15.1 Moving Average Convergence and Divergence (MACD)

In the late seventies, Gerald Appel developed the Moving Average Convergence and Divergence (MACD) indicator. Traders consider MACD as the grand old daddy of indicators. Though invented in the seventies, MACD is still considered one of the most reliable momentum traders’ indicators.

As the name suggests, MACD is all about the convergence and divergence of the two moving averages. Convergence occurs when the two moving averages move towards each other, and divergence occurs when the moving averages move away.

A standard MACD is calculated using a 12 day EMA and a 26 day EMA. Please note, both the EMA’s are based on the closing prices. We subtract the 26 EMA from the 12 day EMA, to estimate the convergence and divergence (CD) value. A simple line graph of this is often referred to as the ‘MACD Line’. Let us go through the math first and then figure out the applications of MACD.

| Date | Close | 12 Day EMA | 26 Day EMA | MACD Line |

|---|---|---|---|---|

| 1-Jan-14 | 6302 | |||

| 2-Jan-14 | 6221 | |||

| 3-Jan-14 | 6211 | |||

| 6-Jan-14 | 6191 | |||

| 7-Jan-14 | 6162 | |||

| 8-Jan-14 | 6175 | |||

| 9-Jan-14 | 6168 | |||

| 10-Jan-14 | 6171 | |||

| 13-Jan-14 | 6273 | |||

| 14-Jan-14 | 6242 | |||

| 15-Jan-14 | 6321 | |||

| 16-Jan-14 | 6319 | |||

| 17-Jan-14 | 6262 | 6230 | ||

| 20-Jan-14 | 6304 | 6226 | ||

| 21-Jan-14 | 6314 | 6233 | ||

| 22-Jan-14 | 6339 | 6242 | ||

| 23-Jan-14 | 6346 | 6254 | ||

| 24-Jan-14 | 6267 | 6269 | ||

| 27-Jan-14 | 6136 | 6277 | ||

| 28-Jan-14 | 6126 | 6274 | ||

| 29-Jan-14 | 6120 | 6271 | ||

| 30-Jan-14 | 6074 | 6258 | ||

| 31-Jan-14 | 6090 | 6244 | ||

| 3-Feb-14 | 6002 | 6225 | ||

| 4-Feb-14 | 6001 | 6198 | ||

| 5-Feb-14 | 6022 | 6176 | ||

| 6-Feb-14 | 6036 | 6153 | 6198 | -45 |

| 7-Feb-14 | 6063 | 6130 | 6188 | -58 |

| 10-Feb-14 | 6053 | 6107 | 6182 | -75 |

| 11-Feb-14 | 6063 | 6083 | 6176 | -94 |

| 12-Feb-14 | 6084 | 6066 | 6171 | -106 |

| 13-Feb-14 | 6001 | 6061 | 6168 | -107 |

Let us go through the table starting from left:

- We have the dates, starting from 1st Jan 2014

- Next to the dates, we have the closing price of Nifty

- We leave the first 12 data points (closing price of Nifty) to calculate the 12 day EMA

- We then leave the first 26 data points to calculate the 26 day EMA

- Once we have both 12 and 26 day EMA running parallel to each other (6th Feb 2014) we calculate the MACD value

- MACD value = [12 day EMA – 26 day EMA]. For example, on 6th Feb 2014, 12 day EMA was 6153, and 26 day EMA was 6198. Hence the MACD would be 6153-6198 = – 45

When we calculate the MACD value over 12 and 26 day EMAs and plot it as a line graph, we get the MACD line, which oscillates above and below the central line.

| Date | Close | 12 Day EMA | 26 Day EMA | MACD Line |

|---|---|---|---|---|

| 1-Jan-14 | 6302 | |||

| 2-Jan-14 | 6221 | |||

| 3-Jan-14 | 6211 | |||

| 6-Jan-14 | 6191 | |||

| 7-Jan-14 | 6162 | |||

| 8-Jan-14 | 6175 | |||

| 9-Jan-14 | 6168 | |||

| 10-Jan-14 | 6171 | |||

| 13-Jan-14 | 6273 | |||

| 14-Jan-14 | 6242 | |||

| 15-Jan-14 | 6321 | |||

| 16-Jan-14 | 6319 | |||

| 17-Jan-14 | 6262 | 6230 | ||

| 20-Jan-14 | 6304 | 6226 | ||

| 21-Jan-14 | 6314 | 6233 | ||

| 22-Jan-14 | 6339 | 6242 | ||

| 23-Jan-14 | 6346 | 6254 | ||

| 24-Jan-14 | 6267 | 6269 | ||

| 27-Jan-14 | 6136 | 6277 | ||

| 28-Jan-14 | 6126 | 6274 | ||

| 29-Jan-14 | 6120 | 6271 | ||

| 30-Jan-14 | 6074 | 6258 | ||

| 31-Jan-14 | 6090 | 6244 | ||

| 3-Feb-14 | 6002 | 6225 | ||

| 4-Feb-14 | 6001 | 6198 | ||

| 5-Feb-14 | 6022 | 6176 | ||

| 6-Feb-14 | 6036 | 6153 | 6198 | -45 |

| 7-Feb-14 | 6063 | 6130 | 6188 | -58 |

| 10-Feb-14 | 6053 | 6107 | 6182 | -75 |

| 11-Feb-14 | 6063 | 6083 | 6176 | -94 |

| 12-Feb-14 | 6084 | 6066 | 6171 | -106 |

| 13-Feb-14 | 6001 | 6061 | 6168 | -107 |

| 14-Feb-14 | 6048 | 6051 | 6161 | -111 |

| 17-Feb-14 | 6073 | 6045 | 6157 | -112 |

| 18-Feb-14 | 6127 | 6045 | 6153 | -108 |

| 19-Feb-14 | 6153 | 6048 | 6147 | -100 |

| 20-Feb-14 | 6091 | 6060 | 6144 | -84 |

| 21-Feb-14 | 6155 | 6068 | 6135 | -67 |

| 24-Feb-14 | 6186 | 6079 | 6129 | -50 |

| 25-Feb-14 | 6200 | 6092 | 6126 | -34 |

| 26-Feb-14 | 6239 | 6103 | 6122 | -19 |

| 28-Feb-14 | 6277 | 6118 | 6119 | -1 |

| 3-Mar-14 | 6221 | 6136 | 6117 | 20 |

| 4-Mar-14 | 6298 | 6148 | 6112 | 36 |

| 5-Mar-14 | 6329 | 6172 | 6113 | 59 |

| 6-Mar-14 | 6401 | 6196 | 6121 | 75 |

| 7-Mar-14 | 6527 | 6223 | 6131 | 92 |

| 10-Mar-14 | 6537 | 6256 | 6147 | 110 |

| 11-Mar-14 | 6512 | 6288 | 6165 | 124 |

| 12-Mar-14 | 6517 | 6324 | 6181 | 143 |

| 13-Mar-14 | 6493 | 6354 | 6201 | 153 |

| 14-Mar-14 | 6504 | 6380 | 6220 | 160 |

Given the MACD value, let’s try and find the answer for a few obvious questions:

- What does a negative MACD value indicate?

- What does a positive MACD value indicate?

- What does the magnitude of the MACD value actually mean? As in, what information does a -90 MACD convey versus a – 30 MACD?

The sign associated with the MACD just indicates the direction of the stock’s move. For example, if the 12 Day EMA is 6380, and 26 Day EMA is 6220, the MACD value is +160. Under what circumstance do you think the 12 day EMA will be greater than the 26 day EMA? Well, we had looked into this in the moving average chapter. The shorter-term average will generally be higher than the long term only when the stock price trends upward. Remember, the shorter-term average will always be more reactive to the current market price than the long term average. A positive sign tells us that there is positive momentum in the stock, and the stock is drifting upwards. The higher the momentum, the higher is the magnitude. For example, +160 indicate a positive trend which is stronger than +120.

However, while dealing with the magnitude, always remember the price of the stock influences the magnitude. For example, the higher the underlying price such as Bank Nifty, naturally, the higher will be the magnitude of the MACD.

When the MACD is negative, it means the 12 day EMA is lower than the 26 day EMA. Therefore the momentum is negative. Higher the magnitude of the MACD, the more strength in the downward trend.

The difference between the two moving averages is called the MACD spread. The spread decreases when the momentum mellows down and increases when the momentum increases. To visualize convergence and the divergence traders usually plot the MACD value chart, often referred to as the MACD line.

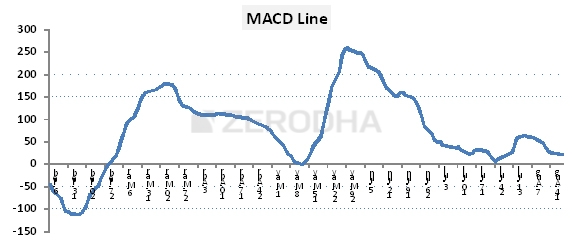

The following is the MACD line chart of Nifty for data points starting from 1st Jan 2014 to 18th Aug 2014.

As you can see, the MACD line oscillates over a central zero line. This is also called the ‘Centerline’. The basic interpretation of the MACD indicator is:

- When the MACD Line crosses the centerline from the negative territory to positive territory, it means there is a divergence between the two averages. This is a sign of increasing bullish momentum; therefore, one should look at buying opportunities. From the chart above, we can see this panning out around 27th Feb

- When the MACD line crosses the centerline from positive territory to the negative territory, it means there is a convergence between the two averages. This is a sign of increasing bearish momentum; therefore, one should look at selling opportunities. As you can see, there were two instances during which the MACD almost turned negative (8th May, and 24th July) but the MACD just stopped at the zero lines and reversed directions.

Traders generally argue that while waiting for the MACD line to crossover the centerline, a bulk of the movie would already be done and perhaps it would be late to enter a trade. To overcome this, there is an improvisation over this basic MACD line. The improvisation comes in the form of an additional MACD component which is the 9-day signal line. A 9-day signal line is an exponential moving average (EMA) of the MACD line. If you think about this, we now have two lines:

- A MACD line

- A 9 day EMA of the MACD line also called the signal line.

A trader can follow a simple 2 line crossover strategy with these two lines as discussed in the moving averages chapter and no longer wait for the centerline cross over.

- The sentiment is bullish when the MACD line crosses the 9 day EMA wherein MACD line is greater than the 9 days EMA. When this happens, the trader should look at buying opportunities.

- The sentiment is bearish when the MACD line crosses below the 9 day EMA wherein the MACD line is lesser than the 9 day EMA. When this happens, the trader should look at selling opportunities.

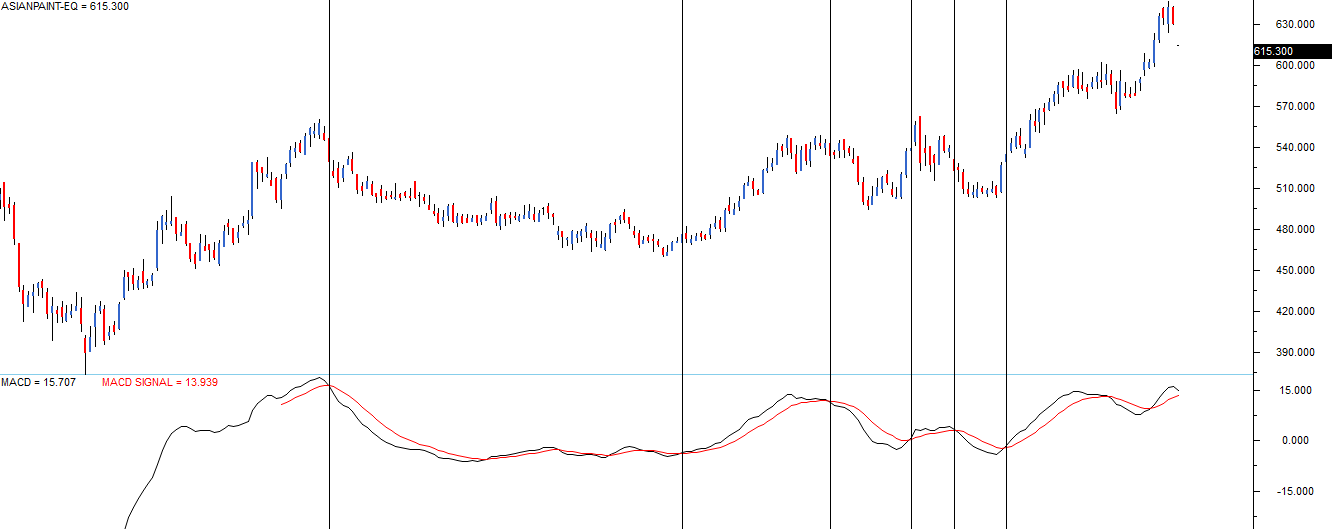

The chart below plots the MACD indicator on Asian Paints Limited. You can see the MACD indicator below the price chart.

The indicator uses standard parameters of MACD:

- 12 day EMA of closing prices

- 26 day EMA of closing prices

- MACD line (12D EMA – 26D EMA) represented by the black line

- 9 day EMA of the MACD line represented by the red line

The chart’s vertical lines highlight the chart’s crossover points where a signal to buy or sell originated.

For example, the first vertical line starting from left points to a crossover where the MACD line lies below the signal line (9 day EMA) lies and suggests a short trade.

The 2nd vertical line from left points to a crossover where the MACD line lies above the signal line should look at buying opportunity. So on and so forth.

Please note, at the core of the MACD system, are moving averages. Hence the MACD indicator has similar properties like that of a moving average system. They work quite well when there is a strong trend and are not too useful when moving sideways. You can notice this between the 1st two-line starting from left.

Needless to say, the MACD parameters are not set in stone. One is free to change the 12 days, and 26 day EMA to whatever time frame one prefers. I personally like to use the MACD in its original form, as introduced by Gerald Appel.

15.2 – The Bollinger Bands

Introduced by John Bollinger in the 1980s, Bollinger Bands (BB) is perhaps one of the most useful technical analysis indicators. BB is used to determine overbought and oversold levels, where a trader will try to sell when the price reaches the top of the band and will execute a buy when the price reaches the bottom of the band.

The BB has 3 components:

- The middle line which is The 20 day simple moving average of the closing prices

- An upper band – this is the +2 standard deviation of the middle line

- A lower band – this is the -2 standard deviation of the middle line

The standard deviation (SD) is a statistical concept; which measures a particular variable’s variance from its average. In finance, the standard deviation of the stock price represents the volatility of a stock. For example, if the standard deviation is 12%, it is as good as saying that the stock’s volatility is 12%.

In BB, the standard deviation is applied on the 20 days SMA. The upper band indicates the +2 SD. Using a +2 SD, we multiply the SD by 2 and add it to the average.

For example if the 20 day SMA is 7800, and the SD is 75 (or 0.96%), then the +2 SD would be 7800 + (75*2) = 7950. Likewise, a -2 SD indicates we multiply the SD by 2 and subtract it from the average. 7800 – (2*75) = 7650.

We now have the components of the BB:

- 20 day SMA = 7800

- Upper band = 7950

- Lower band = 7650

Statistically speaking, the current market price should hover around the average price of 7800. However, if the current market price is around 7950, it is considered expensive concerning the average. Hence one should look at shorting opportunities with an expectation that the price will scale back to its average price.

Therefore the trade would be to sell at 7950, with a target of 7800.

Likewise, if the current market price is around 7650, it is considered cheap concerning the average prices. Hence, one should consider buying opportunities to expect that the prices will scale back to its average price.

Therefore the trade would be to buy at 7650, with a target of 7800.

The upper and lower bands act as a trigger to initiate a trade.

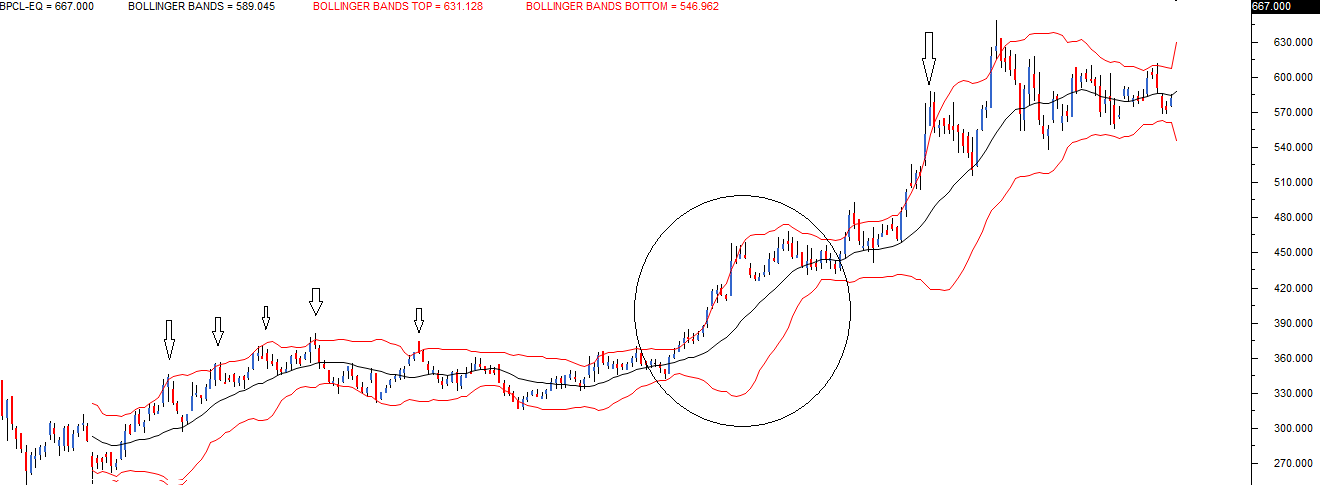

The following is the chart of BPCL Limited,

The central black line is the 20 day SMA. The two red lines placed above and below the black like are the +2 SD and -2SD. The idea is to short the stock when the price touches the upper band, expecting it to revert to average. Likewise, one can go long when the price touches the lower band, expecting it to revert to the average.

I have highlighted using a down arrow all the sell signals BB generated, while most of the signals worked quite well, there was a phase when the price stuck to the upper band. In fact, the price continued to drift higher, and therefore even the upper band expanded. This is called an envelope expansion.

The BB’s upper and lower band together forms an envelope. The envelope expands, whenever the price drifts in a particular direction, indicating strong momentum. The BB signal fails when there is an envelope expansion. This leads us to an important conclusion; BB works well in sideways markets and fails in a trending market.

Whenever I use BB, I expect the trade to start working in my favour almost immediately. If it does not, I start validating the possibility of an envelope expansion.

15.3 – Other Indicators

There are numerous other technical indicators, and the list is endless. The question is, should you know all these indicators to be a successful trader? The answer is a simple no. Technical indicators are good to know, but they by no means should be your main tool of analysis.

I have personally met many aspiring traders who spend a lot of time and energy learning different indicators, but this is futile in the long run. The working knowledge of a few basic indicators, such as those discussed in this module is sufficient.

15.4 – The Checklist

In the previous chapters, we started building a checklist that acts as a guiding force behind the trader’s decision to buy or sell. It is time to revisit that checklist.

The indicators act as a tool which the traders can use to confirm their trading decisions, and it is worthwhile to check what the indicators are conveying before placing a buy or a sell order. While the dependence on indicators is not as much S&R, volumes or candlestick patterns, it is always good to know what the basic indicators suggest. For this reason, I would recommend adding indicators in the checklist, but with a twist to it. I will explain the twist in a bit, but before that, let us reproduce the updated checklist.

- The stock should form a recognizable candlestick pattern

- S&R should confirm to the trade. The stoploss price should be around S&R

- For a long trade, the low of the pattern should be around the support

- For a short trade, the high of the pattern should be around the resistance

- Volumes should confirm

- Ensure above average volumes on both buy and sell day

- Low volumes are not encouraging, hence do feel free to hesitate while taking trade where the volumes are low

- Indicators should confirm

- Scale the size higher if the confirm

- If they don’t confirm, go ahead with the original plan

The sub-bullet points under indicators are where the twist lies.

Now, hypothetically imagine a situation where you are looking at an opportunity to buy shares of Karnataka Bank Limited. On a particular day, Karnataka Bank has formed a bullish hammer, assume everything ticks on the checklist:

- Bullish hammer is a recognizable candlestick pattern

- The low of the bullish hammer also coincides with the support

- The volumes are above average

- There is also a MACD crossover (signal line turns greater than the MACD line)

With all four checklist points being ticked off I would be happy to buy Karnataka Bank. Hence I place an order to buy, let us say for 500 shares.

However, imagine a situation where the first 3 checklist conditions are met, but the 4th condition (indicators should confirm) is not satisfied. What do you think I should do?

I would still go ahead and buy, but instead of 500 shares, I’d probably buy 300 shares.

This should hopefully convey to you how I tend to (and advocate) the use of indicators.

When Indicators confirm, I increase my bet size, but when Indicators don’t confirm I still go ahead with my decision to buy, I scale down my bet size.

However, I would not do this with the first three checklist points. For example, if the low of the bullish hammer does not coincide in and around the support, I’ll really reconsider my plan to buy the stock; in fact, I may skip the opportunity, and look for another opportunity.

But I do not treat the indicators with the same conviction. It is always good to know what indicators convey, but I don’t base my decisions. If the indicators confirm, I increase the bet size; if they don’t, I still go ahead with my original game plan.

Key takeaways from this chapter

- A MACD is a trend following system

- MACD consists of a 12 Day, 26 day EMA

- MACD line is 12d EMA – 26d EMA

- The signal line is the 9 day SMA of the MACD line

- A crossover strategy can be applied between the MACD Line and the signal line

- The Bollinger band captures the volatility. It has a 20-day average, a +2 SD, and a -2 SD

- One can short when the current price is at +2SD with an expectation that the price reverts to the average

- One can go long when the current price is at -2SD with an expectation that the price reverts to the average

- BB works well in a sideways market. In a trending market, the BB’s envelope expands and generates many false signals

- Indicators are good to know, but it should not be treated as a single source for decision making.

Hi Karthik

Wanted to understand fast and slow stochastic and where they are used

The indicator is best used while trading intra day. I will probably include a write on this sometime soon.

Thanks will be waiting for the same but its working awesomly well for intraday for few points profit in options but i really fail to understand why this news channels and advisory keep fooling people and when the best way to learn TA is keep it simple Thanks for all your efforts

You said it, the best way to learn TA is by keeping it really simple and not complicating it with many lines and indicators.

We have tried to do the same in Varsity 🙂

Learning TA seems simple because of the way you presented the information to us. I have been going though your tutorial for last two days and I never felt bored even for a single moment, things have been explained in a very very simple way but in great detail backed by practical experiences. Thanking you won’t be sufficient to express my gratitude to you for writing such a wonderful tutorial.

Arunava, thank you so much for the kind words. Words like these encourage us to write more meaningful content. Happy learning 🙂

Hi Nitesh,

Mind if I ask how are you using stochastics on options? For example what is the candle duration you are using and the details of the stochastic parameters?

MACD with 9 day SMA crossover/ MACD SIGNAL example for Asian paints seems wrong.

The red line might be for MACD line and black for MACD SIGNAL.

please look into this.

Thanks, I’m aware of this. Its just that I’ve not been able to rectify it yet. Will do shortly.

I think the MACD/signal line confusion still remains (30/09/2016). “The sentiment is bullish when the 9 day SMA crosses over the MACD Line wherein the 9 day SMA is greater than the MACD line. When this happens, the trader should look at buying opportunities” . This is in fact a bearish sentiment. Please clarify.

While changing the above, could you avoid using crosses over in both bullish and bearish scenarios? It creates confusion in newbies like me. Crosses over can be used in bullish sentiment whereas crosses under can be used in bearish sentiment. Or simply could you say that ” When the MACD line (generally black) goes above the signal line, then it indicates a bullish sentiment” or something like that. Thanks.

I understand there is a confusion here, will fix it as soon as possible.

Please fix this.

Karthik, please fix this.

I hope the interpretation of MACD crossover as per universal standards is :-

MACD()>MACDSIGNAL() —– Bullish

MACD()<MACDSIGNAL() —– Bearish

I hope this issue is automatically resolved when TV is implemented in kite. But, the same issue is still persisting in PI. Be aware. Actually, PI has many other indicators having different interpretation issues.

I hope ZERODHA will follow international standards and provide with indicators in its original forms as designed by respective inventors along with with their true interpretation.

Happy trading….

Getting this checked, Sandesh.

black is MACD line and pink is signal line.Just believe it and go ahead my friend.

ok

What chart do we have to plot to analyze indicators and EMA? Because all parameter values changes when we select min, day, month and year chart.

I’m assuming you are talking about the intraday chart. You can look at the 10 or 15mins charts, Bhushan.

I wanted to work on overbought-oversold indicators.Now rsi and cci have been here for too long….How do I get better confirmations and reversals?I am sure we need to keep up with latest indicators….as these have been here for ages.Is there anything new I can work on?

Well, I agree it has been around for a while. But disqualifying it based on time factor may not be a great idea. Having said that, I have not come across anything new that looks promising 🙂

Hi Ashutosh all this indicators are there from along time and promise all this will be there till eternity and the ones mentioned in varsity are the chosen best ones with a great record and tested, don’t look for new ones practice more with old ones and promise you will never know you will become a master trader

In the intraday chart, RSI is never touching the oversold region. Can i add a SMA and check the crossover for bullish and bearish confirmation??

Thanks in advance.. 🙂

No in fact what you can do is estimate the level upto which the RSI increases (on intra day basis) and based on this you can re calibrate the oversold and overbought levels.

Thank you so much for your reply. 🙂

Do you mean that i need to change the oversold and overbought regions regularly on intraday basis?? I read somewhere that the rsi oscillates between 45 and 100 in uptrend and between 65 and 0 in downtrend. How far it is true? Hope im not bugging you with my doubts. 😀

Thanks in advance.

Not regularly, but you need to understand what levels work for which stock. For example a level of 40 and 60 may work extremely well for Infy while at the same time 30 and 70 may work for TCS. So the point is to identify this metrics.

Btw, you are not bugging me, you are just contributing significantly towards making the community more vibrant. Please keep the comments queries coming 🙂

Thanks alot sir.. 🙂

Considering all the effort you put here to explain this stuff, I think I owe you.. 😀

You owe me nothing Jagadeesh 🙂

Sir,

Is there any calculated formula where we can predict the proper closing. If yes, how to calculate?. If no, then how do some people predict in crowd index?

Excellent to say the least…

Really now understand the application of BBs.

One request .. Would you please include in your tutorial Stochastics & their applications soon?

Thanks, I’m glad you found this useful 🙂

Will include a chapter on Stochastics sometime soon.

Adani Ent. seems to be trading sideways for considerable time. I found the formation on chart perfectly suited for application of BBs.

Do you agree? Hope i am not embarrassing you by asking this

Lol, why would you embarrass me :). This platform is meant to ask question and learn from one another.

Btw, you are perfectly right with Adani Ent. It is at the lower SD..which advocates a long position. But do make sure other things on the checklist confirm. Good luck.