] Buildup trading hubs in big cities and in the surrounding suburban cities and use trained operators in those trading hubs.

3] Allow sub-brokers system by taping into existing sub-brokers or by employing new sub-brokers. As this existing sub-brokers are more inclined to be a sub-broker rather than they becoming a client of Zerodha. Though I already know that Zerodha don’t have any kind of sub-broker system in place..

4] You can also advertise Zerodha’s amazing features and technological advancement and advantages over existing trading system via localized cable TV networks.

I know all of these will pull finance from Zerodha’s account. So, these are only some suggestion and depends solely on you and your team’s decision to follow them up or to discard them altogether.

Thanking you.

Vismadev, Don’t think with our pricing we will be able to run this business in the traditional way. Today people are still trading offline, it won’t be the same few years from now.

Is India VIX available to trade in the forms of futures only? Or any options / etf are also available?

Secondly it is understood from the comment above that if it reaches 22 level…nifty will lilely to move upwatds so buying call option or selling put option will be the two possible scenarios. And if VIX reaches around 15, buying put or selling call will be the two ways. Am i right?

How to trade individual stock either for intraday or for delivey by checking VIX?

Hi,

India VIX is available only futures and no ’option’ is available.

Even futures contract has become illiquid.

If India VIX is above 22, then markets are likely to go up and down in an unpredictable manner but eventually markets will go down. So selling Call option on every rise should be the right strategy.

If India VIX is below 15, then markets will be stable and likely to move higher slowly. So the right strategy is to sell Put option on every dip.

Buying of option is only for very short term traders who can judge the market movement. Usually people who buy options and hold until maturity will loose money most of the time.

But risk associated with buying of option is very less and correspondingly the chances of winning is also very low.

Selling of options carry unlimited risk, but if you know how to manage your risk and if you have more capital, you can make decent return. You need more capital to sell options as you are required to pay margin money as well as Marked to Market (MtoM) losses. Whereas if you are a buyer of option, then just pay the premium and that is it.

But option seller wins most of the time and loose lot of money when loosing if does know how to manage the risk.

Thanks.

P R Sundar

http://www.prsundar.blogspot.in

Thanx Mr.Sunder & Mr.Nitin too

Yes currently India vix available only in terms of futures. Instead of directly relying on using India VIX to trade stocks, I’d suggest you to go through this. Read from the start, especially the volatility basics. http://zerodha.com/varsity/module/option-theory/

Hello Nitin ,

To check one min or 5 min or 10 min or daily chart of INDIAVIX ( volatility index ). with the help of this daily trading movement .we can see the Nifty future and option.

is this index is available in your index list like Nifty future , bank nifty future , cnxit future etc…..Finally indiavix..

Kindlye reply me sir

Kind Regards

Ashok Mani

Ashok, yes both India vix and India vix futures is available on Pi.

In the contract selection dropdown, choose NSE – Indices – Indiavix and add it to the chart.

If you want Indiavix futures, Choose NFO – FUTIVX – IndiaVIX

is india vix equal to implied volatality?

No.

Hi Nithin,

I am unable to access Indianvolatility.com. Getting timed out error msg.

Is the site still active?

Thanks,

Sachin

Looks like it is working okay for me.

Hi Nitin,

Have a question with regards to order placing. Do we have a option of ”Good till Cancel” option in zerodha.

Like if i place a order today and system automaticly place the order till it is executed .

Regards,

Vj

No VJ, stock exchanges in India don’t support GTC orders.

Hmm that is your making incorrect statement in General . ICICI, Sharkhan, Kotak supports it. I have done trading at ICICI as well as sharkhan. order can be placed till it is cancelled for certain date and system takes the order overnight for unexecuted order till it is executed or till the specified date.

Please check the possibility to incorporate in Zerodha.

VJ they are not really Good till cancelled orders, GTC orders ideally have to stay on the exchange servers until they are cancelled. What Sharekhan/ICICI etc do is that at the close of everyday they place another order on your behalf. So it is like a hack, and not really GTC. We are also looking at doing something similar to this, but it will not really be a GTC order.

Oh ok..thank you for the information… Yes i am eagerly looking for this option as i can not be online every day to check my portfolio and it gives me some leverage in trade.

Thank you again…Hope we have it soon.

1 ) we have India ViX to identify NIfty future and Option. So Is their any index to identify volatility of commodity market ? 2 ) By using INdia vix can we trade stock futures and stock options 3 ) India vix works only in Nifty Index future and index options ? please reply me with this three question . please ..!!!

1. No index for commodity

2/3. Yes you can look at India VIX and gauge the market expectation of volatility – both for Nifty Index and individual stocks. If you are trading based on VIX, Nifty(F&O) is a better bet, rather than individual stocks(F&O).

Thanks Nithin for your prompt reply. And thank you for this detailed article on Indiavix. I found it quite helpful.

Hi Nitin,

Why there is no trading in India Vix? I checked the 22nd April 2015 NSE Bhavcopy and it does not have any volume for all the 3 contracts. At least the near week contract should show some activity, isn’t it? Is this open for trading for retailers?

Thanks…

Mark it is open for trading, but somehow is not getting any trading activity. The interest has been continuously dropping in this contract.

Dear Nithin,

In Back office, noticed some thing wrong in the options turnover calculation.

In Reports –> Tax P&L, Options turnover calculation is showing wrong.

Can you just verify?

Seenu, can you tell me what is that you are seeing wrong with an example?

I did 4 option trades in one of my account. total options turnover must be

10112.5 + -26550 + 5000 + 10000 = 51662.5 but turnover is showing as 29,78,875/- in the Tax P&L report which must be wrong.

FYI, the following trades i did

1 NIFTY14APR6750CE 7,500 ₹83.59 ₹6,26,950.00 7,500 ₹84.94 ₹6,37,062.50 0 0 ₹10,112.50 0

2 NIFTY14SEP8050CE 18,300 ₹115.61 ₹21,15,700.00 18,300 ₹114.16 ₹20,89,150.00 0 0 ₹-26,550.00 0

3 NIFTY14OCT8050CE 1,000 ₹95.00 ₹95,000.00 1,000 ₹100.00 ₹1,00,000.00 0 0 ₹5,000.00 0

4 INFY14OCT3850CE 1,000 ₹91.00 ₹91,000.00 1,000 ₹101.00 ₹1,01,000.00 0 0 ₹10,000.00 0

Srinivas,

It is showing correct. Check this link on how we are calculating turnover. Along with using gross profit + losses, we are also considering selling side of option turnover. This is the most compliant way of calculating turnover.

Ok..its clear now.

But, options player would easily reach 100 lakh turnover though they do very less. I am going to eliminate options trading to avoid the auditing.

All options have different volatility…like in your example the option volatility for 7700 call option is 11.4 given the price is 54…use the option oracle. This will give you further insight in options. It is freely available. I have not used it for a while and I don’t know the status if it is still freely available.

Hi,I want to know that the implied volatility which is used in calculating price of nifty options is same as this VIX?

Current(17/7/14) India VIX is 14.97% and today closing price of nifty 7700 call is 54 while nifty spot is at 7640.When i use the implied volatility as 14.97% in calculating option price than 7700 call price comes as 72.And when i calculate implied volatility putting 7700 call option price as 54 than it comes as 11.4%.Rate of interest i use is 10%.

I generally write nifty options so this factor to be exact is very much important for me.Please help

Rajat, India VIX is not a % and it is not the implied volatility that goes into calculating theoretical value of options.

Ok Nitin..but then from where do we get the implied volatility number for determining price options?

Hi Sundar

Could you please explain what is delta hedging in option writing and how to use it practically?

Delta hedging is all about creating balance in hedging positions. It is difficult to explain here in the blog everything. We conduct one day workshop to explain all these.

Thanks.

Mr Kamath a quick question:What will be the Margin required for INDIAVIX, after the revision of Market Lot from 750 to 550 ?

Reduction in Market Lot size will reduce the Margin requirement for trading INDIAVIX or not.. ?

Yes should drop proportionately, around 3lks (https://zerodha.com/margin-calculator/Futures/) so should drop to around 2lks for overnight positions.

When do you think VIX options would be introduced?

Might take a while according to me.

@Nitin-is it true that Zerodha exempt exposure margin. If yes what should be lot size for selling options on Nifty.

Zerodha is a low cost brokerage, they can not afford to waive exposure margin. If you do not know what is the lot size for selling options on Nifty, I would advise you to stay away from selling options. This is a high risk game and only knowledgeable people should enter. Otherwise you will end up loosing your entire wealth.

Hi Hi Sundar,I am very impressed with your comments,could you please guide me how to pick right strik price(call or put)for write option based on market trend and implied volatility.

Thanks in advance

Prakash

H,

Choosing the right strike price is the skill required by the trader. You go too long, your return will be very low, if you go too close, your risk will be very high. So this is a game of risk-reward. As you have already mentioned, implied volatility is the most important thing to consider. In addition price movement, time value also to be considered. Option buyers are gamblers, they invest a small amount of money, if they loose, they loose only a little, if they gain (though probability is low) they get huge profit. Option sellers are business people, they expect a decent return for their investment. Most option writers have agreement with brokers so that they do not pay exposure margin. (The margin money that you pay for writing an option consists of two margins, one span margin and the other one is exposure margin). So most heavy traders pay only half the money when it comes to selling options, compared to normal retail investors, so their return doubles. Hence they can reduce their risk and yet can get good return. So there is no fixed formula to choose the strike price (if there is any, by this time every one would have been following that), there are a number of other factors like doubling your return by making the broker to agree for exposure margin waiver, diversifying (not selling options only in one counter, sell in many counters so that your risk is diversified), using the wing strategy (For eg, Nifty is trading around 7200, one may sell 6800 Put and 7600 Call, but what I do, since I invest huge money, I sell 6800, 6700, 6600, 6500 Put and 7600, 7700, 7800, 7900 Call, I call this wing strategy), etc. For your kind information, I have made Rs 1 Crore in the month of May, considered to be very difficult month for option traders due to election results uncertainty. For any clarification, you may contact me at [email protected].

Thanks

P R Sundar

Hi Sundar,Could you please suggest me how to pick right strik price (call or put) based on market trend and implied volatility for write option.

Thanks in advance.

Prakash

Thanks Nitin.

Hi Nitin,

Fail to understand why is India VIX expiring on May 20, 2014 trading at significant discount to underlying. It is around 23.5 against underlying of 32.5.. does it make a good trade to buy given the elections

Hi,

India VIX was trading around 15 few months before. VIX shot up due to election. Election results will be announced on 16 May. By 19 May, the results will be fully priced in the market. So volatility is likely to go down drastically by 20 May. It is a contract that requires a margin of around 7 lakhs. 10 points difference, one can loose 7.5 Lakhs. Still people are ready to short at 10 points lower. So they are informed people who take calculated risk.

Hi..

1) Would it be good idea to buy Indiavix May 20th contract on may12th at discounted price and sell it before may16th (before it cools off)?

2) How does May 20th contract move after May 12th contract’s expiry? Hope the India Vix spot price may not cool to 2x.xx range as May 20th contract priced in now?

Hi Nitin,

Is it a good strategy if I buy nifty puts and calls of NTPC and Coal India as mentioned in this

http://www.fiis.in/trading-strategy-election-2014-india-strategy/

Please suggest

The link is not opening William, I’d personally stay away from tips like these..

Thanks Nitin for your prompt response. Premiums of NTPC and Coal India seems to be okay when comparing with other stocks. What will be the impact of election result on these two stocks?

just i am doing a copy paste of what is written in that link

if NDA forms government, NIFTY might move between 5-10%. This move might not be sufficient to make profit. But stocks from particular segments like Infra, Bank, PSU and Power would make a rally due to the reform plans.

On the other hand, if third party gains majority, market fall will be unstoppable. I am expecting 30% downwards movement and that is sufficient for me to make profit.

I would buy ATM and nearest OTM calls of below stocks for which Option Premiums are comparatively low and has a good potential to rally if NDA forms the government:

NTPC

Coal India

IDFC

Bharti Airtel

Hindalco

BHEL

SBI

Hi Nitin,

Waiting for your suggestion. Thanks.

Can’t really comment on this William, personally I would rather than stay on the index around news events, the reward might be lower but so is the risk. But if you do decide to buy these options make sure to not risk more than 3% of your trading capital, remember it will be like buying a lottery ticket. 🙂

vix option trading aa gayi mere teminal main nahi aati

hi when would BO for equity kickstart.??

Hi Akhil/Nithin, Can you please make me understand the following things:

1.) Why IndiaVIX has risen by 13 vol points in the last 2-3 weeks

2.) Now, do you think shorting the IndiaVIX future (29 Apr expiry) make sense given the future is trading at 38.75 whereas the spot is 29.18. So, you are protected till the spot level rises to 38.75 which is anyways 9 vol points (~30%) from the current level. Additionally, there won’t be any major news (locally + globally) till the 29th expiry, so you are not exposed to any major index movement

AZ, Check this answer I had recently posted on TradingQ&A, http://tradingqna.com/1104/calendar-spread-opportunity-in-india-vix?show=1104#q1104

The VIX has been going up in anticipation of the impending event – elections.

Though there is a big gap between VIX 29th APril to underlying, but it could very well go much higher by the end of April and the underlying VIX can catch up with it. So don’t really go long or short, just looking at the spread.

Hi Akhil/Nitin, this reply is in continuation of what I posted on 13 April 2014.

1.) As I said, shorting 29th April VIX future would have made sense as in just a week span of time it has fallen from 38.75 to 31.65, i.e. ~7 vol points (18%) in just 1 week. I said so as my model predicted IndiaVIX spot level of 35 by 21st April and thereby the fall in the IndiaVIX levels. So, my forecast of IndiaVIX spot and its future levels turned out to be the absolutely accurate.

2.) Now, I want to know your view on the 13th May 2014 expiry VIX future, which is trading at 34.31. Given the spot level of IndiaVIX at 30.68, the 13th May future is trading at just 12% premium. Since market participants hasn’t yet positioned themselves for the election through Nifty options, I believe vol should increase going into the elections. At the same time, this is one of the most crucial events in the last 5 yrs, yet IndiaVIX is no where close to its highs of 50 level. So, from risk-reward perspective, it makes sense to long 13th May VIX future.

Let me know of your thoughts.

Thanks

Personally I think long VIX 13th May is a trade that I might take personally, but not sure if I would hold it till the event.

So, I was right on IndiaVIX (current level 37.7) this time as well. I still think it has more to go in the remaining 2 trading days, so I would advice to continue holding it.

I feel 24 and above we should buy call options ,bellow buy put options at present volatility

Mr Nithin

I am new to stock market. I want to read the fundamentals of stock trading. Can you pl guide me the right material to understand the basic concepts.

S Venkataraman

A good way to actually start trading (I am saying trading not investing) is by using technical analysis, a lot more easier to get started. Check this link

Also do check out our new initiative Trading Q&A

Cheers,

Thanks for your proactive response.

Sir, I have a suggestion, Zerodha has branches in Southern Zone. As you are on expansion spree in various zones, you may start your training centre in every city/zone wherever you have a branch. In India with increase in awareness about financial markets in public, it has become indispensable to enlarge the knowledge horizons about financial markets.. It would help the masses to acquire skills in financial field as well as to have optimum leverage of the available opportunities and skill-oriented labs in achieving their goals of investment.

Venkat,

We are not really looking at expanding physically, but we are trying our bit to educate via various online initiatives. http://tradingqna.com/ is our latest.

Sir thanks for your reply.

It is seen in your website that Zerodha has launched automated trading in the year 2012. Can you pl brief me about automated trading regarding its operation, technical analysis etc

S Venkataraman

Automated trading is not allowed for a retail trader.

Can you pl brief me about automated trading regarding its operation, technical analysis etc?

hmm.. the above question is actually quite broad, will try to put up a post on this, but go through this section you should be able to get some answers.

Hi,

First let me introduce myself, I am Sundar from Chennai, trading only in options and making lot of money, at least Rs 10 lakh a month.

Second, let me appreciate your effort in making low brokerage venture a reality.

Third, everybody want to buy options ahead of elections to make money. That is actually a wrong strategy. There is something called ”Market Efficient Hypothesis” which says that whatever news in public domain, they all are factored into the prices of options. So the buyer usually makes money when there is something surprise. For example, in 2009, nobody expected Congress coalition to get majority without Left support, that happened, so the markets shot up, option buyers made money. You may check, option prices for May series onwards are really very high.

Assuming that one buys May series 6500 Put and 7000 Call, he has to pay Rs 350. He will make money only when Nifty crosses 7350 or fall below 6150. Let us see what happens next month.

For option buyers: Option buyer pays only premium, option seller pays margin money which is very high. Option buyer has limited risk, seller has unlimited risk. Option buyer has the possibility of unlimited profit, seller’s profit is limited. So think basically why should any body want to be on sell side with everything is favorable on the buy side? The answer is simple.

If you want high profit, you have take high risk (Example: robbing a bank, your investment is very low, your reward is very high and correspondingly your risk is also very high)

If you want high reward without corresponding high risk, then also it is possible, but the probability of winning is very low. (Example: Buy lottery ticket, your investment is only Rs 10 or 20, you may get Rs 1 crore if you are lucky, no risk absolutely, but probability is very low)

So, the fact is that the probability of seller winning is very high. I have not seen anybody making good amount of money consistently by buying options.

I am a living example for making money consistently by selling options.

Option buying is just like buying lottery ticket, if you get it be happy, if you don’t get is, don’t worry as you lost only a small amount.

What I mean to say, the amount of money which you are prepared to loose completely, only must be deployed in buying options.

Last but not the least, option seller has the advantage of hedging his positions and can continue to apply delta hedging in order to come out if market goes against him. Option buyer has no options if his views go wrong, except getting out with stop loss.

Hope option buyers understand all the risks involved.

Most brokers entice the retail people into buying options by telling them ”Limited risk, unlimited profit”. In reality that is totally wrong, the correct one is ”Limited Risk, unlimited probability, low chance of winning”

Thanks.

.

i am a living example for making money consistently by selling options.

, option seller has the advantage of hedging his positions and can continue to apply delta hedging in order to come out if market goes against him. Option buyer has no options if his views go wrong, except getting out with stop loss.

Hope option buyers understand all the risks involved.

Most brokers entice the retail people into buying options by telling them “Limited risk, unlimited profit”. In reality that is totally wrong, the correct one is “Limited Risk, unlimited probability, low chance of winning”

Thanks.

anybody can explain with this with example

Hi,

You actually do not require reply as you understand things.

Anyway since you wanted example, I will give you.

You want to get married. You have two girls. One, beautiful, well educated and has lot of money. The other girl is ugly, not educated and very poor. Which girl will you choose? A common sense will tell you that every one will choose the first one and nobody will choose the second one.

Come to option buying and option selling. Option buyer has limited risk, unlimited profit and low margin money (like beauty, education and money) all three working in buyers side. Then logically everybody should be on the buy side and no one should be on the sell side.

But the fact is that for every contract buyer there is one contract seller. (This equality is in amount not the number of people) 100 people may buy options but one person will sell the equivalent options.

So the trick here is that the option seller winning has high probability.

Option buyers should understand one thing.

There is no such thing called ”Low Risk and High Reward”, there is one more to add in reality.

1. ”Low investment high reward” is possible if you take high risk.

Let us rob a bank, investment is very low, reward is very high, but corresponding risk is very high, if you are caught you will be spending rest of your life in Jail.

2. ”Low risk, High Reward” is possible but probability of winning is very low.

You buy a lottery ticket, risk is limited to Rs 10. Reward can be as high as Rs 1 crore. But what is the probability?

It is very low. But people are aware of that. This is why most people do not buy lottery tickets.

But buying of options is the same.

But people do not realise this.

Against lottery ticket awareness is created, some states like Tamil Nadu even has banned the sale of lottery ticket.

But in stock market, there is no one to create awareness.

On the other hand brokers make big money out of these people and make sure that these innocent people do not get any awareness.

Options are introduced for the purpose of hedging (for that matter even futures are also introduced for the purpose of hedging), but being used by people for gambling.

In Gambling no one wins except the Gambling den owner.

Thanks

P R Sundar

Dear Mr. P R Sundar

Good Afternoon Sir,

At the very outset,kindly excuse me for taking your precious time to read this note in your busy schedule.

Sir thank you for telling us(me and all newbies) about importance & profitability of shorting,i m sure by practicing it ’ll be highly beneficial for all budding awa experienced trader/investor/analyst to develop profitable trading plan Scientifically.who are in/want to learn trading F&O.

Sir I have few queries & i’m sure your answer to that’d be highly beneficial to all guys who wants to learn it–

1-How can a person with limited money and resources can profitably practice F&O Trading (esp. Shorting) in current scenario (after hiking of lot size by sebi),will it b a smart choice ?

2a- As few experts are claiming ’tape reading’ is a significant indicator of trades in mkt ,but here stock exchanges dnt provide it,can we consider data from option chain analysis equivalent to such tape?

2b- Some experts are also suggesting ’liquidity’ issues in mkts,hw this effects f&o trades for small traders?

3- plz guides us which is more useful : Predictive Analysis or Technical Analysis

Sir feel free to say no/any reply,i understand the professional/other limitations.

Thank you for your time and consideration.

Regards

True Leaders don’t create followers…they create more Leaders – A Wise Man

1. Had recently answered this query, check this video.

2. Yeah, tape reading is essentially looking at market depth window and price and trading.

Small traders actually have an edge in the markets as liquidity doesn’t matter to the.

3. Have you checked out http://zerodha.com/varsity/, has everything that you need to get started trading.

I hope this is a futures and not options… Kindly explain

Yes Shankar, Presently as explained in the post above, we have only VIX future contracts, options contract might be introduced in the future.

Hi Nithin,

I have been prepping to develop a simple options trading system. However, I have hit a wall – where do I get historical options data (specifically, historic IV for each underlying and calculations like ”IV Percentile”)? And how do I back test option strategies?. Kindly throw some light on this.

Cheers!

Hi Nithin,

Can you also mention the margin needed to do a trade on this script pls?

Margin required is updated here, search for INDIAVIX. It is Rs 2.2lks for overnight, and 89k for intraday.

Cheers,

what is Lot size? You have mentioned 750 correct? or still to decide?

Yes decided, the lot size is 750, and margin required is around 2.3lks for now using NRML and 90k using MIS.

HI,

Very useful explanation let’s see how we can benefit from it practically.I think it’ll take

a while to be familiarize so wish us good luck & good-luck to all.

Hi Nithin,

Do you see end of retail trading in near future. I am asking because I have heard that SEBI is trying to reduce margin it means do we need to have atleast half of the margin to trade Nifty Future in future.

I think it will kill the market…what do you feel?

http://www.business-standard.com/article/markets/sebi-panel-suggests-changes-to-margin-funding-norms-114021500896_1.html

Arpit, what the article talks about is margin funding norms, basically where people borrow money to buy for stocks for a lot more than what they can buy with the money in their account. This has nothing to do with the futures trading business. There is no concept of margin funding when trading derivatives.

Cheers,

Anyone who needs to read this article to understand VIX futures should stay away from trading them. They are inherently complex instruments and the primary purpose of trading them should be to negate the beta of your portfolio. Do not be fooled into trading them as easy money. You’d have a better chance at making money playing markets intraday, and most of intraday traders lose money 😉

I perfectly agree with mr. Pankaj .

It’s realy wonderful explanation. VIX (the word) itself is so complicated, but you have explained it in a very simple and effective manner. I am very excited to trade.

Thanks a lot for the entire team of Zerodha and You.

When would the INDIA VIX options commence trading?

Options will probably take a while I guess.

thanks for the info

u r really a very good person no one takes pain to provide so much information to public. U r great sir

it is brokerage free upto 1st June but what are the other charges/taxes for one lot

We will update the brokerage calculator as soon as we have an idea on the lot size.

Cheers,

Weekly Contracts much difficult to handle….what will be the breakeven ? You mean we have to pay 14% for 10 lacs = Rs 140,000 for one lot ?

Looks like that will be the margin, we will need to wait until the lot size is announced.

Super Explanation, was confused looking at all the information on NSE site.

Nitin Thanks for very well explanation…

Off lately as Election Commission has announced the elections dates and RESULT day, most of us must be thinking how to use VIX or any other trading instruments during the election.

There are few trading instrument I am considering to use- VIX Futures, Nifty Futures & Options and Bank Nifty Future & Options.

Now question arises…which one is best? Let us see one by one

1) VIX- There is no doubt that VIX is going to hit high high on Election result day!! So one can consider buying of VIX at least one week before the election result announcement. Since these contracts expire weekly one has no option than buying the nearest week expiry! But I am not sure if we can square it off on the Election Day as there may many circuit filters!!! Squaring off next day which will be Monday may result in loss if VIX goes down sharply. But I assume the VIX will remain high for at least some time.

2) Nifty Future or Options: Of course options…now when to buy options? One week before election result or two weeks before? I assume VIX is going to increase a lot from beginning of April and one has to time buying the options at right time. Any past experience from GURUS?

3) Bank Nifty Future or Option: Bank Nifty options may be very expensive and may not be as liquid as Nifty Options….Any idea??? In this case we may go for BankNifty futures but this will be a directional bet as you can’t buy and seel at the same time!!Given all this Banknifty still remains lucrative as it is going to zoom more than Nifty

Manish,

1. VIX is a direct play, but the limitation would be that the longest contracts are just 3 weeks old, so if you have to play for the election results from May 16, you can start taking positions only from last week of April. Since it is a derivative, there won’t be any circuit filter on the contract, but yeah there is a 20% circuit on the entire market itself. If you look at the VIX historical chart, the range has been 13 to 30, but during the 2009 election it had spiked upto 60, so if the play is volatility even if VIX is available to be bought at around 30 3 weeks before the event, though it would be on the high end of the range, it might still be a good bet.

2. Definitely better to be in options than futures. If you check out the May option prices, the premiums have already factored in extremely high volatility. Long strangle might be a good bet, if you are expecting extreme volatility, buy OTM calls and OTM puts.

3. Another strategy could be that since so many people are trying to play volatility, and since premiums are so high, you could also simultaneously run a bear call and bear put spread. Sell ITM option, hedge it by buying an OTM option. You can do it on calls and puts at the same time.

Nifty options are much better instruments to trade than Bank nifty, because of liquidity.

Best of luck

Nitin Thanks for prompt response

Is it better to do long strangle now or wait till end of April….I mean it would be cheap now or then…I understand there are many factors that will play significant role into it such as time value of option and volatility. But any idea from previous Election data?

I think the best bet would be to wait as close to the event as possible and then take a strangle, 3 to 4 weeks before the results. That has historically been the best time to take strangles around the election. This time around, with the increased popularity of option trading, everyone is trying to play the volatility game, and somehow my gut says that this time around there may not really be that much volatility around the election.

Cheers,

I had been doing my research on long strange strategy and decided to study about VIX. Thanks a ton for sharing your practical experience on the topic.

Hi Manish,

There are number of valid strategies that you can play with as already discussed here but I would like you to note that last date if polling is 12th May (monday) and result day is 16th may (friday). Exit poll results will come out on 12th itself. So you need to pay for exit poll results day and not results days as you have been stressing in your post and it will make a lot of difference. Recent assembly polls in Dec saw a lot of spike in volatility and it died down on 5th dec itself even though results came out on 8th Dec.

So one other strategy you can consider is go short on volatility on 12th May if you see volatility REALLY running up during election (Nithin is skeptical of volatility rise). This way you will be more sure and also not loose due to big theta of long strangle kind of strategy.

These are my 2 cents to the discussion.

cheers,

Akhil

I am a registered user of Zerodha trading account as well as tge demat account. My id is ZS4397 and name is ayush sharma. I have one query: how do i add stop loss to my holdings daily? Also, pls tell me how do i put trailing stop losses?? And how to modify the stop loss?

Check this post on placing SL order. Also check this video.