7.1 – Remember these graphs

Over the last few chapters, we have looked at two basic option type’s, i.e. the ‘Call Option’ and the ‘Put Option’. Further, we looked at four different variants originating from these 2 options –

- Buying a Call Option

- Selling a Call Option

- Buying a Put Option

- Selling a Put Option

With these 4 variants, a trader can create numerous different combinations and venture into some really efficient strategies, generally referred to as ‘Option Strategies’. Think of it this way – if you give a good artist a colour palette and canvas he can create some fascinating paintings, similarly a good trader can use these four option variants to create some outstanding trades. Imagination and intellect is the only requirement for creating these option trades. Hence before we get deeper into options, it is important to have a strong foundation on these four variants of options. For this reason, we will quickly summarize what we have learnt so far in this module.

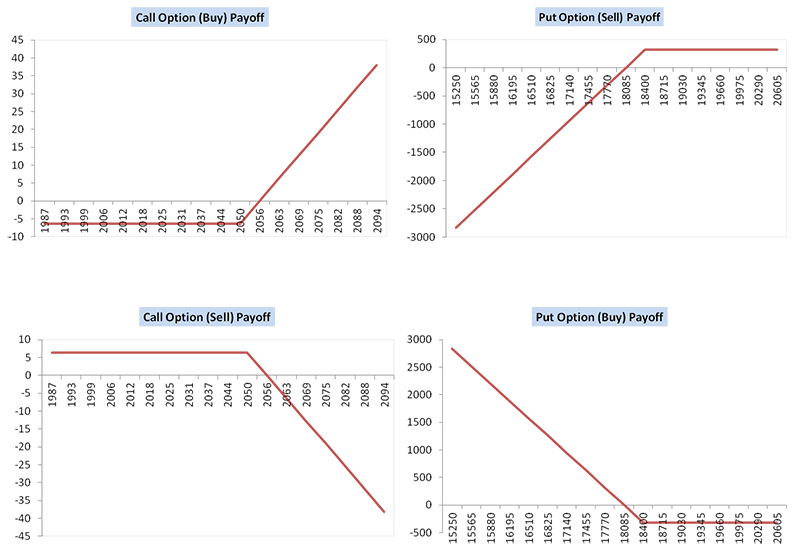

Please find below the pay off diagrams for the four different option variants –

Arranging the Payoff diagrams in the above fashion helps us understand a few things better. Let me list them for you –

- Let us start from the left side – if you notice we have stacked the pay off diagram of Call Option (buy) and Call option (sell) one below the other. If you look at the payoff diagram carefully, they both look like a mirror image. The mirror image of the payoff emphasis the fact that the risk-reward characteristics of an option buyer and seller are opposite. The maximum loss of the call option buyer is the maximum profit of the call option seller. Likewise, the call option buyer has unlimited profit potential, mirroring this the call option seller has maximum loss potential.

- We have placed the payoff of Call Option (buy) and Put Option (sell) next to each other. This is to emphasize that both these option variants make money only when the market is expected to go higher. In other words, do not buy a call option or do not sell a put option when you sense there is a chance for the markets to go down. You will not make money doing so, or in other words, you will certainly lose money in such circumstances. Of course, there is an angle of volatility here which we have not discussed yet; we will discuss the same going forward. The reason why I’m talking about volatility is that volatility has an impact on option premiums.

- Finally, on the right, the pay off diagram of Put Option (sell) and the Put Option (buy) are stacked one below the other. Clearly, the pay off diagrams looks like the mirror image of one another. The mirror image of the payoff emphasizes the fact that the maximum loss of the put option buyer is the maximum profit of the put option seller. Likewise, the put option buyer has unlimited profit potential, mirroring this the put option seller has maximum loss potential.

Further, here is a table where the option positions are summarized.

| Your Market View | Option Type | Position also called | Other Alternatives | Premium |

|---|---|---|---|---|

| Bullish | Call Option (Buy) | Long Call | Buy Futures or Buy Spot | Pay |

| Flat or Bullish | Put Option (Sell) | Short Put | Buy Futures or Buy Spot | Receive |

| Flat or Bearish | Call Option (Sell) | Short Call | Sell Futures | Receive |

| Bearish | Put Option (Buy) | Long Put | Sell Futures | Pay |

It would help if you remembered that when you buy an option, it is also called a ‘Long’ position. Going by that, buying a call option and buying a put option is called Long Call and Long Put position respectively.

Likewise, whenever you sell an option, it is called a ‘Short’ position. Going by that, selling a call option and selling a put option is also called Short Call and Short Put position respectively.

Now here is another important thing to note, you can buy an option under 2 circumstances –

- You buy to create a fresh option position.

- You buy intending to close an existing short position.

The position is called ‘Long Option’ only if you are creating a fresh buy position. If you are buying with and intention of closing an existing short position, then it is merely called a ‘square off’ position.

Similarly, you can sell an option under 2 circumstances –

- You sell intending to create a fresh short position.

- You sell intending to close an existing long position.

The position is called ‘Short Option’ only if you are creating a fresh sell (writing an option) position. If you are selling with and intention of closing an existing long position, then it is merely called a ‘square off’ position.

7.2 – Option Buyer in a nutshell

By now, I’m certain you would have a basic understanding of the call and put option both from the buyer’s and seller’s perspective. However, I think it is best to reiterate a few key points before we make further progress in this module.

Buying an option (call or put) makes sense only when we expect the market to move strongly in a certain direction. If fact, for the option buyer to be profitable, the market should move away from the selected strike price. Selecting the right strike price to trade is a major task; we will learn this at a later stage. For now, here are a few key points that you should remember –

- P&L (Long call) upon expiry is calculated as P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

- P&L (Long Put) upon expiry is calculated as P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

- The above formula is applicable only when the trader intends to hold the long option till expiry

- The intrinsic value calculation we have looked at in the previous chapters is only applicable on the expiry day. We CANNOT use the same formula during the series

- The P&L calculation changes when the trader intends to square off the position well before the expiry

- The buyer of an option has limited risk, to the extent of the premium paid. However, he enjoys an unlimited profit potential

7.2 – Option seller in a nutshell

The option sellers (call or put) are also called the option writers. The buyers and sellers have the exact opposite P&L experience. Selling an option makes sense when you expect the market to remain flat or below the strike price (in case of calls) or above strike price (in case of put option).

I want you to appreciate the fact that all else equal, markets are slightly favourable to option sellers. This is because, for the option sellers to be profitable the market has to be either flat or move in a certain direction (based on the type of option). However for the option buyer to be profitable, the market has to move in a certain direction. Clearly there are two favorable market conditions for the option seller versus one favorable condition for the option buyer. But of course, this in itself should not be a reason to sell options.

Here are a few key points you need to remember when it comes to selling options –

- P&L for a short call option upon expiry is calculated as P&L = Premium Received – Max [0, (Spot Price – Strike Price)]

- P&L for a short put option upon expiry is calculated as P&L = Premium Received – Max (0, Strike Price – Spot Price)

- Of course the P&L formula is applicable only if the trader intends to hold the position till expiry

- When you write options, margins are blocked in your trading account

- The seller of the option has unlimited risk but minimal profit potential (to the extent of the premium received)

Perhaps this is the reason why Nassim Nicholas Taleb in his book “Fooled by Randomness” says “Option writers eat like a chicken but shit like an elephant”. This means to say that the option writers earn small and steady returns by selling options, but when a disaster happens, they tend to lose a fortune.

Well, with this I hope you have developed a strong foundation on how a Call and Put option behaves. To give you a heads up, the focus going forward in this module will be on moneyness of an option, premiums, option pricing, option Greeks, and strike selection. Once we understand these topics, we will revisit the call and put option all over again. When we do so, I’m certain you will see the calls and puts in a new light and perhaps develop a vision to trade options professionally.

7.3 – A quick note on Premiums

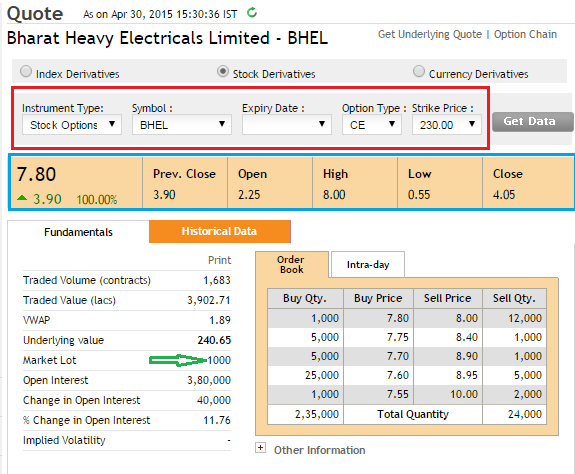

Have a look at the snapshot below –

This is the snapshot of how the premium has behaved on an intraday basis (30th April 2015) for BHEL. The strike under consideration is 230, and the option type is a European Call Option (CE). This information is highlighted in the red box. Below the red box, I have highlighted the price information of the premium. If you notice, the premium of the 230 CE opened at Rs.2.25, shot up to make a high of Rs.8/- and closed the day at Rs.4.05/-.

Think about it; the premium has gyrated over 350% intraday! i.e. from Rs.2.25/- to Rs.8/-, and it roughly closed up 180% for the day, i.e. from Rs.2.25/- to Rs.4.05/-. Moves like this should not surprise you. These are fairly common to expect in the options world.

Assume in this massive swing you managed to capture just 2 points while trading this particular option intraday. This translates to a sweet Rs.2000/- in profits considering the lot size is 1000 (highlighted in green arrow). In fact this is exactly what happens in the real world. Traders trade premiums. Hardly any traders hold option contracts until expiry. Most of the traders are interested in initiating a trade now and squaring it off in a short while (intraday or maybe for a few days) and capturing the movements in the premium. They do not really wait for the options to expire.

In fact, you might be interested to know that a return of 100% or so while trading options is not really a thing of surprise. But please don’t just get carried away with what I just said; to enjoy such returns consistently you need to develop a deep insight into options.

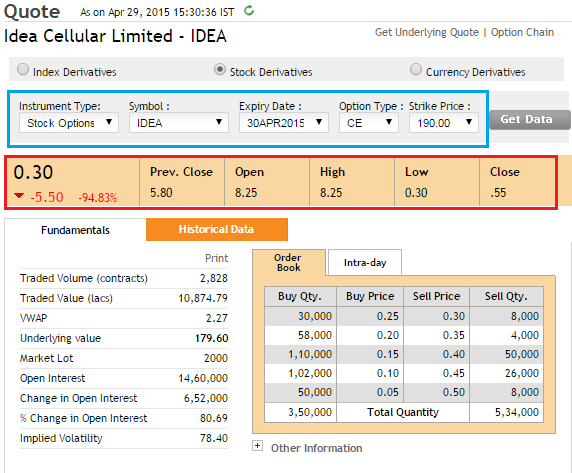

Have a look at this snapshot –

This is the option contract of IDEA Cellular Limited, strike price is 190, expiry is on 30th April 2015 and the option type is a European Call Option . These details are marked in the blue box. Below this we can notice the OHLC data, which quite obviously is very interesting.

The 190CE premium opened the day at Rs.8.25/- and made a low of Rs.0.30/-. I will skip the % calculation simply because it is a ridiculous figure for intraday. However assume you were a seller of the 190 call option intraday and you managed to capture just 2 points again, considering the lot size is 2000, the 2 point capture on the premium translates to Rs.4000/- in profits intraday, good enough for that nice dinner at Marriot with your better half J.

The point that I’m trying to make is that, traders (most of them) trade options only to capture the variations in premium. They don’t really bother to hold till expiry. However by no means I am suggesting that you need not hold until expiry, in fact I do hold options till expiry in certain cases. Generally, speaking option sellers tend to hold contracts till expiry rather than option buyers. This is because if you have written an option for Rs.8/- you will enjoy the full premium received, i.e. Rs.8/- only on expiry.

So having said that the traders prefer to trade just the premiums, you may have a few fundamental questions cropping up in your mind. Why do premiums vary? What is the basis for the change in premium? How can I predict the change in premiums? Who decides what should be the premium price of a particular option?

Well, these questions and therefore, the answers to these form the crux of option trading. If you can master these aspects of an option, let me assure you that you would set yourself on a professional path to trade options.

To give you a heads up – the answers to all these questions lies in understanding the 4 forces that simultaneously exerts its influence on options premiums, as a result of which the premiums vary. Think of this as a ship sailing in the sea. The speed at which the ship sails (assume its equivalent to the option premium) depends on various forces such as wind speed, sea water density, sea pressure, and the power of the ship. Some forces tend to increase the speed of the ship, while some tend to decrease the speed of the ship. The ship battles these forces and finally arrives at an optimal sailing speed.

Likewise the premium of the option depends on certain forces called as the ‘Option Greeks’. Crudely put, some Option Greeks tends to increase the premium, while some try to reduce the premium. A formula called the ‘Black & Scholes Option Pricing Formula’ employs these forces and translates the forces into a number, which is the premium of the option.

Try and imagine this – the Option Greeks influence the option premium; however, the Option Greeks itself are controlled by the markets. As the markets change on a minute by minute basis, therefore the Option Greeks change and therefore the option premiums!

In the future, in this module, we will understand each of these forces and their characteristics. We will understand how the force gets influenced by the markets and how the Option Greeks further influence the premium.

So the end objective here would be to be –

- To get a sense of how the Option Greeks influence premiums

- To figure out how the premiums are priced considering Option Greeks and their influence

- Finally keeping the Greeks and pricing in perspective, we need to smartly select strike prices to trade

One of the key things we need to know before we attempt to learn the option Greeks is to learn about the ‘Moneyness of an Option’. We will do the same in the next chapter.

A quick note here – the topics in the future will get a little complex, although we will try our best to simplify it. While we do that, we would request you to please be thorough with all the concepts we have learnt so far.

Key takeaways from this chapter

- Buy a call option or sell a put option only when you expect the market to go up

- Buy a put option or sell a call option only when you expect the market to go down

- The buyer of an option has unlimited profit potential and limited risk (to the extent of the premium paid)

- The seller of an option has an unlimited risk potential and limited reward (to the extent of the premium received)

- Majority of options traders prefer to trade options only to capture the variation in premiums

- Option premiums tend to gyrate drastically – as an options trader, and you can expect this to happen quite frequently.

- Premiums vary as a function of 4 forces called the Option Greeks

- Black & Sholes option pricing formula employs four forces as inputs to give out a price for the premium

- Markets control the Option Greeks and the Greek’s variation itself

Good material to boost up for option trading.

Thank you so much 🙂

if the spot price of yes bank is 185 in the market then what if a i buy call option of yes bank nov strike price 170. what will happens then and what is my profit and loss and same with buying puts. if i buy 190 put and spot price is already 185 then what will happen. please clarify.

You’d be paying a high premium since the option is ITM and there is ample time to expiry. The profitability really depends on your square off price.

Dear Sir !!

You hv been doing a great job.

I have one query… could you just advise me….. There are so many ifs and buts… but reading all this , i hv some query.. could you please clear my doubts….

say a stock is doing good…. i buy it… spot price is 1000 in first week of month…. then stock starts going down…. then after 5-6 % drop in spot price….. I sell CALL @ 1000 at 28 Rs when the spot price is 950 Rs…. then stocks keeps going down for 2-3 days.. with time….. this premium value will keep coming down…. SAY I AM TRYING TO DO HEDGING……

Now suddenly in 2nd week, the stock spot value jumps backs to sat 990 Rs….. my losses from futures stock are getting less… but 1000CE call sell will definitely go towards losses AM I CORRECT ?????????

SO IN THIS CASE, WHAT will do????? like…. if the stock spot value is coming up in 3rd week, then from futures one can earn money … but at the same time, he will start lossing money from CE sell option…..

what will be the scenario now………….. i mean what should one do in this……

WAIT FOR DECAY WITH TIME.. SO THAT LOSSES FROM THIS SELL CALL @ 1000 RS CAN COME DOWN…. or is there anything else…..

i am confused with this covered call strategy…..

if you dont sell the call imeedietely when you are buying the stock futures, then u r at loss…. but u are buying futures only when u r optimistic about the stock…..

could you please throw some light here….. HOW IS THIS COVERED CALL HELPING….. what should one do when things dont go as per your plan….. should one wait for time to pass…. or do something else….

thanks and many regards

V. Rana

For this reason, the covered call should be initiated with OTM options. In this example, you’d probably be better off writing 1050CE as opposed to 1000CE.

Thanks a lot for sharing learning material, it is really helpful for beginners like me to understand the concept and strategy of share market.. eagerly waiting for rest of the modules to learn more. 🙂

Thanks Ajay. We are trying out best to complete the modules as fast as we can. Please stay tuned.

if india follows European options and not the americans one then how come one can trade options on intraday basis? doesn’t he/she has to wait till expiry?

European option means the settlement is on expiry day. However, you can just speculate on option premiums…and by virtue of which, you can hold the position for few mins or days.

Sir, by this do you mean we will get our settlement amount (if in profit) on the expiry or day after?

The P&L is adjusted on the day you square off the position.

Looking forward to know more about Option Strategy.

That would be in the next module 🙂

Hi kartik,

In this chapter you have mentioned that 100% return in option world is not a thing of suprise. Also we have potential of unlimited profit in long call or long put and even we can trail stoploss of premiums.Then why people people waste so much time in spot market for generating a return of 20% or even less.

tO ACHIEVE 100 PER CENT YOU MUST BE CERTAIN OF FUTURE PRICE. TRAJECTORY. OF THE UNDERLYING TO EXPIRY DAY. AND THAT IS WHERE THE CATCH IS.

Khyati option trading looks easy but when you goes live its very complicated and hard.

also remembar only 1% option trader make money in market.

happy reading and happy trading

Thank you so much for your articles sir. Don’t know how to thank you for your effort. 😀 Options was Greek and Latin for me once and now, Im slowly getting the concept with this. Thanks again. 🙂

sir,in trading stock options&calculting theoratical value which IV

Sorry, can you please elaborate a bit?

We are trading premium of an option is great but how to put SL and target on option’s premium? Cause sitting in front of computer is not possible. Even if we r there we may miss the trade id doing some thing else at the time we are suppose to trade or squareoff the tyrade.

Till now it has been very clear and crisp. Thanks for that and hope that further chapters will also come the same way.

We will be discussing SL based on Volatility very soon. Request you to kindly stay tuned till then. We certainly hope to keep the future chapters as easy and lucid as the previous ones have been.

sir,when trading optionsstock which IV shouldwe take is it IV OF STOCK AS STATED IN NSE WEBSITE OR INDIA VIX

IV of stocks makes sense.

Hi kartik,

In this chapter you have mentioned that 100% return in option world is not a thing of suprise. Also we have potential of unlimited profit in long call or long put and even we can trail stoploss of premiums.Then why people people waste so much time in spot market for generating a return of 20% or even less?????

Well, its easier said than done 🙂

To achieve a success rate of say 100% on options you need couple of things going in your favor –

1) You need to be extremely well versed in options theory

2) You need a strategy to trade

3) You need to be excellent in your assessment of market direction, volatility, time decay, option pricing etc

4) You need to have liquidity (for example sometimes you may be forced to book a series of losses – forced because you are following a strategy and there is no point going against your strategy)

5) You need a bit of luck!

helpful material

Glad to know that 🙂

Hi

Really nice initiative sir. Can you please tell what do you mean by point movements while you talk of individual stock options (like IDEA and BHEL) in your example because what I know is that INDEX is measures in points and stocks in rupee value. Please tell me where I’m wrong?

Both are somewhat same, for example if I’m referring to 1 point change in Nifty I’m essentially talking about 1 unit change in Nifty index. Whereas 1 point change in BHEL refers to Rs.1 change in the stock.

Hello Sir, if I buy a lot of 1000, call option of strike price 260 at a premium of Rs 2 with a spot price of 250. Now if the price moves to 270 and premium is now at 3 so would be my profit??

1. Would it be 270-260-2(premium paid)= 8 per share

2. Difference of premium amounts 3-2= 1 per share

Firstly, if the spot moves from 250 to 270, the premium of the 260 Call option will certainly be more than Rs.3, I would suggest you read the chapter on Delta…for sake of this example, assume the premium is now Rs.12. Your profits would be –

Rs.12 (latest premium) – Rs.2 (premium paid) = Rs.10

10 * 1000 = Rs.10,000/- would be you total profits (from this deduct brokerage and other charges).

Hello Sir,

I am still confused with the way the profit is calculated. Might be, I am not able to get what u explained and I am really sorry for asking it again. In some of your replies, you mentioned that the profit is calculated as per the difference of spot price and strike price and in some replies u mentioned that it is as per the difference of premium.

Let me give you a live scenario, yesterday ” TVSMOTOR 30Jul2015 CE 260″ was trading at rs 7 (premium) and today it is at rs 12.30 (premium) when value of the underlying moved to 270.7.

In case of 1 lot of 1000 shares the profit would be

1. As per the value of underlying

(270)-(260)=10*1000= Rs 10,000 (Profit)

or

2. As per the value of Premium

(12.3)-(7)=5.3*1000= Rs 5300. (Profit)

So which of the above options are correct??? (Is there a difference if I am closing my position before expiry or excersize it at expiry?)

Saurabh – I’m sorry if I have confused you. For all practical purposes I would suggest you use the 2nd way of calculating profits…i.e the difference in premium method. In fact somewhere in this module, I have explained different ways of calculating P&L…and it all leads to the same answer…I’m unable to figure out which chapter I’ve done that 🙂

This is the example that you have given earlier

I as the buyer of Bajaj Auto’s 2050 call option would make under the various possible spot value changes of Bajaj Auto (in spot market) on expiry. Do remember the premium paid for this option is Rs 6.35/–. Irrespective of how the spot value changes, the fact that I have paid Rs.6.35/- remains unchanged. This is the cost that I have incurred in order to buy the 2050 Call Option. Let us keep this in perspective and work out the P&L table –

Please note – the negative sign before the premium paid represents a cash out flow from my trading account.

Serial No. Possible values of spot Premium Paid Intrinsic Value (IV) P&L (IV + Premium)

01 1990 (-) 6.35 1990 – 2050 = 0 = 0 + (– 6.35) = – 6.35

02 2000 (-) 6.35 2000 – 2050 = 0 = 0 + (– 6.35) = – 6.35

03 2010 (-) 6.35 2010 – 2050 = 0 = 0 + (– 6.35) = – 6.35

04 2020 (-) 6.35 2020 – 2050 = 0 = 0 + (– 6.35) = – 6.35

05 2030 (-) 6.35 2030 – 2050 = 0 = 0 + (– 6.35) = – 6.35

06 2040 (-) 6.35 2040 – 2050 = 0 = 0 + (– 6.35) = – 6.35

07 2050 (-) 6.35 2050 – 2050 = 0 = 0 + (– 6.35) = – 6.35

08 2060 (-) 6.35 2060 – 2050 = 10 = 10 +(-6.35) = + 3.65

09 2070 (-) 6.35 2070 – 2050 = 20 = 20 +(-6.35) = + 13.65

10 2080 (-) 6.35 2080 – 2050 = 30 = 30 +(-6.35) = + 23.65

11 2090 (-) 6.35 2090 – 2050 = 40 = 40 +(-6.35) = + 33.65

12 2100 (-) 6.35 2100 – 2050 = 50 = 50 +(-6.35) = + 43.65

(Now in this example, you are clearly calculating P&L as per the difference in strike and spot price but not the difference in premium price. This lead to my confusion. Please clairify)

Got your point, see if you are holding the option till expiry you will end up getting the amount equivalent to the intrensic value of the option. For example if you bought 2050 call option and upon expiry the spot is at 2150, then you will makes exactly 2150-2050 = 100 minus the premium you have paid. However if you do not intent to hold till expiry then you will end up making the difference in premium…so for example if you bought 2050 CE @ 7, and few days later the same option is trading at 15, then you will make 15-7 = 8.

Do remember premium = Intrinsic value + time value . I have explained more on this in the recent chapter on Theta…but I would suggest you read up sequentially and not really jump directly to Theta.

The above example given by you was in chapter 3 (Buying a call option)

Saurabh..The calculation provided by karthik in chapter 3 is for expiry(calculation on expirt date)..The profit for ur above example for ” TVSMOTOR 30Jul2015 CE 260″ would be (12.3)-(7)=5.3*1000= Rs 5300 (this is before expiry).. On the expiry date, if u exercise the option when the spot price is 270, then the profit would be (270)-(260)=10*1000= Rs 10,000 (Profit)..

Hope this clears your doubt.. Or karthik can explain in a more lucid way 🙂

Oh, I dint notice this…thanks for pitching in Sumeet 🙂

Hi Karthik,

But you have written in the next chapter that

Underlying CNX Nifty

Spot Value 8070

Option strike 8050

Option Type Call Option (CE)

Days to expiry 15

Position Long

Given this, assume you bought the 8050CE and instead of waiting for 15 days to expiry you had the right to exercise the option today. Now my question to you is – How much money would you stand to make provided you exercised the contract today?

Do remember when you exercise a long option, the money you make is equivalent to the intrinsic value of an option minus the premium paid. Hence to answer the above question we need to calculate the intrinsic value of an option, for which we need to pull up the call option intrinsic value formula from Chapter 3.

Here is the formula –

Intrinsic Value of a Call option = Spot Price – Strike Price

So now why did you use spot price-strike price and not the difference in premiums, while we are gonna square off today rather than on the expiry date

And please excuse me if I got it wrong and help me,

Thanks.

This is assuming you exercise the option today. Remember exercising the option on expiry is different from selling the option to benefit from the difference in premium. When you exercise, you get the intrinsic value, else you get the difference in premium.

Karthik can you please elaborate more?

And sorry I didnt understand you.

Ram, if you buy an option today, you can sell it anytime you wish. Even 5 seconds later. The P&L will the be the difference between the buy and sell premium. However, you can also decide to hold the option till expiry (also called exercising the option), in this case when you get is the intensive value of the option.

Got it, hope I’ve cleared your doubt.

Great Sir.

I am new to this option market.

Will definitely. Learn your basics.

Happy Learning!

Perfecto….thank u Karthik and Sumeet….it is clear now….:)

Good luck!

sir as premium =intrinsic value +time value of a option.but in the given example of bhel the option value is 7.8 of 230 call option.but as underlying value is 240.5 so it means time value of the option is negative.is this possible?

Happy you spotted this 🙂

The minimum value for this option should be 10.65 (240.65 – 230)….but then it was the expiry day. There is an additional effect of STT for ITM options….guess mkt is factoring in that.

sir what is STT?

STT stands for Security Transaction Tax, which is levied by the Government whenever a person does any transaction on the exchange. More about here – https://en.wikipedia.org/wiki/Securities_Transaction_Tax

Hi Karthik, Thanks a lot for these wonderful modules. A ocean to learn !! made simpler … Please clarify me on this phrase “Usually traders don’t hold the option contract till expiry, rather they trade the change in premium”. I have a situation here. I have Rs.5000/- in my trading account. I go long on call option of the underlying stock A. 50 CE @ premium Re.1/-. I enter a contract for buying a lot of 5000 shares at the time of expiry. After three days I find that the premium for the same call has moved to Rs.3/-. I feel that I should make a profit out of it. So here is my doubt. To make profit should I sell the same contract for a higher premium say Rs.3/-, thereby making a profit of Rs.2/-. If I am doing so, should I do that by writing a put option? In the event of writing should I have the required margin in my trading account ? Please bare with me if the question is so dumb… thanks a lot.

Thanks for the kind words 🙂

If you bought a call option @ 1 and the premium for the same is now trading at 3, then you can square off your position and make a profit of 2. Its just like buying a share at 10 and selling the same at 13. When you sell, someone in the market will buy it from you and you are completely out of the trade.

Thanks for the immediate reply. This means that the person who buys the contract from me @ premium Rs.3/- will deal with the other counterpart in the contract. In that case am I writing an Call option ? should I have a margin for this ? Thanks.

Yes you are right, it becomes the counterparties obligation. Btw, you are not writing a call option when you sell an existing ‘long call option’. You are just squaring off the position.

There is a difference between writing options and squaring off…you need to be aware of this.

Thanks a lot Karthik.

Thanks for the great explanation.

Please clarify me on this.

1. What is square off in options?

2. Ex: Hypothetical example Let’s say person B1 bought a call option of HDFC bank Call which expires on 28th Sept 2017 premium paid 40rs on 4th sept 2017 (B1 has limited risk max 40rs loss). Let’s say person S1 is the seller of that call option (S1 has unlimited risk).

if B1 wants to sell the call option before expiry date (may be on 6th sept) , what will happen will he becomes S2 (will have unlimited risk)

1) Square off in markets, in general, refers to you closing and existing open position

2) He can sell it. When he sells, the person buying from it becomes the holder of the contract.

“Just Dial and Divi’s Lab are two good options for going short on Thursday as massive bearish bets have been built up in these counters.Traders can consider going long on Reliance Communication and Mcleod Russel India for intraday purpose as these stocks have attracted bullish bets.”……karthik, i am pasting this from an article in pulse. where are these data points captured? i guess it gives a trader an indication to a general sentiment on a stock. your views. thanks.

Here is the article – http://profit.ndtv.com/news/market/article-nifty-range-seen-at-7-600-8-000-just-dial-divis-lab-to-be-under-pressure-1216021

Now sure which data points you are talking about. Also do note, the views expressed in any article is representative of the author’s view and not the market’s view in general.

hey karthik, what i meant was, the data where one can gauge where the long or the shorts are being built. what strikes etc. i had read that article in pulse earlier hence, wanted to know where can we spot these build up. thanks.

Raj – most of the view stems from simple OHLC data and the analyst’s interpretation of the same. So if you have access to the same along with volumes and maybe open interest you are good to go. Someone like http://www.neotradeanalytics.com/ should be able to provide you with this info.

hi Karthik

its been very informatic book,i havea same question as Raj.i have gone to site you have recomened,can you recomend some more

Check out Global data feeds as well.

thank you Karthik

Its fabulous material. I have read so many books but was still apprehensive to try Options. Now I will certainly try Options. Simple, thorough, to the point and more importantly most practical guide

Congrats.

Awesome, glad you liked it Prasanna, good luck!

Hi Karthik,

Thanks to Zerodha and specially you , the content, flow of information and the examples given by you to make varsity as simple but effective practical guide.

I am sill learning the dynamics of Option, Just started trading a week ago.

I would like to know the following things.

1.What happens on Options expiry if i don’t square off in the following cases:

(i)If I call nifty 7900 nifty spot is 8000 , premium i bought is 100 now premium is 120. What will be my P&L?

(ii)If I call nifty 7900 nifty spot is 7800, premium i bought is 100 now premium is 120. What will be my P&L?

(iii)If I call nifty 7900 nifty spot is 8000 , premium i bought is 100 now premium is 80. What will be my P&L?

(iv)If I call nifty 7900 nifty spot is 7800, premium i bought is 100 now premium is 80. What will be my P&L?

I’m glad you like Varsity Pavan, my answers in line –

1 & 2) You stand to make 20 in profits (120 – 100)

3 & 4) You make a loss on 20 (100 – 80)

.Q)What happens on Options expiry if i don’t square off in the following cases:

(i)If I call nifty 7900 nifty spot is 8000 , premium i bought is 100 now premium is 120. What will be my P&L?

A) Karthik can the premium be 120 for this call ? taking it as 120 even then too on expiry it should be No Profit no Loss ( excluding brok& stt) as it will be 8000-7900=100 rs only. karthik correct me if i am wrong.

ii)If I call nifty 7900 nifty spot is 7800, premium i bought is 100 now premium is 120. What will be my P&L

A) it is out of money so on expiry loss of 100 rs .

1) Upon expiry this option will be at 100…so you make no profit no loss

2) You will lose the premium.

I have questions. Please answer.

1- If my view is bullish on an index or stock, I should buy a call option for intraday? Which one to select current month, next month or far month? In the money or at the money or out of money?

2- How to select and which one to select because there are many available. Please.

Manus – You need to read the entire module for this 🙂

Hi Karthik,

I am beginner in call and put options, trying to learn this.

My one friend explained one strategy in which one can earn money surely if nifty aggressively move upward or downward.

I am explaining this, please let me know what loopholes are in it

Buy call option 8000 ©50 (example)

Buy put option 8050 ©100 (example)

Now add both premium 100+50=150

Now we get range (8000-150=7850)

(8050+150=8200)

If on expiry nifty does not fall in this range we surely get profit.

Firstly there is no such thing as ‘surely’ in markets 🙂

This is a simple strategy called Strangle. Will be talking about it in the next module.

Correction,

After adding both premium (100+50) we get 150

Now subtract both strike price (8050-8000) we get 50

Now subtract this from lower strike price and add this to upper strike price

8000-50=7950

8050+50=8100

Now we get range (7950-8100)

As replied earlier.

I got it,

I have checked it will not work

🙂

Hi Karthik,

I have never ever bought or sold options, because I did not know anything about it. But after reading your article I have developed basic understanding about it.

Thanks to you and your team

I want to share one strategy regarding options

If.we buy one call option of nifty, strike price 7000@770 and sell one call option @1075 (all are real value)

In this case surely we can make money, does not matter on expiry nifty closes on what value.

But this strategy works only when

Difference in strike price <difference in LTP

Please comment on this strategy

Rohit in the upcoming module I will lay down a structure where you will be able to analyse such strategies yourself. So please do wait just for a little longer 🙂

7050@1075

Hi Karthik,

Firstly, I convey my heartily thank for this type of wonderful effort. Here, I made the simplify excel document, what i learn from here. This may be use someone. Hence, I uphold the part of excel Sheet screen short image here.

I use some colour for make sense for the logical view.

Green – Bull Market

Red – Bear Market

Blue – Buy

Orange – Sell

Dark Colour – High

Light Colour – Low

Here is another one

Here is another one

Saravana – you have summarized it quite well. I hope people will benefit from the same. Good luck 🙂

Where is the sheet? And how the upload of any supporting document is done here?

Nisha, you can upload only images and post comments. You cannot upload documents.

I am waiting for that

But please take a look

Buying one lot call option 7000@770

Selling call option 7050@1075

It means net amount I am getting 1075-770=305

305*75

If nifty closes to any value on expiry, let

8000

My profit would be

8000-7000=1000

8000-7050=950

1000-950=50

Net profit 305+50=355(355*75)

If nifty is between 7000-7050

or below 7000, I can make profit

As you stated that nothing is sure in stock market, please let me know what are loopholes in it

Rohit, this is a classic bull call spread. I understand your curiosity to get clarity, but I would request you to wait just for few days and I will upload a chapter on this. Thanks for your patience.

Hi Karthik, I am eagerly waiting for that module.

,expecting that coming module would be at par with excellence to the previous modules.

Thank you

Be assured, we will give it our best shot 🙂

Hi , karthik thanks for the wonderful explanation , I just have one doubt , I have posted the screen shot below ,

You said that ” The 190CE premium opened the day at Rs.8.25/- and made a low of Rs.0.30/-. I will skip the % calculation simply because it is a ridiculous figure for intraday. However assume you were a seller of the 190 call option intraday and you managed to capture just 2 points again, considering the lot size is 2000, the 2 point capture on the premium translates to Rs.4000/- in profits intraday, good enough for that nice dinner at Marriot with your better half J.”

My doubt here is that how can a seller sell a contract before expiry as he has no right only the buyer ,, or it was due to he was in indraday and short on call option ??

Please clarify sir , thanks !! and good work for module,

Thats the beauty of derivatives – you can buy and sell a contract anytime you wish and not really wait for expiry!

if i sell a deep itm put option will i get the full premium if i square it off the same day

Margins will be blocked and the same will be released by end of day when you square off.

Dear Karthik

In your article you have mentioned that options in India are European in nature and not American.

i.e. one can exercise only on the strike date.

i think exercising and squaring off are the same.

in exercising you get the shares and in squaring off you get the difference in cash.

so if you are able to square off within the next minute or few minutes then is it not American in nature.

entry and exit possible at any time during the tenure of contract is American or European. please clarify.

also please clarify point 4 and 7 below if my understanding is right

1.you have sold me a call i am the buyer of that call option and you are the seller of that call option

2.price is moving in my direction and against you

3.to limit your losses (a)either i should exit with a limited profit or (b)you should square off on your side

4.if you are squaring off does it mean somebody else is entering into your position because for my profit to be theoretically unlimited some other party has take your seat.

5.opposite scenario if price is moving against me and in your favour either you have to square off or i should do.

6.suppose you are not limiting your profit and your allowing the price movement to run its course in your direction and you want to pocket the full premium,then i will be forced to exit my long call to cut loss of entire premium.

7.in this case when i am squaring off am i squaring off with my call option seller i.e. yourself or will i be selling my call to some body else meaning that somebody else will be taking my seat.

that’s how liquidity helps .

rgds/arunravi.k

Exercising and squaring off are two different aspects. You can square off anytime you wish, but exercising is only on the expiry day, and it does make a huge difference on when you can exercise your contracts.

Also, which part do you want me to elaborate on?

Hi Karthik,

Can you please let me know few great tools (free or cheaper ones) available in the market to do:

1. Scanning of opportunities(scripts of Nifty or other blue chip derivatives) through Volatility Cone. Eg the tool can reveal opportunities of shorting scripts if VI is high as compared to 2 SD Vol etc. on real time basis

2. Do technical analysis using trend lines, R&S, Fibonacci Retracements

3. Scanning of opportunities based on OI build up across Blue chip scripts on real time basis

4. Scraping NSE websites on daily basis to pull our OI data, Historical Volatility data, VI data for analysis.

I know all these tools can be developed by me, but any ready made tool will be helpful. I am really struggling to get such tools from the market.

Cheers,

Abash

1) Check Options Oracle for Option analysis. Great tool, but not sure if its still actively supported. Give it a try

2) & 3) Use Zeordha’s Kite and Pi for charting and TA requirements. In fact PI has this ‘Expert Advisor’ feature which will help you scan the markets based on your requirements

4) They give out this information on a daily basis. I guess you will have to write a scrip to scrap this info from NSE site.

Extremely thankful to you for sharing. However, having downloaded Opts Oracle, I am struggling to select the database. Not working for me having tried all troubleshooting.

Pi and Kite are good, but unlike amibroker etc one cant search with OI in Tradescript. A big limitation. Any others you can recommend?

Have you tried Metastock? Data vendors like Viratech give out OI information…when you have this data in metastock, you can use the metastock’s tradescript equivalent to filter scrips.

Let me try this.

One more question. The option premium which Black scholes calculator suggests is generally day’s morning price or closing price? eg. if I put days to expire as 10 , the price suggested is day’s start or closing price?

The price is not pegged to any particular time frame. It generally indicates the option price for the given set of variables, at that particular moment.

From bhavcopy options data only, what does it mean when derivative analysts say that ” There’s a build up happening for a possible price increase”? Do they see OI change data for ITM OTM call and puts and conclude that? When does the build up condition meet?

“Build up happening” means open interest is increasing, “for a possible price increase” is just his speculation about a possibility of an increase in price. You can refer to any option strike and pass such comments 🙂

Does OI for a call or a put lead to this kind of speculation?

Increase / decrease in OI certainly adds to the speculative activity.

Are American type options traded in Zerodha?

All stock and index options in India are European.

Excellent materials. good going zerodha !

Cheers!

Thank you and ZERODHA for the great content Karthik.

I have a doubt doubt in the above idea cellular example, the sentence is this ” if you have written an option for Rs.8/- you will enjoy the full premium received i.e. Rs.8/- only on expiry”.

my doubt is why the option writer have to wait till expiry for 8 Rs. if the option trades at 16Rs before expiry . Can the option writer square off his position and take the profit of 8 Rs? . Please correct me if im wrong.

Thanks&Regards.

When you write an option, the maximum profit you make is to the extent of the premium you receive. So if 8 becomes 16, then you are looking at a loss of 8 and not a profit of 8.

Sorry karthik , that was a wrong doubt i posted above . i got the answer . he is in a short position so if the premium increases in market he will face loss if he squares off. so he have to wait till expiry to get full premium.

Absolutely!

Hi Sir, excellent explanation. Thankyou. My query below:

1. In practical trading world, is all trades on Options done on premiums? which means my P&L is (sell premium price) minus (buy premium price). or as you mentioned can we exercise our right and get the P&L as you had mentioned? IF latter is possible how do we do it in real trading world. should we just leave it and not to square off our positions on the expiry day? Thanks.

Yes, its all a play on premiums, while some prefer to close it before expiry others prefer to hold to expiry. This depends on your strategy. If you decide to let it expire, then you just let it be as it is…and the exchange will work on the settlement for you.

Hi,

if the premium for CALL option of a particular stock increases by 1% then will the premium for PUT option for the same stock reduces by same% ? I know its not that straight forward, what is the trend you have observed in your experience.

No, options are non linear instruments and have multiple forces (option Greeks) acting upon them. So increase in calls does not mean Puts also have to increase.

I have seen today on 28th Oct 2016, both call and put options premiums are going up. this is happening in both Nifty and Bank Nifty.

can you explain why this behaviour ?

Increase in volatility leads to increase in premiums.

Under 7.1

“You buy with an intention of creating a fresh option position”

it should say

“You buy with an intention of creating a fresh long position”

am I right?

Yes, if its with respect to a call option 🙂

In 7.3 first example of BHEL quote, if closing is 4.05, then what is 7.80, green uptick 3.90 followed by 100%?

It means from the close of 4.05, BHEL has shot up by 3.9 to about 7.8, which is a 100% upmove.

hi…! i have a small doubt. in the previous chapters i read that we have to wait till expiry of call option but in here i read that we can Square off before the expiry. which is not possible in European trade CE as u said.. please clarify. thanks

There is a difference between exercising and square off. You can square off anytime you wish….but if you want exercise, you will have to wait till expiry.

thanks…by the way I love ur explanation. i am a newbie but i am now feeling a bit confident after knowing things from varsity

Very happy to know that 🙂

Good luck.

I want to know suppose I bought jan expiry

pe @1 now it’s value is 2

And strike is 68 and spot market is @67 and cant I exit position and make profit. Is it possible. What would be if I exit position now.

Yes, you can. Profit will be 1 * lot size.

But u said we can’t exercise European option. In the mid of the month m I right. So can I do it? What is meaning of exercise.?

Yes, EU Options are structured differently. However, in India all options are American, which can be exercised only on the day of expiry.

How to trade the Nifty on intraday basis.

How to square the Nifty call option on Intraday Basis

I f one is trading the Nifty on a intraday basis how is the postion squared off ?Do yoiu have to keep a track of the premium as well as the Nifty Index?As Nifty does not have a window to buy or sell how does the Call or Put Option screen look like?

A example if on a intraday basis the Nifty moves up by 10 points how does this get captured less brokerage and transaction charges when trading the Nifty Call Option ,for example in the first step on intraday basis the Nifty Call Option is brought then in the next step on the same trading day this position is squared off ,pl explain on intraday basis

You can trade it based on your view. If you feel bullish, buy the call option …if you fee bearish, buy the put option. You can square it off intraday, no need to hold till expiry. Yes, you need to track the premiums to identify the profitability. Check the brokerage calculator to figure out the profitability – https://zerodha.com/brokerage-calculator

Hi Karthik

How come large OI in a call at a particular strike price indicates resistance while it should mean that traders are expecting that price to cross thats why they are buying that call strike….?

It is not necessary for a large OI to indicate resistance.

In option selling, if I choose to wait till expiry, I guess, I shall be saving brokerage and other charges of second leg. So, which one is better, to square off beforehand or wait till expiry, if there is no risk of incurring loss? Kindly explain.

It is advisable to square off ITM options for reasons stated here – http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

If you have sold and option or holding on to an option which is OTM, then you can let just expire without worrying about Sq off on expiry.

Dear sir I thank you and your team members for educating the public in stock trading. IT seems that for the same scrip at the same strike on the same day CE seller and PE seller are paying different margin amount.Why? Is it due to difference in premium received or in other words due to moneyness of the option? Kindly clarify..

You are basically referring to the margins for ATM options. They are very similar with very little difference I guess.

if premium is 6 rs. and lot is of 1000 than does we need to pay premium = 1000*6 else only 6

Premium payable will be 6000/-.

Hey Karthik,

small query to clear my confusion btn square off and exercising an option ,

as I understand I can square off anytime as per my profitability or loss but suppose have shorted the strangle and then though I am into profit but I can see that ( due to OTM call n put write ) , liquidity got reduced resulting I hesitate to square off and I allow it to exercise on the day of expiry then in that case will I get get entire profit ( full premium of call n put ) or still there will be spread impact on my profit ?

Also is there any extra charge I have to pay if I allow it to get squared off automatically @ 3.30 on the day of expiry then to squaring off the option manually.

If you have shorted, then you need to hold till expiry to get the full premium. When you hold the written option to expiry, its not referred to as exercising the option. Only buyers of an option can exercise an option, as they have the right. You can square off the written option anytime before the expiry, but you will not get the full premium. There are no additional charges that you pay if you hold the sold option to expiry.

Thanks for reply …… one more small doubt …. you said “You can square off the written option anytime before the expiry, but you will not get the full premium” agree to you …. on continuation to this my point is what if I dont square of ? will exchange do it on the day of expiry @ 3.30 ? If yes @ what premium they will square off ? as OTM options will have large spread ( difference between bid and ask price ) If I need to square off then this spread will reduce my profit and if exchange do it then what price it will take ?

If you let the option expire worthless, then the exchanges will let settle them for you at 0.

Thanks for the great explanation.

Please clarify me on this.

1. What is square off in options?

2. Ex: Hypothetical example Let’s say person B1 bought a call option of HDFC bank Call which expires on 28th Sept 2017 premium paid 40rs on 4th sept 2017 (B1 has limited risk max 40rs loss). Let’s say person S1 is the seller of that call option (S1 has unlimited risk).

if B1 wants to sell the call option before expiry date (may be on 6th sept) , what will happen will he becomes S2 (will have unlimited risk)

1) Square Off means booking profit / loss on premium during series (before expiry date).

2) As mentioned, before expiry date means he just square off his position. Now what happens here B1 just transfers his position to another person, say B2 who is interested to take position from B1. Once B2 will take position, B1 will no longer the participant of the game. B2 can hold it till expiry or can transfer his position to B3 before expiry. Before expiry the profit / loss will be calculated on premium difference.

1) Sq Off means you are closing an open position. If you are long, then Sq off means you are selling your long position. Likewise, if you are short, sq off means you are closing by means of buying back. Expiry has nothing to do with this.

2) Yes, B2 has taken on the risk from B1. P&L before expiry is the essentially the difference between premiums. Upon expiry, P&L is the difference between spot and strike.

Hello sir,

I want to know in which indexes weekly options contract are traded and in which nse is going to start?

Banknifty.

What will be The charges lavied for Option call order execution at a time i.e. 5 lot of Reliance 850CE (5 Lot of 1000 ) at 25 and same lot sale at 35₹

My doubts is for charges is per lot or per order??

Thanks

Brokerage – 40

STT total – 18

Total txn charge – 31.8

GST – 12.92

SEBI charges – 0.09

Total tax and charges – 102.81

Points to breakeven – 0.1

https://zerodha.com/brokerage-calculator

Sir where can we find historical call and put data for contracts that has already expired, say for the past one year?

You will have to get it from Bhavcopy – https://www.nseindia.com/products/content/derivatives/equities/historical_fo.htm

Karthik,

If suppose I have bought one lot(75) of Nifty CE 10400 @ premium of 80 and now its premium at 170. Now If I square off my position

I will get 12750 including 6750 profit. Please confirm.

Also while squaring off what if I do not get any buyer for the same position. Please confirm.

Yes, you will. You will get a buyer for Nifty. Nifty is quite liquid.

Great module and in par with the standards maintained by Zerodha 🙂

Question: It has been mentioned time and again the Option contracts have to be held until expiry (following European Call format). At the same time, it’s mentioned that traders don’t usually keep contracts until expiry but instead simply try to take advantage in the fluctuations of the premiums. Aren’t those 2 statements contradictory? I’m sure I am missing a piece of the puzzle here.

Thanks, Team!

Hamish, technically you can hold the contract until expiry. But at the same time, you can choose to sell it before expiry, anytime after you initiate the position. So its completely your choice, which obviously depends on your P&L.

Do note – If you sell options, then you will receive the full premium only if you hold it to expiry (this is assuming the option you have written turns out to be a worthless option meaning the premium goes to 0).

Thanks, Karthik! A follow up question: if it’s the case that we can choose to sell it before expiry, then doesn’t that make it American format and not European format?

No the fact that the settlement for intrinsic value happens only on expiry day, makes it European. If you can settle it anytime during the series, then it becomes American.

Dear sir

Thanks for being so nice in answering everything ….. you are doing a great job……….

If one SELLS CE… ONE RECEIVES PREMIUM…… ok.. say.. i sell call 500 Rs @ 20 Rs…. spot price was 460 Rs

Now on expiry… value is 500 Rs CE @ 32…. Spot price is 520

How much are my losses…… is it simply 32-20………. or Premium received – (difference between spot price and strike price )

what happens in above scenario ??????????

If the premium is 32 and you’ve sold it at 20, then the loss is 12. This is basically the difference in the premium.

Karthik,

Thank you for your wonderful effort for putting the options concept.

Thanks, Muthu. Happy learning!

Thanks karthik sir and zerodha team for all the efforts ur taking…

I m little confused about option selling,

for eg; if I sell option and it turns to be worthless than i should wait till expiry for premium right…. please elaborate if I am wrong with your sweet examples

Devrat, as a seller of the option, you should look for situations where the option will turn worthless. When the option turns worthless, you get to keep the entire premium. The option turns worthless only close to expiry and not before that. This is because the option will always have some amount of time value associated with it.

Thanks sir

Once we buy we become seller the moment we sell… Seller is obligated to hold until expiry.Here in the second case(Sell) whether we have to pay margin for it? First, we have to pay the premium(buy) and secondly, we have to pay margin for same trade!!. Isn’t true? Little confusing kindly clarify me.

I’m a little confused with your query, can you kindly elaborate? Thanks.

Hi Karthik,

Why is there difference in close price and last price in a snapshot of quote? Isn’t both are suppposed to be same? The last price at which the instrument traded should be equal to close price?

Check this – https://tradingqna.com/t/how-to-determine-closing-price-in-f-o/584

Hi Karthik,

Thank you for the effort! 🙂 I have few questions:

1. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option(as both are for bearish). I know the point of unlimited profit and limited profit, but why would anybody want to sell a put option as it has limited reward i.e. premium?

2. Suppose we are selling put option, the premium went from Rs. 3 to Rs. 5, is it a Rs. 2 profit or loss (confused as we are selling). Please explain with example.

Thanks in advance!!

1) This really depends on the volatility. If the volatility of the stock has increased, then so would the premiums. In such situations, selling the option would be a better deal than buying the option. Hence the decision to sell the call or Put

2) Since you’ve sold you want the premium to go down (irrespective of call or Put). Hence You’d make a loss here.

Thanks Karthik for reply, but i am still not clear with point number 1. I am not able to make out the difference between buying the call option or selling the put. Could you please share an example?

Raj, increase in volatility increases the premium of options, therefore making the premiums quite expensive. In case, you feel the option is expensive to buy, then you can take the opposite position by selling it and pocketing the premium.

What happens if there is a loss in the options premium at the end of the trading day? Will the loss amount be deducted from my Trading A/c ? And should I hold the options contract in normal, as I expect the market to go down and earn profits till the contract expires ?

No, not really. There is no mark to market (like in Futures) in options. Have explained this in detail, request you to read through the chapters. Thanks.

The F&O margin calculator shows ‘0’ Total margin when i select ‘Call Buy’ or ‘Put Buy’.

Why so?

It should show the premium i require to deposit.

However it works fine for Call Sell and Put Sell.

There is no margin when you buy either calls or puts. When you buy options, you need to pay only the premium. You need a margin only when you sell options.

Karthik Sir, I had a doubt regarding Expiry. In case of stocks the expiry is monthly in case of both futures & options.

But in case of Indexes are the following statements true :

1. Nifty or Banknifty futures , they both have a monthly expiry just like stock futures.

2. Nifty Options also have monthly expiry.

3. Only Bank Nifty Options have weekly expiry.

1) Yes

2) Yes

3) Yes

Thankyou Sir. _/\_

Cheers!

If I bought a call option at certain premium and the premium shoots up substantially in an hour and I would now want to sell to pocket the premium difference. Is it certain that I will always find a buyer or in spite of me wanting to sell can not sell it because I do not have a buyer??

Not certain. This really depends on the liquidity of the contract. However, if you are trading something like Nifty, then you can find buyers and sellers.

***typographical error,

7.1 ,after pay off digram, point no. 3

“Put Option (sell) and the Put Option (buy)”

i think it is call option sell and the put option buy

Vishal, don’t find any errors here. Can you try reading it again?

i apologies for it, i got confused.

hi kartik sir,

i have query, what would be fair value of 10600 PE Jun21 when nifty spot is 10640 and how it is calculated plz explain

This is calculated based on the Black & Scholes Calculator. Have discussed the same here – https://zerodha.com/z-connect/queries/stock-and-fo-queries/option-greeks/how-to-use-the-option-calculator

Sir, can a seller of the call option also trade the contract? If yes, how he makes profit?

Yes, you can sell the contract and buy it back whenever you want. Seller makes a profit when the price of the contract starts to go lower than the price at which he sold the contract.

Thank u sir ?

Welcome!

Though I really feel I should have been able to answer it by myself now, it was so simple. I feel so silly ?

Thats alright, Hina 🙂

Dear Sir, Please help me out here

Assume its the expiry date and I’ve shorted ASHOKLEY18MAY145CE ; Premium paid Rs:6

At the end of the closing bell the spot price of Ashokleyland is 148 ; ASHOKLEY18MAY145CE ,Premium Rs 2.5

Since the spot price is greater than the strike price will I be under a loss or since the premium has reduced in value will I be under profit?

If you have shorted @ 6 and the premium is now at 2.5, then you make a profit of 3.5.

Thanks for clarifying, sir. 🙂

I thought premiums are also decided by demand and supply, similar to the share prices. So you mean, all option premiums on NSE/BSE are calculated using Black Scholes formula only and not demand/supply?

The theoretical prices are calculated by the B&S model. However, the day to day trading is an out of demand and supply….which further is decided by fair pricing. So its kind of a function all factors 🙂

Sir it is being said that derivatives market would be open until 11:55pm from Oct 1 but sir equity market would be closed as usual 3:30pm so if there is no movement in underlying how would anything in options would change ?

Interesting, if this happens, the price will reflect the current news and events around the underlying stock.

Sir, that means premiums would be able to change even on news flow, without any help of underlying ? ?

Lets wait for things to roll out, Manans 🙂

I’ve read up to chapter 6 & the option module is toughest one Karthik, I’m spending days on reading it. maybe bcoz its 1st time I m knowing about Option 🙂 your module gave very deep knowledge and understanding. THANK YOU ZERODHA TEAM.

Happy to note that, Chanu. Take your own time to read and understand options. Markets will always have opportunities. Good luck 🙂

In option contract of IDEA Cellular Limited, the seller has sold Call option? as the stock was bearish (going down)?

Yes, when you sell a call option, the expectation is that the stock will go down or at the most, stay in a range.

Wishing you a very happy Independence Day sir,

According to me in today’s world Financial freedom is of utmost importance & you are the biggest freedom fighter by sharing your wisdom of knowledge with all of us…

God bless you sir… ?

Happy Independence day, to you too Manas!

Thanks for the kind words, keep spreading your knowledge, that’s when India will be a much greater country 🙂

Are options marked to market ?

i mean if i buy TCS call option today (16th august)( strike price 2100) and square off on 20 th august, will there be any dr/ cr in my account on 16th august day end, 17th day end ( any cost involved)? apart from actual profit as the case may be on monday 20th when i actualy square it off ?

No, options are not marked to market. So no debit or credit in your account. However, if you write options, the daily margin blocked can vary based on the volatility of the stock.

Hi karthik,

I am little bit confused.

(1) If we can buy & sell CALL option, then why do we need PUT option?

(2) what is the difference between buy call & sell put option ?

(3) is premium included in margin ?

(4) Does both seller & buyer need to deposit Margin ?

1) Call option premium increases when the prices increase and the put option premium increases when the price decreases

2) Buy call = you are bullish on the stock or bullish on volatility. Sell Put = you are either bullish, expect the market to be flat, or you are bearish on volatility

3) No

4) Only option sellers need to place margin deposits.

Marvelous ….. Thanks Karthik sir and team for this…

Happy learning, Arun 🙂

Case:

As on 3/9/2018

Call option bought

Spot: 100

Strike: 120

Premium: 12

As on 4/9/2018 (not expiry date)

Spot :90

Premium changes from 12 to 10

So that means I lose more 2 rupees if I sell this option? Or on selling I have lost nothing but the 12 bucks premium?

Yes, if you square off the position, you’d lose 2 Rupees.

Ok. So on squaring off I’ll get 10 rupees back on the options. Right?

Yes, its always the difference between the price you pay for the premium and the price you receive when you sell the premium.

When I try to buy equity option under BO/CO type, I get a message “option buying is enabled for NIFTY and BANKNIFTY only.”

Does Zerodha does not provide equity options under BO/CO order??

How do we trade in such a scenario because MIS positions do not provide any leverage?

Daljeet, BO is permitted only for Nifty Options. This is not available for stock options.

Thanks for the prompt reply Karthik.

Welcome!

Leverage is not provided for option long positions as they carry the risk of losing the whole premium.

We only provide 1.4X leverage for Nifty options as it is relatively less volatile

Thanks for the prompt reply Faisal. Most of the brokers don’t provide much leverage for stock options trading.

Hi,

I have one query, understood that if i done square off, order gets executed on the day of expiry.

1. If I buy Call option (say 1 lot of 40 shares of Infy) paid a premium , and if i dont sell my option then at the expiry day, exchange will buy 40 shares of Infy at that day’s price and add to my account, later i can sell them in open market in smaller quantity, say i sell 10 and keep 30 shares in my account, am i missing anything here? please clarify

Thanks

Srini

Srini, the exchange settles Futures and options using 2 methods- Cash and Physical mode(This differs from individual stocks).

Currently, there are 46 stocks that are physically settled, the rest are cash settled.

In case of cash settlement, if your option expires in the money, you will receive the intrinsic value gained of the option contract.

In case of physical settlement, you will receive shares of the underlying equal to the lot size in your demat account. Read more here

You can choose to sell them all at once or partially, or choose to hold them as long as you want.

Thank you very much , practical suggestion will be very helpful..

i want to get some clarity on how this works, planning to buy below Put option and qty is 1750

Strike Price Bid Qty Bid Ask Ask Net

price price Qty Chang LTP IV Volm Change OI

in OI

310.00 12,250 4.65 4.70 3,500 0.45 4.65 46.39 2,345 68,250 1,953,000

1. How much i need to buy 1 Lot, amount to be paid

2. If i watch this values tomorrow, which one will indicate that this put option is increased or decreased, i dont know which column to look for to find if my call option is profitable or not

3. If increased , how much can i sell to make profit?

1) 1750 * 4.70 = Total premium payable

2) You need to watch the premium (bid-ask)

3) The difference between the buy premium rate and the sell premium rate is what you make.

Hey Karthik,

Great job with these articles.

Thanks, Binesh! Happy learning 🙂

Hi, Thanks a lot for the useful content. I have recently started using kite platform and need to clarify few things-

1. How do we put both target and stop loss in a single order? I mean I know about bracket orders, but is it not allowed while trading options? For eg. If i want to buy a CE lot at 100 and want to set the target as 120 and stoploss as 90. Do i have to first put a buy order @ 100 and once it is completed put another order for sell @ 90?? If that is the case then how can can I put target of 120 in the same order. Whenever I try to do it, I get order rejected notification. Kindly guide me.

2. If a scrip reads as BANKNIFTY 1ST NOV 25000 CE, it means the expiry is 1st of November right? Also, would you kindly send a link where i can understand the expiry cycle for options.

Thanks in advance. Your lessons are truly great in giving much needed insight and very lucid. Keep up the good work!

1. For buy options, you can only place one sell order, either target or stop-loss. You can’t place both due to the risk of both the orders executing and leading to a short position in your account. However, you can place both target and stop-loss for Futures and option short.

2. That’s correct, the expiry is 1st November. Monthly expiry will not carry a date(only the month) in it, Banknifty weekly expiry will have the date on which they are expiring. Explained here

sir is it profitable to buy both call and put at same strike price and hold it till the end like till two days before expiry.

By doing so you are getting rid of directional risk, but for you to be profitable, the stock has to move in any single direction.

If the nifty Price is 10600

Can I short CE 12000 ?

Will I get profit ?

You can short. You will be profitable if Nifty stays below 12000 upon expiry.

Hi Karthik

Thank for valuable information

Suppose I sell call or put option in NRML I get the premium amount credited to my account can i exit the trade the same day by collecting the premium, OK with minimum decrease in premium but in profit.

Request you to please clear my doubt.

Regards

Aasim

Yes, you certainly can, Aasim. No problem with this.

So If I would like to exercise the put option do I need to instruct the dealing desk or if I hold the option position untill expiry, is it assumed to exercise?

Since I have a long put option but not sure whether if I hold untill expiry it’s assumed to exercise?

Yes, you can continue to hold. No need to inform the dealing desk. But you will have to bring in stock (if applicable), check this – https://zerodha.com/z-connect/tradezerodha/policy-on-settlement-of-compulsory-delivery-derivative-contracts

Great content Karthik.

Few questions :

If i have a view that stock will go up, so which CE is better to buy ? ITM, ATM or OTM ?

and

If i have a view that stock will go down, so which PE is better to buy ? ITM, ATM or OTM ?

Also in case of buying call option, which option(ITM,ATM and OTM) will increase faster if the stock goes up and similarly for buying Put option ?

People make lot pf money on Option Expiry. so how to do that? Do you have any article on that?

Depends on the market sitation, but by and large, buying ATM makes sense. This true for both PE and CE.

Also in case of buying call option, which option(ITM,ATM and OTM) will increase faster if the stock goes up and similarly for buying Put option? —-> This really depends on the market? There is no straightforward answer to this. Thanks.

Karthik, First and foremost, Thanks a ton for all your effort and help in educating so many of us. Grateful for that.

I am new to options and have one doubt. If i am a ” Call” option seller, will the P&L be based on the CMP / Spot at the closing bell on the final date of the month or the highest price achieved during the month once i have sold the call. Say i sold an NBCC CE Jan 19 at Strike Price 58 ( CMP 56) and on 31 Jan , it is 55 , but during the month(but not on date of expiry) it has touched say 65. How will that affect me as a call seller . Can the buyer of the call excercise the option when CMP is highest or is it only on date of expiry. There are varying explanations online. hence the doubt

Thanks in advance

Harry, as far as your P&L is concerned, what really matters is the price at which you close i.e buy back the option at. So if you choose to square off the position at 65, then you will have to consider 65 to calculate your P&L. If it is 50, then that is the price…so on and so forth.

Thanks Karthik for the answer . If i am a ” Call” option seller, will the P&L be based on the CMP / Spot at the closing bell on the final date of the month or the highest price achieved during the month once i have sold the call. Say i sold an NBCC CE Jan 19 at Strike Price 58 ( CMP 56) and on 31 Jan , it is 55 , but during the month(but not on date of expiry) it has touched say 65. How will that affect me as a call seller . Can the buyer of the call excercise the option when CMP is highest or is it only on date of expiry.

What i wanted to know was that is I am a passive call seller i.e. i dont intend to buy it back. Assuming on the date of expiry it is 60 , but during the month it touched 65. I am not buying it becos i am assuming it will fall by the end of the month. In that case will i need to take action or automatically it will get settled at the spot price . Secondly, Will i need to pay up (65-58) or (60-58) is my doubt. on last traded day of the month i.e. 31 Jan 19. ? I hope i am framing it right

Harry, I guess I answered this query earlier. The P&L is dependent on the price at which you exit the trade and not really at the highest or the lowest price it has traded during a period.

Karthik sir,

this is very useful information for me.as i am new to options trading.

I have some doubts please clarify.

1.can i buy both call &put options at a time?

2.if i buy next month options(suppose feb2019) do i need to wait to 1st february to exit the position? or can i exit 1/2 days later(before jan2019expiry date)?

3.suppose i bought 1 call option,and 1 put option today.(both are same same worth)

the next day call options premium raised to 50%,and put options premium decresed to 30% .if i exited from all 2 positions my profit would be 20%,am i right?

thanks in advance..

1) Yes, you can. In fact, this is one of the better strategies and its called Straddles.

2) You can exit it anytime you’d want

3) Yes, although its better you place numbers to check the exact P&L.

Sir,

Thank you for excellent way you explain.

But, I am still not able to figure out why one should sell a put option or call option instead of just buy a call option when bullish and buy a put option when bearish.

Please clarify

JS

The answers to those question lie in your understanding of option greeks. Have explained the same later in the module.

No matter at what great length one would write, it won’t suffice the needed “much” , to thank you for ‘what & with such beautiful precision’ you have done in public space for the beginners’ help. It’s fantastic and mesmerising. Salute you sir!!! great work

Chandan, thanks for the kind words! Glad you liked it, keep going.

I used to purchase a call option of nifty 11050CE. AS nifty has been closed at 11058 on 7th march expiry and i haven’t released my position by myself then what will happen. will i get these 8 rupees? 11050 CE is showing 2.85, so what will i get?

Ankur, although you are in profit of Rs.8, the STTs will eat away your profits, hence, for this reason, the option will not be exercised.

Hello sir,

Now nifty is closed at 11521.05. Suppose my view is bullish, i think that nifty will touch 11600 tomorrow.

Which strike price should i select?

Since my view is bullish, should i select a strike price below current nifty value or above nifty value?

Vishwajith, I’m guessing you are talking about this month’s expiry. Since the time to expiry is very short, maybe you should stick to ATM or slightly ITM option.

If I buy an option OTM and it expires ITM, which amount do i get as my profit? The difference in premium appreciation only or also the difference in the strike price & underlying price?

You will get the difference between the strike and spot. This is also the final value of the premium.

Some poor soul lost 16k on idea call option on that day 🙁

This is my one month of groceries gone in 6-7 hours.