Introducing Alert Triggers Order (ATO) feature on Kite

Imagine you are tracking a stock currently priced at ₹500. You believe that if the stock drops to ₹480, it could be a good time to buy, as you expect it to bounce back. But you can’t keep checking the market all the time. So to make it easier for you to monitor price movements, we introduced the Alerts feature on Kite, which lets you create alerts based on various parameters such as price, OHLC, volume, open interest, and more and notifies you whenever your alert condition is met.

However, once an alert is triggered, you have to manually place an order. There may be times when you might miss the notification or fail to place the orders, causing you to lose the opportunity to take the trade. To help with this, we are now introducing the Alert Triggers Order (ATO) feature on Kite web.

With ATO, you can link a basket of orders to an alert, and as soon as the alert is triggered, your orders are placed on the exchange. This saves you time and ensures you don’t miss out on opportunities.

This is just one way to use ATO. You can also apply it to other scenarios, such as:

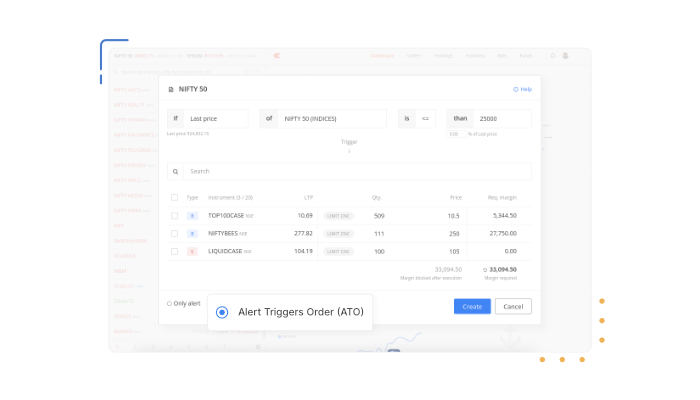

Investing in stocks or ETFs based on index levels: Let’s say you want to invest in ETFs when the Nifty 50 index drops to 23,000. Instead of checking the index level every day. You can set an ATO for when the index reaches 23,000. Once your condition is met, the order to buy these ETFs will be placed on the exchange, without you needing to take any action.

Taking positions in F&O contracts: Suppose you’re trading index options, and want to enter a short straddle trade when Nifty hits 25000, you can set the alert for Nifty 50 at 25000, and link orders to sell both call and put contracts when this price level is reached.

Using ATO for risk management: Imagine you’re holding positions in multiple stocks or F&O contracts and want to exit when an index or a stock rises or falls below a certain level. You can easily create an ATO to protect your profits or minimise your losses in such cases.

ATOs can be created using the same parameters as alerts. Learn more about Kite alerts and uses.

To place an ATO on the Kite app:

- Tap on the instrument and click on Set alert.

- Enter the alert name and conditions.

- Enable Alert Triggers Order (ATO) button.

- Search and add instruments.

- Swipe or Tap to create ATO.

To place an ATO on the Kite web:

- Hover over an instrument and click on More icon.

- Click on Create alert / ATO.

- Click on Alert Triggers Order (ATO)

- Enter the alert name and conditions.

- Search and add instruments.

- Click on Create.

You can also check out this video to learn more.

Market price protection

All market orders in ATO are placed with market price protection. This ensures your order gets executed at the best possible price available, while also reducing the risk of sudden price changes. Unlike a regular market order, which can go through at any price, market price protection converts your market order into a limit order if the price moves too far away from your preferred price (also called the protection range).

This way, you don’t end up buying or selling at a price that’s very different from what you intended. If the price moves outside of the protection range, there’s a risk that not all of the shares you wish to buy or sell will be executed. The remaining quantity will remain open as a limit order.

The market protection percentage is calculated as per the below table:

| Security type | Price range (in ₹) | Percentage of the Last Traded Price (LTP) |

| EQ and FUT | Less than 100 | 2% |

| EQ and FUT | Between 100 and 500 | 1% |

| EQ and FUT | More than 500 | 0.5% |

| OPT | Less than 10 | 5% |

| OPT | Between 10 and 100 | 3% |

| OPT | Between 100 and 500 | 2% |

| OPT | More than 500 | 1% |

Example scenario

Consider that a stock is currently trading at ₹90.

- Buy order: You place a market price protection buy order for 100 shares.

- Protection range: The system establishes a protection range, i.e., 2% above the current price since the price is less than 100. As a result, the protection limit price is set at ₹91.80.

- Order execution: The order attempts to execute immediately, buying shares at ₹91.80 or below, ensuring the best available price within that limit.

- Limit order placed: If the order cannot be filled for 100 shares within this range, the remaining quantity will remain open as a limit order at ₹91.80.

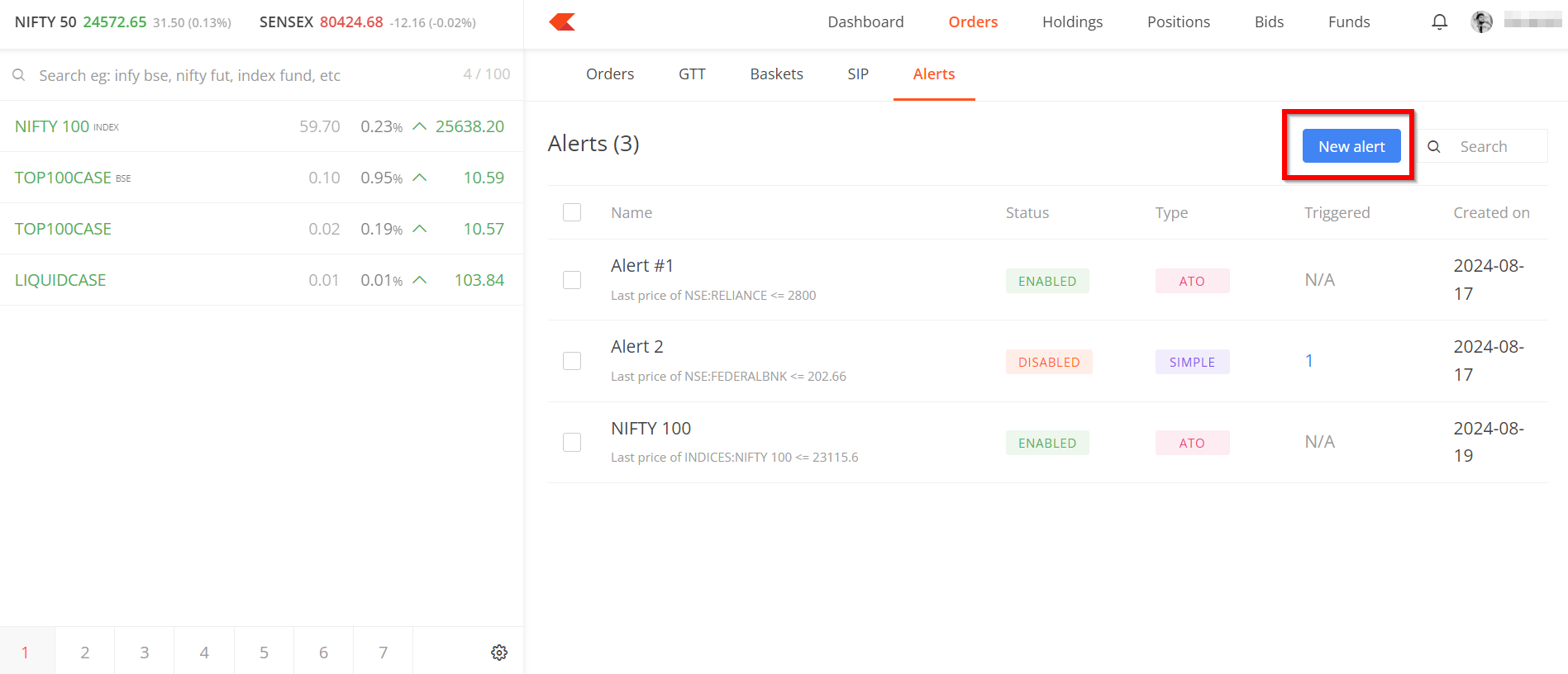

ATOs can also be created for a particular instrument by visiting kite.zerodha.com/orders/alerts and then clicking on New alert.

ATOs can only be placed in NSE equity, NSE F&O, BSE equity, and BSE F&O segments.

Alerts will be disabled automatically if there’s a corporate action for the instrument that changes the price by more than 2%, such as extraordinary dividends, bonuses, splits, or rights issues.

By default, orders have a Day validity and are cancelled if not executed by the end of the trading day. This validity can be changed from the order window. Learn more about Day orders and IOC orders in trading.

You will receive push and email notifications when an ATO is triggered and the order is executed. Once an ATO is triggered and placed, you can check its status via email or in the Alerts section.

I have a suggestion for price protection percentages. Currently you have decided them whatever it looks best for you. What I want is give it to my hand and I will decide whatever is good for me. For example for equity options the price protection range you decided is very less. Say when an alert is triggered a call option SL which is at 1.00/- may not be sold even at 0.90/- because as per your 5% it cannot be sold below 0.95/- Sometimes markets fall so quick that by the time you go and try to adjust the price it may go to even to 0.60/- So, by default you can set the defaults when I open ATO window, but I should be able to modify as per my risk taking capacity like 10%, 20%, etc.

Hello Support,

It is possible to place exit FNO order(Which I have already Sold or buy) through ATO ?

ATOs based on simple triggers like index level, stock price etc. are so simple that in this time and era only Indian brokers can claim they are state of the art!

As a pioneer, you should provide ATOs based on target cost price of a straddle or strangle; and ATO based on a set profit for straddles and strangle; and similar things. Tall order, no!

What is your latest trailing stoploss option? anything improved .. Why you charge for API when no other broker charges for this ?

If i want to buy nifty bees at 1% fall of every day wat will i be chosen day change %or intraday day % ?

By far the best upgrade and technical inclusion over GTTs. You made my life easier n now I am able to take more F&O trades than before. GTT was always cumbersome and non-flexible. Never triggered in most cases. Thank you so much, these are certain INNOVATIONS why one will continue to stick to Zerodha despite many out there.

In the ”create alert”, the last item is ”% of Last price”. Is it necessary to fill the value or we can skip it? What is the purpose of this entry?

Hi, no, you can either enter the price or ”% of Last price” to set the alert.

Kite Alert option should be provided in full screen mode also. Let say when you are analyzing stock in full screen mode then you need option to create alert there only instead of going back to the instrument on the left hand side of screen

Does Zerodha have indicator based alerts which can trigger orders?

If i want to buy nifty bees at 1% fall of every day wat will i be chosse day change %or intraday day % ?

Can I exit(sell) my existing position through ATO in F&o

Can anyone tell me detail, how can use trailing stop loss in kite?

Hi Vijay, trailing stoploss is currently not available on Kite. We’ll take this as feedback and check on the possibilities. Thanks.

How this is different from GTT ?

Hi Vijay, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

This feature is great.

Please add time validity option in this. So that trigger expires automatically after set time. This will make its use case more relevant.

Also come up with something to squareoff positions based on mtm trigger alert.

Important guidance. Useful to save my hard earned money. Thank you team

Jis tarha position ko long press karne par exit position ka option aata hai aur click karne par market price par sare share sell ho jate hain.

Ussi tarha buy position ke liye bhi option hona chahiye. Jis mein 90% fund utilities ho.

Kion k aksar quantity calculation karte karte price movment bahut tezi se hota hai khaskar market open hone. Aur live market mein.

Jo log market ko zyada time nahi de sakte aur chhoti chhoti movment capture karna chahate hain.

Zerodha team please

Kindly add support to SELL for at least RSI levels and trailing stop loss cross-overs.

Can we set alert to buy stock when RSI < 30

Hi Rahul, for indicator or candlestick patten based alerts, you can check out Streak.

Can ATO be placed for sell options?

Hi Sanjeev, yes it can. However, for F&O strategies, we’d suggest placing buy option orders before future or short/writing option orders so that the F&O strategy will be executed with the least margin requirement. More here.

ATO is useful only to buy shares, can’t use gor selling shares.

Hi Abdul, you can place an ATO for selling shares too.

Price index, will fall further, more correction is ahead, ATO may not work properly at this fear zone, and extreme volatility. Always upward or downward swing does not show the good health of a market, but when the correction is more than 40/50% , it means intrinsic value is much lower than the calculated, expected figure. I am not market expert, very low age, still what I studied,,, most of the you tuber, announcer is wrong. So this is not the time to calculate opportunity loss. Thanks.

This is the best. In every step made easier way to trade in zerodha

Send me recent posts and research article

Your account opening is on hold as additional documents to activate your account please complete your application here to activate your account

Dear zerodha team,jaisa ki aap dekh pa rahe hain aapke users kafi loss mein hai kuchh Aisa hona chahie ki jo users regular loss le rahe hain unhen kuchh support aapki taraf se Milana chahie like entry, exit or hold or achcha stock share lene ka hai aur hold karna hai.

ATO is a good initiative but it will be far good if a add stop loss option in percentage visibility while set off.

I’m writing to suggest a valuable addition to your ATO tool. While the current alert system is excellent, I believe it could be further enhanced to provide more granular control for traders.

Specifically, I propose the following feature:

1) Selective Trigger and Automatic Deletion: Allow users to set a desired number of stocks that should be automatically triggered and sent to the exchange when their respective alert prices are reached. Any remaining stocks that haven’t triggered should be automatically deleted.

For example, if a user sets five alerts and selects ”2,” only the first two stocks to trigger would be sent to the exchange, and the remaining three would be deleted.

This feature would be particularly beneficial for traders who want to manage multiple alerts efficiently and avoid unnecessary trades. It would also provide more flexibility in terms of risk management and portfolio allocation.

I believe this enhancement would significantly improve the overall user experience of the ATO tool and make it even more valuable for traders.

Thank you for considering my suggestion.

Alert feature itself is useless since it is based on just price level. I want an alert be triggered and notified if there is bearish or bullish engulfing takes place on 5M or 15M or when a candle on 5M/15M closes above/below the high/low respectively of its preceding candle. Unfortunately this kind of alert is not facilitated.

Hi Vinay, for indicator or candlestick patten based alerts, you can check out Streak.

Pls start STP (systematic transfar plan) coin app. Thankyou🙏

Hi Piyesh, we’re close to launching STP feature on Coin. We’ll keep you posted on it.

Pls introduce moving average cross line in the moving average cross indicator in IQ chart

What is difference between ATO and GTT order

Hi Meghana, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

Good 👍🏻

Good

This is not related to ATO but related alert notification. My feedback and opinion to enhance user interface.

1. When notification is viewed from drop down list. It diverts to Kite app. Can this be linked to the specific alert instead.

2. When viewing the alert which is trigerred, there is no way to check the chart, i need to go back to watchlist and open the chart. Can you have a provision to hyperlink the chart with the alert that is trigerred.

Hi Riyaz, we’ve noted your feedback and will look into this. Thanks.

Sir kya hum ATO sa selling kar sakta hai intraday stocks ma jaisa ki 500 par stock hai aur mujhe vo selling position banani hai intraday stock ma ki 480 par sell ho jay

Hi Rahul, yes, you can use ATO for trading in intraday too.

Dear respected sir,

How to sell the stock which is having lower circuit as the market opens

Please introduce Indicator based alert .

Hi Muhammad, for indicator or candlestick patten based alerts, you can check out Streak.

Equity and comodity ka fund ek hi account me karo taki margin sab me use ho sake🙏🙏🙏

Hi Minaxi, this is already available. Here’s how you can switch to single-ledger facility.

Is it possible to place an alert based on Nifty PE Ratio?

Hi Ishwar, this is currently not possible. However, we have noted your feedback an will check on the possibilities.

There is an toggle option like ”Consider existing position” in ATO. What is the use of that?

Hi, this works similarly to the ”Include existing positions” option in Basket Orders. If you already hold a position, enabling this option will display the margin required, factoring in your current position as well. https://support.zerodha.com/category/trading-and-markets/kite-features/basket-order/articles/kite-basket-orders#:~:text=To%20include%20open,disable%20the%20option

Good 👍

Let’s say I put an alert that if Nifty drops 10%, buy niftybees. However, I need to have the funds in my trading account. People generally park their money in liquidbees. So, what I have to do is, place 2 alert orders. One is to sell my liquidbees and then the second one to buy niftybees. Correct?

Question- if an ATO triggers and there aren’t enough funds in zerodha account; how much time do we have to add funds so the order goes through

Hi Jyoti, in this scenario, the order will be rejected. You can place the orders again manually after adding funds.

In addition to below comment, I would like to suggest below. Could you consider it, it will be helpful in options trading strategies like call spread

Single alert condition based on two instrument with substraction. For example: (NIFTY 25100CE – NIFTY 25200CE) <= 10, then execute set of orders

Hi Girivisan, thank you for your feedback. We’ll bounce this off our team and check on the possibilities.

This is extremely useful for me in options trading. Could you please expand the alert condition to more than one ? For example if set of two conditions matched with AND/OR, then execute set of basket orders.

1 if I create ATO on holiday or in evening after market hours, will it execute next day during market hours?

2 can I create simple GTT buy order using ATO?

Add indicators and profit/loss based entry exit in ATO, by doing so will make you stand on 1st.

Hi Radhakrishna, we’ve noted your feedback and will pass it on to our team. For indicator based alerts, you can check out Streak.

Hello Team,

Congratulations on completing 14 Years.

I use Zerodha from very long time and i like it.. recently i saw one feature in other platform, which is Real-Time marker displaying the Profit / loss on the chart and i think this feature should be added in zerodha as it is very easy exit and entry on the chart based on the profit/loss.

”Real-time marker on the chart showing your active sell trade’s profit/loss, allowing you to monitor your position’s performance directly on the chart”

I want to buy NIFTYBEES ETF whenever NIFTY down on any day. How can i do this with ATO? Current config doesn’t seem to provide this .

Can we have a platform or means to create algoritm which can generate buy or sell signals on Chart or alerts in kite? Based on signal or alert we can manually place order.

It’s a good feature, but it’s not working properly. I tested it for two days. My criteria were to place an ATO for some stocks with a 1% up limit order. Last night, I placed orders, but they were executed today at market price. Similarly, the night before, I placed orders with the same criteria; some were executed, but one wasn’t, even though the criteria were met.

Please, stop loss and percentage of targets are given in GTT order in options.Add points to it.

Please add algo trading

Streak pro not working

What’s the difference between GTT and ATO ?

Hi Chiranjeevi, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

Please give a option for validity of Alert (ATO) as Day. I want to setup a alert on intra day basis and want that to be deleted if condition is not matched on day. Also I want that to be importable and exportable.

Hi Amit, your feedback has been noted. We will check into the possibilities.

It would be great if you could make these Alert Triggers Order (ATO) features importable and exportable, this would really be a great feature and make an already tall standing Zerodha even taller.

Thank you for the additional features.

Hi Reema, will bounce this off our team. Thanks for the feedback.

It is good feature, is it possible to include time combination with this? e.g. at 3:00 PM If nifty is 1% down then buy SBIN.

Hi Manju, we’ve noted your feedback. We will check into the possibilities.

Where these alerts will appear ? On Kite Or will delivered by Mail ?

It will be nice if you start What’s app Notification or SMS Notification for this !

Hi Nilesh, once an alert is triggered, you will get a Kite notification as well as email on your registered email ID. Regarding, WhatsApp or SMS notification, we have noted your feedback.

This is why I love Zerodha! Democratising some basic-Algos for all! In future, please consider adding Intraday orders too. And maybe nested ATOs (If this, then that, etc. etc.)

It is good features to kapture buy or sale opportunity for equities or Niffty as it does not require to monitor price up or down but automated with system. only you have to endure the balance of fund .

Yes, thats true, but Streak is for traders.. you have to enter a stoploss and target prices.. For Investors we don’t use SL and Targets 🙂

The problem is when the order gets triggered there may not be funds in my kite wallet. Can you make provision to link the order to bank account for the funds so that there is no intervening kite wallet ??

Thanks for this very helpful feature for Investors. Can you add few basic indicators for triggers ? ( e.g MA or RSI ) that will really help investors who

look for technical indicators for doing SIP rather than fixed datewise.

Thanks again.

Ajay

Hi Ajay, thank your for your feedback. We’ll check on this. Currently, you can generate indicator based alerts using Streak.

Can you please do something to notify events for scripts in the portfolio, like dividend, buyback, bonus/split etc.

Hi Pareshkumar, wherever there is any event like ex-date for the rights issue, bonus, dividend, or stock splits, we show an event tag for that stock on Kite. You can also check all stock-related events in the Fundamentals widget and Timeline on Console dashboard.

I hope this is what i was looking for. So please confirm if any stock that is 2000rupees touches 1500. I understand I can post an order to buy that stock or F&O, But if its a stock can I buy if the stock touches 1550..The purpose being that once it touches 1500 only if the stock price (or index) reverses then only it should buy at that price?

In alerts can you provide an option to to alert based on the candle close . For example alert iert is set for price 50, then it alert if peice closed above 50 in 15 mins candle?

Hi Vishwanath, you can create alerts based on indicators and candlestick conditions using Streak. You can check out the Streak user manual here.

What is difference between GTT and ATO?

Hi Shatrughan, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

a) Can this be linked to a basket execution?

b) Kindly make adding to basket from marketwatch.

Thanks

Thank you for your feedback, Subu. We’ll check on the possibilities.

day by day improving as per customer requirement will make you the leader all the time. keep it up. lot of thanks

I like to place trades based on closing price. Does this feature allow me to place an order for example: if Reliance price > 2950 at 3.25 pm, place buy order for 10 shares. Is that possible?

Hi Amit, this is not possible using ATO on Kite, however, you can create alerts based on indicators and candlestick conditions using Streak. You can check out the Streak user manual here.

I love this feature, can’t tell you how much I was waiting for something like this. I even explored some of the Algo tools just for this feature. No I can pretty much run most of my options strategy in zerodha without any Algo tool. The only thing missing is total profit or total loss alert and ATO for that, but I am hopeful that also would come some day.

This suggestion was given by me in october 2020 through email and now that you have finally implemented it I want a reward for giving such a brilliant idea.

FIRST REMOVE DRACONIAN RULES LIKE,

1.NOT GIVEING INTRADAY GAINS TO TAKE INTRADAY TRADES…

2.PLACE TRAILING STOP LOSE ORDERS

3. PLACE ORDERS IN MULITICHART WINDOW.

Hi Mahesh, as per SEBI regulations, intraday profits cannot be used for further trades until the settlement happens, this is the reason intraday profits are not available on the same day. We’ve explained this in detail here. Regarding trailing stoploss and order placement from multichart layout, we have noted your feedback.

we became zerodha family in 2018. minimum problem faced in 6 years. we are very small retailer facing brokerage on one lot options.i eewrote, tweet but…..ok.

platform is fantastic for a sr. citizen [ 73 years ]thanks your new features , may i use ’ total loss wise’ ATO. eg. close all ouosision when loss cross 1000 ?????

pl. reply personally if you can. thanks

multiple triggers conditions required for order placement

OI change alert not present

Hi Mayur, you can create an alert based on Open Interest too, you can check all the available parameters here.

Only slight useful. Several other conditions must meet for any buy or sell order, else a ”Spike” and all will messed up.

Better if can provide ” IF.. ELSE” type conditional statement with last X tick/bar checking/calculations and parse that then to trigger order.

But it can be then call a sort of ”algorithm” and may be not allow here, not know, but its actually required feature.

Please introduce chart trading on Kite. this is should be same as Trading view’s Chart Trading. It will be much helpfull for a trader or a investor.

much awaited feature 🙂

when can we expect this feature for commodities trading?

This is on our list of things to do, Vivek. We’ll keep you posted.

It does not help in scenarios where P&L of an Option Strategy needs to be exited basis predefined loss levels.

E.g If I sell out and call options contracts of ICICI with max profit of 2000, I would like to exit this position if loss accumulates to 4000.

Currently I can exit when condition of a leg is met , say put breaches a pre defined LTP or Call breaches an LTP.

Hi Abhishek, we’ve noted your feedback.

Great feature. Thanks!

If we can include some technical indicator like based on moving average value if you can initiate alert/trade.

thanks team for this feature .

kindly pls update the spread price in iq charting it may skipped the price (sl )if we set below or above order it may skip,this i already spoke your officer 1 year ago.

pls provide this spread price limit in iq chart.

thanking you

india me stock market ke satte me pade bade bade log isme bik chuke hai broker ke bangle ban gaye hai isse door rahe ye satta bazar fix hai otherwise india me sirf only 1 hi trader ka naam bata dijiye jisne isme success achieve kari ho only sabhi bookie stock market me success achieve kar rahe hai baki sabhi bheek mangne layak tak nahi reh gaye hai itna barbaad hue hai sabhi is market me agar kisi ko barbaad hone ka itna hi shok hai to apne sabhi paies kisi trust me donate kar de kum se kum time to bachega is satte bazar ame aye to time bhi kharab hoga aur barbaad bhi hoge

Confusions i have are :

01. Final margin is not seems reducing for current open futures and i want to reverse position if market reverse.

exp ; i have open long position of nifty fut of 3000 Qty from nifty spot 25000, now if nifty reverse i need to sell 6000 Qty to make it net -3000 Qty in fut.

margin here shows in ATO is full for -6000 Qty & not doing netoff for -3000 ( which in basket orfer i am seeing )

02. in spread order will it 1st place buy by default to take benefit of margin or place order in que in which we added orders ?

Hi Krunal,

01. Final margin is not seems reducing for current open futures and i want to reverse position if market reverse.

The margins for existing positions are factored in when the order is placed. We’ll add an option to include margins for existing postions in the ATO order window.

02. in spread order will it 1st place buy by default to take benefit of margin or place order in que in which we added orders ?

Orders are sent in the sequence you add them in. So if buy order is added first in the sequence, it will be sent first.

Hello ,

M really happy to have this feature in Zerodha.Thank you.

I have a humble request.

When we place SL and target ,it has to be placed in percentage.

Can that be done in terms of value.

For eg: If the stock price is 50 and I want to place SL or Target at 45.

Can I directly place 5 in value instead of percentage.

Thank you.

Can we also have ”Position” in the ”If” condition?

I believe it will be a good to have when I want to square of all my positions if my PnL is breaching my risk for the day

Does authorization required for ATO orders (sell) to get placed/executed?

The same could be achieved using GTC order – how it is different than GTC order

Can You Add Trend Line Based Price Alert??

AND

Can You SL And Take Profit on Chart

Very good feature. Wish to try after studying it further. Hope there is no change in brokerage and other charges. Introduction of boxes next to GTT orders for ’ease of multiple order cancellation quickly’ is still a pending request. Please study and implement.

Pretty much helpful feature for the execution of option strategy. It was very much needed.

What is the Difference between GTT order and ATO?

Hi, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

It is different from GTT, as in GTT your trigger condition can be related to that Stock’s price only. While Alert can be set on broad set of parameters as well as cross between Index & Stock.

In GTT you can’t set to buy Infy when NIFTY is below 23000. In ATO you can.

This is a nice feature.

Please incorporate grouping feature like this for creating customizable groups.

Monkey script created by Amit Rana

https://github.com/amit0rana/betterOptionsTrading/blob/master/betterKite.md

What is the difference between GTT and ATO?

Hi Ram, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

So this alert system will be valid only for the current day? Or whenever the alert gets triggered?

Hi Kiran, the Alert will remain valid until it is triggered.

WOW

limit order itself not triggering well at all even SL were not triggering even market moves unable to belive these sexy toys

excellent. good step towards much awaited algo trading for retail traders from zerodha. thanks a lot!!!

A much needed feature. Everyone will get benefit from this.

Hi There!

Could you please add the alert feature based on RSI value ? And also if SMA(x) crosses some value ?

Thanks

Samir

We’ll check on the possibilities, Sam. Thanks for your feedback.

How is this different from GTT? Is it only the Market price protection feature that makes it unique. What if we add this feature to GTT?

Hi, ATO can be used for buying or selling basket of stocks/F&O contracts based on an Alert which can be set on any index, stock, F&O contract.

For example, you want to buy certain set of stocks when Nifty falls below 24,000. You can set an Alert for this and add stocks to the list, once Nifty falls below 24,000 your ATO will be triggered and order for that set of stocks will be placed on the exchange.

With GTT, you can only buy/sell only single scrip.

Hello Support,

Is market price protection available for regular market order of options trading in FNO?

Not currently, Sanjay. This is on our list of things to do. Currently, you can use limit orders to do this, we’ve explained how to here.