Introducing Margin Trading Facility (MTF) on Kite

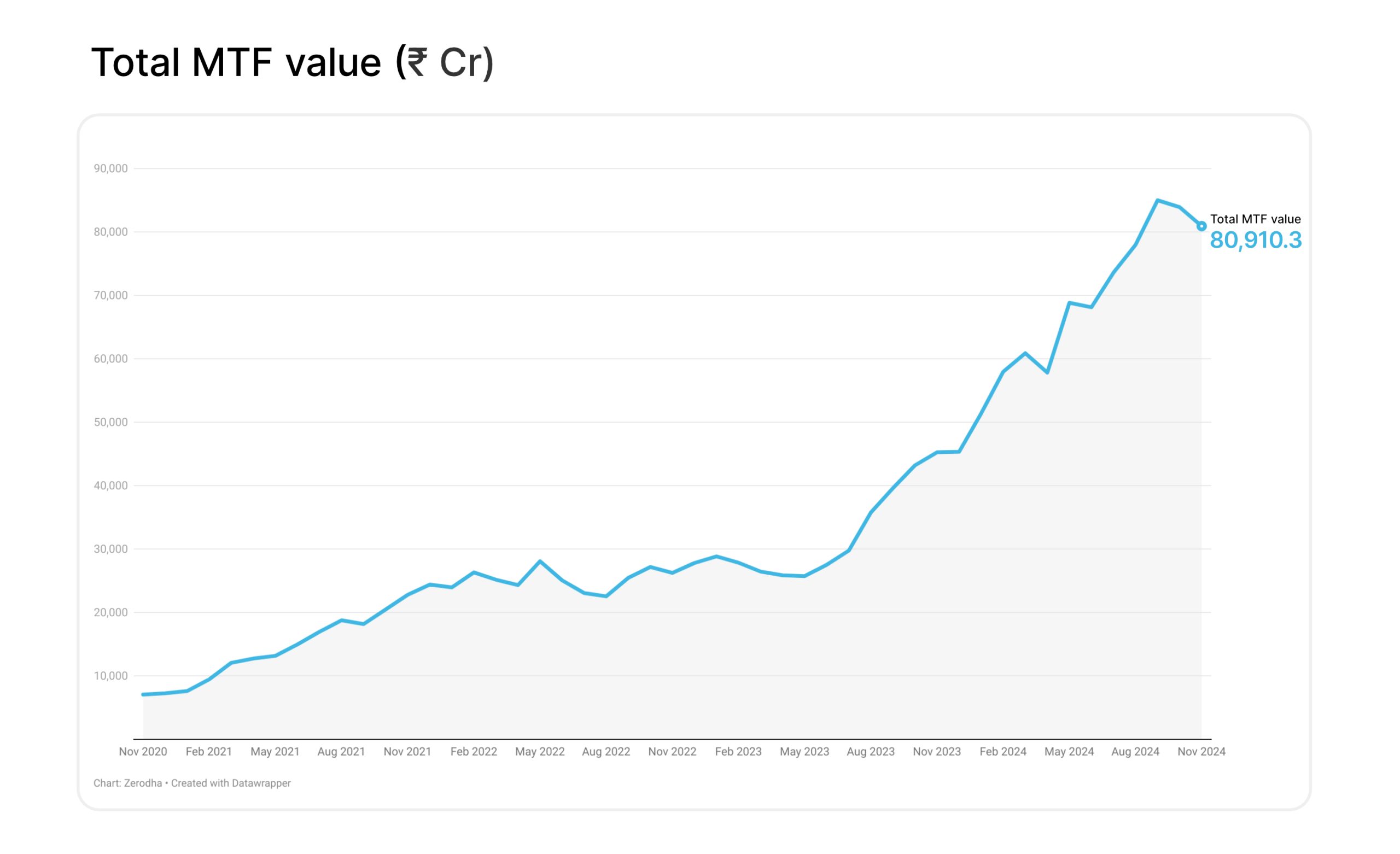

We are happy to finally announce the launch of MTF (Margin Trading Facility) at Zerodha. This one has been a long time coming and is probably the most frequent feature request we’ve received over the years. We were caught up in two minds about whether to offer MTF or not. But eventually, given the pace at which it is growing and what is happening to derivatives in terms of contract value going up, we had to. Also, it made no business sense for us to be the only big broker to not offer MTF.

Growth of MTF book across the industry.

What is MTF?

MTF allows you to trade using leverage. With it, you can buy stocks for delivery even without the full funds required. Depending on the stock, you can borrow up to 80% of the trade value. An interest rate of 0.04% per day (Rs. 40 per lakh per day) is charged on the borrowed funds until the MTF position is active.

Here is a list of stock-wise leverage provided at Zerodha. The minimum margin is determined by the exchanges, and brokers can block over and above this as per their risk management policy.

Enabling MTF

Since MTF is a leveraged product, you’ll have to explicitly enable it for your account to use it. If your account has PoA or DDPI enabled, MTF can be enabled instantly. If not, enabling MTF takes about a day, but we are working on making this faster. Here are the steps to enable MTF:

Placing an order

Placing an MTF order on Kite is the same as placing other orders. Just select the MTF option on the order window and place your order as shown below. You can hold your MTF positions for as long as you want.

Monitoring your MTF holdings

Once you buy a stock with MTF, you’ll see it in your holdings with a small “M.” You can also use the filter button to select only MTF holdings. This is available on Kite mobile and will soon be available on Kite web.

Console reports

MTF interest is charged on a daily basis, and you can keep track of this and the margin required on the Console MTF statement.

Risks of MTF

Leverage is like a weapon of mass destruction, and MTF is a leveraged product, so trade with caution.

With equity delivery trades, time is in your favour. Since you can hold a stock for a longer period of time, the price of a stock can recover. With a leveraged trade, time is acting against you because there is a cost to holding a stock bought via MTF. Each passing day costs you 0.04% of the funded amount. The longer you hold, the more this eats into the potential profits. Also, if the stock price falls, you have to bring in additional margin money to continue holding the position or you have to close it.

At Zerodha, we have never triggered people to trade. If anything, we’ve discouraged people from trading through nudges and all our educational initiatives. This will remain the same with MTF as well, and we’ll never push you to borrow and trade.

Why charge interest?

Leveraged trades also bring a lot of risk to the broker. If the cost of funds is 9.5% to 10%, we have to charge over and above this to compensate for the risk associated with the trade.

MTF has a higher interest rate than LAS (loan against security) provided by our NBFC Zerodha Capital at 11.5% because the margin provided is much lesser for LAS, and hence, the trade carries significantly less risk. For LAS, the haircut or loan provided against security as mandated by RBI is a 50% minimum. For MTF, it is up to 20%.

And the loan taken against a security (LAS) is not supposed to be put back in the stock markets.

Other charges

- Brokerage: Brokerage: 0.03% or ₹20, whichever is lower per executed MTF order. From 1st March 2025, the brokerage charges will be revised to 0.3% or ₹20, whichever is lower per executed MTF order.

- Pledge and unpledge charges: ₹15 + GST per ISIN per pledge, and ₹15 + GST per unpledge request.

- Square-off charges: ₹50 + GST per order squared off by Zerodha.

You can read our MTF policy here.

what is this

I need conversion of my MTF shares to CNC by providing funds in my accounts as market came down 20% and my portfolio also came down heavily.I do not wish to pay interest for a long time to MTF., till my purchase price comes at the same time do not wish to sell at a loss.Please advise me further steps.My code SKR 690

Hi Ganesan, currently you cannot convert MTF to CNC/MIS or vice versa. https://support.zerodha.com/category/trading-and-markets/margins/margin-trading-facility/articles/margin-trading-facility-mtf-faqs

MTF Feature is Best for everyone but it is risk Without maintenance your Funds Balance

Can I my mtf stock position convert to cnc delivery

I don’t think so it is possible. Just refer this article – https://support.zerodha.com/category/trading-and-markets/margins/margin-trading-facility/articles/margin-trading-facility-mtf-faqs

I have hold OIL, UGRO CAPITAL, Zomato on mtf order.

Now I have to verify it.

But I am not provided the facilities to authenticate the orders placed today during market hours.

The same problem happened on Friday.I could not verified it. Because of it I had to add money.

I am not getting the facilities of MTF.

Plz sort out my problem.

Hi Pradyut, could you please create a ticket at support.zerodha.com and elaborate on your issue so we can look into this?

Sir namste I’m buying today Mtf shares but I’m haven’t cdsl otp

Hi Rekhambika, this will be auto-pledged now. You will no longer be required to authorise your MTF purchases with the CDSL OTP. More here: https://zerodha.com/z-connect/general/sebis-new-rules-for-direct-payout-of-securities-whats-changing

I am unable to activate MTF as while creating DDPI request I am getting error. I have raised support ticket #20250219409883 FIVE (5) days before, But Customer care did not resolved my issue yet. Please help as no one is taking care so solve my issue

After buying shares using MTF cdsl OTP needs to be given before 7 pm for pledging shares. Has the condition of OTP been now removed?

If I buy through MTF and sale on same day what charges will be imposed

Hi Biplab, interest will not be applicable for MTF intraday. More here.

Whether you apply FIFO system in your across the product or separately ?

Hi Dipen, couldn’t quite get what exactly you are referring to. Could you please elaborate and provide more details?

Dashboard for MTF has to be improvised further, although there is a lot which has come in and is appreciated.

1) MTF holdings visibility.

If I have 100 reliance shares in cash holding and 100 reliance shares in MTF holdings . Even if you select MTF in filter , you don’t get to see only MTF holdings status .

2) PNL visibility in holdings .

There should be a visibility of charges and interest occurred against each MTF holdings and projected PNL at the market price to give required clarity on the MTF holdings .

3) MTF summary in console should also reflect the interest and other charges incurred .

Hi Vijesh, these are on our list of things to do, will keep you posted. Thanks for the feedback.

Can I use mtf for ETF transaction?

Hi Madhukeshwar, yes you can. Check out the approved list of securities for MTF.

Is MTF available for NRI’s too?

Hi Alex, MTF is not available for NRI’s currently.

Hi,

Suppose I have 128 shares of Asian Paints; 100 in mtf and rest 28 in cash, is it possible to sell the mtf stocks separately? if yes, will it take the mtf buy price or average buy price?

Dividend, spilt bonus etc corporate actions available on mtf shares?

On the Risks, will Zerodha square off the positions if the entire capital from the client side is wiped out or comes to a very low level after taking a position

Will you not give an option to convert that position to NRML by settling the remaining margin and charges

e.g., lets say I take a long term position and stock rises slightly and then dips significantly, for a long term investor he will leave it as is (there is a chance that Zerodha will square off) after that dip lets say the stock moves on the higher side from that dip

when will you charge the interest, is it after we exit the positions or your square off or is it deducted daily?

I am not able to buy stock with mtf even though it is mentioned in the list of approved stocks

Could you help with it

Hi Manisha, could you please create a ticket at support.zerodha.com with more details so we can get this checked?

Why MTF is not enabled in Zerodha kite?

Please enable the same immediately.

Hi Uday, we’ve explained how to enable MTF on your account here..

I am planning to shift my MTF from HDFC SKY to Zerodha because of Stop Loss features absense in HDFC SKY

Will I get STOP LOSS option for my MTF holdings?

Hi Prathap, stoploss is available for MTF just like regular stocks.

Hi, why the pledge authorization time limit is only 7 pm? On ICICIDirect I get time till 10 pm i.e. they allow us to authorize the pledge request up to 10 pm. So it is not an exchange mandate I believe, you have set the 7 pm time limit for your internal reasons. I have a personal constraint to make it before 7 pm regularly and it will really help me if you can extend it at least by an hour. Possible?

I trade with mtf for delivery. I got margin for trading, and which margin i have used is showing in negative in zerodha account. Example I bought xyz stock for longtime with 80% margin. Now money of 80% margin are showing in negative in my zerodha account

Hi, Why We don’t have feature to convert MTF share/delivery to CNC once we have money. suppose my fund is blocked somewhere so I bought using MTF so I should be able to convert to CNC once i have fund and you can charge for that period when share was in MTF. If we take it lil harshly its more over looking like money making machine for you and to get stuck in MTF game for a retailer. Can we expect something like this in future where we able to convert MTF to Normal delivery once we have fund to hold them as normal delivery ?

Can I place gtt for MTF

Hi Lalit, currently, GTT orders for MTF are not available. It’s on our list of things to do. We’ll keep you posted on it.

you have cancelled some etf for mtf (means no funding). Is it available in future?

Hi Hardeep, you can find the eligible stocks for MTF here. Could you please let us know which ETFs you are referring to?

0.04 percent will be charged as trading session…means in one week there is 5 days trading only.

2. about pledge share- if I buy share with MTF as cnc so it is also mandatory to accept pledge share?

Hi Jay, interest on MTF is charged on all days, including holidays.

Yes, it is mandatory that if you are purchasing shares via MTF, those stocks must be pledged. We’ve explained what happens if you don’t here.

Following facility should be provided. Selling of mtf shares in auction which is held in nse from 2.30 to 3 pm. I mean such shares which have been bought using MTF

I have purchased stocks through MTF but now there is no option to sell them through GTT or AMO. How can I monitor every second to sell a stock? Zerodha should provide GTT option for MTF self orders as well.

Need of ddpi definitely requires re consideration by Zerodha. I mean there should be no necessity of ddpi. If I have to use MTF facility only 3 days in a month for that I have to enable ddpi on a permanent basis. If a person wants to use MTF facility for Rs 50k he has to enable ddpi for his entire portfolio irrespective of whether portfolio value is 1 lakh or 50 lakh. As per my limited knowledge enabling ddpi will make things easier for cyber fraudsters. Few years ago I used MTF facility of another broker. There was no need of POA or ddpi. I think ddpi didn’t even exist at that time

Suppose I have bought 20 shares of reliance using MTF. After few days I want to sell 12 shares of reliance. Will I have to go through process of pledging 8 shares again. Will I have to pay pledging charge once again. What if I place limit sell order for 20 shares but only 12 shares get sold

If I have an MTF position can I place limit sell order for those shares or shares will have to be unpledged first

If I have an MTF position can I sell those shares in auction which is held on NSE from 2.30 to 3 pm

I have reliance shares in demat account. If I sell reliance shares on delivery basis will the money become available to buy reliance or some other shares using MTF, on the same day. If I already have an MTF position and I sell that stock will the money become available on the same day for purchase of shares on delivery basis

If I buy ETF using MTF, can I sell it on the same day

Hi , Is there any loss limit % (Meaning do we need to add any % drop from buying Price) to add additional margin as MTM (Mark-to-Market) requirement on long term positions? because you said MTM margins are reset each day.

Good decision to allow MTF

Hi..

If I am not pledge shares by given time what will happen to my share can you concert shares in to cnc holding or you automatically squere of shares

There should be option to disable MTF as well. As of now it’s one way option

Do we need to have liquid cash and if not required can we carry it for 90 days

I had enabled MTF and how to disable MTF in my account if do not wish to use it?

Hi Darshana, currently it is not possible to disable MTF. This option will be available soon.

My AC YY1061 doesn’t show MTF order on kite , does it require any activation process?

Hi Dinesh, could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

How long I can hold mtf stock

Hi Kallesh, you can hold the MTF position for as long as you wish.

Many brokers give this facility

Sir,

How many days i holding one share days through MTF. Some securities given MTF 365 working days after share purchase. Please clear.

Hi Sankar, you can hold the MTF position for as long as you wish.

Very good Idea. I will use it please tell me how to operate the A/c please send details Or tell meyou give limit against our holdings For intra day

Hi..

Assume I’m bought 1000 shares of Rs. 100/- Each worth Rs. 1,00,000/- (1.000 * 100) for long term. I have funded Rs. 20,000 and used MTF for balance of Rs. 80,000/-. Say, in the interim share value decreased and came down to Rs. 80/-, thus total value decreasing to Rs. 80,000/-. What are the sequences in this scenario. To be clear, Zerodha initially funded 80,000/- (80% of the purchase value) and now the value is Rs. 80,000/-, Zerodha’s margin will be only Rs/. 64,000/- (80,000 * 80%). still can i carry the same positions for my desired period or should I pay additional margin etc

Hi Venkatesh, you will have to bring in additional margin to meet MTM (Mark-to-Market) requirement. We collect mark-to-market (MTM) margins daily based on the buy price of your positions. These MTM margins are reset each day, and new MTM margins are blocked. MTM is collected only on losing positions and not on profitable ones.

What is your repayment condition if someone wants to pay full amount in future date

Hi Sagar, currently this is not possible. We’re working on it.

Hello,

I have few questions.

1) How will system collect interest? Daily or on squaring off? (Other who offer MTF service don’t charge interest for first 30 days or 23 trading days)

2) What will happen if there is some corporate action like split or Dividend?

Thanks

Hi Jagdish, 1. The interest is collected daily at 0.04% on the funded amount. 2. Corportate actions like bonuses, splits, dividends will not affect your MTF position and you will be eligible for all benefits. However, in case or mergers and demergers, you will have to square-off the position before the ex-date.

Getting below Error while enabling mtf.

Error updating: Error processing request. Try again.

Hi Bharat, we’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

Sir,

How many days i can hot shares buy through MTF

Thx

Hi Shyam. You can hold shares purchased using MTF as long as you want. An interest charge of 0.04% per day(₹40 per lakh) will be applicable on the funded amount The charges will apply from T+1 day until the stocks are sold.

at one time how many shares can we buy with MTF leverage amount can we buy multiple shares ?

Hi Sojwal, the number of shares you can buy depends on the margin multiplier available for the stock. You can check out the approved list of securities for MTF for details.

Hii this is sojwal

I understood everything but if you give us one example with one stock then it will be more helpful for all the broker

Hi Sojwal, you can check out the example scenario here. If you still have further clarifications, please create a ticket so our team can reach out and assist you.

I BUY TWO 50000 SHARES scripts. kindly tell me how to pledge them? i cant see any pledge request option from no postion or holding tab in console. i didnt even recived the pledge request yet , kindly explain how this pledge works for MTF its so much ocnfusion

Can we use MTF for Option selling

Hi Umakant, MTF is available only for equity and not FNO.

This too much batter for the traders

As per statement of Ms Shruthi zerodha will square off mtf position if share price falls below a certain level. What I understand is that in case of March 2020 like fall zerodha will square off all mtf positions even if I have cash in my trading account. It seems terrible. Please reply

Hi Mahesh, as mentioned, if the losses in MTF positions cross 80% of the funded amount, it will result in an RMS square off, even if the user has free cash.

Sorry Zerodha, you shouldnt be happy to launch this product, but should be utterly disappointed to give in to the FOMO. Do you really believe the so called retail investors like us are able to make more than 15% XIRR return by directly investing into stocks? Yes, this is the interest you will be charging in MTF. So even if we make 15% pa, net return we will earn on this leveraged trade is ZERO.

I cant complain to other brokers for this product, but Zerodha, who has always claimed that they want more profitable retail investors so that they can remain long in the game and in turn be an asset to Zerodha, this particular move is absolutely against that principle.

for how long you can retain the stock if the stock price go below you cost price.

Hi..

Assume I’m bought 1000 shares of Rs. 100/- Each worth Rs. 1,00,000/- (1.000 * 100) for long term. I have funded Rs. 20,000 and used MTF for balance of Rs. 80,000/-. Say, in the interim share value decreased and came down to Rs. 80/-, thus total value decreasing to Rs. 80,000/-. What are the sequences in this scenario. To be clear, Zerodha initially funded 80,000/- (80% of the purchase value) and now the value is Rs. 80,000/-, Zerodha’s margin will be only Rs/. 64,000/- (80,000 * 80%). still can i carry the same positions for my desired period of should I pay additional margin etc….

Awaiting your swift response.

Thanks in Advance

If I have eg 50 shares of reliance in demat account and if I sell those on delivery basis can I use that money to buy reliance or some other shares using mtf on the same day. In other words if I sell on delivery basis reliance shares worth Rs 50k can I buy using mtf on the same day reliance or some other shares worth say 80k or 1 lakh

Sir

Pl.extend this facility for IPO application also.

Thanks

Patil

Can the shares bought using MTF be sold in auction which is conducted in nse from 2.30 to 3 pm

Dear Sir/Ma’am,

That is good you have announced MTF facility. My query is – Can we do intra day or BTST trading in cash market with shares bought through MTF?

I hav already purchased equity’s stock and I want to convert it in MTF so it’s possible ? How’s my limit increase ?

waht f i take mtf, as i can trade intraday, square off at the end of the day, do i get margin, say for example, i found selling opportunity a for tcs at 4217, if i would have squred off at 4165 some 50 points, do you give margin which you used to give earlier?

Hello,

What if I purchase some stocks of worth 10L Rs so zerodha will fund more 40L for the stocks, so in total now i have shares worth 50L & then the stocks are Pledged of worth 50L.

Will I get some of the funds to Use them again in F&O trading, To Sell

options, As I already Hold some of the equity and those are already pledged and Im using the amount to Trade options.

Awaiting your response

Thank you

Hi

I hold zerodha account. I have some shares I bought in CNC. I pledged them already for using for intraday.

Can i buy stocks as MTF with collateral margin which I already have now

Thanks

I am a Muslim and cannot avail this facility as it charges interest… What I suggest is you charge the same percentage.. but just call it charges and not interest.. that will help us

Investing own money in stock market is

a gamble, where we lose peace of mind.

In view of prevailing PROFIT BOOKING

TREND, for every 1000, 2000 points raise

In NIFTY, already we lost profit & PEACE

Of mind. MTF will aggregate the situation in

Terms of loss, PEACE OF MIND, health

Issue, more important than anything else, but

not accounted in books of Account.

Personally, I AM not lucky enough to

Beat MTF but thank Zerodha for this product

MTF POSITION HOLD 8 MONTH

TOTAL 10 LAKHS.

POSITION SQUARE OFF 11 LAKH

TOTAL CHARGES=

RECEIVED MONEY

IN MY ACCOUNT =

PLEASE ANSWER THIS

Can we Pledge the Stocks that which we bought with MTF

To record liquid cash 1 lakh is a terrible thing.

Your executive didn’t inform about thus, and now I’ve pledged shares costing 1200 loss

Disappointed

ICIC securities provides it at 9.6% int. p. a.

M Stock provides at int 6.9%p. a. while Zerodha provides at 15% p. a.

And when they charge zerodha may impose at 20% or more. Because Zerodha has no ethics and they have specialists to misguide investors. They speak one thing today and do another thing. Different people at Zerodha speak differently and cheat people.

Hi,

do we need to unpledge the MTF share by visiting cdsl portal

or does merely selling the mtf share does all the work,

and in how many days the margin money is refunded into account,

pls clear all doubts regarding selling or MTF shares

1. How many days MTF Position hold limit.

2. I am hold on 100000₹ with MTF 500000₹

POSITION hold than next week my loss 10000₹ zerodha how to handle in this situation.

i have a 1500 shares of KARURVYSYA BANK IN MY DMAT ACCOUNT

how can i using this MTF FECILITY

Previously I pledged this shares to receive the margin for F&O Trading

in the same way how can i trade in equities?

in this MTF Fecility whether Pledge my shares required or not ?

give me the clarification

tq

What, if I want to pay full amount later without selling the equity

Can I hold shares bought with MTF for indefinite period?

Hi, yes. You can hold shares purchased using MTF as long as you want. An interest charge of 0.04% per day(₹40 per lakh) will be applicable on the funded amount The charges will apply from T+1 day until the stocks are sold.

Correction. Auction is conducted from 2.30 to 3 pm

Auction is conducted at nse from 2.30 pm to 3.30 pm. Can I sell such shares in auction which I have bought using MTF

This is worst feature I have even seen.

I request you to pls discontinue this feature from Zerodha.

Thanks Shruthi for your reply. If shares bought using MTF remain with zerodha and do not get credited to my demat account then there should be no need of DDPI. OR I can be asked to pledge 1000 units of liquid case before using MTF. Few years ago I used MTF of upstox there was no requirement of giving POA or DDPI. OR zerodha should allow a person to open two demat accounts. In that case I can give DDPI only for one demat account. OR there should be facility of short term eg 3 day or one week DDPI . MTF shares in any case we have to pledge on the same day. Because of DDPI requirement I have never used SLBM

I am already holding 10 Reliance shares for the long term. Suddenly, I came to know that Reliance is expected to perform well in the upcoming days. To catch the trend, I used the MTF feature to buy an additional 10 shares. How can I differentiate between them?

I believe that in the portfolio summary, it will display something like ”M 10,” indicating that 10 shares are under MTF. Meanwhile, I will still hold a total of 20 Reliance shares. This means only 10 shares are in MTF.

If I want to sell only the MTF shares, I need to click the Sell button and select the MTF option to sell those 10 shares. Is that correct?

Hi Shiva, yes, to exit the MTF position, you need to place an MTF sell order. However, this will be treated like any other delivery trade and P&L will be calculated based on FIFO (First In First Out) method.

After buying stocks using MTF facility, do we have to pay MTM margin daily if the price of the stock purchased falls?

Hi Yash, we’ve explained what happens if the value of the pledged stock decreases here.

Hi ,

Why Zerodha is not allowing us to Pledge the securities that are in the Demat account and get Funding on the share’s Pledged.

Kindly clarify

Hi

I already hold shares in cnc at higher cost.later now I bought in mtf at a lesser rate than my cnc holdings.can I sell mtf alone keeping my cnc shares?can I sell cnc and keep my mtf.? How does this work?

good feature

Create MTF calculator like other brokers, it will be great if you implement it on contract note so we know everyday how much we will be paying.

Please describe in Hindi. some of technical words may be in English.

I am interested in MTF but not willing to enable DDPI because I think enabling DDPI will make things easier for cyber fraudesters. MTF should be provided without DDPI OR there should be facility so that I can enable DDPI only for certain scrips eg only 5 scrips out of 40 scrips which I have in demat account OR there should be facility to disable DDPI. For example I enable DDPI today and use MTF tomorrow after one or two weeks I close MTF position and disable DDPI

Hi Mahesh, currently MTF is only available for users with POA/DDPI enabled due to operational complexities. However, we’ve noted this. Your concern has been communicated to the relevant department.

Well, we have something to learn now. Thank you

It’s unfortunate that you are giving up on your principles seeing the regulatory and market conditions. Offering a WMD with a caution that it’s dangerous may not be enough. There is a reason why Zerodha is what it is, this step probably is not in right direction.

As far myself, this is a long pending request now fulfilled. Myself placed orders in Angelone with this facility against the shares pledged with limit order. If the order executed, I remit the full amount against the MTF and taken delivery. By this method, I am not transferring funds in advance, availed margin facility to place order and after execution the funds immediately transferred before 4pm on the traded date. I will check this facilities in Zerodha and then place my comments afterwards a journey of MTF trade. Thanks.

If buy trade in MTF can sell same day.

Hi Ranjan, you can carry out intraday trades in MTF.

In what scenario, Zerodha can square off the position in loss?

Hi Amol, your MTF positions will be squared off by our RMS team if the loss has exceeded 80% of Zerodha’s funded amount. The position will be squared off even if you have available free cash in your account.

Can I convert already bought share to MTF.

Hi Govinda, you cannot convert them.

What about dividends we get on stock ? Do we get it if the stock is bought via MTF ?

Since you say interest will be charged on a daily basis , will it be a compounding interest on a daily basis?

Hi Nagaraju, the interest is applied from T+1 day until the stocks are sold. We’ve explained the interest calculation here.

Is it possible to convert MTF to CNC by paying remaining amount?

As for my knowledge, if any investor want to buy stock and don’t have enough money at that time he will go with MTF option, after few days full amount will be available so he can convert into CNC order.

advantages of conversion:

we hold for longterm no need to short term tax by selling mtf order

Hi Nandeeswara, currently you cannot convert your positions. However, we’ve noted this. Your concern has been communicated to the relevant department.

If I buy and sell using MTF same day, shall I pay interest of one day ?

Hi Manoj, interest will not be applicable for MTF intraday.

Pl. give the stocks list in which we can trade.

Can we trade in etfs?

Hi, you can check out the list here.

Can intra day /mid orders covered o MTF

Can I square off the same day!

Can you charge a lower rate of interest !!

Hi Subramanian, you can square off on the same day. Interest will not be applicable for intraday MTF.

Hi

No where mentioned what’s the max holding time frame in mtf as many brokers provide it for a year’s time .

Awaiting the reply on the same .

Thanks

Hi Rahul, you can hold shares purchased using MTF as long as you want. An interest charge of 0.04% per day(₹40 per lakh) will be applicable on the funded amount The charges will apply from T+1 day until the stocks are sold. We’ve explained this here.

Can a MIS ORDER COVERTED TO MTF??

Hi Abhinav, you cannot convert MTF to CNC/MIS or vice versa.

How do you handle dividends with MTF. will I get the dividend?

Hi Carlos, since you can buy MTF stocks during dividend corporate action, you will be eligible to receive the dividends.

Will i be able to short the market and carry those short position in equity in MTF as buying poaition in MTF.

Hi Shouryaraj, you cannot short sell using MTF. In India, regulations do not allow to carry short positions in equities overnight; you can do this only intraday.

We are very interested and waiting for this facility… but Interest rate is too high 15% per annum. other brokers kotak giving9.74% and astha trade 10.99%these are small trading brokers compare with u. But why you charged that much..

Hope you reduce rate of interest less than 12 % per annum.. plz request

Ydi aap 1 lakh k capital s MTF USE KRTE HO OR LEVRAGE 4× MILTA H TO AAP 4LAKH K STOCK HOLD KR SAKTE HO OR YDI KISI DIN MARKET NICHE GIRA OR STOCK 10% GIR GYA TO AAP EK HI DIN M APNA CAPITAL JO 1LAKH THA WO KM HOKAR 60K HI RH JAYGA OR AAPKO IMMEDIATELY JO 40K LEVRAGE KM HO GYA H AAPKO OR 40K DAALNA PADEGA YA STOCK SELL KRNA PADEGA TO Y DHYAAN M RAKH KR HI TRADE KRE BAAKI INTREST OR BROCKRAG OR LTCG STCG KA BHI DHYAAN RAKHNA PADEGA 1LAKH PDA H TO SIRF 50K S HI INVESTMENT KRE MTF S

Nice to here the announcement.

I would suggest the people not to use it as savings in your bank account, it’s for positional traders, who can Having trading ability to cut losses with SL. Else hoping strategies is not going to work with Margin trading. But still interest rates are very high, should be reduced at competitive rates in comparison to other MTF brokers.

Nice 👍

Nice to here the announcement.

I would suggest the people not to use it as savings in your bank account, it’s for positional traders, who can Having trading ability to cut losses with SL. Else hoping strategies is not going to work with Margin trading.

I think this is not a good option to give user trade now pay later kind of option which pushes and have an option to take risk with out having actual liquidity.

My opinion is to think again about this option.

Please try to bring more features like GTT, I personally love GTT alot.

Can I pledge the stocks in portfolio and use the margin for MTF purchase

Hi Asha, that is not allowed. You will need actual cash for MTF purchases.

It’s a kind of trapping traders on the edge. Zerodha also wanted to play smart taking advantage of the falling market where fence sitters would fall prey to trap. Nice idea. Intelligent trader can make money.

I would like to avail this facility with immediate effect. But, please ensure that the 2A security process is ensured efficiently as I am facing the failure attempts to get through.

Hi, could you please create a ticket at support.zerodha.com so we can look into this?

Break down of 10 lakh delivery based ( MTF )

1. 30 ₹ per MTF order + GST.

2. 40₹ per Trade ( Buy Sell both ) like intraday .

3. 0.04 per day on margin money ( 20% MTF then 8 lakh

Rupees added fund . 0.04x 22= 0.8% per month.

4. Beside of this

For a delivery-based share transaction of ₹10 lakhs on the NSE, here’s a breakdown of the charges, taxes, and fees:

✔️Securities Transaction Tax (STT)*: 0.1% of the transaction value, which is ₹10,000 for a ₹10 lakh transaction ².

5✔️Transaction Charges*: 0.00297% of the transaction value for NSE, which is ₹297 for a ₹10 lakh transaction ¹.

6 ✔️GST*: 18% of the brokerage + transaction charges, which is ₹53.46 for a ₹10 lakh transaction ¹.

– *SEBI Charges*: ₹10 per crore, which is ₹10 for a ₹10 lakh transaction ².

– *Stamp Duty*: 0.015% of the transaction value, which is ₹1,500 for a ₹10 lakh transaction ².

The total charges, taxes, and fees for a delivery-based share transaction of ₹10 lakhs on the NSE would be approximately ₹11,860.46. ✔️

As of MTF itself charge 1% ( all included) 12% approximately. ( Assuming calculate for a year ).

1,20,000 ( one lakh twenty thousand ₹ )

Total = 120000+11860= 1 ,31, 860. ₹!!

The reducing of profit yet not been stopped.

If you gain 2 lakh ₹ . Then 10% + GST on profit for ( less than 1 year and 15% on more than one year )

10% of 2 lakh equal 20 ,000/- +GST on 20,000/-

If 18% is there .then 20,000 x 18%= 3600

23000 ₹ IT.

Around 1,50,000 ₹ would be rough calculated cost for

10 lakh ( MTF ) long time invester trader. !!

Just trade and earn for

1. Broker.✔️

2. NSE ✔️

3 .SEBI ✔️

4. Government IT department ✔️

5. Financial advisor ✔️

6. Charted accountant for filling purposes. ✔️

7. Paying Bill for internet , light and services ✔️

# Despite of Being SEBI itself announced that around 95% of traders lose money in the Market.

( Yet he has to be able to pay income taxes ! 🤔🤣 . )

Sir trailing stoploss facility should also be there in zerodha as other have this facility.

Hi Rakesh, thanks for the feedback. We’ll check on this.

If I already have position,can I utilize it by that position

Can we clear the MTF availed within 2/3 days and convert the stock to normal regular holding

I Think this would be going to prove another trap for

” Long time marginal trader ” ….

The Marginal Trade Fund ( MTF ) delivery data can also be cause of manipulation by operators ( big players ) .

They will have this New delivery ( pledge data ) and work

According to new strategy of trap of These Short term

( Carry forward traders ! )

Cost ,charges , taxes make it more costly

As a person invest in one stock and takes leverage of

10 lakhs . Each passing ( T+ day ) will cost 0.04 on whole

Position means 0.04 x 22 days = 0.88 nearly 1% per month including other charges and fees by SEBI + NSE+ Broker ..! If a person executed sell order after six month

Of 10 lakh ₹ MTF money . Then what impact would fall on his profit ?

For example: he gain 15% profit on stock .after six month

Break down all over. And around would be

15% – 6% = 9% actually in the hand.

That too may be reduced ..consider income taxes applied

As per investors categary!!!! 10% income taxes on profits gain in short time . If MTF trader! Has gained in 12 month

1 lakh as profit he has to pay income tax as well ( 10,000₹ as STCG or more than 1year 15% 15000₹ per lakh . So , considering this tax charges ,fees trap it is

Not convenient to the ’long term trader”.

I request Zerodha ,instead all these traps ( To me, it’s trap of taxes ,charges, fees , maintaing margin or squere off automatically obligation in it. And it’s all time hectic process. And not affordable) .

Please increase day trade margin as before .

It is convenient. 40 Times margin required on nifty Nand NFO BFO stocks.for intraday cash segment.

Such as forex , crypto and US brokers allowed 40x margin intraday trades. It will increase more liquidity

to the market .

Increase day margin as ( margin + ). 40x times .

This costly 11% metick charge and if 25 lac plus then below 10% they char15.71% thats huge zerodha

How much time margin provide ?

Is it again existing equity ?

How much is ROI ?

ARE YOU GOING TO EXIT THE POSITION IF TRADE IS GOING ON IN LOSS MORE THAN CAPITAL VALUE ?

Very good dicition.

Is mtf is 5x our money in zerodha id

Waiting for this….. finely MTF is here 😊

Can you please share stocks list with their leverage multiple ? Like how many stocks are there you are offering for MTF and how much leverage you are offering each and every script.

Hi Akash, check out the approved list of securities for MTF here.

What is the Square off charges? When will this charge applied?

My Feedback…..You are charging an interest rate of almost 15% per annum, yet you still charge brokerage fees. This means you are profiting from both ends, which is not favorable for retail participants who have to borrow money for investments. Please consider lowering the brokerage fees for retailers who has limited capital strength.

Hi team, requesting you to answer my following queries.

1) If I’m buying stocks using MTF facility by around 3:00 pm only, will this interest applicable for the whole day?

2) Can I sell those MTF stocks on the same day or on the next day?

Please answer.

Thanks.

For BTST, How many days of interest it will charge?

Hi Nitin for BTST, interest will be charged on the opening balance on T+1 day.

Can we do intraday trade or btst using MTF?

Hi Simranjeet, yes you can carry out either of the two using MTF.

It’s better to keep a toggle in existing order type for MTF . Creating one completely new order type creates one single option which cannot be combined with other order types. For example MTF cannot be combined with AMO .

Also MTF can become more powerful if you provide with bracket orders for delivery along with MTF. This will be game changer for swing traders.

Strange I just downloaded Groww App For MTF and you now tell me that you will now extend MYF. Too much to call this as a coincidence!!!

With the help of MTF, can I trade in Nifty 50?

However, it is not showing up on my app right now(MTF)

Wating for your response!

Thank you

Hi, MTF is available only for equity. Not FNO.

How did I know after enter cdsl otp pledge. Is successful or not?

It shows error ”

Margin pledge set up is not present for input PAN No.”

Interest starts from date of purchase or after some days.?

Hi Narpat, interest is applied from T+1 day until the stocks are sold.

Shall we buy intraday and later is it possible to convert into MTF delivery trades

Hi Shahid, position conversion is not allowed in MTF.

1. Will I get the dividend of the company fully whose shares I have bought using MTF?

2. Could I convert a intraday buy into holding using MTF? Depending on leverage provided on that stock.

Can I Trade ETF By using MTF Facility

Hi Madhukeshwar, you can trade in ETFs. You can check the approved MTF list here.

Suppose I have holding of stock and brought same stock using Mtf does it going to do average in holding or share seperately

It will be averaged, Kiran.

Everything is fine but intrest rate is bit high

Is MTF facility enabled for NRI’s who have a trading account in Zerodha ?

Hi Bhupendra, NRIs cannot trade using MTF.

what is the percentage ratio for mtf stock .how much amount zerodha will put for mtf stocks and how much we are obligate to give

Hi, you can check the leverage you will get for each stock here.

Thank you zerodha for offring MTF. But I have a quary — Could we use pleadge margin against sehers of my holding to by stock in MTF ? or we should required only cash margin?

Some other brokers provide this facility to buy stock using pledge margin under MTF trading.

Dear Zerodha team,

It is really good to know that Zerodha has come out with MTF facility which was much awaited, however the interest @ 0.04% per day (14.6% annually) is higher compared to ICICI direct where I am getting @ 0.0265% per day (9.69% annually).

Can you look into rationalising the interest rate to make it more competitive so that more people can get onboarded to use MTF facility from Zerodha.

Thanks,

Can I trade in bank nifty futures using MTF facility

No, Pooja. MTF can only be used for purchasing stocks, not F&O.

Need more clarity of mtf

Hi Prashant, please let us know your queries. We’d be happy to help. You can also reah out to us by creating a ticket here.

Thank you for team zerodha for this fecility

Thank you zerodha

What is the stock holding period using with MTF facility?

Hi Gautam, you can hold stocks under MTF for as long as you want.

Can I Use MTF to apply for IPO. Specially for Big HNI category.

Hi, no. MTF cannot be used for applying for IPOs.

Hindi ma v batao our sale karne pa kitna paisa kayega

Thanks for MTF

Thank you

Thnq ZERODHA TEAM

Thank you zerodha

We can use this facility in Intraday if we short i.e sell first and buy before 3.15 pm

You can, Shailesh.

Hello Team

Enabling MTF is chargeable?

Mean enabled MTF, not processed with purchase of equity. So what happen in this case

Hi Vishwas, there are no charges for activating MTF.

Good facility getting us. Thanks Zerodha &Team.

Finally waiting for this, I switched to other broker only to avail this. Trust me if it is utilised with precaution you can make lot of money. I am not promoting MTF. But sometimes u get chance where u can encash.

I am new

How many amount for mtf

Hi Ramesh, the limit is Rs. 10,00,000 for one stock, and Rs. 50,00,000 in total.

How much maximum amount limit to buy a single stock in mtf.

Hi Ananth, the limit is Rs. 10,00,000 for one stock, and Rs. 50,00,000 in total.

”If I activate MTF and don’t take a margin, will my money be deducted?”

No, Ajay.

Thank you zerodha

Can we convert our intraday positions which are running r8 now…??

Hi Pritam, this is currently not possible.

I like mtf facility

How to buy futures using MTF

Hi Nikit, MTF can only be used for purchasing stocks, not F&O.

I am having few doubt’s on this. This move is now literally same as trading a stock for multiple day holding.

So what if i have entered a stock with 20% of fund and remaining i got from leverage. If the stock goes down and the loss was more than the fund i have in my account. What would happened in that case. Liquidated automatically or what?

My questions was. What about liquidation?

Can we use MTF for stock options?

Hi Jitthin, MTF can only be used for purchasing stocks, not F&O.

I like your pst

M T.F upyog karva mate kaya ઓપ્શન બટન છે અને કેટલું મર્જીન મની મળે છે

Super

Can I convert my holdings to mtf

Hi Anuraj, you cannot convert MTF to CNC/MIS or vice versa.

Excellent service

Can we convert MTF positions into Holdings later?

Hi Soundaryan, you cannot convert MTF to CNC/MIS or vice versa.

Congratulations Zerodha for an another facility given to customer. Many-Many Thanks.

Can I place GTT orders for shares bought under MYF

Hi Syed, GTT orders for MTF are on our list of things to do. We’ll keep you posted on it.

Thanks

When MTF shares are pledged is that margin available to us for F&O?

Hi, the shares you buy using MTF are pledged as collateral towards Zerodha as these are funded by Zerodha. These shares cannot be pledged again for margin.

Is there a way to convert CNC positions into MTF?

Hi Ishmeet, this is curently not possible. It is on our list of things to do.

Hi,

Suppose we buy the shares using MTF, then we understand that the pledge request received by email should be given consent before 7 pm on the same day.

My question is, if we hold the same shares for 30 days then do we have to sign on the pledge request everyday Or only on the first day of buying it?

Hi Vimal, you have to approve pledge request only on the day your purchase shares.

How to activate MTF facility for HUF account holders.

Many thanks

Can MTF not be used to take short positions in F&O? Sometime we run out of pledged margin for our short F&O positions, can MTF not be used for such situations?

Hi Raag, no. MTF cannot be used for F&O.

Thank you for opportunity

Does it apply to index options trade?

No, Yash. MTF is available only for buying stocks, not for F&O.

how long we can hold the share bought using mtf? and how much fund do we need to add in account if share is in loss?

Hi Sunil, you can hold shares purchased using MTF as long as you want. We’ve explained how the MTM margins are collected in case the value of the stock decreases here.

Can we short sell using MTF ? also does this apply only to stocks or even derivatives ?

Hi Swarav, you cannot short sell using MTF. In India, regulations do not allow to carry short positions in equities overnight, can do this only in intraday. MTF is available only for buying stocks, not for F&O.

if i pay-in on the same day? do i have to still pay the brokerage and interest?

Is it possible to convert an MTF position to a regular long-term position (CNC) by paying back the leverage amount along with the interest?

Hi Deva, currently it is not possible to convert MTF position to CNC, this is on our list of things to do.

Can we reduce the MTF charges. as you are charging brokerage also. so why not reduce the charges. you are charging this and on top of this we have to gst also.

Can we use this MTF for applying IPO ?

No, Piyush.

Can we use this Margin Trading Facility for the stocks which I wish to take delivery as a result of short PE or long CE stock option going into ITM?

CDSL authorization is mandatory for MTF trades. Please complete the authorization before 7 PM to avoid conversion to normal holdings which increases the margin requirements.

It’s asking to enable DDPI to enable MTF on placing order of MTF

Hi Dhinesh, MTF is only available for users with POA/DDPI enabled due to operational complexities. We’ve explained this here. And the CDSL authorization is for pledging the shares.

will charges apply for non trading day also like weekend and holidays?

Hi Varun, yes, charges will be applicable on market holidays too.

You rightly said MTF is ”A WEPON OF MASS DESTRUCTION”

Thank you Shubham . A follow-up question on tax calculation for MTF trade please. Can the interest paid towards MTF position be added to ”cost of acquisition” during p&l calculation ?

Does buying more quantity of a stock which I already have with mtf averaged the price

Plz try to take the OTP validation o the MT trades on Kites platform only. that way, it would be easier to validate instantly w/o waiting for the SMS to show up and then validate.

Rg

Can I buy the share using MTF and also sell on the same day? What about pledge request.

Hi Naveen, intraday is allowed for MTF shares. Pledge request is not required in case of intraday.

What are the difference between MTF and pledging?

Is it possible to convert MTF to CNC?

Can MTF positions be converted into delivery after paying the difference amount.

Thanks for the MTF facility. I just wanted to know what if the price of the share drops? Any threshold for the price drop? When do we need to refund the account?

It was awaited but not looking competitive as MTF is enough matured more as an industry by now. Even simple 14% ROI is much higher as other large brokers do funding internally and range 9 to 10.75%. Are you going to charge for delivery trades as well in MTF. How margin release mechanism will work for unsettled or settled trades for fresh trades.

I dont understand one thing here. The charges of 0.04% per day comes around 14.6% per annum. When i can get a personal loan for 10.5-11% from a bank, why would i pay 14.6% charges to zerodha.? Is it so not easy for people to get personal loan .?! Or am i missing something here.!

Thanks for executing our request.

Hi,

Can this be used for shorting intra day in equity segment? Or it’s only buying

After taking MTF position How much % drop after you will squareoff the postion per one perticular trade???

1. How is tax calculated on MTF trades? will LTCG/STCG be applicable or does it fall under derivative like tax structure

2. Can existing stock holding be used as margin ?

Hi, As per the regulations, taxation for MTF trades is done on a First-in First-out (FIFO) basis at the demat level. Your MTF trades are treated like any other delivery trade (CNC), and a combined P&L and capital gains statement is prepared accordingly. Regarding yoursecond query, this is currently not possible.

IS IT AVAILABLE TO TRADE IN F & O STOCKS AND INDICES? KINDLY CLARIFY.

Hi Viswanathan, MTF is available only for stocks, not for F&O.

much and more is interest rate in view of @per day including Holiday. please correct it. for better trading and holding in equity. Facility is best but required some correction.

Terms and Conditions of MTF mentions that it will be auto squared off after 30 or 90 days , from where I can set this duration .

Is pledging mandatory post buying MTF. How to do that, please put a short video.

Hi Vivek, yes, you will have to approve the pledge request after taking trade using MTF. You can check out this video to check out the process.

On calculation, Zerodha is offering leverage at an interest of almost ~15% per annum. This is like taking personal loan to by stocks . But since the stocks are there as collateral, it would have been nice if the interest charged by Zerodha was lower.

1) How this can be used with respect to options selling ? As we already used stock colletral to perform intraday selling. Will this help in positional please explain in that context.

2) For each individual stock i should goto MTF tab of respective order page and enable MTF ? Is this enabling account level change or stock level change ?

Hi Silambarasan, 1. Stocks bought using MTF are already pledged, so these cannot be pledged again for trading in F&O segment. 2. You have to activate the MTF segment only once (while placing MTF order for first time).

very nice very good ,i have still some confison abaout it pls. cleryfiy it

Hi Pravin, please feel free to ask any query you might have, we will clarify it for you.

for enabling MTF, whether we need the F&O account needs to be activated or is not required since I have only equity segment activated and not derivatives segment

Hi Keshavlal, you don’t need to activate F&O segment to trade using MTF.

Pls offer some brokerage plan to reduce interset rate

Good initiative.” An interest rate of 0.04% per day (Rs. 40 per lakh per day)” as stated in the post. My calculation (whether simple or compound) is as follows. ( .04*1*100000/36500 or less if non trading days are excluded.) Simple PTR/100 forumula..04% per day works out to .11 paise. Please cross check.

Is Interest chargeable is on the compounded O/s (Principal + Interest) or is it fixed per day.

Hi Mukesh, interest is fixed per day and is charged on the the funded amount.

can this be used with gtt buy orders? if i pay-in on the same day? do i have to still pay the brokerage and interest?

Hi Prakash, we’re working on providing GTT orders for MTF. Currently, it is not possible to convert MTF trade to CNC, this is on our list of things to do.

What is the brokerage charges for equity delivery under this MTF product ? it is same as ZERO or there should be minimum charge ?

Hi Darshak, the brokerage of 0.03% or Rs. 20 whichever is lower per executed order, will pe applicable for MTF trades.

Good Zerodha

Thank you,

Please consider providing Margin on pledged shares for buying shares as how you do that for options.

Maximum Holding period under MTF is not given in this note…kindly provide

Hi Veda, there is no such limit. You can hold your MTF positions for as long as you wish.

Interest rate is on higher side, since it is charging on daily basis therefore interest should not be exceed more than 9.50%

do you have mtf for options?

Hi Harshal, no. Regulations do not allow providing additonal leverage for F&O as these are already leveraged products. For buying options, you will need to pay full premium and for selling options, you will need to maintain SPAN + Exposure margins as per exchange requirements.

we want more features to analyes the stock for long term investment. we want tijori finance free for every zerodha customers. that is very helpfull for us like zeroda customers so i request to MR.nithin kamath please provide the advanced features for helpfull long term investments

MTF is leverage for overnight trading at some cost. Is it anything else ?

The proposed interest seems to be on a daily basis @ 0.04%. Would interest on interest be applicable in this case or only simple interest @ 14.6% per annum?

Hi Sreejith, interest on interest is not applicable. It is simple 14.6% interest per annum, charged at 0.04% per day.

PLEASE SHARE AN EXAMPLE LIKE IF YOU HAVE BORROWED 100000 ONE LAKH TOWARDS MTF THEN @11.5 PER DAY INTREST COST WILL BE =

thank you team zerodha. i am waited for mtf on zerodha plz make cost effactive for retail trader on mtf charges

iam interested