Deciphering NSE’s ‘Execution Range’ circular.

The National Stock Exchange earlier this month rolled out a circular prescribing a ‘reference price’ & and an ‘execution range’ for Futures & Options contracts which was effective from Feb 8th, 2016. There seems to be some confusion in understanding the circular and this is our attempt to decipher it for you.

Option trading has been growing leaps and bounds contributing upto 75% of total exchange volumes, the most popular being the index (Nifty) options. But the liquidity (trading volume) is limited to present/near month contracts in index options and only a few stock option contracts.

With lower trading activity in most option contracts, there have been multiple incidents over the past few years when a market order has caused significant impact cost and eventual loss. Here’s an example:

Consider Bank Nifty currently at a value of 13050 in April and May 12500 Call since it is deep ITM (in the money) and because it is 2 months from expiry, having no liquidity to trade. Assume that someone has put a selling order at 900 for this option (ideally should be trading around 500) hoping to get lucky. In case if you decide to buy this option and instead of placing a limit order at around 500 you place a market order, your order will get filled at 900, causing a potential loss because of impact cost of Rs 10,000 (900-500 x 25 which is the lot size) per lot. The chances of such mistakes are higher when, you see an offer for 1 lot at 525 and you place a market order to buy 10 lots, 1 lot will get bought at 525 but the rest of the 9 lots would get bought at whatever is the price available in the market, in this case at 900.

To help protect the trader from such significant impact costs, National Stock Exchange (NSE) has taken several order and risk management measures to ensure orderly trading. NSE now says that orders shall be matched and trades shall take place only if the trade price is within the reference price and execution range of a particular contract.

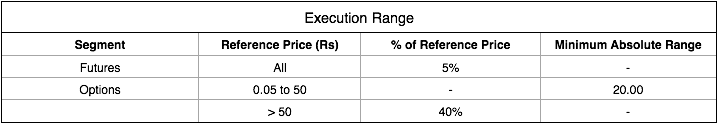

How is the Execution range defined?

Execution range is the price range on both sides of the reference price of the contract only within which if orders are placed will be accepted, if not cancelled.

Reference price for each contract shall be computed as follows

- At market open – Theoretical price derived from the underlying price. (Using implied volatility in case of options contracts and rate of interest which shall be revised daily with the applicable 30 days MIBOR rate) or base price of the contract in case underlying price is not available at the time of computation.

- During Trading Hours – it shall be the simple average of trade prices of that contract in the last 1 minute. For contracts that have traded in the last 1 minute, the reference price shall be revised throughout the day on a rolling basis at 1 minute intervals.

- For all other contracts the reference price shall be the theoretical price based on the latest available underlying price and shall be revised throughout the day at regular intervals. (30 minutes)

So the execution range on both sides of reference price would be:

Now, coming back to the bank nifty example, with the 40% execution range in place (since premium > 50), your market order will get executed only in the range of 300 to 700 (anything beyond this will get cancelled).

Important:

- The ‘Execution range’ is available only for Futures and Options trading on NSE.

- The ‘Execution range’ is applicable for near month, mid month contracts and far month contracts.

- The Exchange does not make the reference price available to the Stock broker. As a result you will not be able to see the Execution range on Zerodha Trader yet.

- All orders above or below the range will be cancelled immediately, so ensure to double check your open positions when you place market orders in illiquid contracts.

This initiative of the Exchange is laudable as it safeguards the interest of traders and is applicable on all F&O contracts (near month, mid month contracts and far month contracts).

Edit: Effective February 8th, 2016, NSE has made the changes on execution range for NFO and CDS as mentioned in the attached circulars.

Do post any queries you may have.

If any strike price like 18000 ce is trading at rs 1200 & I am placing gtt order at rs 5 for 20000 qty. After some days gtt order comedown at rs 3 then pls confirm gtt order will be execute or not ?

Hey Virendra, once the GTT order is triggered a limit order will be placed which will execute at the price you’ve specified or a better price. If the price moves beyond the limit price specified the order will remain pending. You can check how the limit order works here.

Sir,

I faced many times the issues of stop loss not triggered and got loss in bank nifty. It happens when suddenly movement comes. I have lost many of the money.

What is the reason for this and what is the solution?

Please reply as I am waiting…

Sir on 19 july I was holding Short position of PE, I had placed Stop Loss order for same at 25% from its trade price, but later my order was cancelled by exchange. Why this happened was this due to liquidity or some other reason and what are the probability of happening this again, as this was second incident in this month, similar thing happened on 12 july 2021

Sir…I sold NIFTY ATM PE 15750 today at 56 Rs with market stop loss Rs 85…At 13.10 pm, market just came down from 15750 to 15650 instantly… my market stoploss got cancelled due to Exchange restrictions….please elaborate….Also provide solution for the same

It was the same for my order. But why?

It happened the same with me in Bank Nifty. I want to know that how come an SLM order gets canceled when everywhere in zerodha articles it is mentioned that put a stop loss to protect big losses etc. What other Stop Loss should we place so that the order gets executed even if there is a slippage but still it gets executed rather than getting canceled?

I am shifting to other broker due to this. as per my understanding, at others not faced such issues

when there is sudden fall there will be delay due to your trigger price it will be executed in at price it reaches the where buyer is keeping his buy price this only occurs once in a while in sudden drastic fall this is not zerodha fault any broker is that same

Hi Sir ,

I would like to give a suggestion that pls consider this is a concern , there is difficult in trading options and unable to sell Deep OTM and In-order to that i want to open account in other broker ( which is not possible due to fund (MTF) issue ) and there is other option that’s to go with Orbis which is unconventional and difficult due to unbale to pledge and use , hence pls build independent platform to place orders i.e. sensibull (but it goes through broker ) , so if independent broker with same zerodha console and funds in zerodha’s account (updated and convenient than orbis) . pls if do something , because i Love Zerodha. pls consider

@Zerodha @Nithin Kamath

Yesterday I purchased Hind Petro Jul 290 PE @ 3.67 but now this option is disappeared and now it is showing Hind Petro Jul 267.25 PE, How this has happened ???

This happened because the company recently gave out a dividend of more than 5% and so the strikes were changed.

Hi , Zerodha

Open market most of time you showing some error & ‘you blaming this is exchange problem’ ( for example:- Bank nifty options range, position converting mis to normal, order placing & etc.) and same time I’m checking other broker there was not credited this type of problam. I think u r not good place for trading. I’m requesting to everyone not join Zerodha.

Sir, Some of my Futures are auto squareoffed on 27th and 28th may but its amount is not added to my zerodha account “EE0539” , So kindly look into this Issue pls

Even I face such problem. Zerodha RSM 81 is making money by executing trades without client’s approval.

Due to price out of execution range ( extreme movement in price), the second leg of Cover Order gets cancelled by exchange, the control of order execution is never given back to client. Instead Zerodha does it themselves, by it’s risk management bot RSM 81. This bot executes the order within next minute when exchange updates the price range for F&O item. Then this BOT uses the credit and trades the F&O and makes money and finally executes the order for client at extreme loss and after substantial loss to client. I am writing to exchange regarding this malpractise of Zerodha and I urge all to make a complaint with NSE.

This is worst rule with zerodha only, i never faced such problems with any other broker , these guys r fishy . i lost my whole capital bcoz of this rule , ZERODHA IS THE WORST TRADING PLATFORM TO TRADE OTM/ATM/ITM OPTIONS.

let me explain my real scenario here then u guys decide to trade with zerodha or not ..

EVEN IF U TRADE ITM/ATM OPTION ALSO THIS ZERODHA MAKES U LOSS IF THERE IS BIG GAPUP/DOWN OR VOLATILE IN THE MARKET.

let me explain real scenario here. how they loot my money …

Friday(9th April 2021) banknifty closed @ 32448 NIFTY CLOSED @ 14834.85

i am holding below positions :—

NIFTY 15th APR 14950 CE SELL QTY 300

NIFTY 15th APR 14850 CE BUY QTY 300

NIFTY 15th APR 14800 PE BUY QTY 300

NIFTY 15th APR 14700 PE SELL QTY 300

BANKNIFTY 15th APR 34500 PE BUY QTY 200

BANKNIFTY 15th APR 34400 PE SELL QTY 200

MONDAY(12th APR 2021) GAPDOWN OPEN BANKNIFTY 31637 (almost close to 800 points down) NIFTY OPENED AT 14644 (almost close to 200 points down)

Monday morning i saw around 70K profit and executed all my positions at once. after execution(i though they are executed) andeven profit showed around 60K after execution…. when i refresh the page then it showed 65k LOSS … then i realised that some of my oders are not executed …then i try to execute them they are not, after 3,4 mints they are executed at higher prices took all my profits and make loss around 50k…

Funny part is they executed below orders :—

NIFTY 15th APR 14950 CE SELL QTY 300

NIFTY 15th APR 14800 PE BUY QTY 300

NIFTY 15th APR 14700 PE SELL QTY 300

BANKNIFTY 15th APR 34500 PE BUY QTY 200

they are not executed folowing orders they say that ERROR 17070 :—price is out of current execution range

NIFTY 15th APR 14850 CE BUY QTY 300

BANKNIFTY 15th APR 34400 PE SELL QTY 200

they executed these orders to make sure i got big loss and then executed at higher prices …..

my question to buggers is 34400 PE is not executed then y the hell 14700,14800 are executed.

14850 , 14950 which is the faraway strike buggers , y 14950 is executed and y not 14850.

i ask for refund and they says exchange prob .

support team tells the same f***ing story for everything. now tell me this is my fault or urs?..

When high volume and volatility happens they loot ur money simple says tech glitch .

DECIDE UR SELF GUYS.. ……zerodha tho app ko zero karake bhagayega…. t

34400 PE (bcoz its a sell order and making losses on it) is not executed

but 34500 PE(bcoz its a buy order making profits on it) is executed.

and they executed 34500 PE and they hold on to 34400 PE (cancelled execution) they increase the price and executed . this is how they make money and loot common man hard earned money.

sir ,we make profit once in a decade even though ur not willing to give then what else can we do here.

How do I exit my position in Nifty option, it shows “The price out of the current execution range”

You’ll have to wait for the exchange to update the execution range in such instances.

Maine put sell kiya 10900 ka 20rs me.

Stoploss rakha 40rs and limit price 52 thaa. But ye execute huva 64rs me.. Itna to mere account me balance bhi nahi the… Or jaha stoploss lagaya thaa waha likh ke aaya the price is out of current execution range. But ye 40.5 se 45 tak trade kiya thaa.. To mera 40 ra me execute hona chahiye thaa na… Yaa 40to 45 takk me… But ye kyo nahi huva.. Plz reply.

Hi,

Facing this issue in CO SL Trigger. When I wrote an option for Rs. 35.35, with initial SL as 42, it went through. Now as I looked to change the SL, it says, ‘The stop loss trigger price is beyond the allowed range of 20%. Try a price within the range.’ Actually, I could not change my SL to 43 when the price was trading at 40.

This has been happening many times, I checked with entering different prices but to no avail.

Please suggest a solution, or please explain what is this 20% allowed range.

As according to this article, all options below Rs. 50 should have absolute range as +-20 of Reference point, but this does not seem to work here.

Lokendra, CO Sl can only be +/-20% from the LTP.

What the hell is this error. I don’t encounter it while buying. Have encountered in the last many expiry day trading. When making losses your zerodha portal easily executes orders. When someone is making profits you guys block those orders saying out of current execurion orders. What the hell! Today expiry was spot on bought 21600 CE at around 18 rs premium. Then was trying to sell when it went up around 35 – 36 it got blocked. Then it came down a bit to around 27 something it got executed. Why is that.???? You want traders to just put in your brokerage money and make revenues for you guys huh!!! and personally we make losses huh!!!??? You don’t want them to make profits.You guys should answer this

I placed the Bank nifty option sell call at price x which trading at that time. My sell order got cancelled even when it is at that price x.

how can it be possible?

it is trading at x price and placing sell order for same x price. It has to accept the order. If it is ill-quid (no Buyers) then should keep it open order why it is cancelled.

If the price out of range then how it is trading at that price?

Looks like Zerodha doing double game here.

Thanks,

Chidanand

I am able to provide all the required proof. Zerodha Customer care peoples simply they will put everything on exchange. This issue is due to exchange.

If it is exchange issue why can’t Zerodh go ahead and raise complaint against exchange and get resolved it. They won’t do that because, they know that they are doing all this game.

By reading all others comments it is 100% clear that, Zerodha is not at all good for traders. Looks like they are playing double game with traders.

One more point I want to bring to the notice of traders and Zerodha.

SO many times, e.g. If the BN option trading at rs 2.00 and I am able to place order at rs 30.00. Now tell me where this rule is holding here?

Today BN 21800 CE trading at 38.35 and I placed sell order at 38.35. It got cancelled saying “17070 : The Price is out of the current execution range”

Now why this rule is holding here even when price at 38.35 and order is at 38.35.

I think something is fishy.

today i was trading in banknifty options banknfty June 20500 PE i had purchased 1 lot at 112… after a few hours bank nifty spot went up and the same 20500 PE was available at Rs 70… I tried to buy the Bank Nifty PE at Rs 70… Zerodha terminal gave me a message the order is rejected..There was no margins issues… i had enough money in my account… later on The banknifty PE recovered and i would have been in a position to exit my trade at no loss… but since zerodha cancelled my order i had to suffer a loss… i never faced this problem with my previous broker… First of all options trading is risky… and then zerodah rejections one is at a disadvantage and will lose money further…secondly zerodha does not a allow to buy OTM options …so the zerodha platform is not meant for traders to make money… but to lose their money…

Hello Nithin sir,

Today I was holding BN option under cover order. When I tried to exit in profit, it cancelled saying 17070- price is out of current execution range. As its CO, there was no way out and SL also cancelled. Quantity was less luckily. This would erase whole capital. How often does this happen? Does using NRML instead of BO/CO will help? And in NRML will SL be still in the system if this happens? How can I exit my order after I get this message without contacting customer care (by the time we call and they respond, we would go to deep red as options are momentum trade)

Please don’t igone. Help me!

Hi Nitin,

Suppose i want to sell share X at limit price 851. CMP is 840.

But trade execution range for stock X is 750-850.

Q1. When can i expect (at what CMP) trade execution range to change so i can place an order for limit sell at 851?

Q2. Or is it that trade execution range for a day is fixed – permanent for that day?

I didn’t get the concept, since options prices are so volation, this range is very meagre, if we talk about today, and 20th Sep, call options were 5000%, 500% up.

Today I tried to exit my open positions made on Friday at around just the market open when volatility is high, I had long calls for Nifty Sep 11600, 11500, 11700 and they again and again got cancelled. These contracts have the best liquidity still why?

Only after like half an hour when price came down they got executed. Can somebody please explain why this is so?

Tanmay,

The exchange came up with the execution range mechanism to handle fat finger trades placed at erroneous prices.

However, the mechanism of revising the execution range is not perfect. It gets updated based on the average prices of trades in the last 1 minute, which if there aren’t any trades, doesn’t get updated. This is the issue you faced on Friday when there was a sudden move.

We’ve tried to explain this in this support article.

What is the Strike price & Spot price in case of Options trading? Also let me know why the option orders are rejected with the reason that Strike price is outside the allowed range & try a strike price closer to the spot price. This happened in my case though I was placing Buy order in Bank Nifty 14 August 28500 CE at the price it was trading at that point of time.

I suggest you check out this Varsity module for an answer to your first question. For your second question, your order would have been rejected because there’s an exchange restriction on the total OI a broker can hold. Due to this, we have to limit the range of tradeable strikes. Explained in detail here.

I am trying to buy out of money put for BankNifty for 29000 strike. But i am getting the same message whether i try it for Mar, Apr or May expiry. –

BUY 20 x BANKNIFTY MAR 29000 PE is rejected.

Strike price is outside the allowed range. Try a strike closer to the spot price.

BANKNIFTY19MAY29500PE buy order also received same message.

Please guide me regarding the range of puts that i can buy which is acceptable.

Today morning I bought 100 quantities of BANKNIFTY13DEC1827000CE @ Rs.49.1. Later at noon when I tried to buy the same qty again at price Rs.44 (in fact I tried different price between 43 and 49), getting rejected each order immediately with below reject reason.

RMS:Rule: Option Strike price based on Ltp percentage for Buy Orders for entity account-YL9667 across exchange across segment across product

can you explain the reason with the above scenario ?

Hey Rony,

This is explained here on the Support portal.

my F& O order get cancelled even my funds are available.Like LICHSGFinance 400 CE,JSWSTEEL sep 430 CE.

what is the problem.

Hi, Does this mean that if someone purchases say a 5Rs OTM Call option on BankNifty (lets say at whatever strike), will this person have any upside capping to the gains due to this rule i.e. will his payout get capped at say 100,500,1000 or it will truly be unlimited as it should ideally be in case of call options. Kindly clarify

Today i placed an order for 1 lot of TATAMOTORS18APRFUT, but it was rejected.

Why it was rejected.

What was the rejection reason you received?

Sir,

Thanks for giving an opportunity to put such queries for layman investors like me.I sold banknifty 24000Sep 17 PE @25.45 IN BRACKET ORDER WITH SLM OF 20 POINTS AND TARGET ALSO 20 POINTS QUANTITY 520 at 10:04 hrs on 27 September. Upto here all was in order at around 10:30 I noticed that in my a/c MTM WAS increasing and in order book target as well SLM order was vanished and it was not shown in trade book also.Hence I contacted broker’s helpline who confirmed that both the target and SLM order are still open,On my instructions which was closed at market price of 110 which resulted me a loss of around 42000 RS.

Now broker replied me that order was cancelled by NSE with error code 17070 order beyond execution range.I have fwded the complaint to NSE also How exchange can cancel the order without informing me or my broker.The loss could have been to 3 lacs if I had not taken the initiative to call helpline.Nobody informed me about the order cancelation.Now who will bear the loss Either NSE OR BROKER OR INVESTOR.

PLEASE DO REPLY

I can’t commit on this without knowing both sides of the story.

Hi,

I had purchased 1000 banknifty 24700 CE 21SEPT17 (high volume option on a weekly expiry day) expiry in the morning, in some time(10:01am) of the day, price moved to 32. I hit the sell button with price 18, thinking that it will get executed at best price. But the order got cancelled even at that time the market price was between 23-24. The error was same as mentioned out of execution range. can any please explain why so, wanted to take this to Exchange, since i am not convinced.

Menakshi, it is explained in the post above. Exchanges don’t accept orders above or below a certain price, usually 20 to 25% above or below.

Sorry, i didn’t understood.

20% to 25% above the purchase price, or previous close, or prevailing price?

Suppose i have option @ Rs.2 , and cmp is 24 ? Will it not accept selling order @ 18 ?

Yeah it is 20% of the CMP. Check the exchange circular in the post above.

Ok, thanks,

Sir suppose in bank nifty weekly expiry 23600 CE price is rs15 ,23500 PE is rs20.and I want to buy when it goes CE 17.60 or PE goes 23 then my limit order execute what I do to execute the limit order my order is executing in market order.

You can use stoploss orders to enter. So SL-M buying order with trigger price at 17.6, only when price goes to 17.6 will it buy. Check this video.

Sir today auropharma closed in NSE at 835 and in BSE it closed at 832. Sir I have 2 doubts.today can I buy in BSE and sell tomorrow in NSE.Another doubt is since it closed high in NSE today when compared to BSE, is there any chance the price of Auropharma will godown in NSE tomorrow.or will there be any chance prices gets same in both exchanges tomorrow.please explain the concept clearly

Check this answer: http://tradingqna.com/2163/arbitrage-buying-equity-nse-and-selling-it-bse-is-it-possible

Sir today suppose I buyed Banknifty 19700 September call optionat 78. And tomorrow if banknifty raises by suppose 500 points can I put AMO order in morning for aroundRs. 300 sir.whether my AMO orders gets rejected.bank nifty options are liquid

If you put as AMO it will get rejected. Every option contract has a range within which you can place an order. But you can place that order once the market opens.

is there and cap on the number of lots one can buy in the nifty options index. suppose i want to by a 21000 lots of nifty 9000 at strike price of say 50 and later sell the same at say 50.10. what are the possible difficulties that i may face due to circuit breakers?

Per order limit is 7500, but you can buy as much as you want in multiple lots.

why my orders to sell futures of JUST DIAL July 2016 were rejected today 31 may 2016-tuesday by 3.15 PM to 3.30PM ( for price 640,638.55,640), though there were purchasers at 640,638,625 and seller at 645 also for reasons “The price is out of current execution range “, though the prevailing price was much above for that contract at 645, underlying price of equity just dial was 677 at that moment , though today’s low of equity just dial was 640.50 at 9.29 hrs , high of equity just dial was 680.90 at 14.25 hrs, though i could manage to sell 2 contracts of just dial July 2016 earlier at -626.85, and -641.35, kindly put your views…why this happened

Best if you send account specific queries to [email protected]

Hi,

Today i have bought AMTEKAUTO CALL Option with strike price 50 at 0.80 and when i want to book profit at 32 pi is not executed my order with message “17070 : The Price is out of the current execution range”.

After trying so much time finally i booked my profit at 9.80.

So why my order is not executed at 32 when i was on profit of 58000 Rs.

I lose my profit of 58000 Rs due to this message and booked profit at 18000 Rs.

I have attached my order details, please check why this happened.

Please find the attached copy for your reference.

Waiting for your quick reply.

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 2000 2000 0 9.8 0 complete

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE MKT SELL 2000 0 0 2000 0 0 cancelled 17070 : The Price is out of the current execution range

NFO NRML AMTEKAUTO15SEP50CE L BUY 2000 2000 2000 0 0.8 0 complete

Anant, NSE has a price limit set in the system. When the option price hits this limit, NSE doesn’t allow anymore trading in that contract. Similarly on Aug24th when markets crashed, a lot of put options were not trading for almost 20 mins. Check this: http://tradingqna.com/19211/how-upper-circuit-limit-for-nifty-options-set-and-managed-nse

I believe this wont be impacting much for the ‘At the Money’ Nifty contracts because they are the most liquid F&O trading in India..

Correct me if I am wrong.

Thanks..

You are correct.

Hello sir

I have faced at ATM contract also.

And same report to your team.

Kindly elaborate .

NSE vide circular 26762 has implemented this mechanism for all near month contracts too. Reference: http://www.nseindia.com/content/circulars/FAOP26762.pdf

hi nitin sir

reference price system yea liqued contract par bhi aplicable hai

ager main koi contract 1 month pahle sell karta hue (@100 rs. preamum banknifty) to use limit order pe buy kar sakta hue ki nahi after 20 day (@10 rs)

“sorry mera thoda english acha nahi hai”

Yes you can place limit order at Rs 10, if present month contract.

Thanx sir

Hi team, I tried to buy banknifty Put option for strike 30000 today for May expiry as well as tried to buy Banknifty put option for strike 29000 however both of these got rejected stating that strike is outside the allowed range, but I was able to buy same option for strike 29000 on 23rd May, why so?

This is really very annoying

Please call me to discuss the issue as I want to understand in details what is restricted & why only at some interval

Many Thanks,

Samir savla

09892842838

Hey Samir, explained here.

Okay, that clears it up for me. Thank you so much for the personal attention and great support. Really appreciate it man.

Thanks Nithin for this explanatory blog post. Any reason why the reference price is not applicable for the same month expiry? (Apart from the fact that they don’t have liquidity issues and lower volumes)

Also, if i understand this correctly, i can assume the likelihood of the following scenario:

Suppose i am sitting on profits and holding 100 lots of 7000 CE call (trading at Rs.294), and tomorrow i want to close my position by putting a MARKET sell order when it touches Rs.300, so assuming that the reference price system is not applicable, i could get a fill of anything below Rs.270 (10%) also for some or all of my lots?

I guess very soon it will be applicable for the same month, as many stock options are quite illiquid.

Yep, as of now without an execution range, if you place a market order it can basically get executed at any price where the liquidity is available (anything below 270 also).

is this supposed to affect only those who use Market/SL-L orders or even those who use Limit order?

If you are placing a limit order, you would know the price, so wouldn’t affect unless you do a mistake while placing the limit order. For example assume a certain call option best offers are 1 lot at Rs 30 and 20 lots at Rs 60, if you by mistake place a limit order to buy 20 lots at Rs 60, you could have still lost quite a bit as 1 lot would get bought at 30 and the rest 19 at 60. But with the new execution range, 1 lot will get bought at 30, but the rest of the order will get cancelled as the price available is above the execution range. The execution range in this case would be 24 to 36 ( 20% above and below 30).

Can we trade leap nifty options in zerodha ? Its span margin is same as near month margin ?

Yes you can trade long dated options. Margin required increases with time value of the option contract.

Hello Nithin Sir

At the outset let me congratulate you and for all the wonderful work you and your team are doing. I am a huge fan of Team Zeordha .

I mostly OTM Options. I have spoken to your people a couple of times but have not been satisfied by the answers provided ( i am sure they are only saying what they are empowered to do/say )

Today, 08.12.17, I wished to write a Jan’18 Bank Nifty 27000CE @ 64.90 ( the rate had already been traded at and there was a buyer and seller at similar rates ) , but due to limit restrictions my order would not go through. Similarly for the 23500PE. They suggested i should write at closer strike prices but then i am not willing to increase my risk.

There are no margin issues, others are being able to trade at the rates and i am not increasing any risk as i am Deep OTM. I wish there is a way to resolve this.

Thanks & Regards

Not right now Hiten. The exchange has a regulation that states that a broker can have only 15% of the marketwide OI as open positions for all his clients combined. As such, we’ve had to restrict the strikes our clients can trade so we don’t hit this limit (no other broker has ever hit these limits for index options). If we do hit this limit, nobody would be able to trade these scrips and that is a worse situation. We’re in talks with the exchange to find a solution to resolve this.

Did we get any solution for this?

We have found a workaround. Create a ticket on our Support Portal and someone will get in touch.

Today, We tried to sell Bank nifty option “BANKNIFTY16AUG1828400CE NFO” @ 09:21:12 and it got rejected multiple times..

Rejection reason “RMS:Rule: Option Strike price based on Ltp percentage for entity account-RN3971 across exchange across segment across product”.

And this happens very frequently.

Because of this we may have to enter into more nearest stike price, which increases the risks? Could you specify the reason and login behind it.

Mr Nithin, what is wrong with you/Zerodha, you have blocked all OTM option buying, where as same strikes can be bought with other brokers. what are you trying to achieve exactly. I am missing golden opportunity to make profit in option buying due to this scrap rule of yours. on top you have trained your help-desk to lie saying its from exchange, then how come other brokers are allowing it. Please answer, just dont walk away.

I met with the similar problem where I was about to achieve good profit while this irritating message ” The price is out of the current execution range ” appeared when ever I tried to place the order when the range was in good profit and it got completed only when the range was close enough to buy price causing me total upset wth ZERODHA. what kind of logic is this when others made good profit risking 10 and thousands of money while I got nothing. Also I request zerodha to immediately sort out the popup stating ” placed ” and we get no either cancellation or completion of that trade yet keeps on waiting. Please fix this issue

hi nitin sir,

can you please suggest how to over came this issue. suppose we put direct mis (normal order) it have no issue right.and as liquidity i buy atm but error geeting “The order was cancelled by the exchange because the price is outside the current allowed execution range. Read more. “